Description

|

|

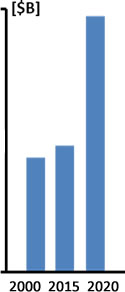

European Police Modernization & First Responders Markets – 2000, 2015 & 2020

|

Europe’s 2.55 million police officers and 820,000 1st responders are facing ISIS terror attacks and threats coupled with the surge in entry of 1.8 million migrants (UN data) with far greater complexity than ever before.

Germany’s police forces and other 1st responders (which include only 9% of the European police officers and 1st responders) are forecast by 2020 to procure 22% of the continent’s market for police and 1st responder’s related goods and services. The European police forces challenges were best stated in March 2016 by Mr. E. Walter, Chairman of the German Federal Police (DPoIG): “Germany’s police (is) the first and last line of defense and response to any terror attack; they’re simply not equipped for the challenge. Where we are not prepared is with the policeman on the street; normally the first to confront terrorists. (For example) we need modern weapons. We need armed helmets against shooting by a Kalashnikov. We have very old weapons in the German police force. The machine guns are the machine pistol MP5 it is about 50 years old“.

Present European police agencies’ capabilities simply can’t meet Europe’s Terror & Migration Crisis challenges. Following the Paris and Brussels terror attacks a major overhaul of the European police forces infrastructure and funding is already in progress.

The “European Police Modernization & First Responders Markets – 2017-2022” report is the most comprehensive review of the market available today. It provides a detailed and reasoned roadmap of this growing market.

The market is set to undergo a major transformation from 2016-2022 through the following drivers:

- The Paris and Brussels 2015-2016 terror attacks shook the European police agencies, governments and public unlike any other recent homegrown or ISIS-Da’esh-inspired terrorist attacks since they were complex and well-planned.

- Western Europe, the largest economy in the world with a 2015 GDP of approximately $22 trillion (vs. the U.S. $17.5 trillion), can invest “whatever it takes” in its police forces to protect its citizens from the looming risks of terrorism and immigration.

- The Western European police forces are ill equipped to counter 21st century terrorists who use cutting edge encrypted communication, conduct remarkable pre-attack intelligence by jihadists who have been trained by ISIS ex-Iraqi military officers on planning and conducting modern day guerrilla warfare, and use modern weapons.

- Europol estimates that up to 11,000 European jihadists (5000 in Western Europe and 6000 in Eastern Europe) have returned to Europe after obtaining combat experience on the battlefields of the Middle East.

- The European Police Office (EUROPOL) estimates that there are 4 million unregistered illegal firearms in the Balkans, and over 30,000 military-grade weapons from the former Yugoslavia in circulation in Western Europe.

- The Law Enforcement, Police modernization & 1st Responder industry faces a considerable challenge in seeking to provide the necessary solutions to current and future threats. At the same time, this challenge presents immense opportunities for the defense and security industries able to deliver effective functions, integrate systems and maximize security and productivity per $ invested.

- The EU and the rest of the European police & 1st responders’ market for products and services are served by local defense and security companies. Even with a preference for locally manufactured products, foreign products can usually strongly compete on the basis of cost-performance. They do not encounter any EU direct trade barriers or quotas. Non-tariff, indirect trade barriers may be the approval process of dual use goods, which include many security market products.

This report is a resource for executives with interests in the market. It has been explicitly customized for the security industry and other decision-makers in order to identify business opportunities, developing technologies, market trends and risks, as well as to benchmark business plans.

Questions answered in this 185-page report + one* report include:

- What will the market size and trends be during 2016-2022?

- Which submarkets provide attractive business opportunities?

- Who are the decision-makers?

- What drives the police and 1st responder agencies to purchase products and services?

- What are the customers looking for?

- What are the technology & services trends?

- What is the market SWOT (Strengths, Weaknesses, Opportunities and Threats)?

- What are the challenges to market penetration & growth?

With 185 pages, 21 tables and 32 figures, the “European Police Modernization & First Responders Markets – 2016-2022” report covers 12 countries and regions and 3 revenue source submarkets, offering for each of them 2015 data and assessments, and 2016-2022 forecasts and analyses.

* Customers who purchase a multi-readers license of the report will get the “Global Homeland Security & Public Safety Industry – 2016 Edition” report free of charge. Single-reader license customers will get a 50% discount for the Industry report.

Why Buy this Report?

A. Market data is analyzed via 2 key perspectives:

With a highly fragmented market we address the “money trail” – each dollar spent – via the following 2 viewpoints:

- By 12 Country Markets:

- UK

- France

- Holland & Belgium

- Sweden, Norway, Finland & Denmark

- Germany

- Austria & Switzerland

- Italy

- Spain

- Poland

- Hungary & Czech Republic

- Russia

- Rest of Europe

- By 3 Revenue Sources:

- Products Sales Revenues

- After Sale Revenues Including: Maintenance, Service, Upgrades & Refurbishment

- Other Revenues Including: Planning, Training, Consulting, Contracted Services & Government Funded R&D

B. Detailed market analysis frameworks for each of the market sectors:

- Market drivers & inhibitors

- Business opportunities

- SWOT analysis

- Competitive analysis

- Business environment

- The 2015-2022 market segmented by 36 submarkets

C. The report includes the following 4 appendices:

- Appendix A: European Homeland Security & Public Safety Related Product Standards

- Appendix B: The European Union Challenges and Outlook

- Appendix C: Europe Migration Crisis & Border Security

- Appendix D: Abbreviations

D. The report addresses over 300 European Homeland Security and Public Safety standards (including links)

E. The supplementary (*) “Global Homeland Security & Public Safety Industry – 2016 Edition” report provides the following insights and analyses of the industry including:

- The Global Industry 2016 status

- Effects of Emerging Technologies on the Industry

- The Market Trends

- Vendor – Government Relationship

- Geopolitical Outlook 2016-2022

- The Industry Business Models & Strategies

- Market Entry Challenges

- The Industry: Supply-Side & Demand-Side Analysis

- Market Entry Strategies

- Price Elasticity

- Past Mergers & Acquisitions (M&A) Events

F. The supplementary (*) “Global Homeland Security & Public Safety Industry – 2016 Edition” report also provides a May 2016 updated extensive data (including company profile, recent annual revenues, key executives, homeland security and public safety products, and contact info.) of the leading 119 Homeland Security and Public Safety vendors including:

- 3M

- 3i-MIND

- 3VR

- 3xLOGIC

- ABB

- Accenture

- ACTi Corporation

- ADT Security Services

- AeroVironment Inc.

- Agent Video Intelligence

- Airbus Defence and Space

- Alcatel-Lucent (Nokia Group)

- ALPHAOPEN

- American Science & Engineering Inc.

- Anixter

- Aralia Systems

- AT&T Inc.

- Augusta Systems

- Austal

- Avigilon Corporation

- Aware

- Axis

- AxxonSoft

- Ayonix

- BAE Systems

- BioEnable Technologies Pvt Ltd

- BioLink Solutions

- Boeing

- Bollinger Shipyards, Inc

- Bosch Security Systems

- Bruker Corporation

- BT

- Camero

- Cassidian

- CelPlan

- China Security & Surveillance, Inc.

- Cisco Systems

- Citilog

- Cognitec Systems GmbH

- Computer Network Limited (CNL)

- Computer Sciences Corporation

- CrossMatch

- Diebold

- DRS Technologies Inc.

- DVTel

- Elbit Systems Ltd.

- Elsag Datamat

- Emerson Electric

- Ericsson

- ESRI

- FaceFirst

- Finmeccanica SpA

- Firetide

- Fulcrum Biometrics LLC

- G4S

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Getac Technology Corporation

- Hanwha Techwin

- Harris Corporation

- Hewlett Packard Enterprise

- Hexagon AB

- Honeywell International Inc.

- Huawei Technologies Co., Ltd

- IBM

- IndigoVision

- Intel Security

- IntuVision Inc

- iOmniscient

- IPConfigure

- IPS Intelligent Video Analytics

- Iris ID Systems, Inc.

- IriTech Inc.

- Israel Aerospace Industries Ltd.

- ISS

- L-3 Security & Detection Systems

- Leidos, Inc.

- Lockheed Martin Corporation

- MACROSCOP

- MDS

- Mer group

- Milestone Systems A/S

- Mirasys

- Motorola Solutions, Inc.

- National Instruments

- NEC Corporation

- NICE Systems

- Northrop Grumman Corporation

- Nuance Communications, Inc.

- ObjectVideo

- Panasonic Corporation

- Pelco

- Pivot3

- Proximex

- QinetiQ Limited

- Rapiscan Systems, Inc.

- Raytheon

- Rockwell Collins, Inc.

- Safran S.A.

- Salient Sciences

- Schneider Electric

- SeeTec

- Siemens

- Smart China (Holdings) Limited

- Smiths Detection Inc.

- Sony Corp.

- Speech Technology Center

- Suprema Inc.

- Synectics Plc

- Tandu Technologies & Security Systems Ltd

- Texas Instruments

- Textron Inc.

- Thales Group

- Total Recall

- Unisys Corporation

- Verint

- Vialogy LLC

- Vigilant Technology

- Zhejiang Dahua Technology