Description

The “Industry 4.0 Market and Technologies 2018-2023 – Focus on Europe” 4-volume report is the most comprehensive (granulated into 58 submarkets) and data driven market research available today regarding the European Industry 4.0 market.

Why buy this report?

1] No Risk. We Provide a Money-Back Guarantee**

As a sign of confidence, HSRC launched a Money-Back Guarantee for the report customers, a bold move in the market research industry.

2] This report is based on thousands of sources

The report research team:

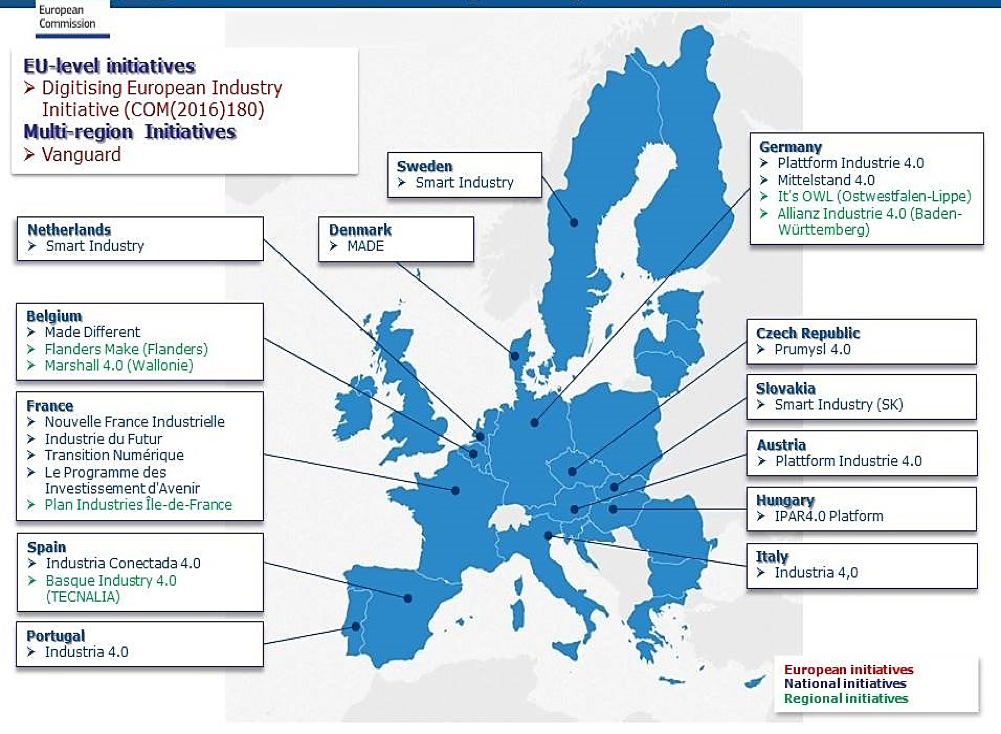

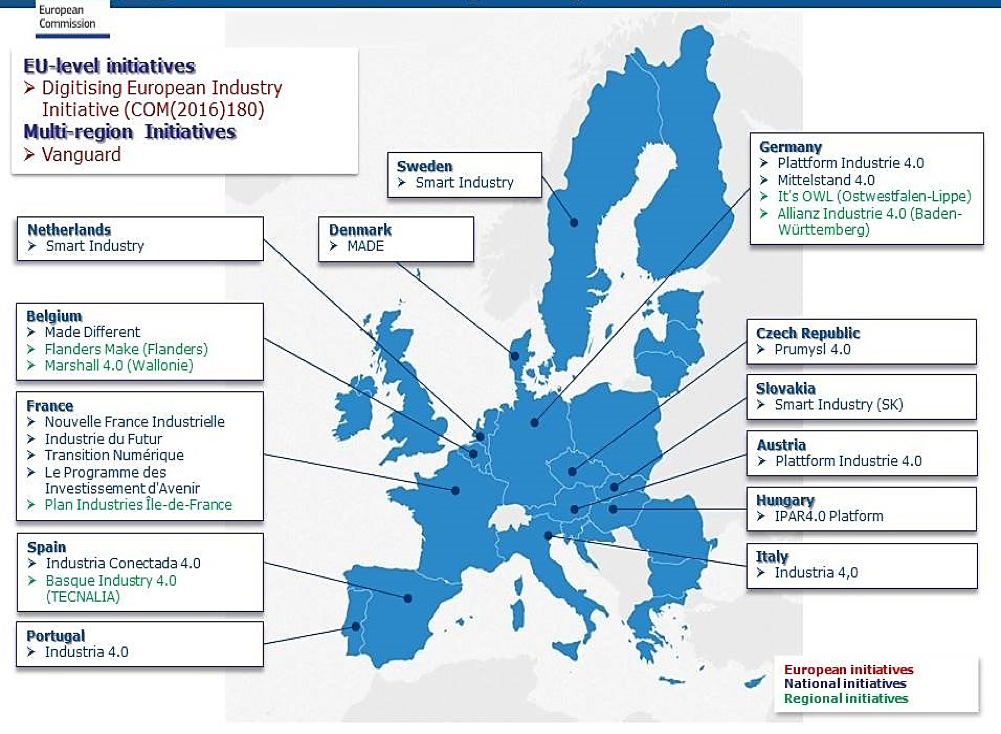

- Analyzed 26 national, local and EU Industry 4.0 programs across Europe (See Figure 1)

- Reviewed over 600 Industry 4.0 reports, papers, vendors and governmental information sources

- Participated in 16 round table Industry 4.0 focus groups

- Conducted 75 face-to-face interviews with industry executives

- Conducted a meta-research including more than 4000 industry executives from more than 2,700 companies in 29 countries

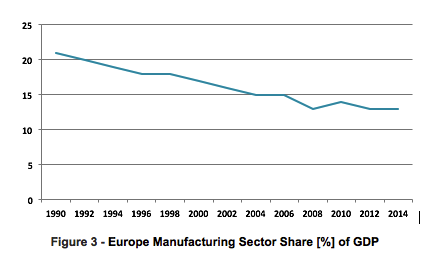

The report analyzes each dollar spent in the Industry 4.0 market via 5 bottom-up research vectors (see figure 3), thus providing a must have mega report for all decision makers in the Industry 4.0 market.

Europe is at the end of the beginning of the industry 4.0 revolution. The proliferation of industrial sensors, the expansion of radio communication and networks, the deployment of intelligent industrial robots and Industrial IoT as well as increased computing power and the development of artificial intelligence and big data analytics, will transform the way products are manufactured in Europe.

Source: European Commission

Figure 1 – European National, Local and EU Industry 4.0 Programs

The industrial sector is important to the European economy, comprising more than 2 million manufacturing companies; it is responsible for over 33 million jobs and over 80% of the European exports.

This 4th industrial revolution holds the promise of improved flexibility in manufacturing, product customization, increased speed, predictive maintenance, better quality and improved productivity across Europe. However, to capture these benefits, enterprises will need to invest in equipment, information and communication technologies and data analysis as well as the integration of data flows throughout the industrial value chain.

Some of the world technology giants (see Figure 2) recognizing the huge business opportunities of the Industry 4.0, invested in R&D, Commercialization of Industry 4.0 technologies and acquired smaller technology companies especially in the AI and big data sector.

The European Industry 4.0 market share race (see Figure 2) is led by the global tech. giants (such as Siemens, SAP, Microsoft, HP, Intel, TI, Alphabet-Google, Samsung and IBM) who have invested billions of dollars in Industry 4.0 products R&D, M&A and Commercialization & Internal Use. The transformation of the global economy, being brought about by Industry 4.0, means that business processes such as supply, manufacturing, maintenance, delivery and customer service will all be connected via the Industrial IoT systems. These extremely flexible value networks will require new forms of collaboration between companies, both nationally and globally.

Figure 2 – Leading Industry 4.0 Technology Corporations

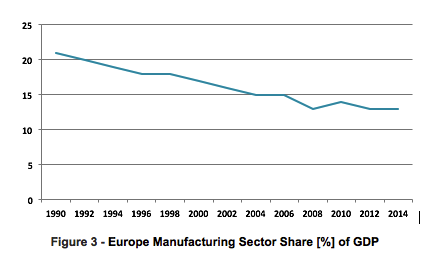

However, the relative contribution of industry to the EU economy (see Figure 3) is declining. The European economy has lost a third of its industrial base over the past four decades. This de-industrialization is partly due to the globalization and the rise of manufacturing in other parts of the globe (especially China). In response to this deterioration, the EU set a target that manufacturing should represent 20% of total value-added in the EU by 2020. As part of its new Digital Single Market Strategy, the European Commission is interested in helping all industrial sectors exploit modern technologies and manage a transition to a smart, Industry 4.0 industrial system. European governments and the private sector invest tens of billions in Industry 4.0 projects each year to increase their industrial base, which has been taken over by low labor cost countries to maintain their industrial base. European governments, also fund Industry 4.0 projects, R&D, and provide subsidies and tax incentives to Industry 4.0 investors.

Figure 3 – Europe Manufacturing Sector Share [%] of GDP

European governments and the EC support Industry 4.0 through investments in R&D, infrastructure, tax incentives and Industry 4.0 projects subsidies. Member states are also sponsoring national initiatives such as Industria 4.0 in Italy and Portugal, Industrie 4.0 in Germany, the Industrie du future in France and Catapult centers in the UK. Industry 4.0 may help to reverse the decline in industrialization and increase the total value-added from manufacturing to a targeted 20% of all value-added by 2020.

Figure 4 – European Industry 4.0 Report Submarkets Granulation Vectors

Europe’s multi trillion USD manufacturing sector, yield over 80% of exports and 80% of the private sector R&D, and as such is one of the key elements of the European sustainable economic growth. Moreover, Due to the globalization and low labor costs in Asia Pacific, the relative contribution of industry to the EU economy is declining. The European economy has lost a 33% of its industrial base over the past four decades. This de-industrialization , a process which is also present in other developed economies, is in part due to the rise of manufacturing in other parts of the world (particularly China), the relocation of labor-intensive manufacturing to countries with lower labor costs and global supply chains with suppliers located abroad.

In a series face-to-face interviews HSRC conducted by Q4 2017 with European executives of 76 multi-billion manufacturing primes we learned that:

- 64 of the respondents said they are fully aware of the risks of a wait and see how industry 4.0 evolves policy

- 35 did not know the underlying business models of the Industry 4.0 and its long-term implications for their industry

- 14 responders stated that their enterprises are already in some stage of conversion to Industry 4.0.

- Even those convinced of the value of Industry 4.0 foresaw a series of barriers ahead.

According to the report:

The Industry 4.0 transformation will change long-held dynamics in commerce and European and global economic balance of power. In the next decades, businesses will establish European and global networks that incorporate their machinery, warehousing systems and production facilities in the shape of Cyber-Physical Systems (CPS). In the manufacturing environment, these cyber-physical systems comprise smart machines, storage systems and production facilities capable of autonomously exchanging information, triggering actions and controlling each other independently. These changes add to the traditional business pressure on manufacturers, but also offer unprecedented opportunities to optimize production processes.

End-to-end transparency is provided over the manufacturing process, facilitating optimized decision-making. Industry 4.0 will also result in new ways of creating value and novel business models. It will provide European start-ups and SMEs with the opportunity to develop and provide downstream services.

The Industry 4.0 competition is not only about technology or offering the best products, but also, about the companies that gather the best data and combine them to offer the best digital services. Those who know what the customer wants, and can forecast consumer demand, will provide the information to develop an unfair competitive advantage.

The major winners might be those that control Industry 4.0 platforms , software layers that syndicate various devices, information and services, on top of which other firms can build their own offerings.

The European Industry 4.0 market will undergo a major transformation in 2018-2023 through the following drivers:

- The risk of continued de-industrialization of Europe

- Global competition in the manufacturing sector is becoming fiercer and fiercer

- Unprecedented opportunities to optimize production processes and customer services

- European governments and their private sector invest in Industry 4.0 to increase their industrial base taken by low labor cost economies

- Government and EU funded Industry 4.0 projects, R&D, subsidies and tax incentives

- Industry 4.0 offers start-ups and SMEs the opportunity to develop and provide downstream services

- Industry 4.0 dynamic business and engineering processes enable last-minute changes to production and deliver the ability to respond flexibly to disruptions and failures on behalf of suppliers and customers

- Industry 4.0 provides the link to the consumer, and can forecast consumer demand

The 4-volume “Industry 4.0 Global Market & Technologies – 2018-2023” report is the most comprehensive review of this emerging market available today. It provides a detailed and reasoned roadmap of this rapidly growing market.

The report analyzes each dollar spent in the Industry 4.0 market via 4 bottom-up research vectors (see Figure 4), thus providing a must-have mega-report for all decision-makers in the Industry 4.0 market.

The report is aimed at:

- Industry 4.0 products vendors

- Industry 4.0 systems integrators

- Government industry agencies

- Manufacturing companies, SME included

The report has been explicitly customized for the industry and government decision-makers to enable them to identify business opportunities, emerging technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 481-page market report include:

- What was the 58 submarkets size and what were the trends during 2016 & 2017?

- What is the 2018-2023 forecast for each of the 58 submarkets?

- Which industries and technologies provide attractive business opportunities?

- What drives the Industry 4.0 managers to purchase solutions and services?

- What are the technology & services trends?

- What are the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

With 481 pages, 74 tables and 223 figures, this 4-volume report covers 10 industries, 10 leading technologies 4 revenue sources and 7 national markets, offering for each of them 2016-2017 estimates and 2018-2023 forecasts and analyses.

Why Buy This Report?

A. This is the most comprehensive information source of the global Industry 4.0 market and technologies.

B. Market data is analyzed via 4 key perspectives:

With a highly fragmented Industry 4.0 market we address the money trail via the following 4 bottom-up market size vectors:

- Aerospace I4.0

- Defense I4.0

- Agriculture I4.0

- Food I4.0

- Automotive I4.0

- Chemical I4.0

- Electronic Hardware I4.0

- Energy, Power I4.0

|

- Oil & Gas I4.0

- Machine Industry I4.0

- Pharmaceutical I4.0

- Machine Industry I4.0

- Biotechnology I4.0

- Semiconductors I4.0

- Other I4.0 Industries

|

- By Industry 4.0 Technologies:

- Additive Manufacturing- 3D Printing

- Advanced Human Machine Interface

- Artificial Intelligence

- Industrial Robots

- Big Data & Analytics

- Cybersecurity & Cloud Computing

|

- Horizontal &Vertical System Integration

- Industrial IoT (IIoT)

- Sensors

- Simulation

- Virtual Reality & Augmented Reality

- Predictive Maintenance

|

- By 4 Revenue Sources:

- Product Sales

- System Installation, Integration & Commissioning

- Aftersale Maintenance, Upgrades & Spare Parts

- Consulting, Planning & Training

- UK

- Germany

- France

- Italy

- Spain

- Scandinavia

- Rest of Europe

C. Detailed market analysis framework is provided:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Barriers to new entry, supplier power, buyer power and competitive rivalry

- Business environment

- The 2016-2023 market segmented by 212 submarkets

- More than 1000 references and links to Industry 4.0 data sources & publications

D. The report includes the following appendices:

- Appendix A: Industry 4.0 Smart Maintenance

- Appendix B: How to Convert an Industry 2.0 or Industry 3.0 Business to Industry 4.0

- Appendix C: Abbreviations

- Appendix D: Terminology

- Appendix E: Research Sources & Bibliography

E. Industry 4.0 market report addresses 12 technologies:

- Additive Manufacturing- 3D Printing

- Advanced Human Machine Interface

- Artificial Intelligence

- Industrial Robots

- Big Data & Analytics

- Cybersecurity & Cloud Computing

- Horizontal and Vertical System Integration

- Industrial IoT (IIoT)

- Sensors

- Simulation

- Virtual Reality

- Augmented Reality

F. The report presents extensive information on 49 leading companies (including companies profile, Industry 4.0 activities & products, and recent events), namely:

3D Systems

ABB Ltd.

Advantech

Aibrain

Alphabet

Arcadia Data

Arm Ltd.

Beijer Electronics

Bosch

Cisco

CyberX

Dassault Syst?mes

DENSO

EOS

ExOne

General Electric

Honeywell |

Hewlett Packard

Huawei

IBM

Intel

Intelligent Automation

Interset Software

Kuka

Magic Leap

Microsoft

Mitsubishi Electric

NEC

NGRAIN

Oculus VR

Oracle

QUALCOMM

Rethink Robotics

Rockwell Automation |

Samsung

SAP

Sensory

Siemens

SIGFOX

Splunk

Sri International

Stratasys

Texas Instruments

TRUMPF

u-blox

Wittenstein

Worldsensing SL

Xerafy

Xjet |

NOTES:

(*) “Market” Definition. Industry 4.0 turnkey systems sale, aftersales maintenance & upgrades and outsourced services such as consulting, planning & training

(**) Industry 4.0 Report “Money-Back Guarantee” Program: Terms & Conditions

- To qualify for the money-back guarantee program send an email with your contact information to: sales@homelandsecurityresearch.com

- HSRC will inform the customer of his/her eligibility for the program ASAP.

- Qualified customers are required to pay the full list price of the report, and a copy of the report will be dispatched to them ASAP.

- Customers wishing to implement the money-back-guarantee policy, must notify HSRC via e-mail (sales@homelandsecurityresearch.com), within 48 hours of receipt of the report that they request a refund. The customer will have to erase and destroy any copy of the report and inform sales@homelandsecurityresearch.com that it has been done.

- The customer has 48 hours of receipt of the report to fully comply with Clause (4).

- HSRC would appreciate receiving customer’s honest review of the report and the reason(s) it didn’t meet his/her needs/expectations.

- Upon receipt of the e-mail as detailed in Clause (4), HSRC will issue within 3 working days a refund instruction (minus $300 for shipping and handling).

- HSRC reserves the right to decide that a company doesn’t qualify for this promotion at HSRC’s own discretion

(***) The Meta-Research is based on the statistics of 11 Industry 4.0 surveys conducted by HSRC, BCG, PwC, Deloitte, Roland Berger, Rittal, Siemens and The Economist Intelligence Unit, totaling >4000 responders.

Table of Contents

Download TOC as PDF

4 Volumes:

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 1

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 2

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 3

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 4

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 1

| 1 |

Executive Summary |

| 1.1 |

Industry 4.0 Definition |

| 1.2 |

Fourth Industrial Revolution – Industry 4.0 Evolution |

| 1.3 |

Key Findings |

| 1.4 |

Key Market Drivers |

| 1.5 |

Industry 4.0 Key Challenges |

| 1.6 |

Major Conclusions |

| 1.7 |

Industry 4.0 Eco-System |

| 1.8 |

Industry 4.0 Client CEO Takeaway |

| 1.9 |

Recommendations for Industry 4.0 Vendors |

| 1.1 |

Industry 4.0 Market Research Vectors |

| 1.11 |

Europe Industry 4.0 Market Size – 2016-2023 |

| 1.11.1 |

Europe Industry 4.0 Market Size by Industry – 2016-2023 |

| 1.11.2 |

Europe Industry 4.0 Market Size by Technology – 2016-2023 |

| 1.11.3 |

Europe Industry 4.0 Market Size by Revenue Source -2016-2023 |

| 1.11.4 |

Industry 4.0 Market Size by Country – 2016-2023 |

| 2 |

Industry 4.0 Market Background |

| 2.1 |

Industry 4.0 Market: Introduction |

| 2.2 |

Industry 3.0 Factory Vs. Industry 4.0 Factory |

| 2.3 |

Industry 4.0 Ecosystem and Outlook |

| 2.4 |

Industry 4.0 Design Principles |

| 2.5 |

Industry 4.0 Technologies, Architecture and Supply Chain Intra-Relationship |

| 2.6 |

Manufacturers Industry 4.0 Introduction Strategies |

| 2.7 |

Cobots |

| 2.8 |

In-memory Computing |

| 2.9 |

Edge Computing |

| 2.1 |

Industry Cyber-Physical Systems (CPS) |

| 2.11 |

Industry 4.0 Mega Trends |

| 2.12 |

Predictive Maintenance 4.0 |

| 2.13 |

Smart Factories |

| 2.14 |

Society 4.0 |

| 2.15 |

Customized Manufacturing 4.0 |

| 2.16 |

Industry 4.0: Value Chain |

| 2.17 |

Logistics 4.0 & Smart Supply Chain 4.0 Management |

| 2.18 |

Value of Industry 4.0 Partnerships |

| 2.19 |

Industry 4.0 & Smart Manufacturing: Operational-Technology & Information Technology Convergence |

| 2.2 |

Industry 4.0 Lifecycle Management |

| 2.21 |

Industry 4.0 Vertical Integration |

| 2.22 |

Industry 4.0: Effects on the Private Sector |

| 2.23 |

Industry 4.0: Effects on Governments |

| 2.24 |

How to Introduce Industry 4.0: The Fourth Industrial Revolution Intelligence Concept (4IRI) |

| 2.25 |

Industry 4.0 Challenges |

| 2.26 |

Industry 4.0 Risks |

| 3 |

Industry 4.0 Market Drivers |

| 4 |

Industry 4.0 Market Inhibitors |

| 5 |

Industry 4.0 SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

Barriers to New Entry, Supplier Power, Buyer Power and Competitive Rivalry |

| 7 |

Business Opportunities |

| 7.1 |

Industrie 4.0 is Both Good and Bad News For Suppliers |

| 7.2 |

Industry 4.0 Business Opportunities |

| 7.2.1 |

Platforms |

| 7.2.2 |

Licensed IP: |

| 7.2.3 |

Pay-By-Use and Subscription Based Services: |

| |

|

| |

INDUSTRY 4.0 MARKET |

| 8 |

Europe Industry 4.0 Market by Industry – 2016-2023 |

| 8.1 |

Europe Industry 4.0 Market Size 2016-2023 |

| 8.2 |

Europe Industry 4.0 Market Breakdown 2016-2023 |

| 9 |

Aerospace & Defense 4.0 Market – 2016-2023 |

| 9.1 |

Defense Industry 4.0 Market Background |

| 9.2 |

U.S. Defense Scenario |

| 9.3 |

Aerospace Industry 4.0 Market Background |

| 9.4 |

Europe Aerospace & Defense Industry 4.0 Market Size 2016-2023 |

| 9.4.1 |

Industry 4.0 Aerospace & Defense Market Size 2016-2023 |

| 9.4.2 |

Aerospace & Defense Industry 4.0: Market Dynamics 2016-2023 |

| 9.4.3 |

Aerospace & Defense Industry 4.0: Market Breakdown 2016-2023 |

| 10 |

Agriculture & Food Industries 4.0 Market – 2016-2023 |

| 10.1 |

Agriculture 4.0 Market Background |

| 10.1.1 |

Introduction |

| 10.1.2 |

Agriculture 4.0 Scope |

| 10.1.3 |

Agriculture 4.0 Farm Machinery |

| 10.1.4 |

The Added Value for Customers & Farmers |

| 10.1.5 |

Agriculture 4.0 Conclusions |

| 10.2 |

Europe Agriculture & Food Industry 4.0 Market 2016-2023 |

| 10.2.1 |

Industry 4.0 Agriculture & Food Market Size 2016-2023 |

| 10.2.2 |

Agriculture & Food Industry 4.0: Market Dynamics 2016-2023 |

| 10.2.3 |

Agriculture & Food Industry 4.0: Market Breakdown 2016-2023 |

| 11 |

Automotive Industry Market – 2016-2023 |

| 11.1 |

Industry 4.0 Automotive Industry Market Background |

| 11.2 |

Industry 4.0 on the Automotive Industry: Major Trends |

| 11.2.1 |

Automotive Industry Cloud Computing |

| 11.2.2 |

Automotive Industry Cybersecurity |

| 11.2.3 |

Automotive Industry Big Data Analytics |

| 11.2.4 |

Automotive Industry Internet of Cars |

| 11.2.5 |

Automotive Industry: Opportunities |

| 11.3 |

Automotive Industry 4.0 Market Drivers |

| 11.4 |

Automotive Industry 4.0 Market: Key Challenges |

| 11.5 |

Autonomous Cars 4.0 |

| 11.6 |

Automotive Industry 4.0: Internet of Things |

| 11.7 |

Automotive Industry 4.0: Machine-Learning |

| 11.8 |

Automotive Industry 4.0: Cloud-based Intelligence |

| 11.9 |

Customized Car Manufacturing 4.0 |

| 11.1 |

Automotive Industry 4.0 Example: BMW |

| 11.11 |

Europe Automotive Industry 4.0 Market 2016-2023 |

| 11.11.1 |

Industry 4.0 Automotive Market Size 2016-2023 |

| 11.11.2 |

Automotive Industry 4.0: Market Dynamics 2016-2023 |

| 12 |

Chemical Industry 4.0 Market – 2016-2023 |

| 12.1 |

Chemical Industry 4.0 Market Background |

| 12.1.1 |

The Europe Chemical Industry |

| 12.1.2 |

Chemical Industry 4.0 Market |

| 12.1.3 |

Industry 4.0 Transformations in the Chemical Industry |

| 12.2 |

Europe Chemical Industry 4.0 Market 2016-2023 |

| 12.2.1 |

Industry 4.0 Chemical Market Size 2016-2023 |

| 12.2.2 |

Chemical Industry 4.0: Market Dynamics 2016-2023 |

| 13 |

Electronic & Electrical Hardware Industries 4.0 Market – 2016-2023 |

| 13.1 |

Electronic & Electrical Hardware: Industry 4.0 Market Background |

| 13.2 |

Europe Electronic & Electrical Hardware Industry 4.0 Market 2016-2023 |

| 13.2.1 |

Industry 4.0 Electronic & Electrical Hardware Market Size 2016-2023 |

| 13.2.2 |

Electronic & Electrical Hardware Industry 4.0: Market Dynamics 2016-2023 |

| 14 |

Energy, Power, Oil & Gas 4.0 Market – 2016-2023 |

| 14.1 |

Industry 4.0 Energy, Power, Oil & Gas Market Background |

| 14.1.1 |

Energy, Power, Oil & Gas Industry Trends |

| 14.1.2 |

The Oil & Gas Industry |

| 14.1.3 |

Industry 4.0 Oil & Gas Sector Environmental Perspective |

| 14.1.4 |

Industry 4.0 Undersea Oil & Gas Challenge |

| 14.1.5 |

Oil & Gas Big Data |

| 14.1.6 |

Oil & Gas Industry 4.0 Outlook |

| 14.1.7 |

Industry 4.0 Energy and Power Market Background |

| 14.2 |

Industry 4.0 & Industrial IoT Energy Productivity |

| 14.2.1 |

Introduction |

| 14.2.2 |

Energy and Power Industry 4.0 Remote Monitoring |

| 14.2.3 |

Predictive Maintenance |

| 14.2.4 |

Energy and Power Industry 4.0 Advanced Control |

| 14.3 |

Europe Energy, Power, Oil & Gas Industry 4.0 Market 2016-2023 |

| 14.3.1 |

Industry 4.0 Energy, Power, Oil & Gas Market Size 2016-2023 |

| 14.3.2 |

Energy, Power, Oil & Gas Industry 4.0: Market Dynamics 2016-2023 |

| 15 |

Machine Manufacturing 4.0 Market – 2016-2023 |

| 15.1 |

Machine Manufacturing Industry 4.0 Market Background |

| 15.1.1 |

The Machine Manufacturing Industry |

| 15.1.2 |

Machine Manufacturing Industry 4.0 Market |

| 15.2 |

Europe Machine Manufacturing Industry 4.0 Market 2016-2023 |

| 15.2.1 |

Industry 4.0 Machine Market Size 2016-2023 |

| 15.2.2 |

Machine Industry 4.0: Market Dynamics 2016-2023 |

| 16 |

Pharmaceutical & Biotechnology 4.0 Market – 2016-2023 |

| 16.1 |

Pharmaceutical & Biotechnology Industry 4.0 Market Background |

| 16.2 |

Europe Pharmaceutical & Biotechnology Industry 4.0 Market 2016-2023 |

| 16.2.1 |

Industry 4.0 Pharmaceutical & Biotechnology Market Size 2016-2023 |

| 16.2.2 |

Pharmaceutical & Biotechnology Industry 4.0: Market Dynamics 2016-2023 |

| 17 |

Semiconductors 4.0 Market – 2016-2023 |

| 17.1 |

Semiconductor Market Background |

| 17.1.1 |

Industry 4.0 Semiconductors |

| 17.1.2 |

Semiconductor Manufacturing Horizontal Integration |

[Back to top]

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 2

| |

TECHNOLOGY MARKETS |

| 1 |

Industry 4.0 Technology Markets |

| 1.1 |

Background |

| 1.2 |

The Forth Industrial Revolution Technologies |

| 1.3 |

Industry 4.0 Manufacturing Technologies |

| 1.4 |

Cyber Physical Infrastructure (CPS) |

| 1.5 |

Industry 4.0 Big Data and Cloud Computing |

| 1.6 |

Augmented Reality, Simulation & Visualization |

| 1.7 |

Industry 4.0 ICT |

| 1.7.1 |

Industry 4.0 Enterprise Resource Planning (ERP) |

| 1.7.2 |

ERP 4.0 |

| 1.7.3 |

Quality Management ERP 4.0 |

| 1.7.4 |

Supervisory Control and Data Acquisition (SCADA) |

| 1.8 |

On-Demand Industry 4.0 |

| 1.8.1 |

Programmable Logic Controller (PLC) |

| 1.8.2 |

Distributed Control System (DCS) |

| 1.8.3 |

Embedded ICT Conclusions |

| 1.9 |

Industry 4.0 Standardization Languages |

| 1.1 |

Visual Intelligence |

| 1.11 |

Industry 4.0 Technologies: Conclusions |

| 1.12 |

Europe Consolidated Industry 4.0 Market, by Technology 2016-2023 |

| 2 |

Additive Manufacturing 3D Printing 4.0 Market – 2016-2023 |

| 2.1 |

Industry 4.0 Additive Manufacturing – 3D Printing Market Background |

| 2.1.1 |

Additive Manufacturing- 3D Printing: Introduction |

| 2.1.2 |

Additive Manufacturing – 3D Printing Technologies |

| 2.1.3 |

3D Printer: 27 Manufacturers |

| 2.1.4 |

Categories of Additive Materials |

| 2.2 |

Europe Industry 4.0 Additive Manufacturing-3D Printing Market 2016-2023 |

| 2.2.1 |

Industry 4.0 Additive Manufacturing – 3D Printing Market Size 2016-2023 |

| 2.2.2 |

Additive Manufacturing – 3D Printing Industry 4.0 Market Dynamics 2016-2023 |

| 3 |

Advanced Human Machine Interface 4.0 Market – 2016-2023 |

| 3.1 |

Industry 4.0 Advanced Human Machine Interface Market Background |

| 3.2 |

Europe Industry 4.0 Advanced Human Machine Interface Market 2016-2023 |

| 3.2.1 |

Industry 4.0 Advanced Human Machine Interface Market Size 2016-2023 |

| 3.2.2 |

Advanced Human Machine Interface Industry 4.0 Market Dynamics 2016-2023 |

| 4 |

Artificial Intelligence 4.0 Market – 2016-2023 |

| 4.1 |

Industry 4.0 Artificial Intelligence Market Background |

| 4.2 |

Industry 4.0 Artificial Intelligence |

| 4.2.1 |

Industry 4.0 AI Automated Planning and Scheduling |

| 4.2.2 |

Industry 4.0 AI Based Machine Learning |

| 4.2.3 |

Industry 4.0 AI in Robotics |

| 4.2.4 |

Artificial Neural Network and Connectionism |

| 4.2.5 |

Deep Learning |

| 4.2.6 |

Automotive AI |

| 4.2.7 |

The AI Partnership |

| 4.3 |

Europe Industry 4.0 Artificial Intelligence Market 2016-2023 |

| 4.3.1 |

Industry 4.0 Artificial Intelligence Market Size 2016-2023 |

| 4.3.2 |

Artificial Intelligence Industry 4.0 Market Dynamics 2016-2023 |

| 5 |

Industrial Robots 4.0 Market – 2016-2023 |

| 5.1 |

Industry 4.0 Industrial Robots Market Background |

| 5.1.1 |

Industry 4.0 Industrial Robots |

| 5.1.2 |

Integration of Robots in Industry 4.0 |

| 5.1.3 |

Robots Role in Industry 4.0 |

| 5.1.4 |

4.0 Autonomous Robots Market: Conclusions |

| 5.1.5 |

Industry 4.0 Autonomous Robots Market Outlook |

| 5.2 |

Industrial Robots: Facts and Figures |

| 5.2.1 |

Industry 4.0 Delta Robots Market Background |

| 5.2.2 |

Industry 4.0 Parallel Robots Market Background |

| 5.2.3 |

Industry 4.0 Articulated Robots Market Background |

| 5.2.4 |

Industry 4.0 Cartesian & Gantry Robots Market Background |

| 5.2.5 |

Industry 4.0 SCARA Robots Market Background |

| 5.2.6 |

Industry 4.0 Collaborative Industry Robots Market Background |

| 5.2.7 |

Industry 4.0 Cylindrical Robots Market Background |

| 5.3 |

Key Vendors |

| 5.4 |

Europe Industry 4.0 Robots Market 2016-2023 |

| 5.4.1 |

Industry 4.0 Robots Market Size 2016-2023 |

| 5.4.2 |

Robots Industry 4.0 Market Dynamics 2016-2023 |

| 6 |

Big Data & Analytics 4.0 Market – 2016-2023 |

| 6.1 |

Industry 4.0 Big Data & Analytics Market Background |

| 6.1.1 |

Big Data Analytics |

| 6.1.2 |

Industry 4.0 Big Data & Analytics Market Outlook |

| 6.2 |

Europe Industry 4.0 Big Data & Analytics Market 2016-2023 |

| 6.2.1 |

Industry 4.0 Big Data & Analytics Market Size 2016-2023 |

| 6.2.2 |

Big Data & Analytics Industry 4.0 Market Dynamics 2016-2023 |

| 7 |

Cybersecurity & Cloud Computing 4.0 Market – 2016-2023 |

| 7.1 |

Industry 4.0 Cloud Computing |

| 7.1.1 |

Summary |

| 7.1.2 |

Introduction to Cloud Computing |

| 7.1.3 |

Cloud Computing Impact on Industry 4.0 |

| 7.1.4 |

Industry 4.0 Cloud Computing Market Background |

| 7.1.5 |

Cloud Manufacturing Market Background |

| 7.2 |

Industry 4.0 Cybersecurity Market Background |

| 7.3 |

Europe Industry 4.0 Cybersecurity & Cloud Computing Market 2016-2023 |

| 7.3.1 |

Industry 4.0 Cybersecurity & Cloud Computing Market Size 2016-2023 |

| 7.3.2 |

Cybersecurity & Cloud Computing Industry 4.0 Market Dynamics 2016-2023 |

| 8 |

Horizontal and Vertical System Integration 4.0 Market – 2016-2023 |

| 8.1 |

Industry 4.0 Horizontal and Vertical System Integration Market Background |

| 8.2 |

Europe Industry 4.0 Horizontal and Vertical System Integration Market 2016-2023 |

| 8.2.1 |

Industry 4.0 Horizontal and Vertical System Integration Market Size 2016-2023 |

| 8.2.2 |

Horizontal and Vertical System Integration Industry 4.0 Market Dynamics 2016-2023 |

| 9 |

Sensors and Industrial IoT 4.0 Market – 2016-2023 |

| 9.1 |

Industry 4.0 Sensors and Industrial IoT Market Background |

| 9.2 |

Industrial IoT (IIoT): Introduction |

| 9.2.1 |

Industrial IoT Market |

| 9.2.2 |

Industrial IoT Cybersecurity |

| 9.3 |

Industrial Internet of Things Market Outlook |

| 9.4 |

Industry 4.0 Sensors Market Background |

| 9.5 |

Industry 4.0 Sensors Communication Protocols |

| 9.6 |

Europe Industry 4.0 Sensors and Industrial IoT Market 2016-2023 |

| 9.6.1 |

Industry 4.0 Sensors & Industrial IoT Market Size 2016-2023 |

| 9.6.2 |

Sensors & Industrial IoT Industry 4.0 Market Dynamics 2016-2023 |

| 10 |

Simulation 4.0 Market – 2016-2023 |

| 10.1 |

Industry 4.0 Simulation Market Background |

| 10.2 |

Europe Industry 4.0 Simulation Market 2016-2023 |

| 10.2.1 |

Industry 4.0 Simulation Market Size 2016-2023 |

| 10.2.2 |

Simulation Industry 4.0 Market Dynamics 2016-2023 |

| 11 |

Virtual Reality & Augmented Reality 4.0 Market – 2016-2023 |

| 11.1 |

Industry 4.0 Virtual Reality & Augmented Reality Market Background |

| 11.2 |

Europe Industry 4.0 Virtual Reality & Augmented Reality Market 2016-2023 |

| 11.2.1 |

Industry 4.0 Virtual Reality & Augmented Reality Market Size 2016-2023 |

| 11.2.2 |

Virtual Reality & Augmented Reality Industry 4.0 Market Dynamics 2016-2023 |

[Back to top]

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 3

| |

NATIONAL MARKETS |

| 1 |

UK Industry 4.0 Market 2016-2023 |

| 1.1 |

Facts & Figures |

| 1.2 |

The UK Government Industry 4.0 Policy |

| 1.2.1 |

Introduction |

| 1.2.2 |

Recommendations |

| 1.3 |

UK Industry 4.0 Market Background |

| 1.4 |

Example: UK Industry 4.0 Vehicle Manufacturing Sector |

| 1.5 |

Industry 4.0 Links |

| 1.6 |

UK Industry 4.0 Market |

| 1.6.1 |

UK Market Size by Revenue Source 2016-2023 |

| 1.6.2 |

UK Industry 4.0 Market Dynamics 2016-2023 |

| 1.6.3 |

UK Industry 4.0 Market Breakdown 2016-2023 |

| 2 |

Germany Industry 4.0 Market 2016-2023 |

| 2.1 |

Facts & Figures |

| 2.2 |

Germany Industrie 4.0 Market Background |

| 2.2.1 |

Market Background |

| 2.2.2 |

German Government and Fraunhofer Industrie 4.0 Projects |

| 2.2.3 |

Germany, France and Italy Industry 4.0 Collaboration |

| 2.2.4 |

General Dos & Don’ts for Industry 4.0 Vendors in Germany |

| 2.2.5 |

The German Industrie 4.0 Transformation Strategy |

| 2.3 |

German Industry 4.0 Links |

| 2.4 |

Germany Industrie 4.0 Market |

| 2.4.1 |

Germany Market Size by Revenue Source 2016-2023 |

| 2.4.2 |

Germany Industrie 4.0 Market Dynamics 2016-2023 |

| 2.4.3 |

Germany Industrie 4.0 Market Breakdown 2016-2023 |

| 3 |

France Industry 4.0 Market 2016-2023 |

| 3.1 |

Facts & Figures |

| 3.2 |

France Industry 4.0 Market Background |

| 3.3 |

The Industrie du Futur Alliance |

| 3.4 |

Industry 4.0 Links |

| 3.5 |

France Industry 4.0 Market |

| 3.5.1 |

France Market Size by Revenue Source 2016-2023 |

| 3.5.2 |

France Industry 4.0 Market Dynamics 2016-2023 |

| 3.5.3 |

France Industry 4.0 Market Breakdown 2016-2023 |

| 4 |

Italy Industry 4.0 Market 2016-2023 |

| 4.1 |

Facts & Figures |

| 4.2 |

Italy Industry 4.0 Market Background |

| 4.3 |

Leading Industry 4.0 Sub-Sectors |

| 4.4 |

Italy Industry 4.0: Tax Incentives |

| 4.5 |

Industry 4.0 Market: Business Opportunities |

| 4.6 |

Italy Industry 4.0 Links |

| 4.7 |

Italy Industry 4.0 Market |

| 4.7.1 |

Italy Market Size by Revenue Source 2016-2023 |

| 4.7.2 |

Italy Industry 4.0 Market Dynamics 2016-2023 |

| 4.7.3 |

Italy Industry 4.0 Market Breakdown 2016-2023 |

| 5 |

Spain Industry 4.0 Market 2016-2023 |

| 5.1 |

Facts & Figures |

| 5.2 |

Spain Industry 4.0 Market Background |

| 5.3 |

Joint Action for Industry Digitization |

| 5.4 |

Developing Local Supply of Digital Solutions |

| 5.5 |

Spain Connected Industry 4.0 (CI 4.0) Program Funding |

| 5.6 |

Spain Industry 4.0 Market SWOT Analysis |

| 5.7 |

Industry 4.0 Links |

| 5.8 |

Spain Industry 4.0 Market |

| 5.8.1 |

Spain Market Size by Revenue Source 2016-2023 |

| 5.8.2 |

Spain Industry 4.0 Market Dynamics 2016-2023 |

| 5.8.3 |

Spain Industry 4.0 Market Breakdown 2016-2023 |

| 6 |

Scandinavia Industry 4.0 Market 2016-2023 |

| 6.1 |

Sweden Industry 4.0 Market Background |

| 6.1.1 |

Sweden Manufacturing Sector |

| 6.1.2 |

Sweden Industry 4.0 Market |

| 6.1.3 |

Sweden Industry 4.0 Links |

| 6.2 |

Finland Industry 4.0 Market Background |

| 6.2.1 |

Finland Manufacturing Sector |

| 6.2.2 |

Finland Industry 4.0 Market |

| 6.2.3 |

Finland Industry 4.0 Links |

| 6.3 |

Denmark Industry 4.0 Market Background |

| 6.3.1 |

Denmark Manufacturing Sector |

| 6.3.2 |

Denmark Industry 4.0 Market |

| 6.3.3 |

Denmark Industry 4.0 Market SWOT Analysis |

| 6.3.4 |

Denmark Industry 4.0 Links |

| 6.4 |

Norway Industry 4.0 Market Background |

| 6.4.1 |

Norway Manufacturing Sector |

| 6.4.2 |

Norway Industry 4.0 Market |

| 6.4.3 |

Norway Industry 4.0 Links |

| 6.5 |

Scandinavia Industry 4.0 Market |

| 6.5.1 |

Scandinavia Market Size by Revenue Source 2016-2023 |

| 6.5.2 |

Scandinavia Industry 4.0 Market Dynamics 2016-2023 |

| 6.5.3 |

Scandinavia Industry 4.0 Market Breakdown 2016-2023 |

| 7 |

Rest of Europe Industry 4.0 Market 2016-2023 |

| 7.1 |

Rest of Europe Market Size by Revenue Source 2016-2023 |

| 7.2 |

Rest of Europe Industry 4.0 Market Dynamics 2016-2023 |

| 7.3 |

Rest of Europe Industry 4.0 Market Breakdown 2016-2023 |

[Back to top]

Industry 4.0 Market & Technologies Focus on Europe – 2018 – 2023 – Volume 4

| 1 |

Vendors |

| 1.1 |

3D Systems Corporation |

| 1.1.1 |

Key Data |

| 1.1.2 |

Company Profile |

| 1.1.3 |

Industry 4.0 Market: Products & Activities |

| 1.1.4 |

Recent Events |

| 1.2 |

ABB Ltd. |

| 1.2.1 |

Key Data |

| 1.2.2 |

Company Profile |

| 1.2.3 |

Industry 4.0 Market: Products & Activities |

| 1.2.4 |

Recent Events |

| 1.3 |

Advantech Co Ltd |

| 1.3.1 |

Key Data |

| 1.3.2 |

Company Profile |

| 1.3.3 |

Industry 4.0 Market: Products & Activities |

| 1.3.4 |

Recent Events |

| 1.4 |

Aibrain Inc. |

| 1.4.1 |

Key Data |

| 1.4.2 |

Company Profile |

| 1.4.3 |

Industry 4.0 Market: Products & Activities |

| 1.4.4 |

Recent Events |

| 1.5 |

Alphabet Inc. |

| 1.5.1 |

Key Data |

| 1.5.2 |

Company Profile |

| 1.5.3 |

Industry 4.0 Market: Products & Activities |

| 1.5.4 |

Recent Events |

| 1.6 |

Arcadia Data |

| 1.6.1 |

Key Data |

| 1.6.2 |

Company Profile |

| 1.6.3 |

Industry 4.0 Market: Products & Activities |

| 1.6.4 |

Recent Events |

| 1.7 |

Arm Ltd. |

| 1.7.1 |

Key Data |

| 1.7.2 |

Company Profile |

| 1.7.3 |

Industry 4.0 Market: Products & Activities |

| 1.7.4 |

Recent Events |

| 1.8 |

Beijer Electronics AB |

| 1.8.1 |

Key Data |

| 1.8.2 |

Company Profile |

| 1.8.3 |

Industry 4.0 Market: Products & Activities |

| 1.8.4 |

Recent Events |

| 1.9 |

Bosch Software Innovations GmbH |

| 1.9.1 |

Key Data |

| 1.9.2 |

Company Profile |

| 1.9.3 |

Industry 4.0 Market: Products & Activities |

| 1.9.4 |

Recent Events |

| 1.1 |

Cisco Systems Inc. |

| 1.10.1 |

Key Data |

| 1.10.2 |

Company Profile |

| 1.10.3 |

Industry 4.0 Market: Products & Activities |

| 1.10.4 |

Recent Events |

| 1.11 |

CyberX, Inc. |

| 1.11.1 |

Key Data |

| 1.11.2 |

Company Profile |

| 1.11.3 |

Industry 4.0 Market: Products & Activities |

| 1.11.4 |

Recent Events |

| 1.12 |

Dassault Syst?mes |

| 1.12.1 |

Key Data |

| 1.12.2 |

Company Profile |

| 1.12.3 |

Industry 4.0 Market: Products & Activities |

| 1.12.4 |

Recent Events |

| 1.13 |

DENSO Corporation |

| 1.13.1 |

Key Data |

| 1.13.2 |

Company Profile |

| 1.13.3 |

Industry 4.0 Market: Products & Activities |

| 1.13.4 |

Recent Events |

| 1.14 |

EOS GmbH |

| 1.14.1 |

Key Data |

| 1.14.2 |

Company Profile |

| 1.14.3 |

Industry 4.0 Market: Products & Activities |

| 1.14.4 |

Recent Events |

| 1.15 |

ExOne Company |

| 1.15.1 |

Key Data |

| 1.15.2 |

Company Profile |

| 1.15.3 |

Industry 4.0 Market: Products & Activities |

| 1.15.4 |

Recent Events |

| 1.16 |

GE – General Electric Company |

| 1.16.1 |

Key Data |

| 1.16.2 |

Company Profile |

| 1.16.3 |

Industry 4.0 Market: Products & Activities |

| 1.16.4 |

Recent Events |

| 1.17 |

Honeywell International Inc. |

| 1.17.1 |

Key Data |

| 1.17.2 |

Company Profile |

| 1.17.3 |

Industry 4.0 Market: Products & Activities |

| 1.17.4 |

Recent Events |

| 1.18 |

HPE – Hewlett Packard Enterprise |

| 1.18.1 |

Key Data |

| 1.18.2 |

Company Profile |

| 1.18.3 |

Industry 4.0 Market: Products & Activities |

| 1.18.4 |

Recent Events |

| 1.19 |

Huawei Technology Co., Ltd. |

| 1.19.1 |

Key Data |

| 1.19.2 |

Company Profile |

| 1.19.3 |

Industry 4.0 |