Download TOC as PDFVERTICAL MARKETS.. 18

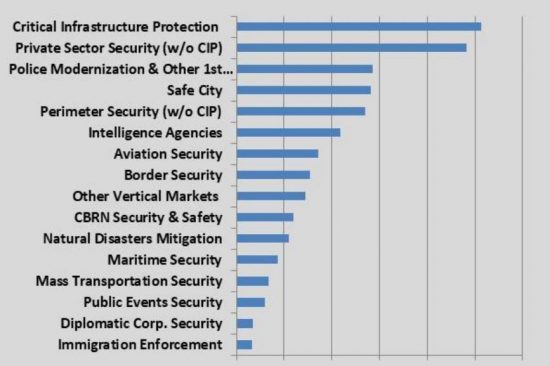

1 Global Homeland Security & Public Safety: Vertical Markets. 18

1.1 Global Market – 2017-2024. 18

1.2 Global Market Breakdown – 2017-2024. 20

2 Aviation Security Market 26

2.1 Scope. 26

2.2 Major Findings. 26

2.3 Major Conclusions. 33

2.4 Market Background. 34

2.4.1 Aviation Security Terror Threats. 34

2.4.2 Aviation Security Tactics. 36

2.4.3 IATA Aviation’s Security Policy. 38

2.5 Aviation Security Technologies. 41

2.5.1 Airport Perimeter Security. 41

2.5.2 X-ray Screening. 42

2.5.3 Explosive Detection Systems (EDS) 43

2.5.4 Explosives Trace Detection (ETD) 44

2.5.5 Biological, Radioactive and Nuclear Detection.. 44

2.5.6 Millimeter Wave Imaging. 44

2.5.7 Canine Screening. 44

2.6 Aviation Security Market Demand Side. 45

2.6.1 Airports. 45

2.6.2 Airlines. 45

2.6.3 Freight Forwarders. 45

2.6.4 Customs. 45

2.6.5 Security Service Providers. 46

2.7 Aviation Passenger Screening Technologies Outlook: 2019-2024. 46

2.8 Checked Baggage Screening Market 48

2.9 Counter-MANPAD Market 48

2.10 Air Cargo Screening Technologies & Markets. 49

2.10.1 Air Cargo Security Process. 49

2.10.2 Air Cargo Related Security Risks. 53

2.10.3 Air-Cargo Supply Chain Security. 53

2.11 Airport Perimeter Security Technologies & Markets. 54

2.12 Aviation Security Market Drivers. 55

2.13 Aviation Security Market Inhibitors. 57

2.14 Aviation Security Market Business Opportunities & Challenges. 57

2.15 Aviation Security Market: SWOT Analysis. 59

2.16 Aviation Security Market Competitive Analysis. 60

2.17 Global Aviation Security Market – 2017-2024. 61

2.17.1 Aviation Security Market – 2017-2024. 61

2.17.2 Market Dynamics – 2017-2024. 62

2.17.3 Market Breakdown – 2017-2024. 63

3 Border Security Market 64

3.1 Scope. 64

3.2 Major Findings. 65

3.3 Major Conclusions. 65

3.4 Market Background. 66

3.5 U.S. Border Security: Investments & Trump. 68

3.6 Border Security Market Drivers. 70

3.7 Border Security Market Inhibitors. 71

3.8 Border Security Market Business Opportunities & Challenges. 73

3.8.1 Border Security Market: SWOT Analysis. 75

3.8.2 Border Security Market Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 76

3.9 Global Border Security Market – 2017-2024. 77

3.9.1 Border Security Market – 2017-2024. 77

3.9.2 Market Dynamics – 2017-2024. 78

3.9.3 Market Breakdown – 2017-2024. 79

4 CBRN Security & Safety Market 80

4.1 Scope. 80

4.2 Major Findings & Conclusions. 80

4.3 Market Background. 82

4.3.1 CBRN Incidents: Characteristics and Countermeasures. 82

4.3.2 Biological Weapons. 83

4.3.3 Chemical Weapons. 83

4.3.4 Public Events CBRNE Security. 85

4.3.5 Examples of Use of CBRN Agents. 87

4.3.6 CBRN Control 89

4.3.7 CBRN Security Challenges. 89

4.4 Market Drivers. 90

4.5 Market Inhibitors. 91

4.6 Global CBRN Security & Safety Market – 2017-2024. 92

4.6.1 CBRN Security & Safety Market – 2017-2024. 92

4.6.2 Market Dynamics – 2017-2024. 93

4.6.3 Market Breakdown – 2017-2024. 94

5 Critical Infrastructure Protection Market 95

5.1 Scope. 95

5.2 Major Findings. 97

5.3 Market Background. 97

5.3.1 Critical Infrastructure Security: Threats. 97

5.3.2 Critical Infrastructure Protection Tactics. 98

5.3.3 Critical Infrastructure Vulnerabilities. 99

5.3.4 Planning of Infrastructure Security. 100

5.3.5 Critical Infrastructure Strategy Outlook. 101

5.3.6 Government Role. 101

5.3.7 Information Sharing with the Private Sector 103

5.3.8 Food and Agro-Terror Market Outlook. 104

5.3.9 Global Oil-Gas Industry Security Market 106

5.3.10 Threats to the Oil-Gas Industry. 107

5.4 Critical Infrastructure Protection Market Drivers. 108

5.5 Critical Infrastructure Protection Market Inhibitors. 110

5.6 Business Opportunities. 112

5.7 Critical Infrastructure Protection Market: SWOT Analysis. 114

5.8 Critical Infrastructure Protection Market Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 115

5.9 Global Critical Infrastructure Protection Market – 2017-2024. 116

5.9.1 Critical Infrastructure Protection Market – 2017-2024. 116

5.9.2 Market Dynamics – 2017-2024. 118

5.9.3 Market Breakdown – 2017-2024. 119

6 Diplomatic Corps Security Market 120

6.1 Scope. 120

6.2 Market Background. 120

6.2.1 Personal Protection.. 121

6.2.2 Protection of Facilities. 121

6.3 Diplomatic Corps Security Market: Business Opportunities. 124

6.4 Diplomatic Facilities Security Industry: SWOT Analysis. 125

6.4.1 Strengths. 125

6.4.2 Weaknesses. 125

6.4.3 Opportunities. 126

6.4.4 Threats. 126

6.5 Diplomatic Corps Security Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 127

6.6 Market Drivers. 128

6.7 Market Inhibitors. 128

6.8 Global Diplomatic Corps Security Market – 2017-2024. 129

6.8.1 Diplomatic Corps Security Market – 2017-2024. 129

6.8.2 Market Dynamics – 2017-2024. 130

6.8.3 Market Breakdown – 2017-2024. 131

7 Immigration Enforcement Market 132

7.1 Scope. 132

7.2 Key Findings & Conclusions. 132

7.3 Market Background. 135

7.4 Market Drivers. 136

7.5 Market Inhibitors. 137

7.6 Global Immigration Enforcement Market – 2017-2024. 138

7.6.1 Immigration Enforcement Market – 2017-2024. 138

7.6.2 Market Dynamics – 2017-2024. 139

7.6.3 Market Breakdown – 2017-2024. 140

8 Intelligence Agencies Market 141

8.1 Scope. 141

8.2 Major Findings. 142

8.3 Major Conclusions. 142

8.4 Market Background. 143

8.5 Counter-Terror & Crime Intelligence Market Drivers. 144

8.6 Counter-Terror & Crime Intelligence Market Inhibitors. 145

8.7 Terror & Crime Intelligence Business Opportunities & Challenges. 145

8.8 Counter Terror & Crime Intelligence Market: SWOT Analysis. 149

8.9 Counter Terror & Crime Intelligence Market Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 150

8.10 Intelligence Agencies Market – 2017-2024. 151

8.10.1 Intelligence Agencies Market – 2017-2024. 151

8.10.2 Market Dynamics – 2017-2024. 152

8.10.3 Market Breakdown – 2017-2024. 153

9 Maritime Security Market 154

9.1 Scope. 154

9.2 Major Findings. 154

9.3 Major Conclusions. 156

9.4 Maritime Security Infrastructure. 157

9.5 Port Critical Infrastructure Operations. 160

9.6 Maritime Security Market Drivers. 162

9.7 Maritime Security Market Inhibitors. 164

9.8 Maritime Security Market: Business Opportunities & Challenges. 165

9.9 Maritime Security Market: SWOT Analysis. 167

9.10 Global Maritime Security Market – 2017-2024. 167

9.10.1 Maritime Security Market – 2017-2024. 167

9.10.2 Market Dynamics – 2017-2024. 169

9.10.3 Market Breakdown – 2017-2024. 170

10 Mass Transportation Security Market 171

10.1 Scope. 171

10.2 Mass Transportation Security: Market Background. 171

10.3 The EU SECUR-ED Project 175

10.4 Mass Transportation Security Market: Business Opportunities & Challenges 177

10.5 Global Mass Transportation Security Industry: SWOT Analysis. 178

10.5.1 Strengths. 178

10.5.2 Weaknesses. 179

10.5.3 Opportunities. 179

10.5.4 Threats. 180

10.6 Mass Transportation Security Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 181

10.7 Mass Transportation Security Market Drivers. 182

10.8 Mass Transportation Security Market Inhibitors. 183

10.9 Global Mass Transportation Security Market – 2017-2024. 184

10.9.1 Mass Transportation Security Market – 2017-2024. 184

10.9.2 Market Dynamics – 2017-2024. 185

10.9.3 Market Breakdown – 2017-2024. 186

11 Natural Disasters Mitigation Market 187

11.1 Scope. 187

11.2 Natural Disasters Mitigation & Relief Equipment & Systems: Market Background. 187

11.2.1 Overview.. 187

11.2.2 Natural Disasters 2018. 190

11.2.3 2017 Natural Disasters. 191

11.2.4 How to Protect Against Natural Disasters. 194

11.2.5 Natural Disasters Forecasting. 195

11.2.6 Natural Disasters Rescue & Recovery Equipment: Background. 196

11.2.7 Cities Threatened by Major Damaging Natural Disasters. 198

11.2.8 Private Sector Business Involvement in Natural Disaster Mitigation 199

11.2.9 Natural Disasters Mitigation & Relief Equipment & Systems: Business Opportunities. 201

11.3 Natural Disasters Mitigation & Relief Equipment & Systems Market: SWOT Analysis. 202

11.3.1 Strengths. 202

11.3.2 Weaknesses. 202

11.3.3 Opportunities. 203

11.3.4 Threats. 203

11.4 Natural Disasters Mitigation & Relief Equipment & Systems Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 204

11.5 Market Drivers. 205

11.6 Market Inhibitors. 205

11.7 Global Natural Disasters Mitigation Market – 2017-2024. 206

11.7.1 Natural Disasters Mitigation Market – 2017-2024. 206

11.7.2 Market Dynamics – 2017-2024. 207

11.7.3 Market Breakdown – 2017-2024. 208

12 Perimeter Security Market 209

12.1 Scope. 209

12.2 Major Findings & Conclusions. 209

12.3 Market Background. 211

12.4 Market Drivers. 213

12.5 Market Inhibitors. 214

12.6 Perimeter Security Business Opportunities & Challenges. 215

12.7 Perimeter Security Industry Value Chain. 216

12.7.1 The Perimeter Security Value Chain.. 216

12.7.2 Perimeter Security Industry Primary Activities. 217

12.8 Perimeter Security industry Support Activities. 217

12.9 Perimeter Security Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 218

12.10 2018-2024 Perimeter Security Technology Evolution. 219

12.11 Global Perimeter Security (w/o CIP) Market – 2017-2024. 225

12.11.1 Perimeter Security (w/o CIP) Market – 2017-2024. 225

12.11.2 Market Dynamics – 2017-2024. 226

12.11.3 Market Breakdown – 2017-2024. 227

13 Police Modernization & Other 1st Responders Market 228

13.1 Scope. 228

13.2 Police Modernization & Other 1st Responders: Market Background. 229

13.2.1 Police Modernization Vectors. 233

13.2.2 Law Enforcement Agencies and Police Modernization Funding. 234

13.2.3 Police Modernization & Other 1st Responders Business Opportunities 234

13.3 SWOT Analysis. 238

13.3.1 Strengths. 238

13.3.2 Weaknesses. 239

13.3.3 Opportunities. 240

13.3.4 Threats. 241

13.4 Police Modernization Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 242

13.5 Market Analysis. 243

13.5.1 Market Drivers. 243

13.5.2 Market Inhibitors. 244

13.6 Global Police Modernization & Other 1st Responders Market – 2017-2024 244

13.6.1 Police Modernization & Other 1st Responders Market – 2017-2024 244

13.6.2 Market Dynamics – 2017-2024. 245

13.6.3 Market Breakdown – 2017-2024. 246

14 Private Sector Security (w/o CIP) Market 247

14.1 Scope. 247

14.2 Major Findings. 248

14.3 Major Conclusions. 249

14.4 Market Background. 250

14.5 Commercial & Industrial Security Business Opportunities & Challenges 252

14.6 Private Sector Security Market: SWOT Analysis. 253

14.6.1 Strengths. 253

14.6.2 Weaknesses. 254

14.6.3 Opportunities. 254

14.6.4 Threats. 255

14.7 Private Sector Security Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 256

14.8 Market Drivers. 257

14.9 Market Inhibitors. 257

14.10 Global Private Sector Security (w/o CIP) Market – 2015-2022. 258

14.10.1 Private Sector Security (w/o CIP) Market – 2017-2024. 258

14.10.2 Market Dynamics – 2017-2024. 259

14.10.3 Market Breakdown – 2017-2024. 260

15 Public Events Security Market 261

15.1 Scope. 261

15.2 Public Event Security. 262

15.2.1 Pre-Event Planning. 262

15.2.2 During the Event 262

15.2.3 After the Event 262

15.3 Public Events Security Market Background. 263

15.3.1 Public Events Security: Responsible Bodies. 263

15.3.2 Public Events Security: Intelligence Market Background. 263

15.3.3 Public Events Security: Private Sector Market Background. 264

15.3.4 Communication Interoperability Market Background. 264

15.3.5 Perimeter Security Market Background. 264

15.3.6 Public Events Infrastructure Security Market 265

15.3.7 Public Events Emergency Services Market 265

15.3.8 Public Events WMD and Hazmat Detection and Response Market Background. 265

15.3.9 Public Events Transportation Security Market Background. 268

15.4 Public Events Security Market: Business Opportunities & Challenges. 269

15.5 Public Events Security Market: SWOT Analysis. 270

15.5.1 Strengths. 270

15.5.2 Weaknesses. 271

15.5.3 Opportunities. 271

15.5.4 Threats. 272

15.6 Public Events Security Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 273

15.7 Market Drivers. 274

15.8 Market Inhibitors. 275

15.9 Global Public Events Security Market – 2017-2024. 276

15.9.1 Public Events Security Market – 2017-2024. 276

15.9.2 Market Dynamics – 2017-2024. 277

15.9.3 Market Breakdown – 2017-2024. 278

16 Safe City Market 279

16.1 Scope. 279

16.2 Safe City vs. Smart City. 280

16.2.1 Smart Cities. 280

16.2.2 Safe Cities. 283

16.2.3 Key Technology Markets. 285

16.2.4 Safe City Surveillance Systems Market 286

16.2.5 Safe City Disaster Mitigation Process. 287

16.2.6 Safe City Architecture. 289

16.2.7 Safe City Event Awareness Process. 290

16.2.8 Safe City Planning. 291

16.2.9 Safe City Cost Allocation.. 292

16.2.10 Safe City Communication Networks. 293

16.3 Major Findings. 294

16.4 Safe Cities Business Opportunities. 298

16.5 Safe Cities Market: SWOT Analysis. 299

16.5.1 Strengths. 299

16.5.2 Weaknesses. 300

16.5.3 Opportunities. 300

16.5.4 Threats. 301

16.6 Safe Cities Market: Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 302

16.7 Market Analysis. 303

16.7.1 Market Drivers. 303

16.7.2 Regional Market Drivers for Safe Cities. 304

16.7.3 Market Inhibitors. 306

16.8 Global Safe City Market – 2017-2024. 307

16.8.1 Safe City Market – 2017-2024. 307

16.8.2 Market Dynamics – 2017-2024. 308

16.8.3 Market Breakdown – 2017-2024. 309

17 Other HLS & PS Global Vertical Markets. 310

17.1 Other Vertical Markets – 2017-2024. 310

17.2 Market Dynamics – 2017-2024. 311

17.3 Market Breakdown – 2017-2024. 312