| 1 |

Executive Summary |

| 1.1 |

Major Findings |

| 1.2 |

Major Conclusions |

| 1.3 |

Saudi Arabia Homeland Security & Public Safety: Market Background |

| 1.4 |

Saudi Arabia Homeland Security & Public Safety Market – 2015-2022 |

| 2 |

Business Opportunities in the Saudi Security Sector |

| |

MARKET ANALYSIS |

| 3 |

Market Drivers |

| 4 |

Market Inhibitors |

| 5 |

SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

Competitive Analysis |

| 7 |

Market Dynamics |

| |

THE MARKET |

| 8 |

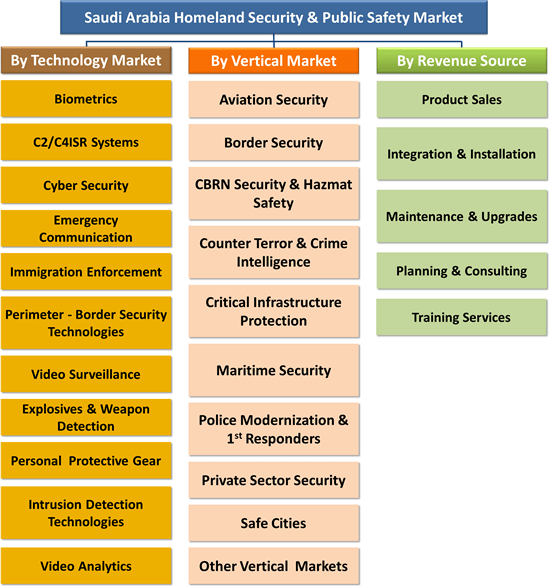

Saudi Arabia Homeland Security & Public Safety Market – 2015-2022 |

| 8.1 |

Saudi Arabia Homeland Security & Public Safety Market by Vertical Market |

| 8.1.1 |

Saudi Arabia Market – 2015-2022 |

| 8.1.2 |

Saudi Arabia Market Breakdown – 2015-2022 |

| 8.2 |

Saudi Arabia Homeland Security & Public Safety Market by Technology |

| 8.2.1 |

Saudi Arabia Market – 2015-2022 |

| 8.3 |

Saudi Arabia Homeland Security & Public Safety Market by Revenue Source |

| 8.3.1 |

Saudi Arabia Market – 2015-2022 |

| 8.3.2 |

Market Breakdown – 2015-2022 |

| |

VERTICAL MARKETS |

| 9 |

Aviation Security Market |

| 9.1 |

Scope |

| 9.2 |

Market Background |

| 9.3 |

Saudi Arabia Airport Security Statistics |

| 9.4 |

Saudi Aviation Security Business Opportunities |

| 9.5 |

Saudi Arabia Aviation Security Market – 2015-2022 |

| 9.5.1 |

Aviation Security Market – 2015-2022 |

| 9.5.2 |

Market Dynamics – 2015-2022 |

| 9.5.3 |

Market Breakdown – 2015-2022 |

| 10 |

Border Security Market |

| 10.1 |

Scope |

| 10.2 |

Market Background |

| 10.2.1 |

The Saudi-Iraq Border Security Fence |

| 10.2.2 |

The Saudi-Yemen Border Barrier |

| 10.3 |

Saudi Arabia Border Security Market – 2015-2022 |

| 10.3.1 |

Border Security Market – 2015-2022 |

| 10.3.2 |

Market Dynamics – 2015-2022 |

| 10.3.3 |

Market Breakdown – 2015-2022 |

| 11 |

CBRN Security & Hazmat Safety Market |

| 11.1 |

Scope |

| 11.2 |

Market Background |

| 11.3 |

Saudi Arabia CBRN Security & Hazmat Safety Market – 2015-2022 |

| 11.3.1 |

CBRN Security & Hazmat Safety Market – 2015-2022 |

| 11.3.2 |

Market Dynamics – 2015-2022 |

| 11.3.3 |

Market Breakdown – 2015-2022 |

| 12 |

Saudi Intelligence Community Market |

| 12.1 |

Scope |

| 12.2 |

Saudi Intelligence Community |

| 12.2.1 |

General Intelligence Presidency |

| 12.2.2 |

Saudi Crime Related Directorate of Intelligence Agency |

| 12.3 |

Market Background |

| 12.4 |

Saudi Arabia Intelligence Community Market – 2015-2022 |

| 12.4.1 |

Counter Terror & Crime Intelligence Market – 2015-2022 |

| 12.4.2 |

Market Dynamics – 2015-2022 |

| 12.4.3 |

Market Breakdown – 2015-2022 |

| 13 |

Critical Infrastructure Protection Market |

| 13.1 |

Scope |

| 13.2 |

Market Background |

| 13.3 |

Critical Infrastructure Security Market Sectors |

| 13.3.1 |

Overview |

| 13.4 |

The Saudi Oil-Gas Industry Security |

| 13.4.1 |

Oil production |

| 13.4.2 |

Oil Refining |

| 13.4.3 |

Exports |

| 13.4.4 |

Major Oil-Gas Ports |

| 13.4.5 |

Major Domestic Petroleum Pipelines |

| 13.4.6 |

Oil-Gas Shipping |

| 13.4.7 |

The Oil-Gas Industry Security |

| 13.5 |

The Saudi Oil & Gas Industry Security |

| 13.6 |

Water and Electric Utilities |

| 13.7 |

Railway Transportation Security |

| 13.7.1 |

Banking Sector |

| 13.7.2 |

IT/Telecom Sector |

| 13.8 |

Market Drivers |

| 13.9 |

Market Inhibitors |

| 13.1 |

Saudi Arabia Critical Infrastructure Protection Market – 2015-2022 |

| 13.10.1 |

Critical Infrastructure Protection Market – 2015-2022 |

| 13.10.2 |

Market Dynamics – 2015-2022 |

| 13.10.3 |

Market Breakdown – 2015-2022 |

| 14 |

Maritime Security Market |

| 14.1 |

Scope |

| 14.2 |

Market Background |

| 14.3 |

Security of Oil Export Terminals |

| 14.4 |

Market Outlook |

| 14.5 |

Saudi Arabia Maritime Security Market – 2015-2022 |

| 14.5.1 |

Maritime Security Market – 2015-2022 |

| 14.5.2 |

Market Dynamics – 2015-2022 |

| 14.5.3 |

Market Breakdown – 2015-2022 |

| 15 |

Police Modernization & 1st Responders Market |

| 15.1 |

Scope |

| 15.2 |

Market Background |

| 15.3 |

Saudi Arabia Police Modernization & 1st Responders Market – 2015-2022 |

| 15.3.1 |

Police Modernization & 1st Responders Market – 2015-2022 |

| 15.3.2 |

Market Dynamics – 2015-2022 |

| 15.3.3 |

Market Breakdown – 2015-2022 |

| 16 |

Private Sector Security Market |

| 16.1 |

Scope |

| 16.2 |

Private Sector Security, Business Opportunities |

| 16.3 |

Market Drivers: |

| 16.4 |

Market Inhibitors: |

| 16.5 |

Saudi Arabia Private Sector Security Market – 2015-2022 |

| 16.5.1 |

Private Sector Security Market – 2015-2022 |

| 16.5.2 |

Market Dynamics – 2015-2022 |

| 16.5.3 |

Market Breakdown – 2015-2022 |

| 17 |

Safe City Market |

| 17.1 |

Scope |

| 17.2 |

Public Safety Surveillance |

| 17.3 |

Safe Cities: Technologies |

| 17.4 |

The Saudi Safe Cities |

| 17.4.1 |

Saudi Arabia Safe City Projects |

| 17.4.2 |

Saudi Cities – Security Challenges. |

| 17.4.3 |

The Hajj Security Strategy |

| 17.4.4 |

Main Homeland Security & Public Safety Market Opportunities Associated with the Hajj |

| 17.5 |

Saudi Arabia Safe Cities Market – 2015-2022 |

| 17.5.1 |

Safe Cities Market – 2015-2022 |

| 17.5.2 |

Market Dynamics – 2015-2022 |

| 17.5.3 |

Market Breakdown – 2015-2022 |

| 18 |

Other Vertical Markets |

| 18.1 |

Saudi Arabia Other Vertical Markets – 2015-2022 |

| 18.1.1 |

Other Vertical Markets – 2015-2022 |

| 18.1.2 |

Market Dynamics – 2015-2022 |

| 18.1.3 |

Market Breakdown – 2015-2022 |

| |

TECHNOLOGY MARKETS |

| 19 |

Homeland Security & Public Safety Biometrics Market |

| 19.1 |

Scope |

| 19.2 |

Market Background |

| 19.3 |

Saudi Arabia Homeland Security & Public Safety Biometrics Market – 2015-2022 |

| 19.3.1 |

Biometrics Market – 2015-2022 |

| 19.3.2 |

Market Dynamics – 2015-2022 |

| 19.3.3 |

Market Breakdown – 2015-2022 |

| 20 |

Homeland Security & Public Safety C2/C4ISR Systems Market |

| 20.1 |

Scope |

| 20.2 |

Market Background |

| 20.3 |

Saudi Arabia Homeland Security & Public Safety C2/C4ISR Systems Market – 2015-2022 |

| 20.3.1 |

C2/C4ISR Systems Market – 2015-2022 |

| 20.3.2 |

Market Dynamics – 2015-2022 |

| 20.3.3 |

Market Breakdown – 2015-2022 |

| 21 |

Cyber Security Market |

| 21.1 |

Saudi Arabia Cyber Security Market Background |

| 21.2 |

Saudi Arabia Cyber Security Market – 2015-2022 |

| 21.2.1 |

Cyber Security Market – 2015-2022 |

| 21.2.2 |

Market Dynamics – 2015-2022 |

| 21.2.3 |

Market Breakdown – 2015-2022 |

| 22 |

Emergency Communication Market |

| 22.1 |

Saudi Arabia Emergency Communication Market Background |

| 22.2 |

Saudi Arabia Emergency Communication Market – 2015-2022 |

| 22.2.1 |

Emergency Communication Market – 2015-2022 |

| 22.2.2 |

Market Dynamics – 2015-2022 |

| 22.2.3 |

Market Breakdown – 2015-2022 |

| 23 |

Immigration Enforcement Market |

| 23.1 |

Saudi Arabia Immigration Enforcement Market Background |

| 23.2 |

Saudi Arabia Immigration Enforcement Market – 2015-2022 |

| 23.2.1 |

Immigration Enforcement Market – 2015-2022 |

| 23.2.2 |

Market Dynamics – 2015-2022 |

| 23.2.3 |

Market Breakdown – 2015-2022 |

| 24 |

Perimeter – Border Security Technologies Market |

| 24.1 |

Scope |

| 24.2 |

Market Background |

| 24.3 |

Saudi Arabia Perimeter – Border Security Technologies Market – 2015-2022 |

| 24.3.1 |

Perimeter – Border Security Technologies Market – 2015-2022 |

| 24.3.2 |

Market Dynamics – 2015-2022 |

| 24.3.3 |

Market Breakdown – 2015-2022 |

| 25 |

Video Surveillance Market |

| 25.1 |

Market Background |

| 25.2 |

Saudi Arabia Video Surveillance Market – 2015-2022 |

| 25.2.1 |

Video Surveillance Market – 2015-2022 |

| 25.2.2 |

Market Dynamics – 2015-2022 |

| 25.2.3 |

Market Breakdown – 2015-2022 |

| 26 |

Explosives & Weapon Detection Market |

| 26.1 |

Saudi Arabia Explosives & Weapon Detection Market – 2015-2022 |

| 26.1.1 |

Explosives & Weapon Detection Market – 2015-2022 |

| 26.1.2 |

Market Dynamics – 2015-2022 |

| 26.1.3 |

Market Breakdown – 2015-2022 |

| 27 |

Personal Protective Gear Market |

| 27.1 |

Saudi Arabia Personal Protective Gear Market – 2015-2022 |

| 27.1.1 |

Personal Protective Gear Market – 2015-2022 |

| 27.1.2 |

Market Dynamics – 2015-2022 |

| 27.1.3 |

Market Breakdown – 2015-2022 |

| 28 |

Intrusion Detection Technologies Market |

| 28.1 |

Scope |

| 28.2 |

Market Background |

| 28.3 |

Saudi Arabia Intrusion Detection Technologies Market – 2015-2022 |

| 28.3.1 |

Intrusion Detection Technologies Market – 2015-2022 |

| 28.3.2 |

Market Dynamics – 2015-2022 |

| 28.3.3 |

Market Breakdown – 2015-2022 |

| 29 |

Homeland Security & Public Safety Video Analytics Market |

| 29.1 |

Saudi Arabia Homeland Security & Public Safety Video Analytics Market Background |

| 29.2 |

Saudi Arabia Video Analytics Market – 2015-2022 |

| 29.2.1 |

Video Analytics Market – 2015-2022 |

| 29.2.2 |

Market Dynamics – 2015-2022 |

| 29.2.3 |

Market Breakdown – 2015-2022 |

| |

MAJOR VENDORS Active in Saudi Homeland Security & Public Safety Market |

| 30 |

Airbus Defense and Space |

| 30.1 |

Company Profile |

| 30.2 |

Homeland Security & Public Safety Products |

| 30.2.1 |

Monitoring Service |

| 30.2.2 |

Platform & Service |

| 30.3 |

Recent Events |

| 30.4 |

Contact Information |

| 31 |

BAE Systems |

| 31.1 |

Company Profile |

| 31.2 |

Business Groups |

| 31.2.1 |

Electronic Systems |

| 31.2.2 |

Cyber & Intelligence |

| 31.2.3 |

Platforms & Services (U.S.) |

| 31.2.4 |

Platforms & Services (UK) |

| 31.2.5 |

Platforms & Services (International) |

| 31.3 |

Homeland Security & Public Safety Products |

| 31.4 |

Recent Events |

| 31.5 |

Contact Information |

| 32 |

Boeing |

| 32.1 |

Company Profile |

| 32.2 |

Homeland Security & Public Safety Products |

| 32.3 |

Recent Events |

| 32.4 |

Contact Information |

| 33 |

Finmeccanica SpA |

| 33.1 |

Company Profile |

| 33.2 |

Homeland Security & Public Safety Products |

| 33.2.1 |

Finmeccanica Homeland Security Defense Systems |

| 33.3 |

Recent Events |

| 33.4 |

Contact Information |

| 34 |

General Dynamics Corporation |

| 34.1 |

Company Profile |

| 34.2 |

Homeland Security & Public Safety Products |

| 34.2.1 |

IS&T |

| 34.2.2 |

Marine System |

| 34.3 |

Recent Events |

| 34.4 |

Contact Information |

| 35 |

L-3 Security & Detection Systems |

| 35.1 |

Company Profile |

| 35.2 |

Security & Detection Systems Explosives and Weapons Screening Products |

| 35.2.1 |

TSA Certified |

| 35.2.2 |

TSA Checkpoint Qualified |

| 35.2.3 |

EU Standard 3 Approved |

| 35.2.4 |

EU Standard 2 Approved |

| 35.2.5 |

EU Checkpoint Qualified |

| 35.2.6 |

DfT Approved |

| 35.2.7 |

DfT Air Cargo Compliant |

| 35.2.8 |

Transport Canada Qualified |

| 35.2.9 |

Civil Aviation Administration of China (CAAC) certified |

| 35.2.10 |

STAC Approved |

| 35.3 |

Recent Events |

| 35.4 |

Contact Information |

| 36 |

Leidos, Inc. |

| 36.1 |

Company Profile |

| 36.2 |

Homeland Security & Public Safety Products |

| 36.2.1 |

Gamma Ray Container and Vehicle Screening Systems |

| 36.2.2 |

Tomographic Explosives Detection Systems (EDS) |

| 36.2.3 |

Nuclear Detection Portals |

| 36.2.4 |

X-Ray Explosives Detection Systems |

| 36.2.5 |

Other Homeland Security Systems |

| 36.3 |

Recent Events |

| 36.4 |

Contact Information |

| 37 |

Lockheed Martin Corporation |

| 37.1 |

Company Profile |

| 37.2 |

Homeland Security & Public Safety Products |

| 37.2.1 |

Ground Vehicles |

| 37.2.2 |

Unmanned Systems |

| 37.2.3 |

Sensor and Situational Awareness |

| 37.2.4 |

Cybersecurity |

| 37.2.5 |

Biometrics |

| 37.3 |

Recent Events |

| 37.4 |

Contact Information |

| 38 |

Northrop Grumman Corporation |

| 38.1 |

Company Profile |

| 38.2 |

Homeland Security & Public Safety Products |

| 38.2.1 |

Unmanned Systems |

| 38.2.2 |

C4ISR Products |

| 38.3 |

Recent Events |

| 38.4 |

Contact Information |

| 39 |

Raytheon |

| 39.1 |

Company Profile |

| 39.2 |

Homeland Security & Public Safety Products |

| 39.2.1 |

Interception Products |

| 39.2.2 |

Ground-based Air Defense Products |

| 39.2.3 |

Ballistic Missile Defense Products |

| 39.2.4 |

UAV Products |

| 39.2.5 |

Airborne Surveillance Products |

| 39.2.6 |

Maritime Surveillance Products |

| 39.3 |

Recent Events |

| 39.4 |

Contact Information |

| 40 |

Thales Group |

| 40.1 |

Company Profile |

| 40.2 |

Homeland Security & Public Safety Products |

| 40.2.1 |

Air-Borne ISR Products |

| 40.2.2 |

Unmanned Aerial Vehicle (UAV) Systems |

| 40.2.3 |

Security Systems |

| 40.3 |

Recent Events |

| 40.4 |

Contact Information |

| |

APPENDICES |

| 41 |

Appendix A: Doing Business in Saudi Arabia |

| 41.1 |

Direct Exports |

| 41.2 |

Export Documentation Requirements |

| 41.3 |

Customs Duties |

| 41.4 |

Commercial Agents |

| 41.5 |

Franchising |

| 41.6 |

Branch Offices |

| 41.7 |

Direct Foreign Investment |

| 41.8 |

Licensed Insurers |

| 41.9 |

Taxation |

| 41.9.1 |

Residents and Non-residents Taxation (Personal) |

| 41.9.2 |

Corporation Tax |

| 41.9.3 |

Zakat (Religious Wealth Tax) |

| 41.1 |

Useful Websites |

| 42 |

Appendix B: Saudi Arabia Geopolitical Overview |

| 43 |

Appendix C: Saudi Economy |

| 44 |

Appendix D: Saudi Arabia Political Structure |

| 45 |

Appenddix E: Crime, Terror and Law Enforcement in Saudi Arabia |

| 45.1 |

Crime in Saudi Arabia |

| 45.2 |

Terror in Saudi Arabia |

| 45.3 |

Saudi Arabia Counter Terror Legislation & Law Enforcement |

| 46 |

Appendix F: Saudi Arabia Homeland Security & Public Safety Agencies |

| 46.1 |

The Saudi Three Tier Security Strategy |

| 46.1.1 |

External 1st Tier: Ministry of Defense |

| 46.1.2 |

Internal 2nd Tier: Ministry of Interior |

| 46.1.3 |

3rd Tier: The Kingdom’s Court Security Units |

| 46.2 |

The Saudi Security Infrastructure |

| 46.2.1 |

Ministry of Interior |

| 46.2.2 |

Saudi National Guard |

| 46.2.3 |

Paramilitary Security Forces |

| 46.2.4 |

Saudi Arabia Police Forces |

| 46.3 |

Saudi Arabia Defense Forces |

| 46.3.1.1 |

Armed Services |

| 46.3.1.2 |

Independent Forces |

| 46.4 |

The Saudi Intelligence Community |

| 46.4.1 |

General Intelligence Presidency |

| 46.4.2 |

Saudi Civil Intelligence |

| 47 |

Research Scope & Methodology |

| 47.1 |

Research Scope |

| 47.2 |

Research Methodology |

| 48 |

Disclaimer & Copyright |