Description

Click to see the global version of this report

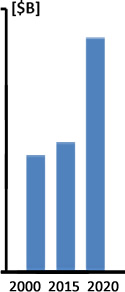

The Paris and Brussels 2015-2016 ISIS-inspired terror attacks shook the European public, governments and security bodies unlike any other recent terror attack. The two attacks demonstrated the crucial value of Video Surveillance and Video Analytics, which gave the security forces time-critical information, enabling them to evade several pending terror attacks (e.g., the terror attack on a Belgian nuclear reactor). Based on 6 months of the “Europe’s Terror & Migration Crisis Series” research, and 95 face-to-face interviews and analyses, we forecast that following a decade of steady (CAGR of 8.3%) market penetration, the European Video Security Surveillance and Video Analytics market will experience a period of dual digit 2015-2020 CAGR of 15.5%.The market is set to undergo a major transformation from 2016-2022 through the following drivers:

- It is an open secret that extensively- deployed 21st century HD video surveillance (associated with high-end real-time video analytics) is a critical component for intelligence agencies and security forces in order to fight terror and crime. It has been proved time and again in the London 7/7, Boston marathon, Paris and Brussels terror attacks that video surveillance and analytics systems played a critical role in apprehension of terrorists and mitigation of terror attacks.

- Nowadays, video security surveillance cameras and ICT systems are widely used in European public and private venues. Fortunately, the increased processing capability allows processing a large amount of video data in real-time. With the available infrastructure, an efficient and accurate intelligent video surveillance will create remarkable business opportunities.

- The European video security surveillance market has grown at a CAGR of 8-10% over the past few years driven by rising concerns for security.

- European governments, security agencies and the business sector show an increased demand for premium (high resolution, real time analytics and high cost,) security surveillance systems.

- CCTV cameras, video analytics DSPs (e.g., Intel & Texas Instruments DSPs) and ICT cost-performance follow Moore’s law. The price of HD cameras has dropped from $3000-5000 in 2010 to $400-600 last year and is forecasted to cost $80-120 by 2020.

- Technology maturity: video analytics algorithms, processors, applications and products underwent a decade of technological evolution to intelligent video processing, based on advancements in image processing, enabling automatic and semi-automatic detection and identification of threat signatures.

- Video analytics is critical when it comes to human operators. These professionals entail a 24/7 high labor cost and a high rate of overlooked threats. Real-time video analysis of video streams and recorded footage is a need that can hardly be answered effectively by human operators due to manpower costs. Furthermore, human operators’ fatigue and boredom cause a high rate of overlooked events.

- Western Europe, the largest economy in the world with a 2015 GDP of approximately $22 trillion (vs. the U.S. $17.5 trillion), can invest “whatever it takes” to protect its citizens from the looming jeopardies of mass migration and terrorism.

- The EU and the rest of the European video security surveillance market for products and services are served by local video and security companies. Even with a preference for locally manufactured products, foreign products can usually strongly compete on the basis of cost-performance. They do not encounter any EU direct trade barriers or quotas. Non-tariff, indirect trade barriers may be the approval process of dual use goods, which include various security market products.

This report is a resource for executives with interests in the market. It has been explicitly customized for the security industry and other decision-makers in order to identify business opportunities, developing technologies, market trends and risks, as well as to benchmark business plans.Questions answered in this 238-page report + one* report include:

- What will the market size and trends be during 2016-2022?

- Which submarkets provide attractive business opportunities?

- Who are the decision-makers?

- What drives the purchase of video surveillance and video analytics products and services?

- What are the customers looking for?

- What are the technology & services trends?

- What is the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

- What are the challenges to market penetration & growth?

With 238 Pages, 31 Tables, 49 Figures and 36 Submarkets, the “European Homeland Security & Public Safety Video Surveillance and Video Analytics Markets – 2016-2022” report covers 12 countries and 3 revenue source submarkets, offering for each of them 2015 data and assessments, and 2016-2022 forecasts and analyses.* Customers who purchase a multi-readers license of the report will get the “Global Homeland Security & Public Safety Industry – 2016 Edition” report free of charge. Single-reader license customers will get a 50% discount for the Industry report.Why Buy this Report?A. Market data is analyzed via 3 key perspectives:With a highly fragmented market we address the “money trail” – each dollar spent – via the following 3 viewpoints:

- By 12 Country Markets including:

- UK

- France

- The Netherlands & Belgium

- Sweden, Norway, Finland & Denmark

- Germany

- Austria & Switzerland

- Italy

- Spain

- Poland

- Hungary & Czech Republic

- Russia

- Rest of Europe

- By 3 Revenue Sources including:

- Products Sales Revenues

- After Sale Revenues Including: Maintenance, Service, Upgrades & Refurbishment

- Other Revenues Including: Planning, Training, Consulting, Contracted Services & Government Funded R&D

- By 2 Core Technologies:

- Video Surveillance

- Video Analytics

B.Detailed market analysis frameworks for each of the market sectors, including:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Competitive analysis

- Business environment

C. The report discusses directly or indirectly the following current and pipeline technologies:

CCTV, Analog Video cameras, Digital Video Camera, Networked Camera, PZT Camera, License Plate Recognition (LPR), Kalman Filters Application to Track Moving Items, Real Time Automatic Alerts Algorithms Online Video Analytics, Object Sorting and ID, Behavioral Analysis, Video Analytic Applications, Video Analytics Architecture Image Segmentation Algorithms Item Tracking, Intelligent CCTV Surveillance Algorithms, Item Identification and Recognition, VA Based Face Recognition, Sorting Actions and Behaviors, Crowd Surveillance, Multi-Camera Intelligent CCTV Surveillance Systems, Remote Threat Identification, Intelligent Video Surveillance System Performance, Distributed Sensors Remote Systems, Remote Biometric Identification, Watch Lists fused VA, Fused VA and Biometrics , Fused Multi-modal VA Biometric Remote People Screening, Intelligent Video Surveillance Tracking, Tag and Track, Wireless Video Analytics, Video Content Analysis Algorithms, Automated Analysis of Video Surveillance Data, Item Detection, Gaussian Mixture Based Background Subtraction Algorithms, Background Subtraction, Item Detection Based on Single-Image Algorithms, Item Tracking Algorithms, Kalman Filtering Techniques, Region Segmentation, Partially Observable Markov Decision Process, “Splitting” Items Algorithms, Dimension Based Items Classifiers, Event Detection Methods, Vision-Based Human Action Recognition, Derived Egomotion, Path Reconstruction Algorithms, Video Cameras Gap Mitigation Algorithms, Networked Cameras Tag and Track Algorithms, Fusion Engines, Event Description Analytics.D. The report includes the following 4 appendices:

- Appendix A: European Homeland Security & Public Safety Related Product Standards

- Appendix B: The European Union Challenges and Outlook

- Appendix C: Europe Migration Crisis & Border Security

- Appendix D: Abbreviations

E. The report addresses over 300 European Homeland Security and Public Safety standards (including links)F. The supplementary* “Homeland Security and Public Safety Industry – 2016 Edition” report provides the following insights and analysis of the industry including:

- The Global Industry 2016 Status

- Effects of Emerging Technologies on the Industry

- The Market Trends

- Vendor – Government Relationship

- Geopolitical Outlook 2016-2022

- The Industry Business Models & Strategies

- Market Entry Challenges

- The Industry: Supply-Side & Demand-Side Analysis

- Market Entry Strategies

- Price Elasticity

- Past Mergers & Acquisitions (M&A) Events

G. The supplementary* “Global Homeland Security and Public Safety Industry – 2016 Edition” report provides a May 2016 updated extensive data (including Company Profile, Recent Annual Revenues, Key Executives, Homeland Security and Public Safety Products, and Contact Info.) of the leading 119 Homeland Security and Public Safety Vendors including:

- 3M

- 3i-MIND

- 3VR

- 3xLOGIC

- ABB

- Accenture

- ACTi Corporation

- ADT Security Services

- AeroVironment Inc.

- Agent Video Intelligence

- Airbus Defence and Space

- Alcatel-Lucent (Nokia Group)

- ALPHAOPEN

- American Science & Engineering Inc.

- Anixter

- Aralia Systems

- AT&T Inc.

- Augusta Systems

- Austal

- Avigilon Corporation

- Aware

- Axis

- AxxonSoft

- Ayonix

- BAE Systems

- BioEnable Technologies Pvt Ltd

- BioLink Solutions

- Boeing

- Bollinger Shipyards, Inc

- Bosch Security Systems

- Bruker Corporation

- BT

- Camero

- Cassidian

- CelPlan

- China Security & Surveillance, Inc.

- Cisco Systems

- Citilog

- Cognitec Systems GmbH

- Computer Network Limited (CNL)

- Computer Sciences Corporation

- CrossMatch

- Diebold

- DRS Technologies Inc.

- DVTel

- Elbit Systems Ltd.

- Elsag Datamat

- Emerson Electric

- Ericsson

- ESRI

- FaceFirst

- Finmeccanica SpA

- Firetide

- Fulcrum Biometrics LLC

- G4S

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Getac Technology Corporation

- Hanwha Techwin

- Harris Corporation

- Hewlett Packard Enterprise

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co., Ltd

- IBM

- IndigoVision

- Intel Security

- IntuVision Inc

- iOmniscient

- IPConfigure

- IPS Intelligent Video Analytics

- Iris ID Systems, Inc.

- IriTech Inc.

- Israel Aerospace Industries Ltd.

- ISS

- L-3 Security & Detection Systems

- Leidos, Inc.

- Lockheed Martin Corporation

- MACROSCOP

- MDS

- Mer group

- Milestone Systems A/S

- Mirasys

- Motorola Solutions, Inc.

- National Instruments

- NEC Corporation

- NICE Systems

- Northrop Grumman Corporation

- Nuance Communications, Inc.

- ObjectVideo

- Panasonic Corporation

- Pelco

- Pivot3

- Proximex

- QinetiQ Limited

- Rapiscan Systems, Inc.

- Raytheon

- Rockwell Collins, Inc.

- Safran S.A.

- Salient Sciences

- Schneider Electric

- SeeTec

- Siemens

- Smart China (Holdings) Limited

- Smiths Detection Inc.

- Sony Corp.

- Speech Technology Center

- Suprema Inc.

- Synectics Plc

- Tandu Technologies & Security Systems Ltd

- Texas Instruments

- Textron Inc.

- Thales Group

- Total Recall

- Unisys Corporation

- Verint

- Vialogy LLC

- Vigilant Technology

- Zhejiang Dahua Technology

|

|

European Homeland Security & Public Safety Video Surveillance and Video Analytics Markets

2000, 2015 & 2020 |