| 1 |

Executive Summary |

| 1.1. |

Major Findings |

| 1.2. |

Major Conclusions |

| 1.3. |

Luggage and Air-Cargo Screening Technologies |

| 1.4. |

Global Tomographic EDS Market Outlook

2011-2016 |

| 1.4.1. |

EDS Related

Markets |

| 1.4.2. |

EDS Markets by

Country 2011-2016 |

| 2 |

Scope and Methodology |

| 2.1. |

Scope |

| 2.2. |

Report Structure |

| 2.3. |

Who Is This

Report For? |

| 2.4. |

The Threat |

| 2.5. |

Assumptions |

| 2.6. |

Possible Scenario

Analysis |

| 2.7. |

Research Methods |

| 3 |

Market Analysis |

| 3.1. |

Market Drivers |

| 3.2. |

Market Inhibitors |

| 3.3. |

SWOT Analysis |

| 3.4. |

Competitive

Analysis |

| 3.5. |

Market Dynamics |

| 4 |

Current EDS Technologies |

| 4.1. |

Explosive

Materials Classification |

| 4.2. |

Explosives Detection Technologies |

| 4.2.1. |

Major Explosives

Detection Technologies |

| 4.2.2. |

Current Luggage,

Carry-on Bags and Parcel Screening Technologies |

| 4.3. |

Bulk Screening Technologies |

| 4.3.1. |

Bulk Screening Technologies: Pros and Cons |

| 4.3.2. |

Throughput |

| 4.3.3. |

Bulk Screening

Technologies: Price Comparison |

| 4.4. |

X-ray Technology |

| 4.4.1. |

X-ray Systems

Characteristics |

| 4.4.2. |

X-ray Systems –

Principles of Operation |

| 4.4.3. |

Innocuous

Materials Interference |

| 4.4.4. |

Threat Image

Projection (TIP) |

| 4.4.5. |

Dual Energy X-ray |

| 4.4.6. |

Coherent X-ray Scatter |

| 4.5. |

EDS Technology

and Certification |

| 4.5.1. |

Tomographic EDS Principle of Operation |

| 4.5.2. |

Hybrid

Tomographic EDS & 2D X-ray Screening |

| 4.5.3. |

EDS Certification |

| 4.5.4. |

EDS Throughput

vs. Price |

| 5 |

Aviation Security Screening |

| 5.1. |

Luggage Screening |

| 5.1.1. |

Screening Systems

Deployment Strategy |

| 5.1.2. |

Checked Luggage

Covert Testing Procedures |

| 5.1.3. |

Checked Luggage

EDS & ETD Screening Configurations |

| 5.1.4. |

Configuration 1: High-Volume In-Line EDS |

| 5.1.5. |

Configuration 2: Medium-Volume In-Line EDS |

| 5.1.6. |

Configuration 3: Mini In-line EDS |

| 5.1.7. |

Configuration 4: Stand-Alone EDS |

| 5.1.8. |

Configuration 5: Stand-Alone ETD (w/o EDS) |

| 5.1.9. |

Alarm Resolution |

| 5.2. |

Carry-on Bag Screening |

| 5.3. |

Air Cargo Screening |

| 5.3.1. |

Background |

| 5.3.2. |

Cargo Security

Policy |

| 6 |

Tomographic EDS Related Markets: Costs and

Prices |

| 6.1. |

Equipment Sales |

| 6.2. |

Installation Market |

| 6.3. |

Refurbishment & Upgrade Market |

| 6.4. |

Building and Luggage Handling System

Modification Market |

| 6.5. |

EDS Service Market |

| 6.6. |

Baggage Handling Systems (BHS) Service Market |

| 6.7. |

Infrastructure Modification Costs for EDS

Replacement |

| 7 |

Global Tomographic EDS Market 2011-2016 |

| 7.1. |

EDS Sales

2011-2016 |

| 7.2. |

Other EDS Related Markets 2011-2016 |

| 7.3. |

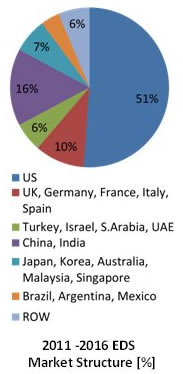

Global EDS

Related Markets by Country 2011-2016 |

| 7.3.1. |

Summary |

| 7.3.2. |

Global EDS

Equipment Market |

| 7.3.3. |

Global EDS

Installation Market |

| 7.3.4. |

Global EDS

Building and BHS Modification Market |

| 7.3.5. |

Global EDS

Refurbishment and Upgrade Market |

| 7.3.6. |

Global EDS

Service Market |

| 7.3.7. |

Global EDS

Handling Systems Service Market |

| 7.4. |

Global Cumulative

2011-2016 EDS Related Markets by Country |

| 8 |

US Tomographic EDS Market 2011-2016 |

| 8.1. |

Market Background |

| 8.2. |

EDS Sales

2011-2016 |

| 8.3. |

Other EDS Related Markets 2011-2016 |

| 8.3.1. |

Summary |

| 8.3.2. |

EDS Installation

Market 2011-2016 |

| 8.3.3. |

EDS Refurbishment

& Upgrade Market 2011-2016 |

| 8.3.4. |

Building and

Luggage Handling System Modification Market 2011-2016 |

| 8.3.5. |

EDS Service

Market 2011-2016 |

| 8.3.6. |

Baggage Handling

Systems (BHS) Service Market 2011-2016 |

| 9 |

UK, Germany, France, Italy and Spain Tomographic

EDS Market 2011-2016 |

| 9.1. |

EDS Sales

2011-2016 |

| 9.2. |

Other EDS Related Markets 2011-2016 |

| 10 |

Turkey, Israel, Saudi Arabia and UAE Tomographic

EDS Market 2011-2016 |

| 10.1. |

EDS Sales

2011-2016 |

| 10.2. |

Other EDS Related Markets 2011-2016 |

| 11 |

China and India Tomographic EDS Market

2011-2016 |

| 11.1. |

EDS Sales

2011-2016 |

| 11.2. |

Other EDS Related Markets 2011-2016 |

| 12 |

Japan, Korea, Australia, Malaysia and Singapore

Tomographic EDS Market 2011-2016 |

| 12.1. |

EDS Sales

2011-2016 |

| 12.2. |

Other EDS Related Markets 2011-2016 |

| 13 |

Brazil, Argentina and Mexico Tomographic EDS

Market 2011-2016 |

| 13.1. |

EDS Sales

2011-2016 |

| 13.2. |

Other EDS Related Markets 2011-2016 |

| 14 |

ROW Tomographic EDS Market 2011-2016 |

| 14.1. |

EDS Sales

2011-2016 |

| 14.2. |

Other EDS Related Markets 2011-2016 |

| 15 |

EDS Products Performance and Pricing Comparison

Data |

| 15.1. |

Analogic EDS Products Performance and Pricing

Comparison Data |

| 15.2. |

Morpho Detection EDS Products Performance and

Pricing Comparison Data |

| 15.3. |

L-3 EDS Products Performance and Pricing

Comparison Data |

| 15.4. |

Reveal Tomographic EDS: Products Performance

and Pricing Comparison Data |

| 16 |

EDS Pricing Trends 2011-2016 |

| 17 |

EDS Technology Outlook 2011-2016 |

| 17.1. |

Rapiscan High-Speed Stationary EDS |

| 17.2. |

Liquid and Homemade Explosives Detection |

| 17.3. |

MagVis Distinguishes Potential-Threat Liquids |

| 17.4. |

Superconducting Quantum Interference Device

(SQUID) |

| 17.5. |

Quasi Tomographic EDS 3D X-ray |

| 17.6. |

Gamma Resonance Tomography (GRT) |

| 17.7. |

Advanced Coherent X-ray Scattering EDS |

| 18 |

Business & Technological Opportunities and

Challenges |

| 18.1. |

Overview |

| 18.2. |

Business Opportunity #1 |

| 18.3. |

Business Opportunity #2 |

| 18.4. |

Business Opportunity #3 |

| 18.5. |

Business Opportunity #4 |

| 18.6. |

Business Opportunity #5 |

| 19 |

Leading Vendors |

| 19.1. |

Analogic Corporation |

| 19.1.1. |

Company Profile |

| 19.1.2. |

Tomographic

Explosives Detection Systems |

| 19.2. |

Eurologix

Security Ltd |

| 19.2.1. |

Company Profile |

| 19.2.2. |

Tomographic

Explosives Detection Systems |

| 19.3. |

L-3

Communications Security & Detection Systems |

| 19.3.1. |

Company Profile |

| 19.3.2. |

Tomographic

Explosives Detection Systems |

| 19.4. |

Morpho Detection

Inc. |

| 19.4.1. |

Company Profile |

| 19.4.2. |

Tomographic

Explosives Detection Systems |

| 19.5. |

NUCTECH

Co. Ltd |

| 19.5.1. |

Company Profile |

| 19.5.2. |

Tomographic

Explosives Detection Systems |

| 19.6. |

Rapiscan Security

Products, Inc. |

| 19.6.1. |

Company Profile |

| 19.6.2. |

Tomographic

Explosives Detection System |

| 19.7. |

Reveal Imaging Technologies, Inc |

| 19.7.1. |

Company Profile |

| 19.7.2. |

Tomographic

Explosives Detection Systems |

| 20 |

Appendix A: TSA Air Cargo Facility Regulations |

| 20.1. |

Introduction to Cargo

Security |

| 20.2. |

Airport – Cargo Processing Facilities |

| 20.3. |

Operational Considerations |

| 20.4. |

Access Control Considerations |

| 20.5. |

Information and Requirement Resources |

| 21 |

Appendix B: Glossary |