| 1 |

Executive Summary |

| 1.1 |

Major Findings |

| 1.2 |

Major Conclusions |

| 1.3 |

Luggage Screening Technologies |

| 1.4 |

Global Tomographic Explosives Detection Systems Market – 2014-2020 |

| 1.4.1 |

Explosive Detection System Related Sub-Markets |

| 1.4.2 |

Global Tomographic Explosives Detection Systems Market by Vertical Market |

| 1.4.3 |

Global Tomographic Explosives Detection Systems Market by Country |

| |

TECHNOLOGIES |

| 2 |

Current Explosive Detection Technologies |

| 2.1 |

Explosive Materials Classification |

| 2.2 |

Explosives Detection Technologies |

| 2.2.1 |

Major Explosives Detection Technologies |

| 2.2.2 |

Current Luggage, Carry-on Bags & Parcel Screening Technologies |

| 2.3 |

Bulk Screening Technologies |

| 2.3.1 |

Bulk Screening Technologies: Pros and Cons |

| 2.3.2 |

EDS Throughput |

| 2.3.3 |

Bulk Screening Technologies: Price Comparison |

| 2.4 |

X-ray Technology |

| 2.4.1 |

2D X-ray Screening: Pros and Cons |

| 2.4.2 |

Innocuous Materials Interference |

| 2.5 |

Explosive Detection Systems Technology and Certification |

| 2.5.1 |

Tomographic Principle of Operation |

| 2.5.2 |

Dual Energy EDS |

| 2.6 |

“Tomographic” X-Ray Diffraction Explosives Detection Technologies and Application |

| 2.6.1 |

Introduction |

| 2.6.2 |

Principle of Operation |

| 2.6.3 |

Automated Level 2-3 Localized Scanning Screening |

| 2.6.4 |

Localized Inspection Using X-Ray Diffraction Technology |

| 2.6.5 |

Hybrid Tomographic Explosive Detection System & 2D X-ray Screening |

| 2.6.6 |

Explosive Detection System Certification |

| 2.6.7 |

Explosive Detection System Throughput vs. Price |

| 3 |

EDS Based Aviation Security Screening |

| 3.1 |

Scope |

| 3.2 |

Checked Luggage Screening |

| 3.2.1 |

EDS based Screening Systems Deployment Strategy |

| 3.2.2 |

Coherent X-ray Scatter Based Multi-Level Screening |

| 3.2.3 |

Checked Luggage Covert Testing Procedures |

| 4 |

EDS Technology Outlook – 2014-2020 |

| 4.1 |

Advanced Coherent X-ray Scattering EDS |

| 4.2 |

Stationary EDS |

| 4.3 |

Liquid and Homemade Explosives Detection |

| 4.4 |

MagViz Distinguishes Potential-Threat Liquids |

| 4.5 |

Superconducting Quantum Interference Device (SQUID) |

| 4.6 |

Quasi Tomographic EDS – 3D X-ray |

| |

INDUSTRY |

| 5 |

Explosive Detection Systems (EDS) Industry: SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

EDS Industry Competitive Analysis |

| 7 |

EDS Business & Technological Opportunities and Challenges |

| 7.1 |

Business Opportunity #1 |

| 7.2 |

Business Opportunity #2 |

| 7.3 |

Business Opportunity #3 |

| 7.4 |

Business Opportunity #4 |

| 7.5 |

Business Opportunity #5 |

| 7.6 |

Business Opportunity #6 |

| 7.7 |

Business Opportunity #7 |

| |

GLOBAL MARKET |

| 8 |

Market Drivers |

| 9 |

Market Inhibitors |

| 10 |

Global Tomographic Explosives Detection Systems Market – 2014-2020 |

| 10.1 |

EDS Vertical Markets |

| 10.1.1 |

EDS Related Sub-Markets |

| 10.1.2 |

Market Forecast – 2014-2020 |

| 10.1.3 |

Market Dynamics – 2014-2020 |

| 10.1.4 |

Market Breakdown – 2014-2020 |

| 10.2 |

Global Tomographic Explosives Detection Systems Vertical Markets |

| 10.2.1 |

Global EDS Equipment Market – 2014-2020 |

| 10.2.2 |

Global EDS Installation Market – 2014-2020 |

| 10.2.3 |

Global Baggage Handling Systems Market – 2014-2020 |

| 10.3 |

Global Tomographic Explosives Detection Systems Market by Country |

| 10.3.1 |

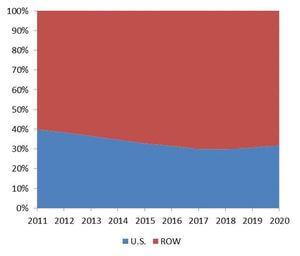

Consolidated Market – 2014-2020 |

| 10.3.2 |

Market Dynamics – 2014-2020 |

| 10.3.3 |

Market Breakdown – 2014-2020 |

| |

NATIONAL MARKETS |

| 11 |

U.S. Tomographic Explosives Detection Systems Market – 2014-2020 |

| 11.1 |

U.S. Federal HLS Organizations |

| 11.2 |

U.S. Aviation Security Market Background |

| 11.2.1 |

The Transportation Security Administration |

| 11.2.2 |

Screening Partnership Program |

| 11.2.3 |

Screening Training and Other Programs |

| 11.2.4 |

Passengers Checkpoint Support Program |

| 11.2.5 |

Electronic Baggage Screen Program (EBSP) |

| 11.2.6 |

Replacing Cost of Aging EDS Machines |

| 11.2.7 |

TSA- Airport Cost Share Issue |

| 11.2.8 |

Life Cycle cost |

| 11.2.9 |

Screening Technology Maintenance & Utilities Program |

| 11.2.10 |

Aviation Regulation and Other Enforcement Programs |

| 11.2.11 |

Airport Management, IT and Support Program |

| 11.2.12 |

Air Cargo Security Program |

| 11.2.13 |

Secure Flight Program |

| 11.2.14 |

Transportation Security Support Programs |

| 11.3 |

Passenger Baggage Screening Data [M] by 514 U.S. Airports |

| 11.4 |

2011-2013 Market Data |

| 11.5 |

U.S. Tomographic Explosives Detection Systems Market |

| 11.5.1 |

Market Forecast – 2014-2020 |

| 11.5.2 |

Market Dynamics – 2014-2020 |

| 11.5.3 |

Market Breakdown – 2014-2020 |

| 11.6 |

U.S. Tomographic Explosives Detection Systems Vertical Markets |

| 11.6.1 |

U.S. EDS Equipment Market – 2014-2020 |

| 11.6.2 |

U.S. EDS Installation Market – 2014-2020 |

| 11.6.3 |

U.S. Baggage Handling Systems Market – 2014-2020 |

| 12 |

Canada Tomographic Explosives Detection Systems Market – 2014-2020 |

| 12.1 |

Geopolitical Background |

| 12.1.1 |

Facts & Figures |

| 12.1.2 |

Canadian Economy |

| 12.1.3 |

Canada Security Market |

| 12.2 |

Canada Counterterrorism & Law Enforcement |

| 12.3 |

Canada HLS & Public Safety Agencies |

| 12.4 |

Canada Aviation Security |

| 12.4.1 |

Air Travelers Security Charge |

| 12.4.2 |

Air Cargo Screening |

| 12.4.3 |

Passenger Baggage-Luggage Screening by Airports |

| 12.5 |

Canada Tomographic Explosives Detection Systems Market |

| 12.5.1 |

Market Forecast – 2014-2020 |

| 12.5.2 |

Market Dynamics – 2014-2020 |

| 12.5.3 |

Market Breakdown – 2014-2020 |

| 12.6 |

Canada Tomographic Explosives Detection Systems Vertical Markets |

| 12.6.1 |

Canada EDS Equipment Market – 2014-2020 |

| 12.6.2 |

Canada EDS Installation Market – 2014-2020 |

| 12.6.3 |

Canada Baggage Handling Systems Market – 2014-2020 |

| 13 |

Mexico & Brazil Tomographic Explosives Detection Systems Market – 2014-2020 |

| 13.1 |

Mexico Market Background |

| 13.1.1 |

Facts & Figures |

| 13.1.2 |

Mexico Security Market |

| 13.1.3 |

Mexico Security Industry |

| 13.1.4 |

Terror & Crime in Mexico |

| 13.1.4.1 |

Terror in Mexico |

| 13.1.4.2 |

Crime in Mexico |

| 13.1.5 |

Mexico HLS & Public Safety Agencies |

| 13.1.6 |

Passenger Baggage-Luggage Screening by Airports |

| 13.2 |

Brazil Market Background |

| 13.2.1 |

Facts & Figures |

| 13.2.2 |

Brazil Geopolitical Analysis |

| 13.2.3 |

Security Market |

| 13.2.4 |

Terror & Crime in Brazil |

| 13.2.4.1 |

Crime |

| 13.2.4.2 |

Counterterrorism-Related Activities |

| 13.2.5 |

Legislation & Law Enforcement |

| 13.2.6 |

Brazil HLS & Public Safety Agencies |

| 13.2.7 |

Brazil Aviation Security Market Background |

| 13.2.8 |

Passenger Baggage-Luggage Screening by Airports |

| 13.3 |

Mexico and Brazil Tomographic Explosives Detection Systems Market |

| 13.3.1 |

Market Forecast – 2014-2020 |

| 13.3.2 |

Market Dynamics – 2014-2020 |

| 13.3.3 |

Market Breakdown – 2014-2020 |

| 13.4 |

Mexico and Brazil Tomographic Explosives Detection Systems Vertical Markets |

| 13.4.1 |

Mexico and Brazil EDS Equipment Market – 2014-2020 |

| 13.4.2 |

Mexico and Brazil EDS Installation Market – 2014-2020 |

| 13.4.3 |

Mexico and Brazil Baggage Handling Systems Market – 2014-2020 |

| 14 |

U.K., Germany, France, Spain & Italy Tomographic Explosives Detection Systems Market – 2014-2020 |

| 14.1 |

U.K. Tomographic EDS & BHS Market Background |

| 14.1.1 |

Facts & Figures |

| 14.1.2 |

Economy |

| 14.1.3 |

U.K. Security Market |

| 14.1.4 |

U.K. Security Industry |

| 14.1.5 |

Terror & Crime in the U.K. |

| 14.1.5.1 |

Countering International Terrorism |

| 14.1.6 |

Legislation & Law Enforcement |

| 14.1.7 |

U.K. HLS & Public Safety Agencies |

| 14.1.8 |

U.K. Aviation Security Market Background |

| 14.1.8.1 |

Passengers baggage-Luggage Screening by Airports |

| 14.2 |

Germany Tomographic EDS & BHS Background |

| 14.2.1 |

Facts & Figures |

| 14.2.2 |

Germany Short Range Geopolitical Outlook |

| 14.2.3 |

Economy |

| 14.2.4 |

Security Market |

| 14.2.5 |

Security Industry |

| 14.2.6 |

Terror & Crime in Germany |

| 14.2.7 |

Germany HLS & Public Safety Agencies |

| 14.2.8 |

Germany Aviation Security Market Background |

| 14.2.8.1 |

Passenger baggage-Luggage Screening by Airports |

| 14.3 |

France Tomographic EDS & BHS Market Background |

| 14.3.1 |

Facts & Figures |

| 14.3.2 |

Economy |

| 14.3.3 |

Security Market |

| 14.3.4 |

HLS Market |

| 14.3.5 |

France Security Industry Companies |

| 14.3.6 |

Terror & Crime in France |

| 14.3.7 |

Legislation & Law Enforcement |

| 14.3.8 |

France HLS & Public Safety Agencies |

| 14.3.9 |

France Aviation Security Market Background |

| 14.3.9.1 |

Passenger baggage-Luggage Screening by Airports |

| 14.4 |

Spain Tomographic EDS & BHS Market Background |

| 14.4.1 |

Facts & Figures |

| 14.4.2 |

Economy |

| 14.4.3 |

Spain Security Market |

| 14.4.4 |

Terror & Crime in Spain |

| 14.4.4.1 |

Terror in Spain |

| 14.4.4.2 |

2012 Terrorist Incidents |

| 14.4.5 |

Legislation & Law Enforcement |

| 14.4.6 |

Spain HLS & Public Safety Agencies |

| 14.4.7 |

Spain Aviation Security Market Background |

| 14.4.8 |

Passenger baggage-Luggage Screening by Airports |

| 14.5 |

Italy Tomographic EDS & BHS Market Background |

| 14.5.1 |

Facts & Figures |

| 14.5.1.1 |

Economy |

| 14.5.2 |

Security Market |

| 14.5.3 |

Security Industry |

| 14.5.4 |

Terror & Crime in Italy |

| 14.5.5 |

Legislation & Law Enforcement |

| 14.5.6 |

Italy HLS & Public Safety Agencies |

| 14.5.7 |

Italy Aviation Security Market Background |

| 14.5.7.1 |

Passenger baggage-Luggage Screening by Airports |

| 14.6 |

U.K., Germany, France, Spain and Italy Tomographic Explosives Detection Systems Market |

| 14.6.1 |

Market Forecast – 2014-2020 |

| 14.6.2 |

Market Dynamics – 2014-2020 |

| 14.6.3 |

Market Breakdown – 2014-2020 |

| 14.7 |

U.K., Germany, France, Spain and Italy Tomographic Explosives Detection Systems Vertical Markets |

| 14.7.1 |

U.K., Germany, France, Spain and Italy EDS Equipment Market – 2014-2020 |

| 14.7.2 |

U.K., Germany, France, Spain and Italy EDS Installation Market – 2014-2020 |

| 14.7.3 |

U.K., Germany, France, Spain and Italy Baggage Handling Systems Market – 2014-2020 |

| 15 |

Turkey, Israel, Saudi Arabia, UAE and Qatar Tomographic Explosives Detection Systems Market – 2014-2020 |

| 15.1 |

Turkey |

| 15.1.1 |

Facts & Figures |

| 15.1.2 |

Turkey’s Security Market |

| 15.1.3 |

Turkey’s Security Industry |

| 15.1.4 |

Terror & Crime in Turkey |

| 15.1.5 |

2012 Terrorist Incidents |

| 15.1.6 |

Legislation & Law Enforcement |

| 15.1.7 |

Turkey HLS & Public Safety Agencies |

| 15.1.8 |

Turkey Aviation Security Market Background |

| 15.1.8.1 |

Passenger Baggage-Luggage Screening by Airports |

| 15.2 |

Israel Tomographic EDS & BHS Market Background |

| 15.2.1 |

Passenger Baggage-Luggage Screening by Airports |

| 15.3 |

Qatar Market Background |

| 15.3.1 |

Qatar Passenger Baggage-Luggage Screening by Airports |

| 15.4 |

Saudi Arabia Market Background |

| 15.4.1 |

Economy |

| 15.4.2 |

Terror in Saudi Arabia |

| 15.4.2.1 |

2012 Terrorist Incidents |

| 15.4.3 |

Legislation & Law Enforcement |

| 15.4.4 |

Saudi Arabia HLS & Public Safety Agencies |

| 15.4.5 |

Saudi Arabia Aviation Security Market Background |

| 15.4.6 |

Passenger Baggage-Luggage Screening by Airports |

| 15.5 |

UAE X-ray Security Screening Market – 2014-2020 |

| 15.5.1 |

Facts & Figures |

| 15.5.2 |

Economy |

| 15.5.3 |

U.A.E. Security Market |

| 15.5.4 |

Counterterrorism |

| 15.5.5 |

Legislation & Law Enforcement |

| 15.5.6 |

U.A.E. HLS Agencies |

| 15.5.7 |

UAE Aviation Security Market Background |

| 15.5.8 |

Dubai Airports Expansion Plan 2020 |

| 15.5.9 |

Augmented Baggage Scanning Machines |

| 15.5.10 |

Passenger Baggage-Luggage Screening by Airports |

| 15.6 |

Turkey, Israel, Saudi Arabia, UAE and Qatar Tomographic Explosives Detection Systems Market |

| 15.6.1 |

Market Forecast – 2014-2020 |

| 15.6.2 |

Market Dynamics – 2014-2020 |

| 15.6.3 |

Market Breakdown – 2014-2020 |

| 15.7 |

Turkey, Israel, Saudi Arabia, UAE and Qatar Tomographic Explosives Detection Systems Vertical Markets |

| 15.7.1 |

Turkey, Israel, Saudi Arabia, UAE and Qatar EDS Equipment Market – 2014-2020 |

| 15.7.2 |

Turkey, Israel, Saudi Arabia, UAE and Qatar EDS Installation Market – 2014-2020 |

| 15.7.3 |

Turkey, Israel, Saudi Arabia, UAE and Qatar Baggage Handling Systems Market – 2014-2020 |

| 16 |

China Tomographic Explosives Detection Systems Market – 2014-2020 |

| 16.1 |

Geopolitical Background |

| 16.1.1 |

Facts & Figures |

| 16.1.2 |

Economy |

| 16.1.3 |

China Security Market |

| 16.1.4 |

Terror |

| 16.2 |

China HLS & Public Safety Agencies |

| 16.2.1 |

China Ministry of State Security |

| 16.3 |

China Aviation Security Market Background |

| 16.3.1 |

Passenger baggage-Luggage Screening by Airports |

| 16.4 |

China Tomographic Explosives Detection Systems Market |

| 16.4.1 |

Market Forecast – 2014-2020 |

| 16.4.2 |

Market Dynamics – 2014-2020 |

| 16.4.3 |

Market Breakdown – 2014-2020 |

| 16.5 |

China Tomographic Explosives Detection Systems Vertical Markets |

| 16.5.1 |

China EDS Equipment Market – 2014-2020 |

| 16.5.2 |

China EDS Installation Market – 2014-2020 |

| 16.5.3 |

China Baggage Handling Systems Market – 2014-2020 |

| 17 |

Japan Tomographic Explosives Detection Systems Market – 2014-2020 |

| 17.1 |

Facts & Figures |

| 17.2 |

Economy |

| 17.3 |

Security Market |

| 17.4 |

Japan Security Industry |

| 17.5 |

Japan HLS & Public Safety Agencies |

| 17.6 |

Japan Aviation Security Market Background |

| 17.6.1 |

Passenger Baggage-Luggage Screening by Airports |

| 17.7 |

Japan Tomographic Explosives Detection Systems Market |

| 17.7.1 |

Market Forecast – 2014-2020 |

| 17.7.2 |

Market Dynamics – 2014-2020 |

| 17.7.3 |

Market Breakdown – 2014-2020 |

| 17.8 |

Japan Tomographic Explosives Detection Systems Vertical Markets |

| 17.8.1 |

Japan EDS Equipment Market – 2014-2020 |

| 17.8.2 |

Japan EDS Installation Market – 2014-2020 |

| 17.8.3 |

Japan Baggage Handling Systems Market – 2014-2020 |

| 18 |

India, South Korea, Indonesia and Australia Tomographic Explosives Detection Systems Market – 2014-2020 |

| 18.1 |

Australia EDS & BHS Market Background |

| 18.1.1 |

Geopolitical Background |

| 18.1.2 |

Economy |

| 18.1.3 |

Terror in Australia |

| 18.1.4 |

Australia HLS & Public Safety Agencies |

| 18.1.5 |

Australia Passenger baggage-Luggage Screening by Airports |

| 18.2 |

India EDS & BHS Market Background |

| 18.2.1 |

Geopolitical Background |

| 18.2.2 |

India Short Range Geopolitical Outlook |

| 18.2.3 |

Economy |

| 18.2.4 |

Security Industry |

| 18.2.5 |

Security Market |

| 18.2.6 |

Terror in India |

| 18.2.7 |

Legislation & Law Enforcement |

| 18.2.8 |

India HLS & Public Safety Agencies |

| 18.3 |

India Aviation Security Market Background |

| 18.4 |

Indonesia EDS & BHS Market Background |

| 18.4.1 |

Facts & Figures |

| 18.4.2 |

Economy |

| 18.4.3 |

Security Market |

| 18.4.4 |

Counterterrorism |

| 18.4.5 |

2012 Terrorist Incidents |

| 18.4.6 |

Legislation & Law Enforcement |

| 18.4.7 |

Indonesia HLS & Public Safety Agencies |

| 18.4.8 |

Indonesia Passenger baggage-Luggage Screening by Airports |

| 18.5 |

South Korea EDS & BHS Market Background |

| 18.5.1 |

Facts & Figures |

| 18.5.2 |

Economy |

| 18.5.3 |

South Korea Security Market |

| 18.5.4 |

Counterterrorism in South Korea |

| 18.5.5 |

South Korea HLS & Public Safety Agencies |

| 18.5.6 |

South Korea Aviation Security Market Background |

| 18.6 |

India, South Korea, Indonesia and Australia Tomographic Explosives Detection Systems Market |

| 18.6.1 |

Market Forecast – 2014-2020 |

| 18.6.2 |

Market Dynamics – 2014-2020 |

| 18.6.3 |

Market Breakdown – 2014-2020 |

| 18.7 |

India, South Korea, Indonesia and Australia Tomographic Explosives Detection Systems Vertical Markets |

| 18.7.1 |

India, South Korea, Indonesia and Australia EDS Equipment Market – 2014-2020 |

| 18.7.2 |

India, South Korea, Indonesia and Australia EDS Installation Market – 2014-2020 |

| 18.7.3 |

India, South Korea, Indonesia and Australia Baggage Handling Systems Market – 2014-2020 |

| 19 |

R.O.W. Tomographic Explosives Detection Systems Market – 2014-2020 |

| 19.1 |

R.O.W. Tomographic Explosives Detection Systems Market |

| 19.1.1 |

Market Forecast – 2014-2020 |

| 19.1.2 |

Market Dynamics – 2014-2020 |

| 19.1.3 |

Market Breakdown – 2014-2020 |

| 19.2 |

R.O.W. Tomographic Explosives Detection Systems Vertical Markets |

| 19.2.1 |

R.O.W. EDS Equipment Market – 2014-2020 |

| 19.2.2 |

R.O.W. EDS Installation Market – 2014-2020 |

| 19.2.3 |

R.O.W. Baggage Handling Systems Market – 2014-2020 |

| |

VERTICAL MARKETS |

| 20 |

Global EDS Equipment Market – 2014-2020 |

| 20.1 |

Market by Country |

| 20.2 |

Market Dynamics – 2014-2020 |

| 20.3 |

Market Breakdown – 2014-2020 |

| 21 |

Global EDS Installation Market – 2014-2020 |

| 21.1 |

Market by Country |

| 21.2 |

Market Dynamics – 2014-2020 |

| 21.2.1 |

Market Breakdown – 2014-2020 |

| 22 |

Global Baggage Handling Systems Market – 2014-2020 |

| 22.1 |

Market by Country |

| 22.2 |

Market Dynamics – 2014-2020 |

| 22.3 |

Market Breakdown – 2014-2020 |

| |

PRODUCTS |

| 23 |

EDS, Costs and Prices |

| 23.1 |

EDS Prices |

| 23.2 |

Installation Cost |

| 23.3 |

Refurbishment & Upgrade Cost |

| 23.4 |

Building and Checked Luggage Handling System Modification Market |

| 23.5 |

EDS Service Market |

| 23.6 |

Baggage Handling Systems (BHS) Service Market |

| 23.7 |

Infrastructure Modification Costs for EDS Replacement |

| 24 |

EDS Products Performance and Pricing Comparison Data |

| 24.1 |

Analogic – EDS Products Performance and Pricing Comparison Data |

| 24.2 |

Morpho Detection – EDS Products Performance and Pricing Comparison Data |

| 24.3 |

L-3 – EDS Products Performance and Pricing Comparison Data |

| 24.4 |

Reveal – Tomographic EDS: Products Performance and Pricing Comparison Data |

| 25 |

EDS Pricing Trends – 2011-2020 |

| |

VENDORS |

| 26 |

Leading Vendors |

| 26.1 |

Analogic Corporation |

| 26.1.1 |

Company Profile |

| 26.1.2 |

Tomographic Explosives Detection Systems |

| 26.1.2.1 |

eXaminer SX |

| 26.1.2.2 |

eXaminer 3DX |

| 26.1.2.3 |

eXaminer 3DX-ES |

| 26.1.2.4 |

eXaminer XLB. |

| 26.1.2.5 |

OnGuard Cobra |

| 26.1.2.6 |

OnGuard DualUse |

| 26.2 |

Eurologix Security Ltd |

| 26.2.1 |

Company Profile |

| 26.2.2 |

3D Explosives Detection Systems |

| 26.3 |

L-3 Communications Security & Detection Systems |

| 26.3.1 |

Company Profile |

| 26.3.2 |

Tomographic Explosives Detection Systems |

| 26.3.3 |

eXaminer SX |

| 26.3.4 |

eXaminer 3DX |

| 26.3.5 |

eXaminer 3DX-ES |

| 26.3.6 |

eXaminer XLB. |

| 26.3.7 |

eXaminer 3DX Upgrades and Options |

| 26.3.8 |

MVT-HR |

| 26.4 |

Morpho Detection Inc. |

| 26.4.1 |

Company Profile |

| 26.4.2 |

CTX Tomographic Explosives Detection Systems |

| 26.4.2.1 |

CTX 2500 |

| 26.4.2.2 |

CTX 5500 DS |

| 26.4.2.3 |

CTX 5800 DS |

| 26.4.2.4 |

CTX 9400 DSi |

| 26.4.2.5 |

CTX 9800 DSi |

| 26.4.3 |

XRD 3500 Diffraction Screening Technology |

| 26.4.4 |

Dual Modality: EDS & X-ray Diffraction System |

| 26.4.5 |

EDS Options and Accessories |

| 26.4.5.1 |

MUXv1 and MUXv2 |

| 26.4.5.2 |

Operator Testing Equipment |

| 26.5 |

Nuctech Co. Ltd |

| 26.5.1 |

Company Profile |

| 26.5.2 |

Tomographic Explosives Detection Systems |

| 26.5.2.1 |

XT2080 |

| 26.5.2.2 |

XT2080AD |

| 26.5.2.3 |

XT2100 |

| 26.6 |

Rapiscan Security Products, Inc. |

| 26.6.1 |

Company Profile |

| 26.6.2 |

Tomographic Explosives Detection Systems |

| 26.6.2.1 |

Rapiscan RTT 110 |

| 26.6.2.2 |

Rapiscan RTT 80 |

| 26.7 |

Reveal Imaging Technologies, Inc |

| 26.7.1 |

Company Profile |

| 26.7.2 |

Tomographic Explosives Detection Systems |

| 26.7.2.1 |

CT-80DR |

| 26.7.2.2 |

CT-80XL |

| 26.7.2.3 |

Reveal CT-800 |

| 26.7.2.4 |

ArrayCT 6040, ArrayCT 7555 |

| 26.7.2.5 |

Reveal Mobile EDS |

| |

APPENDICES |

| 27 |

Appendix A: Glossary |

| 28 |

Appendix B: Checked Luggage EDS & ETD Screening Configurations |

| 28.1.1 |

Scope |

| 28.1.2 |

Configuration 1: High-Volume In-Line EDS |

| 28.1.3 |

Configuration 2: Medium-Volume In-Line EDS |

| 28.1.4 |

Configuration 3: Mini In-line EDS |

| 28.1.5 |

Configuration 4: Stand-Alone EDS |

| 28.1.6 |

Configuration 5: Stand-Alone ETD (w/o EDS) |

| 28.1.7 |

Alarm Resolution |

| 28.2 |

Carry-on X-Ray and EDS Bag Screening |

| 29 |

Appendix C: Air Cargo Screening |

| 29.1.1 |

Background |

| 29.1.2 |

Cargo Security Policy |

| 30 |

The Report Research Methodology |

| 30.1 |

Report Structure |

| 30.2 |

Assumptions |

| 30.3 |

Research Methodology |

| 30.4 |

Who Is This Report For? |

| 30.5 |

Research Methods |

| 30.6 |

Terms of Reference |

| 31 |

Disclaimer & Copyright |