| 1 |

Executive Summary |

| 1.1 |

Major Findings |

| 1.2 |

Major Conclusions |

| 1.3 |

Standoff Person- Borne and Vehicle-Borne Explosives & Weapon Detection Technologies |

| 1.4 |

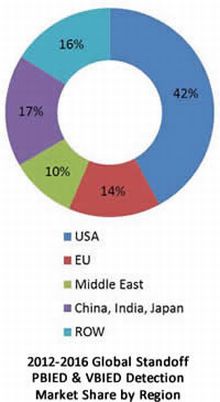

Global Standoff Person- Borne and Vehicle-Borne Contraband Detection Market 2012-2016 |

| 1.4.1 |

Standoff Explosives & Weapon Detection Systems Sales 2012-2016 |

| 1.4.2 |

Maintenance, Upgrade & Refurbishment Market 2012-2016 |

| 1.4.3 |

Consolidated Standoff Person-Borne and Vehicle-Borne Explosives & Weapon Detection Market 2012-2016 |

| 2 |

Introduction |

| 2.1 |

Scope |

| 2.2 |

Methodology |

| 2.3 |

Assumptions |

| 3 |

Market Drivers |

| 4 |

Market Inhibitors |

| 5 |

SWOT Analysis |

| 6 |

Competitive Analysis |

| 7 |

Background and Challenges of PBIED & VBIED |

| 7.1 |

PBIED & VBIED Detection: Operational Considerations |

| 7.2 |

Person-Borne Explosive Devices (PBIEDs): Standoff Detection Challenges |

| 7.3 |

Vehicle-Borne Improvised Explosive Devices (VBIED) Standoff Detection Challenges |

| 7.4 |

Suicide Terrorism |

| 7.5 |

The US PBIED & VBIED Detection Scenario |

| 8 |

Business Challenges and Opportunities |

| 9 |

PBIED & VBIED Detection: Technological Challenges |

| 9.1.1 |

Standoff PBIED & VBIED Threat Identification |

| 9.1.2 |

Standoff System Performance |

| 10 |

Global Standoff Person- Borne and Vehicle-Borne Contraband Detection Market 2012-2016 |

| 10.1 |

Standoff Explosives & Weapon Detection Systems Sales 2012-2016 |

| 10.2 |

Maintenance, Upgrade & Refurbishment Market 2012-2016 |

| 10.3 |

Consolidated Standoff Person-Borne and Vehicle-Borne Explosives & Weapon Detection market 2012-2016 |

| 10.3.1 |

Market by Segment (Sales vs. Maintenance, Upgrade & Refurbishment) |

| 10.3.2 |

Market by Modality |

| 11 |

Walk-by and Pass-through Standoff Threat Detection Corridors: Technologies and Markets 2012-2016 |

| 11.1 |

Walk-by and Pass-through Standoff Threat Detection Technologies |

| 11.1.1 |

Walk-through Corridors: Active Electromagnetic Weapons Detection |

| 11.1.2 |

Passive Electro Magnetic Signature Corridor |

| 11.1.3 |

Standoff Passive MMWave Doorways |

| 11.1.4 |

Focal Plane Array Passive MMWave |

| 11.1.5 |

Walk-by Passive MMWave Imaging System |

| 11.1.6 |

Walk-through Corridors: Fourier Transform Infrared (FTIR) Spectroscopy Systems |

| 11.1.7 |

Covert Walk-through Biometric Identification Corridors |

| 11.1.8 |

Fused Standoff Video Surveillance and Biometrics |

| 11.1.9 |

Example: IOM PassPort |

| 11.2 |

Walk-by Sensing Systems Market 2012-2016 |

| 11.2.1 |

Global Market by Customer Sector |

| 11.2.1.1 |

Systems Sales by Sector – 2012-2016 |

| 11.2.1.2 |

Maintenance, Upgrade & Refurbishment Market by Customer Sector – 2012-2016 |

| 11.2.1.3 |

Global Walk-by Sensing Systems Market by Customer Sector – 2012-2016 |

| 11.2.2 |

Walk-by Sensing Systems Sales by Country/Region& Sector |

| 11.2.2.1 |

US Systems Sales by Sector – 2012-2016 |

| 11.2.2.2 |

Walk-by Sensing Systems EU Sales by Sector – 2012-2016 |

| 11.2.2.3 |

Middle East Walk-By Sensing Systems Sales by Sector – 2012-2016 |

| 11.2.2.4 |

China, India and Japan Walk-By sensing Systems Sales by Sector – 2012-2016 |

| 11.2.2.5 |

ROW Walk-By sensing Systems Sales by Sector – 2012-2016 |

| 11.2.3 |

Walk-by Sensing Systems Market by Region |

| 11.2.3.1 |

Systems Sales by Country/Region- 2012-2016 |

| 11.2.3.2 |

Walk-by Sensing Systems Maintenance, Upgrade & Refurbishment Market by Country/Region – 2012-2016 |

| 11.2.3.3 |

Total Walk-by Sensing Systems Market by Country/Region – 2012-2016 |

| 11.3 |

Pass-through Threat Detection Corridors Markets 2012-2016 |

| 11.3.1 |

Global Pass-through Threat Detection Corridors Market by Customer Sector |

| 11.3.1.1 |

Pass-through Threat Detection Corridors, Systems Sales by Sector – 2012-2016 |

| 11.3.1.2 |

Pass-through Threat Detection Corridors, Maintenance, Upgrade & Refurbishment Market by Customer Sector – 2012-2016 |

| 11.3.1.3 |

Pass-through Threat Detection Corridors, Global Market by Customer Sector – 2012-2016 |

| 11.3.2 |

Pass-through Threat Detection Corridors, Systems Sales by Country/Region& Sector |

| 11.3.2.1 |

US Pass-through Threat Detection Corridors, Systems Sales by Sector – 2012-2016 |

| 11.3.2.2 |

EU Pass-through Threat Detection Corridors, Systems Sales by Sector – 2012-2016 |

| 11.3.2.3 |

Middle East Pass-through Threat Detection Corridors, Systems Sales by Sector – 2012-2016 |

| 11.3.2.4 |

China, India and Japan Pass-through Threat Detection Corridors, Systems Sales by Sector – 2012-2016 |

| 11.3.2.5 |

ROW Pass-through Threat Detection Corridors, Systems Sales by Sector – 2012-2016 |

| 11.3.3 |

Pass-through Threat Detection Corridors, Market by Region |

| 11.3.3.1 |

Systems Sales by Country/Region – 2012-2016 |

| 11.3.3.2 |

Pass-through Threat Detection Corridors, Maintenance, Upgrade & Refurbishment Market by Country/Region – 2012-2016 |

| 11.3.3.3 |

Pass-through Threat Detection Corridors, Market by Country/Region- 2012-2016 |

| 12 |

Open Space Standoff Explosives & Weapon Detection: Technologies and Market 2012-2016 |

| 12.1 |

Open Space Standoff Explosives & Weapon Technologies |

| 12.1.1 |

Introduction |

| 12.1.2 |

Open Space Standoff Explosives & Weapon Detection Technologies Challenges |

| 12.1.3 |

Review of Open Space Explosives & Weapon Detection Technologies |

| 12.1.4 |

Bi-Modal Standoff Person- Borne and Vehicle-Borne Explosives & Weapon Detection Systems |

| 12.1.5 |

Sample: Standoff Fused MMWave & Infrared System |

| 12.1.6 |

Pipeline Standoff Explosives Detection Technologies |

| 12.1.7 |

Standoff Active MMWave Screening |

| 12.1.8 |

Standoff Passive MMWave Imaging |

| 12.1.8.1 |

Principle of Operation |

| 12.1.8.2 |

Advantages of a Passive Millimeter Wave (PMMW) system: |

| 12.1.8.3 |

TREX Enterprises Standoff Passive MMWave Technology |

| 12.1.8.4 |

GEN2 Standoff Passive MMWave PBIED Detection Technology |

| 12.1.8.5 |

Standoff ‘Illuminators of Opportunity’ Passive MMWave Imaging |

| 12.1.8.6 |

Mechanically Scanning Standoff MMWave Screening |

| 12.1.9 |

Standoff MMWave PBIED Gait Characteristics Detection |

| 12.1.10 |

Standoff Infrared Detection |

| 12.1.11 |

Standoff Terahertz Concealed Explosives & Weapons Detection |

| 12.1.11.1 |

Concealed Explosives & Weapons Standoff Detection Technologies: Overview |

| 12.1.11.2 |

Standoff Terahertz Contraband Detection Technology |

| 12.1.11.3 |

Terahertz detection advantages over Other Technologies |

| 12.1.11.4 |

Standoff Active Terahertz Heterodyne Concealed Explosives & Weapons Standoff Detection Imagers |

| 12.1.11.5 |

Standoff Active Terahertz Absorption Spectroscopy Using Principal Component Analysis |

| 12.1.11.6 |

Example: Active Terahertz Stand-off Explosives Detection System of TeraView |

| 12.1.11.7 |

Passive Terahertz Standoff Weapons &Explosives Detection |

| 12.1.11.8 |

Passive Terahertz Detection System: ThruVision Systems |

| 12.1.12 |

Standoff Laser-Based Explosives Detection |

| 12.1.12.1 |

Introduction |

| 12.1.12.2 |

Standoff Laser-induced Breakdown Spectroscopy (LIBS) |

| 12.1.12.3 |

Future Standoff LIBS Systems |

| 12.1.13 |

Standoff Raman Spectroscopy |

| 12.1.13.1 |

Raman Spectroscopy Technology: Introduction |

| 12.1.13.2 |

Standoff Coherent Anti-Stokes Raman Spectroscopy |

| 12.1.13.3 |

Future Standoff CARS Systems |

| 12.1.14 |

Standoff Non-linear Wave Mixing Detection Technology |

| 12.1.14.1 |

Principle of Operation |

| 12.1.14.2 |

Future Standoff Non-linear Wave Mixing PBIED & VBIED detection technology |

| 12.1.15 |

Standoff Laser Induced Fluorescence (PLP/LIF) Technology |

| 12.1.15.1 |

PLP/LIF Standoff Explosives Detection Principle of Technology |

| 12.1.15.2 |

Future Standoff PLP/LIF Systems |

| 12.1.16 |

Standoff Light Detection and Ranging (LIDAR) Explosives Detection |

| 12.1.16.1 |

Overview |

| 12.1.16.2 |

Future LIDAR Systems |

| 12.1.17 |

Standoff Resonant Raman Spectroscopy |

| 12.2 |

Open Space Explosives & Weapon Detection Systems Markets 2012-2016 |

| 12.2.1 |

Global Market by Customer Sector |

| 12.2.1.1 |

Systems Sales by Customer Sector – 2012-2016 |

| 12.2.1.2 |

Open Space Explosives & Weapon Detection: Maintenance, Upgrade & Refurbishment Market by Customer Sector – 2012-2016 |

| 12.2.1.3 |

Global Open Space Explosives & Weapon Detection Market by Customer Sector – 2012-2016 |

| 12.2.2 |

Open Space Explosives & Weapon Detection: Systems Sales by Country/Region& Sector |

| 12.2.2.1 |

Open Space Explosives & Weapon Detection Systems: US Sales by Customer Sector – 2012-2016 |

| 12.2.2.2 |

Open Space Explosives & Weapon Detection Systems: EU Systems Sales by Customer Sector – 2012-2016 |

| 12.2.2.3 |

Open Space Explosives & Weapon Detection Systems: Middle East Systems Sales by Customer Sector – 2012-2016 |

| 12.2.2.4 |

Open Space Explosives & Weapon Detection Systems: China, India and Japan Systems Sales by Customer Sector – 2012-2016 |

| 12.2.2.5 |

Open Space Explosives & Weapon Detection Systems: ROW Systems Sales by Customer Sector – 2012-2016 |

| 12.2.3 |

Open Space Explosives & Weapon Detection Systems: Market by Region |

| 12.2.3.1 |

Systems Sales by Country/Region- 2012-2016 |

| 12.2.3.2 |

Open Space Explosives & Weapon Detection Systems: Maintenance, Upgrade & Refurbishment Market by Country/Region – 2012-2016 |

| 12.2.3.3 |

Open Space Explosives & Weapon Detection Systems: Market by Country/Region- 2012-2016 |

| 13 |

Standoff Vehicle-Borne Explosives Detection: Technologies and Market 2012-2016 |

| 13.1 |

Technologies |

| 13.1.1 |

Overview |

| 13.1.2 |

VBIED Detection: Challenges |

| 13.1.3 |

Example: Raman Spectroscopy Based Vehicle Standoff Detector – P. Eye |

| 13.2 |

Standoff Vehicle Borne IED Detection Systems Markets 2012-2016 |

| 13.2.1 |

Global Standoff Vehicle Borne IED Detection Systems Market by Customer Sector |

| 13.2.1.1 |

Systems Standoff VBIED Detection Sales by Customer Sector – 2012-2016 |

| 13.2.1.2 |

Vehicle Borne Detection systems Maintenance, Upgrade & Refurbishment Market by Customer Sector – 2012-2016 |

| 13.2.1.3 |

Vehicle Borne IED Detection Market by Customer Sector – 2012-2016 |

| 13.2.2 |

Vehicle Borne IED Detection Systems Sales by Country/Region& Sector |

| 13.2.2.1 |

US Vehicle Borne IED Detection Systems Sales by Customer Sector – 2012-2016 |

| 13.2.2.2 |

EU Vehicle Borne IED Detection Systems Sales by Customer Sector – 2012-2016 |

| 13.2.2.3 |

Middle East Vehicle Borne IED Detection Systems Sales by Customer Sector – 2012-2016 |

| 13.2.2.4 |

China, India and Japan Vehicle Borne IED Detection Systems Sales by Customer Sector – 2012-2016 |

| 13.2.2.5 |

ROW Vehicle Borne IED Detection Systems Sales by Customer Sector – 2012-2016 |

| 13.2.3 |

Vehicle Borne IED Detection Market by Region |

| 13.2.3.1 |

Systems Sales by Country/Region – 2012-2016 |

| 13.2.3.2 |

Vehicle Borne IED Detection Systems Maintenance, Upgrade & Refurbishment Market by Country/Region – 2012-2016 |

| 13.2.3.3 |

Standoff Vehicle Borne IED Detection Market by Country/Region – 2012-2016 |

| 14 |

Vendors |

| 14.1 |

ADT Security Services |

| 14.2 |

Axsys Technologies |

| 14.3 |

Brijot Imaging Systems |

| 14.4 |

Flir |

| 14.5 |

Fluidmesh Networks |

| 14.6 |

GE Security |

| 14.7 |

Honeywell |

| 14.8 |

TeraView |

| 14.9 |

ThruVision Systems |

| 15 |

Appendix A: Standoff Person-Borne and Vehicle-Borne Explosives & Weapon Detection Programs and Projects |

| 15.1 |

Localization of Threat Substances in Urban Environment (LOTUS) |

| 15.2 |

Algorithm and Analysis of Raw Images Project |

| 15.3 |

Detection Technology and Material Science Project |

| 15.4 |

Explosives Trace Detection Project |

| 15.5 |

Person-Borne Improvised Explosive Devices (PBIED) Detection Project |

| 15.6 |

Predictive Screening Project |

| 15.7 |

Vehicle-Borne Improvised Explosive Devices (VBIED) Detection Project |

| 15.8 |

Homemade Explosives Characterization Project |

| 15.9 |

IED Risk Prediction Project |

| 15.1 |

VBIED Full Mission Characterization Project |

| 15.11 |

Cross-Cultural Validation of SPOT (Screening Passengers by Observation Techniques) Behaviors Project |

| 15.12 |

Future Attribute Screening Technologies Mobile Module (FAST M2) |

| 15.13 |

Hostile Intent Detection-Automated Prototype Project |

| 15.14 |

Passive Methods for Precision Behavioral Screening Project |

| 15.15 |

Violent Intent Modeling and Simulation (VIMS) Project |

| 16 |

Appendix B: Acronyms |