Description

|

|

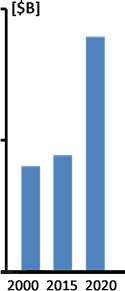

European Explosives & Weapons Detection Technologies Market [$B] 2000, 2015 & 2020 |

The explosives detection and weapon detection market will grow at a CAGR of 20.2% in 2015-2020, a 5-fold hike from the 3.9% CAGR during 2000-2015. Europe is facing a surge of ISIS-inspired explosives and weapon borne terror attacks and threats representing challenges with a far greater reach than their economic ones. This issue impacts airport security, stadium security, public transportation security and other safety measures in populated areas. This alarming situation shows no signs of declining. Europeans are experiencing a new disturbing reality in which explosives and weapon borne terror is their “new normal”. An increase in orders for weapon and explosives detection products had already commenced after the November 2015 Paris carnage (e.g., France manufacturers of weapon detectors reported a 300% sales hike after the Paris carnage).

Based on 6 months of the “Europe’s Terror & Migration Crisis Series” research, and over 110 face-to-face interviews and analyses, we forecast that the 2015-2020 market will grow at a CAGR of 20.2%, a 5-fold hike from the 3.9% CAGR during 2000-2015. Such a growth rate has not been seen in the European market since the 2002-2008 years, following 9/11.

The “European Explosives & Weapons Detection Technologies Market Forecast – 2017-2022” report + the bonus* “Global Homeland Security & Public Safety Industry – 2016 Edition” report are the only comprehensive reviews of the market available today. The objective of this study is to provide a detailed, time-sensitive and reasoned intelligence report.

|

European Explosives & Weapons Detection Technologies Market Report Core Submarkets |

The explosives detection market will undergo a major transformation from 2016-2022 through the following drivers:

- The ISIS-inspired complex and well-planned Paris and Brussels carnage (162 killed and 668 injured) sent shockwaves across the continent.

- The jihadists used both military grade weapons as well as hard-to-detect homemade improvised explosives (i.e. TATP) which pose a threat to existing weapon detection measures

- The attacks shook the European governments and their security agencies unlike any other terror attacks since 9/11, paving the way to new strategies regarding explosives detection capabilities and needs

- The west European security forces are ill-equipped in terms of weapon detection and explosives detection to encounter 21st century ISIS-inspired and trained terrorists who use hard-to-detect improvised explosives, cutting-edge encrypted communication, make a remarkable use of social networks to recruit and train jihadists and conduct efficient pre-attack intelligence.

- European security bodies will have to replace or upgrade their explosive screening systems to new systems capable of detecting improvised explosives like those used in Paris and Brussels (e.g., TATP).

- With no “Magic Bullet” technology in sight, the challenge that remains unresolved is to find out how to stop terrorists from detonating explosives in crowded, unscreened public areas.

- The terrorists were trained by ISIS ex-Iraqi military officers on planning and conducting modern day guerrilla warfare. Europol estimates that up to 5,000 European jihadists have returned to the EU after obtaining combat experience on the battlefields of the Middle East.

- The EU and most of the rest of the European market for homeland security and public safety products are served by local companies. Even with a preference for locally manufactured products, foreign products can usually strongly compete on the basis of cost-performance. They do not encounter any EU direct trade barriers or quotas. Non-tariff, indirect trade barriers may be the approval process of dual use goods, which include many security market products.

This report is a resource for executives with interests in the market. It has been explicitly customized for the security industry and government decision-makers in order to enable them to identify business opportunities, developing technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 254-page report + one* report include:

- What will the market size and trends be during 2016-2022?

- Which submarkets provide attractive business opportunities?

- Who are the decision-makers?

- What drives the customers to purchase solutions and services?

- What are the customers looking for?

- What are the present and pipeline technologies?

- What is the market SWOT (Strengths, Weaknesses, Opportunities & Threats)?

- What are the challenges to market penetration & growth?

With 254 pages, 40 tables and 86 figures, this report + one* report covers 12 Countries and Regions 5 technologies and 3 revenue source submarkets, offering for each of them 2015 data and assessments, and 2016-2022 forecasts and analyses.

Why Buy this Report?

A. A. Market data and forecast on weapon and explosives detection is analyzed via 3 key independent perspectives:

With a highly fragmented market we address the “money trail” – each dollar spent – via the following 3 viewpoints:

- By 12 Country Markets including:

- UK

- France

- The Netherlands & Belgium

- Sweden, Norway, Finland & Denmark

- Germany

- Austria & Switzerland

- Italy

- Spain

- Poland

- Hungary & Czech Republic

- Russia

- Rest of Europe

- By 3 Revenue Sources including:

- Weapon and explosives detection Products Sales Revenues

- After Sale Revenues Including: Maintenance, Service, Upgrades & Refurbishment

- Other Revenues Including: Planning, Training, Consulting, Contracted Services & Government Funded R&D

- By 5 Technology Markets including:

- Explosives Trace Detection (ETD)

- Metal Detectors

- Standoff Explosives & Weapon Detection Systems

- Tomographic Explosive Detection Systems (EDS) & Security related BHS

- Vehicle & Container Screening Systems

B. Detailed market analysis frameworks for the market sectors, including:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Competitive analysis

- Business environment

C. The report discusses directly or indirectly the following current and pipeline technologies:

- Backscatter X-Ray Container-Vehicle Screening Systems

- Coherent Scatter 2D X-Ray Systems

- Desktop ETD Devices

- Hand Held ETD Devices

- Dual Energy LINAC X-Ray Container-Vehicle Screening Systems

- Dual-View LINAC X-Ray Container-Vehicle Screening Systems

- Gamma Ray Systems Container-Vehicle Screening Systems

- Hybrid Tomographic EDS & 2D X-Ray Screening

- IED Placement Detection

- Ion Mobility Spectroscopy (IMS) technologies

- Liquid Explosives Detection Devices

- Luggage, Baggage & Mail Screening Systems

- Metal detection Portals

- Multimodal Biometric Systems

- Narcotics Trace Detection Devices

- Natural & Manmade Disaster Early Warning systems

- People Screening MMWave (AIT) Portals

- People Screening X-Ray Backscatter (AIT) Portals

- Shoe Scanners

- Standoff Explosives & Weapon Detection Systems

- Standoff Suicide Bombers Detection

- Suicide Bombers Borne IED (PBIED) Detectors

- Suicide Bombers Detonation Neutralization

- Tomographic Explosive Detection Systems (EDS)

- Transportable X-Ray Screening Checkpoints

- VBIED Detonation Neutralization

- Vehicle & Container Screening Systems

- Vehicle Borne IED (VBIED) Detectors

- Vehicle Screening ETD Systems

- X-Ray Container-Vehicle Screening Systems

- X-ray Screening systems

D. The report includes the following 4 appendices:

- Appendix A: European Homeland Security & Public Safety Related Product Standards

- Appendix B: The European Union Challenges and Outlook

- Appendix C: Europe Migration Crisis & Border Security

- Appendix D: Abbreviations

E. The report addresses over 300 European Homeland Security and Public Safety standards (including links)

F. The supplementary* “Homeland Security and Public Safety Industry – 2016 Edition” report provides the following insights and analysis of the industry including:

- The Global Industry 2016 status

- Effects of Emerging Technologies on the Industry

- The Market Trends

- Vendor – Government Relationship

- Geopolitical Outlook 2016-2022

- The Industry Business Models & Strategies

- Market Entry Challenges

- The Industry: Supply-Side & Demand-Side Analysis

- Market Entry Strategies

- Price Elasticity

- Past Mergers & Acquisitions (M&A) Events

G. The supplementary* “Global Homeland Security and Public Safety Industry – 2016 Edition” report provides a May 2016 updated extensive data (including Company Profile, Recent Annual Revenues, Key Executives, homeland Security and Public Safety Products, and Contact Info.) of the leading 119 Homeland Security and Public Safety Vendors including:

- 3M

- 3i-MIND

- 3VR

- 3xLOGIC

- ABB

- Accenture

- ACTi Corporation

- ADT Security Services

- AeroVironment Inc.

- Agent Video Intelligence

- Airbus Defence and Space

- Alcatel-Lucent (Nokia Group)

- ALPHAOPEN

- American Science & Engineering Inc.

- Anixter

- Aralia Systems

- AT&T Inc.

- Augusta Systems

- Austal

- Avigilon Corporation

- Aware

- Axis

- AxxonSoft

- Ayonix

- BAE Systems

- BioEnable Technologies Pvt Ltd.

- BioLink Solutions

- Boeing

- Bollinger Shipyards, Inc

- Bosch Security Systems

- Bruker Corporation

- BT

- Camero

- Cassidian

- CelPlan

- China Security & Surveillance, Inc.

- Cisco Systems

- Citilog

- Cognitec Systems GmbH

- Computer Network Limited (CNL)

- Computer Sciences Corporation

- CrossMatch

- Diebold

- DRS Technologies Inc.

- DVTel

- Elbit Systems Ltd.

- Elsag Datamat

- Emerson Electric

- Ericsson

- ESRI

- FaceFirst

- Finmeccanica SpA

- Firetide

- Fulcrum Biometrics LLC

- G4S

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Getac Technology Corporation

- Hanwha Techwin

- Harris Corporation

- Hewlett Packard Enterprise

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM

- IndigoVision

- Intel Security

- IntuVision Inc

- iOmniscient

- IPConfigure

- IPS Intelligent Video Analytics

- Iris ID Systems, Inc.

- IriTech Inc.

- Israel Aerospace Industries Ltd.

- ISS

- L-3 Security & Detection Systems

- Leidos, Inc.

- Lockheed Martin Corporation

- MACROSCOP

- MDS

- Mer group

- Milestone Systems A/S

- Mirasys

- Motorola Solutions, Inc.

- National Instruments

- NEC Corporation

- NICE Systems

- Northrop Grumman Corporation

- Nuance Communications, Inc.

- ObjectVideo

- Panasonic Corporation

- Pelco

- Pivot3

- Proximex

- QinetiQ Limited

- Rapiscan Systems, Inc.

- Raytheon

- Rockwell Collins, Inc.

- Safran S.A.

- Salient Sciences

- Schneider Electric

- SeeTec

- Siemens

- Smart China (Holdings) Limited

- Smiths Detection Inc.

- Sony Corp.

- Speech Technology Center

- Suprema Inc.

- Synectics Plc

- Tandu Technologies & Security Systems Ltd.

- Texas Instruments

- Textron Inc.

- Thales Group

- Total Recall

- Unisys Corporation

- Verint

- Vialogy LLC

- Vigilant Technology

- Zhejiang Dahua Technology