Download TOC as PDF1 Executive Summary. 34

1.1 Major Findings & Conclusions. 34

1.2 Market Estimations and Forecast 37

1.3 Major Dynamics & Opportunities. 43

1.4 Global Big Data and Data Analytics in the Homeland Security and Public Safety Market 2019-2026. 45

1.5 Market Size – Assessment and Forecast – 2019-2026. 45

1.6 Market Dynamics 2019-2026. 46

1.7 Market Breakdown 2019-2026. 46

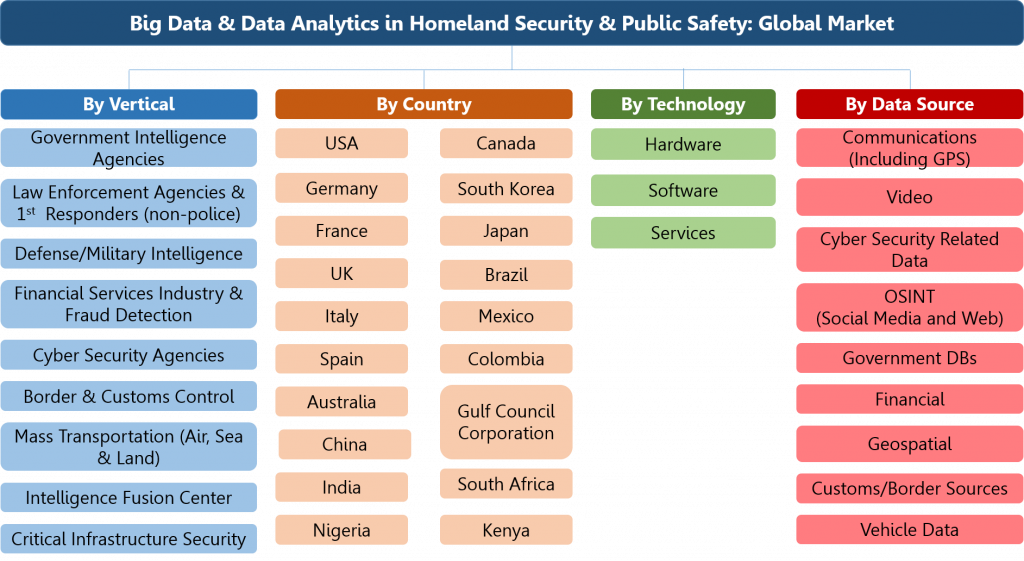

2 Big Data and Data Analytics in Homeland Security and Public Safety Market Background & Assessment 49

2.1 Big Data and Data Anlytics Market Background. 49

2.2 Homeland Security, National Security, Law Enforcement and Public Safety Agencies. 50

2.3 Big Data and Data Analytics in Homeland Security and Public Safety Markets Organogram.. 51

2.4 Palantir IPO Analysis. 52

2.5 Big Data and Data Analytics Market: Drivers & Inhibitors. 55

2.5.1 Big Data and Data Analytics Market Drivers. 55

2.5.2 Big Data and Data Analytics Market Inhibitors. 56

3 Global Security Concerns & Assessment 57

3.1 Global Security Concerns. 57

3.2 Global Risks 2020: A Regional Perceptive. 59

3.2.1 North America Homeland Security & Public Safety Market Drivers. 63

3.2.1.1 Cyber Attacks. 64

3.2.1.2 Data Fraud or Theft 64

3.2.1.3 Terrorism Threat 64

3.2.2 Europe Homeland Security & Public Safety Market Drivers. 65

3.2.2.1 Cyberattacks. 66

3.2.2.2 Assets bubble. 67

3.2.2.3 Interstate conflict 67

3.2.2.4 Terror financing. 67

3.2.3 APAC Homeland Security & Public Safety Market Drivers. 67

3.2.3.1 Water Crises. 69

3.2.3.2 Terrorist attacks. 69

3.2.3.3 Manmade environmental catastrophes. 69

3.2.3.4 Natural catastrophes. 70

3.2.3.5 Cyberattacks. 70

3.2.3.6 Interstate conflict 70

3.2.4 Middle East and Africa Homeland Security & Public Safety Market Drivers. 71

3.2.4.1 Terrorism Threat 72

3.2.4.2 Political and Social Instability. 73

3.2.4.3 Cyber-Attacks. 73

3.2.4.4 Fiscal crises. 73

3.2.4.5 Energy price shock. 73

3.2.5 Latin America and the Caribbean Homeland Security & Public Safety Market Drivers. 74

3.2.5.1 Failure of national governance. 74

3.2.5.2 Economic issues. 75

3.2.5.3 Failure of critical infrastructure. 75

3.2.5.4 Drug trafficking. 75

4 COVID-19 Pandemic Background & Assessment 76

4.1 COVID-19 and Big Data Analytics. 76

4.2 North America COVID-19 Assessment 77

4.3 Europe COVID-19 Assessment 77

4.4 LATAM COVID-19 Assessment 77

4.5 APAC COVID-19 Assessment 77

4.6 Middle East & Africa COVID-19 Assessment 78

5 Big Data and Data Analytics Technology Related Enablers & Inhibitors. 79

5.1 Proliferation of Data. 79

5.1.1 Main Personal Data Sources for Homeland Security & Public Safety Big Data Projects. 79

5.2 Privacy Issues and Concerns. 80

5.2.1 Convention 108+. 80

5.2.2 The General Data Protection Regulation (GDPR) 81

5.3 Data Sharing & Data Ownership. 81

5.4 Profiling Activities. 85

5.5 Cloud Computing Technologies. 86

5.5.1 Cloud Computing Background. 86

5.5.2 Cloud Computing Technologies Adoption by Homeland Security and National Security Agencies. 88

5.6 The U.S. Federal Acquisition Streamlining Act of 1994. 90

6 Global Big Data & Data Analytics in Homeland Security and Public Safety Market by Technology Market – 2020-2026. 91

6.1 Consolidated Market 2019-2026. 91

6.2 Market Analysis 2019-2026. 92

6.3 Market Dynamics 2019-2026. 92

6.4 Market Breakdown 2019-2026. 92

6.5 Big Data & Data Analytics Technology Background. 95

6.6 Big Data Collection and Analysis Process. 95

6.7 Data Sources Collection and Recording. 96

6.8 Digital and Analog Data Production. 97

6.9 Machine Learning. 97

6.9.1 Machine Learning Methods. 98

6.9.2 Deep Machine Learning. 98

6.9.3 Application Types. 99

6.9.3.1 Speech Recognition. 99

6.9.3.2 Image Recognition. 99

6.9.3.3 Natural Language Processing. 99

6.9.3.4 Recommendation Systems. 99

6.9.4 Data Exploration Vs. Machine Learning Model 100

6.10 Legacy Analytics Vs. Big Data Analytics. 100

6.11 Storage & Communications Equipment 100

6.12 Data Warehouses & Data Management 101

6.13 SQL (Structured) and NoSQL (Un-Structured) Database Software. 101

6.13.1 SQL (Structured) Database Software. 102

6.13.2 NoSQL (Un-Structured) Database Software. 102

6.14 Data Analytics & Visualization Applications. 102

6.14.1 Data Analytics. 102

6.14.2 Data Mining. 103

6.14.3 Visualization and Presentation. 103

6.15 Compute Engine. 104

6.16 Professional Services. 104

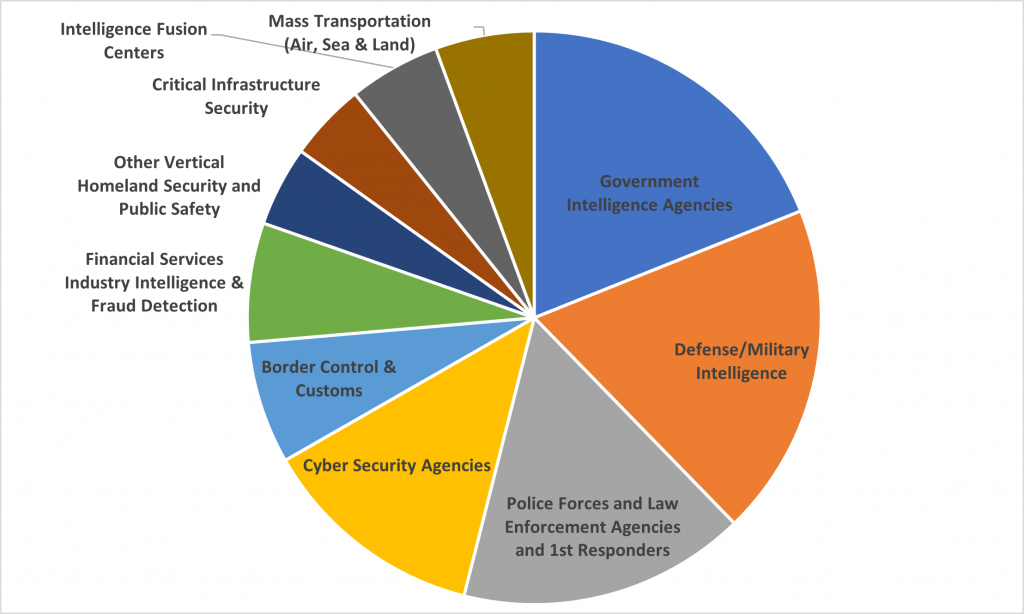

7 Global Big Data and Data Analytics in Homeland Security and Public Safety Market by Vertical Market – 2019-2026. 105

7.1 Consolidated Market 2019-2026. 105

7.2 Market Analysis 2019-2026. 107

7.3 Market Dynamics 2019-2026. 108

7.4 Market Breakdown 2019-2026. 108

7.5 Vertical Markets Background. 113

7.5.1 Vertical Markets Data Sources and Types of Threat Diagram.. 114

7.5.2 Applications and Data Type by Vertical 115

7.5.3 Big Data Maturity Level and Forecast by Vertical 116

7.5.4 Mission Critical Applications. 117

7.6 Government Intelligence Agencies. 118

7.6.1 Use Cases. 118

7.6.1.1 Social Media Monitoring. 118

7.6.1.2 People Interactions and Relationships. 119

7.6.1.3 Money Laundering, Fraud & Terrorist Financing. 119

7.6.1.4 Anticipatory Intelligence. 119

7.6.2 Market Size – Assessment and Forecast – 2019-2026. 120

7.6.3 Market Dynamics 2019-2026. 121

7.6.4 Market Breakdown 2019-2026. 121

7.7 Police Forces, Law Enforcement and 1st Responders Agencies. 122

7.7.1 Police Forces and Law Enforcement Agencies. 122

7.7.1.1 Crime Prediction. 123

7.7.1.2 IoT and Connected Devices. 123

7.7.1.3 Cross-border Crimes. 123

7.7.1.4 Sex Abuse. 124

7.7.1.5 Robberies & Burglaries. 124

7.7.2 First Responders (non-police) 124

7.7.2.1 Use Cases. 124

7.7.3 Market Size – Assessment and Forecast – 2019-2026. 126

7.7.4 Market Dynamics 2019-2026. 127

7.7.5 Market Breakdown 2019-2026. 127

7.8 Defense/Military Intelligence. 128

7.8.1 Use Cases. 128

7.8.1.1 Intelligence, Surveillance, Target Acquisition and Reconnaissance (ISTAR) 128

7.8.1.2 System of Systems. 129

7.8.1.3 R&D – DARPA Big Data Projects & Budget 129

7.8.2 Market Size – Assessment and Forecast – 2019-2026. 130

7.8.3 Market Dynamics 2019-2026. 131

7.8.4 Market Breakdown 2019-2026. 132

7.9 Financial Intelligence & Fraud Detection. 132

7.9.1 Terrorist & Organized Crime Financing. 133

7.9.2 Anti-Money Laundering (AML) & Fraud Detection. 133

7.9.3 Use Cases. 133

7.9.4 FinCEN – Financial Crimes Network. 134

7.9.5 Market Size – Assessment and Forecast – 2019-2026. 134

7.9.6 Market Dynamics 2019-2026. 136

7.9.7 Market Breakdown 2019-2026. 136

7.10 Cyber Security Agencies. 137

7.10.1 Use Cases. 138

7.10.1.1 Mobile Security. 138

7.10.1.2 Predictive Analytics. 139

7.10.1.3 Database Activity Monitoring (DAM) 139

7.10.1.4 Industrial Security (SCADA) Supervision and Control of Critical Infrastructure. 139

7.10.1.5 Identity and Access Management (IAM) 140

7.10.1.6 Forensics Analysis (post-attack) 140

7.10.2 Market Size – Assessment and Forecast – 2019-2026. 141

7.10.3 Market Dynamics 2019-2026. 142

7.10.4 Market Breakdown 2019-2026. 142

7.11 Border Control and Customs. 143

7.11.1 Use Cases. 144

7.11.1.1 Real-Time Data Sets of Personal Information. 144

7.11.1.2 Real-Time Risk Analysis. 145

7.11.1.3 COVID-19 Related Technolgies. 145

7.11.1.4 Illegal Immigration. 145

7.11.2 Market Size – Assessment and Forecast – 2019-2026. 146

7.11.3 Market Dynamics 2019-2026. 147

7.11.4 Market Breakdown 2019-2026. 148

7.12 Mass Transportation (Air, Sea & Land) 148

7.12.1 Use Cases. 149

7.12.1.1 Risk-Based Passenger Screening and Terrorist Watch-lists. 149

7.12.1.2 Detect Identity Fraud. 149

7.12.1.3 Geo-Location Analysis. 149

7.12.1.4 CCTV and Real-Time Feeds on Transit and Passenger Rail 149

7.12.2 Market Size – Assessment and Forecast – 2019-2026. 150

7.12.3 Market Dynamics 2019-2020. 151

7.12.4 Market Breakdown 2019-2026. 152

7.13 Intelligence Fusion Centers. 152

7.13.1 Use Cases. 153

7.13.1.1 Information Gathering and Suspicious Activity Reporting. 153

7.13.1.2 Analytics and Visualization of Relationships. 153

7.13.1.3 GIS Mapping. 153

7.13.2 Market Size – Assessment and Forecast – 2019-2026. 154

7.13.3 Market Dynamics 2019-2026. 155

7.13.4 Market Breakdown 2019-2026. 155

7.14 Critical Infrastructure Security. 156

7.14.1 Cyber-Attacks on Critical Infrastructure. 156

7.14.2 Cyber-Attacks on Critical Infrastructure in the U.S.A. 157

7.14.3 Russian Cyber-Attack on the Ukrainian Energy Sector 158

7.14.4 Use Cases. 158

7.14.4.1 Oil & Gas Operations. 158

7.14.4.2 Energy Utilities. 158

7.14.4.3 Water and Wastewater Systems. 159

7.14.5 Market Size – Assessment and Forecast – 2019-2026. 159

7.14.6 Market Dynamics 2019-2026. 161

7.14.7 Market Breakdown 2019-2026. 161

8 Global Big Data and Data Analytics in Homeland Security and Public Safety Market by Data Source – 2019-2026. 162

8.1 Consolidated Market 2019-2026. 162

8.2 Market Analysis 2019-2026. 163

8.3 Market Dynamics 2019-2026. 164

8.4 Breakdown 2019-2026. 165

8.5 Type of Data Sources Background. 169

8.5.1 Passive Data Sources. 169

8.5.2 Active Data Sources. 169

8.6 Communications (including GPS) 170

8.6.1 GPS Sources. 170

8.6.2 Application Types. 170

8.6.3 Market Size – Assessment and Forecast – 2019-2026. 171

8.6.4 Market Dynamics 2019-2026. 172

8.6.5 Market Breakdown 2019-2026. 172

8.7 Video Stream.. 173

8.7.1 CCTV Systems. 173

8.7.2 Social Media Video Streams. 173

8.7.3 Common Uses of Video Analysis. 173

8.7.4 Market Size – Assessment and Forecast – 2019-2026. 174

8.7.5 Market Dynamics 2019-2026. 175

8.7.6 Market Breakdown 2019-2026. 176

8.8 Cyber Security Related Data. 176

8.8.1 Market Size – Assessment and Forecast – 2019-2026. 176

8.8.2 Market Dynamics 2019-2026. 178

8.8.3 Market Breakdown 2019-2026. 178

8.9 OSINT (Social Media and Web) 179

8.9.1 Social Media Sources. 179

8.9.2 Leading Social Media Platforms. 179

8.9.3 Market Size – Assessment and Forecast – 2019-2026. 180

8.9.4 Market Dynamics 2019-2026. 181

8.9.5 Market Breakdown 2019-2026. 182

8.10 Governmental DBs. 182

8.10.1 National ID Card. 182

8.10.2 Fingerprint Database. 183

8.10.3 National DNA Database. 183

8.10.4 Public Transportation. 183

8.10.5 Car Registration. 183

8.10.6 Driver’s License. 183

8.10.7 Land Records. 183

8.10.8 Criminal Records. 183

8.10.9 Phone Call Records. 183

8.10.10 Market Size – Assessment and Forecast – 2019-2026. 184

8.10.11 Market Dynamics 2019-2026. 185

8.10.12 Market Breakdown 2019-2026. 185

8.11 Financial Data. 186

8.11.1 Digital Banking. 186

8.11.2 Blockchain and Bitcoin. 187

8.11.3 Market Size – Assessment and Forecast – 2019-2026. 187

8.11.4 Market Dynamics 2019-2026. 188

8.11.5 Market Breakdown 2019-2026. 189

8.12 Customs / Border Sources. 189

8.12.1 COVID-19 Related Data. 189

8.12.2 European Immigration Crisis. 190

8.12.3 Data Sources. 190

8.12.4 Market Size – Assessment and Forecast – 2019-2026. 190

8.12.5 Market Dynamics 2019-2026. 191

8.12.6 Market Breakdown 2019-2026. 192

8.13 Geospatial 192

8.13.1 Raster Data. 192

8.13.2 Vector Data. 192

8.13.3 Data Sources. 193

8.13.4 Market Size – Assessment and Forecast – 2019-2026. 193

8.13.5 Market Dynamics 2019-2026. 194

8.13.6 Market Breakdown 2019-2026. 195

8.14 Vehicle Data. 195

8.14.1 V2V and V2X. 196

8.14.2 Data Sources. 196

8.14.3 Market Size – Assessment and Forecast – 2019-2026. 196

8.14.4 Market Dynamics 2019-2026. 197

8.14.5 Market Breakdown 2019-2026. 198

9 Global Big Data and Data Analytics in Homeland Security and Public Safety Market by Region. 199

9.1 Five Regional Markets Comparison Analysis. 199

9.1.1 Consolidated Market 2019-2026. 199

9.1.2 Market Analysis 2019-2026. 200

9.1.3 Market Dynamics 2019-2026. 201

9.1.4 Market Breakdown 2019-2026. 202

10 Select Homeland Security and Public Safety Big Data Projects and Programs. 203

10.1 Select Big Data Projects and Programs by Country. 203

10.2 European Commission Horizon Europe Initiative. 211

10.2.1 European Defense Industrial Development Program.. 212

10.3 European Commission Horizon 2020 Initiative. 213

10.4 European Commission Slandail Project – Empowering Emergency Response Using Social Media. 213

11 Global Big Data and Data Analytics in Homeland Security and Public Safety Market by Country. 215

11.1 19 National Markets Comparison Analysis. 215

11.1.1 Consolidated Market 2019-2026. 215

11.1.2 Market Analysis 2019-2026. 217

11.1.3 Market Dynamics 2019-2026. 218

11.1.4 Market Breakdown 2019-2026. 219

12 USA Big Data and Data Analytics in Homeland Security and Public Safety Market 224

12.1 Facts & Figures 2020. 224

12.2 USA National Security Risk Assessment 2020. 224

12.3 USA Big Data and Data Analytics Overview. 227

12.4 USA Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 230

12.4.1 Market Size – Assessment and Forecast – 2019-2026. 230

12.4.2 Market Dynamics 2019-2026. 232

12.4.3 Market Breakdown 2019-2026. 232

13 Canada Big Data and Data Analytics in Homeland Security and Public Safety Market 233

13.1 Facts & Figures 2020. 233

13.2 Canada National Security Risk Assessment 2020. 233

13.2.1 Canadian National Security. 233

13.2.2 Crime in Canada. 233

13.2.3 Terror in Canada. 234

13.3 Canada Big Data and Data Analytics Overview. 234

13.4 Canada Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 235

13.4.1 Market Size – Assessment and Forecast – 2019-2026. 235

13.4.2 Market Dynamics 2019-2026. 236

13.4.3 Market Breakdown 2019-2026. 237

14 UK Big Data and Data Analytics in Homeland Security and Public Safety Market 238

14.1 Facts & Figures 2020. 238

14.2 UK National Security Risk Assessment 2020. 238

14.3 UK Big Data and Data Analytics Overview. 240

14.4 UK Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 240

14.4.1 Market Size – Assessment and Forecast – 2019-2026. 240

14.4.2 Market Dynamics 2019-2026. 241

14.4.3 Market Breakdown 2019-2026. 242

15 Germany Big Data and Data Analytics in Homeland Security and Public Safety Market 243

15.1 Facts & Figures 2020. 243

15.2 Germany National Security Risk Assessment 2020. 243

15.3 Germany Big Data and Data Analytics Overview. 244

15.3.1 Market Size – Assessment and Forecast – 2019-2026. 245

15.3.2 Market Dynamics 2019-2026. 246

15.3.3 Market Breakdown 2019-2026. 246

16 France Big Data and Data Analytics in Homeland Security and Public Safety Market 247

16.1 Facts & Figures 2020. 247

16.2 France National Security Risk Assessment 2020. 247

16.3 France Big Data and Data Analytics Overview. 248

16.4 France Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 249

16.4.1 Market Size – Assessment and Forecast – 2019-2026. 249

16.4.2 Market Dynamics 2019-2026. 250

16.4.3 Market Breakdown 2019-2026. 251

17 Italy Big Data and Data Analytics in Homeland Security and Public Safety Market 252

17.1 Fact & Figures 2020. 252

17.2 Italy National Security Risk Assessment 2020. 252

17.3 Italy Big Data and Data Analytics Overview. 253

17.4 Italy Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 253

17.4.1 Market Size – Assessment and Forecast – 2019-2026. 253

17.4.2 Market Dynamics 2019-2026. 254

17.4.3 Market Breakdown 2019-2026. 255

18 Spain Big Data and Data Analytics in Homeland Security and Public Safety Market 256

18.1 Facts & Figures 2020. 256

18.2 Spain National Security Risk Assessment 2020. 256

18.3 Spain Big Data and Data Analytics Overview. 256

18.4 Spain Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 258

18.4.1 Market Size – Assessment and Forecast – 2019-2026. 258

18.4.2 Market Dynamics 2019-2026. 259

18.4.3 Market Breakdown 2019-2026. 259

19 Australia Big Data and Data Analytics in Homeland Security and Public Safety Market 260

19.1 Facts and Figures 2020. 260

19.2 Australia National Security Risk Assessment 2020. 260

19.3 Australia Big Data and Data Analysis Overview. 261

19.4 Australia Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 262

19.4.1 Market Size – Assessment and Forecast – 2019-2026. 262

19.4.2 Market Dynamics 2019-2026. 263

19.4.3 Market Breakdown 2019-2026. 263

20 India Big Data and Data Analytics in Homeland Security and Public Safety Market 264

20.1 Facts & Figures 2020. 264

20.2 India National Security Risk Assessment 2020. 264

20.3 India Big Data and Data Analytics Overview. 265

20.4 India Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 265

20.4.1 Market Size – Assessment and Forecast – 2019-2026. 265

20.4.2 Market Dynamics 2019-2026. 266

20.4.3 Market Breakdown 2019-2026. 267

21 China Big Data and Data Analytics in Homeland Security and Public Safety Market 268

21.1 Facts & Figures 2020. 268

21.2 China National Security Risk Assessment 2020. 268

21.3 China Big Data and Data Analytics Overview. 268

21.4 China Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 270

21.4.1 Market Size – Assessment and Forecast – 2019-2026. 270

21.4.2 Market Dynamics 2019-2026. 271

21.4.3 Market Breakdown 2019-2026. 271

22 South Korea Big Data and Data Analytics in Homeland Security and Public Safety Market 272

22.1 Facts & Figures 2020. 272

22.2 South Korea National Security Assessment 2020. 272

22.3 South Korea Big Data and Data Analytics Overview. 272

22.4 South Korea Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 273

22.4.1 Market Size – Assessment and Forecast – 2019-2026. 273

22.4.2 Market Dynamics 2019-2026. 275

22.4.3 Market Breakdown 2019-2026. 275

23 Japan Big Data and Data Analytics in Homeland Security and Public Safety Market 276

23.1 Facts & Figures 2020. 276

23.2 Japan National Security Risk Assessment 2020. 276

23.3 Japan Big Data and Data Analytics Overview. 276

23.4 Japan Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 277

23.4.1 Market Size – Assessment and Forecast – 2019-2026. 277

23.4.2 Market Dynamics 2019-2026. 278

23.4.3 Market Breakdown 2019-2026. 279

24 Brazil Big Data and Data Analytics in Homeland Security and Public Safety Market 280

24.1 Facts & Figures 2020. 280

24.2 Brazil National Security Assessment 2020. 280

24.3 Brazil Big Data and Data Analytics Overview. 281

24.4 Brazil Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 282

24.4.1 Market Size – Assessment and Forecast – 2019-2026. 282

24.4.2 Market Dynamics 2019-2026. 283

24.4.3 Market Breakdown 2019-2026. 283

25 Mexico Big Data and Data Analytics in Homeland Security and Public Safety Market 284

25.1 Facts & Figures 2020. 284

25.2 Mexico National Security Assessment 2020. 284

25.3 Mexico Big Data and Data Analytics Overview. 284

25.4 Mexico Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 286

25.4.1 Market Size – Assessment and Forecast – 2019-2026. 286

25.4.2 Market Dynamics 2019-2026. 287

25.4.3 Market Breakdown 2019-2026. 287

26 Colombia Big Data and Data Analytics in Homeland Security and Public Safety Market 288

26.1 Facts and Figures 2020. 288

26.2 Colombia National Security Assessment 2020. 288

26.3 Colombia Big Data and Data Analytics Overview. 288

26.4 Colombia Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 289

26.4.1 Market Size – Assessment and Forecast – 2019-2026. 289

26.4.2 Market Dynamics 2019-2026. 291

26.4.3 Market Breakdown 2019-2026. 291

27 GCC (Golf Council Corporation) Big Data and Data Analytics in Homeland Security and Public Safety Market 292

27.1.1 GCC National Security Assessment for 2020. 292

27.1.2 Saudi Arabia Country Assessment 292

27.1.2.1 Saudi Arabia Country Assessment 292

27.1.2.2 UAE Country Assessment 293

27.1.2.3 Kuwait Country Assessment 293

27.1.2.4 Bahrain Country Assessment 293

27.1.3 GCC Big Data and Data Analitycs Overview. 293

27.1.3.1 UAE Big Data and Data Analytics Overview. 293

27.1.3.2 Saudi Arabia Big Data and Data Analytics Overview. 294

27.2 GCC Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 294

27.2.1 Market Size – Assessment and Forecast – 2019-2026. 294

27.2.2 Market Dynamics 2019-2026. 295

27.2.3 Market Breakdown 2019-2026. 296

28 South Africa Big Data and Data Analytics in Homeland Security and Public Safety Market 297

28.1 Facts & Figures 2020. 297

28.2 South Africa National Security Assessment 2020. 297

28.3 South Africa Big Data and Data Analytics Overview. 298

28.4 South Africa Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 298

28.4.1 Market Size – Assessment and Forecast – 2019-2026. 298

28.4.2 Market Dynamics 2019-2026. 299

28.4.3 Market Breakdown 2019-2026. 300

29 Nigeria Big Data and Data Analytics in Homeland Security and Public Safety Market 301

29.1 Facts & Figures 2020. 301

29.2 Nigeria National Security Assessment 2020. 301

29.3 Nigeria Big Daya and Data Analytics Overview. 301

29.4 Nigeria Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 302

29.4.1 Market Size – Assessment and Forecast – 2019-2026. 302

29.4.2 Market Dynamics 2019-2026. 303

29.4.3 Market Breakdown 2019-2026. 303

30 Kenya Big Data and Data Analytics in Homeland Security and Public Safety Market 304

30.1 Facts & Figures 2020. 304

30.2 Kenya National Security Assessment 2020. 304

30.3 Kenya Big Data and Data Analytics. 304

30.4 Kenya Big Data and Data Analytics in Homeland Security and Public Safety Market – 2019-2026. 305

30.4.1 Market Size – Assessment and Forecast – 2019-2026. 305

30.4.2 Market Dynamics 2019-2026. 306

30.4.3 Market Breakdown 2019-2026. 306

31 Leading Vendors. 307

31.1 Storage/Data warehouses. 307

31.1.1 Teradata. 307

31.1.1.1 Company Profile. 307

31.1.1.2 Big Data and Analytics Products and Solutions. 307

31.1.2 Oracle. 309

31.1.2.1 Company Profile. 309

31.1.2.2 Big Data and Analytics Products and Solutions. 309

31.1.3 Microsoft 314

31.1.3.1 Company Profile. 314

31.1.3.2 Big Data and Analytics Products and Solutions. 315

31.1.4 Dell 318

31.1.4.1 Company Profile. 318

31.1.4.2 Big Data and Analytics Products and Solutions. 318

31.1.5 Cisco Systems. 322

31.1.5.1 Company Profile. 322

31.1.5.2 Big Data and Analytics Products and Solutions. 323

31.1.6 Hadoop Systems. 325

31.1.6.1 Stream Computing. 326

31.2 Compute. 328

31.2.1 Amazon Web Services. 328

31.2.1.1 Company Profile. 328

31.2.1.2 Big Data and Analytics Products and Solutions. 328

31.2.2 Google Compute Engine. 332

31.2.2.1 Company Profile. 332

31.2.2.2 Big Data and Analytics Products and Solutions. 333

31.3 SQL (Structured) and NoSQL (Un-Structured) Database Software. 334

31.3.1 SAP. 334

31.3.1.1 Company Profile. 334

31.3.1.2 Big Data and Analytics Products and Solutions. 334

31.3.2 Redis Labs. 336

31.3.2.1 Company Profile. 336

31.3.2.2 Big Data and Analytics Products and Solutions. 336

31.3.3 MongoDB. 338

31.3.3.1 Company Profile. 338

31.3.3.2 Big Data and Analytics Products and Solutions. 338

31.4 Data Analytics. 339

31.4.1 Palantir 339

31.4.1.1 Company Profile. 339

31.4.1.2 Big Data and Analytics Products and Solutions. 340

31.4.2 Atos. 343

31.4.2.1 Company Profile. 343

31.4.2.2 Big Data and Analytics Products and Solutions. 343

31.4.3 SAIC. 344

31.4.3.1 Company Profile. 344

31.4.3.2 Big Data and Analytics Products and Solutions. 345

31.4.4 Splunk. 345

31.4.4.1 Company Profile. 345

31.4.4.2 Big Data and Analytics Products and Solutions. 345

31.4.5 ManTech International Corp. 348

31.4.5.1 Company Profile. 348

31.4.5.2 Big Data and Analytics Products and Solutions. 348

31.4.6 IBM.. 349

31.4.6.1 Company Profile. 349

31.4.6.2 Big Data and Analytics Products and Solutions. 349

31.4.7 Govini 352

31.4.7.1 Company Profile. 352

31.4.7.2 Big Data and Analytics Products and Solutions. 352

31.4.8 Hewlett Packard Enterprise (HPE) 353

31.4.8.1 Company Profile. 353

31.4.8.2 Big Data and Analytics Products and Solutions. 353

31.4.9 Thales. 355

31.4.9.1 Company Profile. 355

31.4.9.2 Big Data and Analytics Products and Solutions. 355

31.4.10 Pyramid. 356

31.4.10.1 Company Profile. 356

31.4.10.2 Big Data and Analytics Products and Solutions. 356

31.4.11 SAS. 357

31.4.11.1 Company Profile. 357

31.4.11.2 Big Data and Analytics Products and Solutions. 357

31.4.12 Hitachi Vantara (formaly Hitachi Data Systems) 359

31.4.12.1 Company Profile. 359

31.4.12.2 Big Data and Analytics Products and Solutions. 360

31.4.13 Siren. 363

31.4.13.1 Company Profile. 363

31.4.13.2 Big Data and Analytics Products and Solutions. 363

31.4.14 BAE Systems Applied Intelligence (formerly Detica) 363

31.4.14.1 Company Profile. 363

31.4.14.2 Big Data Products and Solutions. 364

31.4.15 Altamira. 366

31.4.15.1 Company Profile. 366

31.4.15.2 Big Data and Analytics Products and Solutions. 366

31.4.16 Actian. 367

31.4.16.1 Company Profile. 367

31.4.16.2 Big Data Products and Solutions. 367

31.4.17 Ironbrick, Ltd. 369

31.4.17.1 Company Profile. 369

31.4.17.2 Big Data and Analytics Products and Solutions. 369

31.4.18 Raytheon. 369

31.4.18.1 Company Profile. 369

31.4.18.2 Big Data and Analytics Products and Solutions. 370

31.4.19 RipJar 371

31.4.19.1 Company Profile. 371

31.4.19.2 Big Data and Analytics Products and Solutions. 371

31.4.20 Visallo. 372

31.4.20.1 Company Profile. 372

31.4.20.2 Big Data and Analytics Products and Solutions. 372

31.4.21 Nuix. 373

31.4.21.1 Company Profile. 373

31.4.21.2 Big Data and Analytics Products and Solutions. 373

31.4.22 PredPol 373

31.4.22.1 Company profile. 373

31.4.22.2 Big Data and Analytics Products and Solutions. 374

31.4.23 Forensic Logic. 374

31.4.23.1 Company profile. 374

31.4.23.2 Big Data and Analytics Products and Solutions. 375

31.4.24 Numerica. 375

31.4.24.1 Company profile. 375

31.4.24.2 Big Data and Analytics Products and Solutions. 376

31.4.25 PENLINK. 376

31.4.25.1 Company profile. 376

31.4.25.2 Big Data and Analytics Products and Solutions. 376

31.4.26 LexisNexis. 377

31.4.26.1 Company profile. 377

31.4.26.2 Big Data and Analytics Products and Solutions. 377

31.5 Data Visualization. 378

31.5.1 Tableau Software. 378

31.5.1.1 Company Profile. 378

31.5.1.2 Big Data and Analytics Products and Solutions. 378

31.5.2 SemanticAI 379

31.5.2.1 Company Profile. 379

31.5.2.2 Big Data and Analytics Products and Solutions. 380

31.5.3 DataWalk. 380

31.5.3.1 Company Profile. 380

31.5.3.2 Big Data and Analytics Products and Solutions. 381

31.5.4 TIBCO Software. 381

31.5.4.1 Company Profile. 381

31.5.4.2 Big Data and Analytics Products and Solutions. 381

31.5.5 QlikView. 383

31.5.5.1 Company Profile. 383

31.5.5.2 Big Data and Analytics Products and Solutions. 384

31.5.6 MicroStrategy. 385

31.5.6.1 Company Profile. 385

31.5.6.2 Big Data and Analytics Products and Solutions. 386

31.6 Services. 387

31.6.1 Accenture. 387

31.6.1.1 Company Profile. 387

31.6.1.2 Big Data and Analytics Products and Solutions. 387

31.6.2 PwC. 388

31.6.2.1 Company Profile. 388

31.6.2.2 Big Data and Analytics Products and Solutions. 389

31.6.3 Deloitte. 391

31.6.3.1 Company Profile. 391

31.6.3.2 Big Data and Analytics Products and Solutions. 391

32 Appendix. 394

32.1 Big Data Definitions and Introduction. 394

32.1.1 Digital Universe. 394

32.1.2 Big Data – Volume, Velocity and Variety. 395

32.1.2.1 The Core 3 V’s. 395

32.1.3 Big Data Extended – Variability, Veracity, Visualization and Value. 396

32.1.3.1 Variability – Variance in Meaning. 397

32.1.3.2 Veracity – Incorrect Data. 397

32.1.3.3 Visualization – Graphs, Charts. 397

32.1.3.4 Value – $ Value of Information. 398

32.2 Homeland Security and Public Safety Country Backgrounds. 399

32.2.1 USA Major Homeland Security and Public Safety Organizations. 399

32.2.1.1 The US Federal Homeland Security Infrastructure. 400

32.2.1.2 Police Forces and Law Enforcement Agencies. 401

32.2.1.3 Security and Intelligence Agencies. 401

32.2.1.4 Intelligence Community Budget 402

32.2.1.5 Fusion Centers. 402

32.2.2 Canada Major Homeland Security and Public Safety Organizations. 403

32.2.2.1 Canada Border Services Agency (CBSA) 403

32.2.2.2 Canadian Security Intelligence Services (CSIS) 404

32.2.2.3 Royal Canadian Mounted Police (RCMP) 404

32.2.3 UK Major Homeland Security and Public Safety Organizations. 405

32.2.3.1 The Brexit Effects. 406

32.2.3.2 UK Homeland Security & Public Safety Agencies Organogram.. 408

32.2.3.3 UK Police and Law Enforcement Agencies. 408

32.2.3.4 UK Security and Intelligence Agencies. 409

32.2.3.5 UK Fight Against Terrorist Financing. 409

32.2.3.6 UK Homeland Security and Public Safety Regulation Initiatives. 411

32.2.4 Germany Major Homeland Security and Public Safety Organizations. 411

32.2.4.1 Germany Homeland Security & Public Safety Agencies Organogram.. 412

32.2.4.2 Germany Security and Intelligence Agencies. 413

32.2.4.3 Germany Privacy Issues. 413

32.2.5 France Major Homeland Security and Public Safety Organizations. 414

32.2.5.1 France Counter Terror & Public Safety Agencies Organogram.. 414

32.2.5.2 France Homeland Security and Public Safety Regulation. 415

32.2.6 Italy Major Homeland Security and Public Safety Organizations. 415

32.2.6.1 Italy Homeland Security & Public Safety Agencies Organogram.. 416

32.2.7 Spain Major Homeland Security and Public Safety Organizations. 417

32.2.7.1 Spain Homeland Security & Public Safety Agencies Organogram.. 417

32.2.7.2 Security and Intelligence Agencies. 417

32.2.8 Australia Homeland Security & Public Safety Agencies Organogram.. 418

32.2.9 India Major Homeland Security and Public Safety Organizations. 419

32.2.9.1 India Homeland Security & Public Safety Agencies Organogram.. 419

32.2.9.2 Security and Intelligence Agencies. 420

32.2.10 China Major Homeland Security and Public Safety Organizations. 420

32.2.10.1 China Homeland Security & Public Safety Agencies Organogram.. 421

32.2.10.2 Security and Intelligence Agencies. 421

32.2.11 South Korea Major Homeland Security and Public Safety Organizations. 422

32.2.11.1 South Korea Homeland Security & Public Safety Agencies Organogram.. 422

32.2.11.2 Security and Intelligence Agencies. 423

32.2.12 Japan Major Homeland Security and Public Safety Organizations. 423

32.2.12.1 Japan Homeland Security & Public Safety Agencies Organogram.. 424

32.2.13 Brazil Major Homeland Security and Public Safety Organizations. 425

32.2.13.1 Brazil Homeland Security and Public Safety Agencies Organogram.. 425

32.2.13.2 Brazilian Major Homeland Security and Public Safety Organizations. 425

32.2.14 Mexico Major Homeland Security and Public Safety Organizations. 426

32.2.14.1 Mexico Homeland Security and Public Safety Agencies Organogram.. 427

32.2.15 Colombia Major Homeland Security and Public Safety Organizations. 427

32.2.15.1 National Police. 427

32.2.15.2 Law Enforcement 428

32.2.16 GCC Major Homeland Security and Public Safety Organizations. 429

32.2.16.1 Saudi Arabia Government Security Organogram.. 429

32.2.16.2 UAE Homeland Security & Public Safety Agencies Organogram.. 430

32.2.16.3 Kuwait Homeland Security & Public Safety Agencies. 430

32.2.16.4 Bahrain Homeland Security & Public Safety Agencies. 431

32.2.17 South Africa Major Homeland Security and Public Safety Organizations. 432

32.2.17.1 State Security Agency. 432

32.2.17.2 State Security Agency Organogram.. 433

32.2.18 Nigeria Major Homeland Security and Public Safety Organizations. 434

32.2.19 Kenya Major Homeland Security and Public Safety Organizations. 434

32.2.19.1 Ministry of Interior 434

33 Research Methodology. 435

33.1 Report Structure. 435

33.2 Research Methodology. 435

33.3 For Whom is This Report?. 436

34 Disclaimer & Copyright 437