Download TOC as PDFTECHNOLOGY MARKETS.. 23

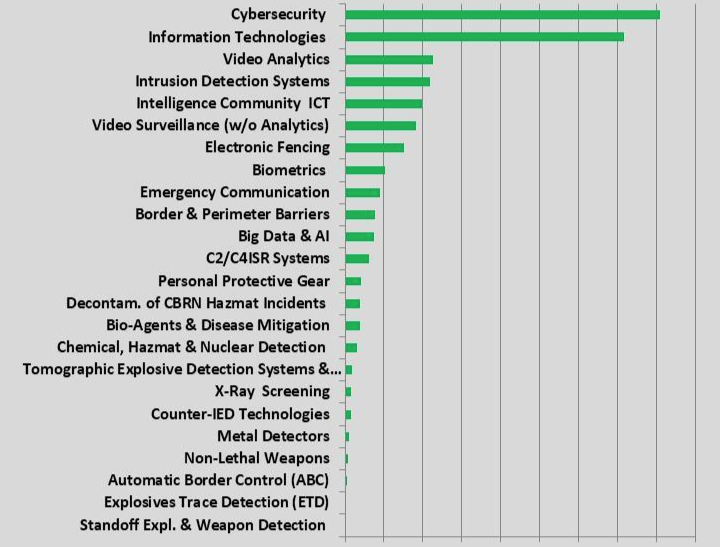

1 Global Homeland Security & Public Safety Technology Markets. 23

1.1 Market by Technology: Summary. 23

1.2 Market by Technology: Data & Trends Analysis. 26

2 Automatic Border Control (ABC) Market 33

2.1 Automatic Border Control (ABC, eGate) Technologies and Market Background 33

2.2 The European Automated Border Control: ABC4EU.. 39

2.3 ABC Artificial Intelligence. 41

2.4 Biometric Automatic Border Control (ABC) Advantages. 41

2.5 Automated Border Control Technologies. 42

2.5.1 Airport Automated Border Control (eGate) 44

2.5.2 Function of Automated Border Control 46

2.6 Automated Border Control Systems Standards. 47

2.7 Automated Border Control Legislation.. 48

2.8 Automated Border Control: Market Drivers. 49

2.9 Automated Border Control Market Inhibitors. 50

2.10 Automated Border Control Market: SWOT Analysis. 51

2.11 Automated Border Control: Market Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 52

2.12 Global Automatic Border Control (ABC) Market – 2017-2024. 53

2.12.1 Automatic Border Control (ABC) Market – 2017-2024. 53

2.12.2 Market Dynamics – 2017-2024. 54

2.12.3 Market Breakdown – 2017-2024. 55

3 Homeland Security & Public Safety, Big Data & Artificial Intelligence Market 56

3.1 Market & Technology Background. 56

3.2 Data Centric Access Control 58

3.2.1 Access Control 58

3.2.2 Access Control in Databases. 58

3.2.3 Encryption Prescribed Access Control 59

3.2.4 Trusted Bootstrapping. 59

3.2.5 Big Data & Data Analytics. 59

3.3 Artificial Intelligence. 60

3.3.1 Big Data, Artificial Intelligence & Data Analytics: HLS and Internal Security Applications. 62

3.4 Big Data Based Urban Surveillance. 63

3.5 Artificial Intelligence Based Machine Learning. 64

3.6 Artificial Intelligence in Cybersecurity. 65

3.7 Artificial Intelligence in Law Enforcement 66

3.8 Big Data, Artificial Intelligence& Data Analytics Industry: SWOT Analysis 67

3.8.1 Strengths. 67

3.8.2 Weaknesses. 67

3.8.3 Opportunities. 67

3.8.4 Threats. 68

3.9 Big Data, Artificial Intelligence & Data Analytics Market Drivers. 68

3.10 Big Data, Artificial Intelligence & Data Analytics Market Inhibitors. 69

3.11 Global Homeland Security & Public Safety related Big Data & Artificial Intelligence Market – 2017-2024. 70

3.11.1 Big Data & Artificial Intelligence Market – 2017-2024. 70

3.11.2 Big Data & Artificial Intelligence Market Dynamics – 2017-2024. 71

3.11.3 Market Breakdown – 2017-2024. 72

4 Bio-Agents & Infectious Disease Mitigation Market 73

4.1 Market Background. 73

4.2 Bio-Detection Technologies. 75

4.2.1 Sampling the Environment 75

4.2.2 Bio-Detectors in a Multitude of Ambient Settings. 76

4.2.3 Bio-Detection Triggering. 76

4.2.4 Sample Collection.. 76

4.2.5 Bio-Particle Detectors. 77

4.2.6 Bio-Agent Identification.. 77

4.3 Links to Bio-Detection Technologies, Products & Applications. 78

4.3.1 National Biosurveillance Systems. 79

4.4 Bio-Agents & Infectious Disease Detection: Homeland Security & Public Safety Applications. 81

4.5 Bio-Agents & Infectious Disease Detection: Business Opportunities & Challenges. 87

4.6 Bio-Agents & Infectious Disease Detection Industry: SWOT Analysis. 88

4.6.1 Strengths. 88

4.6.2 Weaknesses. 89

4.6.3 Opportunities. 90

4.6.4 Threats. 90

4.7 Bio-Agents & Infectious Disease Detection Market Drivers. 91

4.8 Bio-Agents & Infectious Disease Detection Market Inhibitors. 92

4.9 Global Bio-Agents & Infectious Disease Mitigation Market – 2017-2024 93

4.9.1 Bio-Agents & Infectious Disease Mitigation Market – 2017-2024. 93

4.9.2 Market Dynamics – 2017-2024. 95

4.9.3 Market Breakdown – 2017-2024. 96

5 Biometrics Homeland Security & Public Safety Market 97

5.1 Global Biometrics Market Background. 97

5.2 Multimodal Biometric Systems. 100

5.3 Biometrics: Homeland Security & Public Safety Applications. 100

5.3.1 Overview.. 100

5.3.2 Multi-biometrics for Border Control 102

5.3.3 Biometrics for Banking. 103

5.3.4 Biometrics for Digital Security. 104

5.4 Biometrics: Business Opportunities & Challenges. 106

5.5 Biometrics Industry: SWOT Analysis. 107

5.5.1 Strengths. 107

5.5.2 Weaknesses. 108

5.5.3 Opportunities. 108

5.5.4 Threats. 108

5.6 Biometrics Market Drivers. 110

5.7 Biometrics Market Inhibitors. 112

5.8 Global Biometrics Homeland Security & Public Safety Market – 2017-2024 113

5.8.1 Biometrics Market – 2017-2024. 113

5.8.2 Market Dynamics – 2017-2024. 114

5.8.3 Market Breakdown – 2017-2024. 115

6 Border & Perimeter Barriers Market 116

6.1 Major Findings and Conclusions. 116

6.2 Global Border & Perimeter Barriers Market Background. 116

6.3 The Mexico–United States “Wall” 117

6.4 Border & Perimeter Barriers: Market Drivers. 118

6.5 Border & Perimeter Barriers Market Inhibitors. 119

6.6 Border & Perimeter Barriers Market: SWOT Analysis. 121

6.7 Border & Perimeter Barriers Market Barriers to New Entry, Supplier Power, Buyer Power, Barriers to Substitution and Competitive Rivalry. 122

6.8 Global Border & Perimeter Security Barriers Market – 2017-2024. 123

6.8.1 Border & Perimeter Barriers Market – 2017-2024. 123

6.8.2 Market Dynamics – 2017-2024. 124

6.8.3 Market Breakdown – 2017-2024. 125

7 Homeland Security & Public Safety C2/C4ISR Systems Market 126

7.1 Scope. 126

7.2 Market & Technology Background. 127

7.3 HLS & PS C2/C4ISR Systems: Business Opportunities. 133

7.4 C2/C4ISR Industry SWOT Analysis. 133

7.4.1 Strengths. 133

7.4.2 Weaknesses. 134

7.4.3 Opportunities. 135

7.4.4 Threats. 135

7.5 C2/C4ISR Market Drivers. 136

7.6 C2/C4ISR Market Inhibitors. 137

7.7 Global Homeland Security & Public Safety C2/C4ISR Systems Market – 2017-2024. 138

7.7.1 C2/C4ISR Systems Market – 2017-2024. 138

7.7.2 Market Dynamics – 2017-2024. 139

7.7.3 Market Breakdown – 2017-2024. 140

8 Chemical, Hazmat & Nuclear Detection Market 141

8.1 Scope. 141

8.2 Chemical Agent Detection Technologies. 141

8.3 Nuclear/Radiological Detection Technologies. 142

8.3.1 The Advanced Spectroscopic Portal (ASP) 142

8.3.2 Human Portable Radiation Detection Systems (HPRDS) Program 142

8.3.3 Nuclear- Radiological People Screening Portals. 142

8.4 Market Background. 143

8.4.1 Chemical Plant Security. 143

8.4.2 Nuclear/Radiological Detection Markets. 143

8.5 Chemical, Hazmat & Nuclear Detection: Business Opportunities & Challenges 148

8.6 Chemical, Hazmat & Nuclear Detection Industry: SWOT Analysis. 149

8.6.1 Strengths. 149

8.6.2 Weaknesses. 150

8.6.3 Opportunities. 150

8.6.4 Threats. 151

8.7 Chemical, Hazmat & Nuclear Detection Market Drivers. 151

8.8 Chemical, Hazmat & Nuclear Detection Market Inhibitors. 153

8.9 Global Chemical, Hazmat & Nuclear Detection Market – 2017-2024. 155

8.9.1 Chemical, Hazmat & Nuclear Detection Market – 2017-2024. 155

8.9.2 Chemical, Hazmat & Nuclear Detection Market Dynamics – 2017-2024 156

8.9.3 Market Breakdown – 2017-2024. 157

9 Counter-IED Technologies Market 158

9.1 Market & Technology Background. 158

9.2 Counter-IED Technologies: Business Opportunities & Challenges. 162

9.2.1 Maintenance and Upgrades (Particularly of Jammers & Armored Trucks) 162

9.2.2 Sensors and Other Electronic Systems Upgrade. 163

9.2.3 Standoff Suicide Bombers Detection.. 163

9.2.4 Suicide Bombers Detonation Neutralization. 163

9.2.5 Standoff Detection of VBIED.. 163

9.2.6 VBIED Detonation Neutralization.. 164

9.2.7 Standoff Explosive Detection in Urban Environment 164

9.2.8 Large Area IED Detection Coverage. 164

9.2.9 IED Placement Detection.. 165

9.2.10 Active Armors for Vehicles. 165

9.3 Counter-IED Technologies Industry: SWOT Analysis. 165

9.3.1 Strengths. 165

9.3.2 Weaknesses. 166

9.3.3 Opportunities. 166

9.3.4 Threats. 167

9.4 Market Drivers. 167

9.5 Market Inhibitors. 168

9.6 Global Counter-IED Technologies Market – 2017-2024. 168

9.6.1 Counter-IED Technologies Market – 2017-2024. 168

9.6.2 Market Dynamics – 2017-2024. 170

9.6.3 Market Breakdown – 2017-2024. 170

10 Cybersecurity Market 172

10.1 Cybersecurity Market & Technology Background. 172

10.1.1 Cyber Terror & Crime. 172

10.1.2 Cyber Warfare. 174

10.1.3 Denial of Service. 175

10.1.4 Deliberate Manipulation of Information.. 175

10.1.5 Detection of Unauthorized Activity. 176

10.1.6 Anti-Malware Cyber-Security. 177

10.1.7 Privacy Enhanced Technologies (PETs) 178

10.2 Key Cyber Security Vendors. 179

10.3 Cybersecurity Industry: SWOT Analysis. 180

10.3.1 Strengths. 180

10.3.2 Weaknesses. 181

10.3.3 Opportunities. 181

10.3.4 Threats. 182

10.4 Cybersecurity Market Drivers. 183

10.5 Cybersecurity Market Inhibitors. 185

10.6 Global Cybersecurity Market – 2017-2024. 186

10.6.1 Cybersecurity Market – 2017-2024. 186

10.6.2 Market Dynamics – 2017-2024. 187

10.6.3 Market Breakdown – 2017-2024. 188

11 Decontamination of CBRN & Hazmat Incidents Market 189

11.1 Decontamination Technologies Background. 189

11.1.1 Overview.. 189

11.1.2 Decontamination Core Technologies. 191

11.1.3 The Decontamination Cycle. 191

11.2 Decontamination Strategy. 193

11.3 CBRN & Hazmat Decontamination Market Background. 194

11.4 The Decontamination Industry. 196

11.5 Decontamination of CBRN & Hazmat Incidents Market Drivers. 196

11.6 Decontamination of CBRN & Hazmat Incidents Market Inhibitors. 197

11.7 Global Decontamination of CBRN & Hazmat Incidents Market – 2017-2024 199

11.7.1 Decontamination of CBRN & Hazmat Incidents Market – 2017-2024 199

11.7.2 Market Dynamics – 2017-2024. 200

11.7.3 Market Breakdown – 2017-2024. 201

12 Electronic Fencing Homeland Security & Public Safety Market 202

12.1 Electronic Fences Technologies. 202

12.1.1 Vibration Sensors Mounted on Fence. 202

12.1.2 Capacitance Sensors Fence. 204

12.1.3 Strain Sensitive Cables Fence. 204

12.1.4 Fiber Optic Fence. 204

12.1.5 Taut Wire Fence. 204

12.1.6 Ported Coax Buried Line Fence. 205

12.1.7 Buried Geophone Fence. 206

12.2 Electronic Fencing: Business Opportunities & Challenges. 208

12.3 Electronic Fencing Industry: SWOT Analysis. 209

12.3.1 Strengths. 209

12.3.2 Weaknesses. 209

12.3.3 Opportunities. 210

12.3.4 Threats. 210

12.4 Electronic Fencing Market Drivers. 211

12.5 Electronic Fencing Market Inhibitors. 212

12.6 Global Electronic Fencing Market – 2017-2024. 212

12.6.1 Electronic Fencing Market – 2017-2024. 212

12.6.2 Market Dynamics – 2017-2024. 214

12.6.3 Market Breakdown – 2017-2024. 215

13 Emergency Communication Market 216

13.1 Market & Technology Background. 216

13.2 Emergency Communication: Technology Background. 221

13.2.1 Tetra. 221

13.2.2 LTE.. 230

13.2.3 5G Emergency Communication.. 232

13.3 Emergency Communication Market: Business Opportunities. 233

13.3.1 Managed Services for Shared/Core Services. 233

13.3.2 Migration from “Simple” to “Integrated” Networks. 233

13.3.3 Emergency Communication Market Prospects. 234

13.4 Emergency Communication Market Drivers. 235

13.5 Emergency Communication Market Inhibitors. 236

13.6 Global Emergency Communication Market – 2017-2024. 236

13.6.1 Emergency Communication Market – 2017-2024. 236

13.6.2 Market Dynamics – 2017-2024. 238

13.6.3 Market Breakdown – 2017-2024. 239

14 Explosives Trace Detection (ETD) Market 240

14.1 Market & Technology Background. 240

14.1.1 ETD Technologies. 240

14.1.2 ETD Market Background. 241

14.2 Explosives Trace Detection (ETD): HLS & PS Applications. 244

14.2.1 Explosives Detected by Explosives Trace Detection.. 244

14.2.2 Explosives Trace Detection Configuration. 246

14.2.3 ETD Applications. 246

14.3 Explosives Trace Detection (ETD): Business Opportunities & Challenges 248

14.4 Explosives Trace Detection (ETD) Industry: SWOT Analysis. 249

14.4.1 Strengths. 249

14.4.2 Weaknesses. 249

14.4.3 Opportunities. 250

14.4.4 Threats. 251

14.5 Explosives Trace Detection (ETD) Market Drivers. 251

14.6 Explosives Trace Detection (ETD) Market Inhibitors. 252

14.7 Global Explosives Trace Detection (ETD) Market – 2017-2024. 253

14.7.1 Explosives Trace Detection (ETD) Market – 2017-2024. 253

14.7.2 Market Dynamics – 2017-2024. 254

14.7.3 Market Breakdown – 2017-2024. 255

15 Homeland Security & Public Safety Information Technologies (w/o Intel & Cyber) Market 256

15.1 Scope. 256

15.2 Major Findings and Conclusions. 256

15.3 Market Background. 257

15.3.1 Homeland Security & Public Safety: Data Center Systems. 257

15.3.1.1 Overview.. 257

15.3.1.2 Counter Terror and Public Safety: Data Center Services. 258

15.3.1.3 Counter Terror and Public Safety: Support Services. 258

15.3.1.4 Counter Terror and Public Safety: Technical Consulting Services 258

15.3.1.5 Outsourcing Services. 259

15.3.1.6 Application Services. 259

15.3.2 Homeland Security and Public Safety: Enterprise Software. 259

15.3.3 Homeland Security and Public Safety: IT Services. 260

15.3.4 Homeland Security and Public Safety Agencies: Cloud Storage & Computing. 261

15.4 Market Drivers. 262

15.5 Market Inhibitors. 263

15.6 Global Information Technologies (w/o Intel & Cyber) Homeland Security & Public Safety Market – 2017-2024. 264

15.6.1 Information Technologies (w/o Intel & Cyber) Market – 2017-2024 264

15.6.2 Market Dynamics – 2017-2024. 265

15.6.3 Market Breakdown – 2017-2024. 266

16 Intelligence Community ICT Market 267

16.1 Intelligence Services Information Technologies & Market Background. 267

16.1.1 Geospatial Intelligence (GEOINT) Information Technology. 267

16.1.2 Imagery Intelligence (IMINT) Information Technology. 267

16.1.3 Measurement and Signature Intelligence (MASINT) Information Technology. 267

16.1.4 Open-Source Intelligence (OSINT) Information Technology. 268

16.1.5 Signals Intelligence (SIGINT) Information Technology. 269

16.1.5.1 Communications Intelligence COMINT Information Technology 269

16.1.5.2 ELINT Electronic Intelligence Information Technology. 270

16.1.6 Foreign Instrumentation Signals Intelligence (FISINT) Information Technology. 271

16.1.7 Financial Intelligence (FININT) Information Technology. 271

16.1.8 Cryptanalysis Information Technology. 272

16.1.9 Traffic Analysis. 272

16.2 Global Intelligence Community ICT Market – 2017-2024. 273

16.2.1 Intelligence Community ICT Market – 2017-2024. 273

16.2.2 Market Dynamics – 2017-2024. 274

16.2.3 Market Breakdown – 2017-2024. 275

17 Intrusion Detection Systems Homeland Security & Public Safety Market 276

17.1 Market & Technology Background. 276

17.1.1 Passive Infrared (PIR) Motion Detection.. 276

17.1.2 Access Control Systems. 279

17.2 Intrusion Detection Systems: Business Opportunities & Challenges. 279

17.2.1 Challenges. 279

17.2.2 Business Opportunities. 280

17.3 Intrusion Detection Systems Industry: SWOT Analysis. 281

17.3.1 Strengths. 281

17.3.2 Weaknesses. 281

17.3.3 Opportunities. 281

17.3.4 Threats. 282

17.4 Intrusion Detection Systems Market Drivers. 283

17.5 Intrusion Detection Systems Market Inhibitors. 283

17.6 Global Intrusion Detection Systems Homeland Security & Public Safety Market – 2017-2024. 284

17.6.1 Intrusion Detection Systems Market – 2017-2024. 284

17.6.2 Market Dynamics – 2017-2024. 285

17.6.3 Market Breakdown – 2017-2024. 286

18 Metal Detectors Market 287

18.1 Market & Technology Background. 287

18.1.1 Hand-Held Metal Detectors. 287

18.1.1.1 The Market 287

18.1.1.2 Principles of Operation.. 287

18.1.1.3 Technology & Operational Essentials. 288

18.1.1.4 Hand-Held Metal Detectors – Technology Trends. 288

18.1.2 Metal Detection Portals. 289

18.1.2.1 The Market 289

18.1.2.2 Metal Detection Portals Technology. 290

18.2 Metal Detectors: Business Opportunities & Challenges. 292

18.3 Metal Detectors Industry: SWOT Analysis. 293

18.3.1 Strengths. 293

18.3.2 Weaknesses. 293

18.3.3 Opportunities. 293

18.3.4 Threats. 294

18.4 Metal Detectors Market Drivers. 294

18.5 Metal Detectors Market Inhibitors. 295

18.6 Global Metal Detectors Market – 2017-2024. 296

18.6.1 Metal Detectors Market – 2017-2024. 296

18.6.2 Market Dynamics – 2017-2024. 297

18.6.3 Market Breakdown – 2017-2024. 298

19 Non-Lethal Weapons Market 299

19.1 Non-Lethal Weapons Technology Background. 299

19.2 Less-Lethal Weapons: Market Background. 303

19.3 Non-Lethal Weapons: Business Opportunities & Challenges. 306

19.4 Non-Lethal Weapons Industry: SWOT Analysis. 306

19.4.1 Strengths. 306

19.4.2 Weaknesses. 308

19.4.3 Opportunities. 309

19.4.4 Threats. 309

19.5 Non-Lethal Weapons Market Drivers. 311

19.6 Non-Lethal Weapons Market Inhibitors. 312

19.7 Global Non-Lethal Weapons Market – 2017-2024. 314

19.7.1 Non-Lethal Weapons Market – 2017-2024. 314

19.7.2 Market Dynamics – 2017-2024. 315

19.7.3 Market Breakdown – 2017-2024. 316

20 Personal (Ballistic & CBRNE) Protective Gear Market 317

20.1 Market & Technology Background. 317

20.1.1 Personal Body Armor 317

20.1.2 Respiratory Protective Equipment 319

20.1.3 CBRN and Hazmat Personal Protective Gear 321

20.2 Personal (Ballistic & CBRNE) Protective Gear Industry: SWOT Analysis 324

20.2.1 Strengths. 324

20.2.2 Weaknesses. 324

20.2.3 Opportunities. 325

20.2.4 Threats. 325

20.3 Personal (Ballistic & CBRNE) Protective Gear Market Drivers. 326

20.4 Personal (Ballistic & CBRNE) Protective Gear Market Inhibitors. 327

20.5 Global Personal (Ballistic & CBRNE) Protective Gear Market – 2017-2024 328

20.5.1 Personal (Ballistic & CBRNE) Protective Gear Market – 2017-2024 328

20.5.2 Market Dynamics – 2017-2024. 329

20.5.3 Market Breakdown – 2017-2024. 330

21 Standoff Explosives & Weapons Detection Market 331

21.1 Market & Technology Background. 331

21.2 Standoff Explosives & Weapons Detection: Business Opportunities & Challenges. 340

21.3 Standoff Person-Borne and Vehicle-Borne Explosives & Weapons Detection Industry: SWOT Analysis. 341

21.4 Standoff Explosives & Weapons Detection: Market Drivers. 343

21.5 Standoff Explosives & Weapons Detection: Market Inhibitors. 344

21.6 Global Standoff Explosives & Weapons Detection Market – 2017-2024 345

21.6.1 Standoff Explosives & Weapons Detection Market – 2017-2024. 345

21.6.2 Market Dynamics – 2017-2024. 346

21.6.3 Market Breakdown – 2017-2024. 347

22 Tomographic Explosive Detection Systems & BHS Market 348

22.1 Explosive Detection Systems: Technology Background. 348

22.1.1 Pros & Cons of Bulk Threat Detection Systems. 348

22.1.2 Explosive Detection Systems: Throughput 348

22.1.3 EDS Principle of Operation.. 349

22.1.4 Hybrid Tomographic EDS & 2D X-Ray Screening. 350

22.1.5 EDS Certification.. 350

22.1.6 EDS Throughput vs. Price. 351

22.1.7 Aviation Security: EDS Checked Luggage Screening. 351

22.2 Aviation Security: EDS Market Background. 355

22.3 Explosive Detection Systems (EDS) Industry: SWOT Analysis. 356

22.3.1 Strengths. 356

22.3.2 Weaknesses. 356

22.3.3 Opportunities. 357

22.3.4 Threats. 358

22.4 EDS & BHS Market Drivers. 359

22.5 EDS & BHS Market Inhibitors. 360

22.6 Global Tomographic Explosive Detection Systems & BHS Market – 2017-2024 361

22.6.1 Tomographic Explosive Detection Systems & BHS Market – 2017-2024 361

22.6.2 Market Dynamics – 2017-2024. 362

22.6.3 Market Breakdown – 2017-2024. 363

23 Video Analytics Homeland Security & Public Safety Market 364

23.1 Market & Technology Background. 364

23.2 Video Analytics: HLS & PS Applications. 368

23.3 Video Analytics: Business Opportunities. 370

23.4 Video Analytics Industry: SWOT Analysis. 372

23.4.1 Strengths. 372

23.4.2 Weaknesses. 373

23.4.3 Opportunities. 374

23.4.4 Threats. 375

23.4.5 Video Analytics Market Drivers. 377

23.4.6 Video Analytics Market Inhibitors. 381

23.5 Global Video Analytics Homeland Security & Public Safety Market – 2017-2024. 382

23.5.1 Video Analytics Market – 2017-2024. 382

23.5.2 Market Dynamics – 2017-2024. 383

23.5.3 Market Breakdown – 2017-2024. 384

24 Video Security Surveillance (w/o Analytics) Market 385

24.1 Market & Technology Background. 385

24.2 Video Surveillance: HLS & PS Applications. 392

24.3 Video Surveillance: Business Opportunities & Challenges. 394

24.4 Video Surveillance Industry: SWOT Analysis. 395

24.4.1 Strengths. 395

24.4.2 Weaknesses. 396

24.4.3 Opportunities. 396

24.4.4 Threats. 397

24.5 Video Surveillance Market Drivers. 397

24.6 Video Surveillance Market Inhibitors. 398

24.7 Global Video Security Surveillance (w/o Analytics) Market – 2017-2024 399

24.7.1 Video Surveillance (w/o Analytics) Market – 2017-2024. 399

24.7.2 Market Dynamics – 2017-2024. 400

24.7.3 Market Breakdown – 2017-2024. 401

25 X-Ray Security Screening Market 402

25.1 Major Findings. 402

25.2 Major Conclusions. 404

25.3 Market Dynamics & Opportunities. 405

25.4 X-ray Screening Systems: Market Drivers. 406

25.5 X-ray Screening Systems: Market Inhibitors. 407

25.6 X-ray Security Industry: Business Opportunities & Challenges. 408

25.7 X-ray Screening Systems Industry: SWOT Analysis. 409

25.7.1 Strengths. 409

25.7.2 Weaknesses. 410

25.7.3 Opportunities. 410

25.7.4 Threats. 411

25.8 Barriers to Entry, Supplier Power, Buyer Power & Barriers to Substitution 412

25.9 X-ray Security Screening Systems Technologies. 413

25.9.1 X-ray Systems – Characteristics. 413

25.9.2 X-ray Screening Systems – Principles of Operation.. 414

25.9.3 Innocuous Materials Interference. 415

25.9.4 Threat Image Projection (TIP) 416

25.9.5 Automated Target Detection.. 416

25.10 Current X-ray Baggage, Cargo, People, Container & Vehicle Screening Technologies. 417

25.10.1 Major Technologies. 417

25.10.2 2D X-ray, EDS and ETD Technologies – Pros and Cons. 418

25.11 Global X-Ray Security Screening Market – 2017-2024. 419

25.11.1 X-Ray Screening Market – 2017-2024. 419

25.11.2 Market Dynamics – 2017-2024. 420

25.11.3 Market Breakdown – 2017-2024. 421

![Technology Homeland Security & Public Safety Markets Ranked by 2018-2024 CAGR [%]](https://hsrc.biz/wp-content/uploads/2019/03/Technology-Homeland-Security-Public-Safety-Markets-Ranked-by-2018-2024-CAGR-.png)