| 1 |

Executive Summary |

| 1.1. |

Main Findings |

| 1.2. |

Main Conclusions |

| 1.3. |

CBRN Terrorism |

| 1.4. |

Post Event CBRN & HAZMAT Decontaminating Process |

| 1.5. |

The Decontamination Industry |

| 1.6. |

Decontamination Market – 2011-2016 |

| 1.7. |

Technological Challenges |

| 2 |

Scope |

| 3 |

Methodology |

| 3.1. |

Research Methods |

| 3.2. |

Report Structure |

| 3.3. |

Basic Assumptions |

| 3.3.1. |

General |

| 3.3.2. |

Stockpiling Decontamination Means |

| 3.3.3. |

Possible Scenario Analysis |

| 3.4. |

Who is This Report For? |

| 4 |

Market Drivers |

| 5 |

Market Inhibitors |

| 6 |

Competitive Analysis |

| 7 |

SWOT Analysis |

| 7.1. |

Scope |

| 7.2. |

Decontamination Industry SWOT Analysis |

| 8 |

Market Dynamics |

| 9 |

The Obama Administration CBRN Terror Mitigation Strategy |

| 10 |

Decontamination: Technological Requirements |

| 10.1. |

The Problem |

| 10.2. |

The Decontamination Process |

| 10.2.1. |

Contaminant Identification |

| 10.2.2. |

Sample Characterization |

| 10.2.3. |

Isolation of Contaminated Area |

| 10.2.4. |

Design of Decontamination Strategy |

| 10.2.5. |

Decontamination |

| 10.2.6. |

Clearance Sampling |

| 10.3. |

Building & People Decontamination |

| 10.3.1. |

People Decontamination |

| 10.3.2. |

Buildings Decontamination |

| 10.4. |

Performance Challenges |

| 10.4.1. |

Challenge 1 |

| 10.4.2. |

Challenge 2 |

| 10.4.3. |

Challenge 3 |

| 10.4.4. |

Challenge 4 |

| 10.4.5. |

Challenge 5 |

| 10.4.6. |

Challenge 6 |

| 10.4.7. |

Challenge 7 |

| 10.5. |

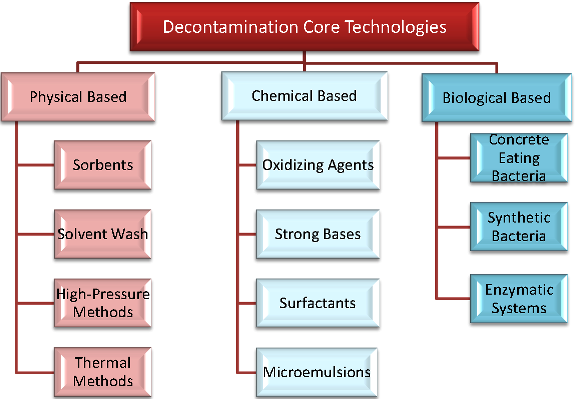

Technologies Overview |

| 10.6. |

Physics-Based Decontamination Core Technologies |

| 10.6.1. |

Sorbents |

| 10.6.2. |

Solvent-Wash |

| 10.6.3. |

High-Pressure Methods |

| 10.6.4. |

Thermal Methods |

| 10.7. |

Chemistry-Based Decontamination Core Technologies |

| 10.7.1. |

Oxidizing Agents |

| 10.7.2. |

Strong Bases |

| 10.7.3. |

Surfactants |

| 10.7.4. |

Microemulsions |

| 10.8. |

Biology-Based Technologies |

| 10.8.1. |

Bacterial Decontamination Agents |

| 10.8.2. |

Enzymatic Systems |

| 10.9. |

Decontamination System Configurations |

| 10.9.1. |

Application 1 People Decontamination Systems |

| 10.9.2. |

Application 2 Equipment Decontamination Systems |

| 10.10. |

Indoor Heavy Equipment Decontamination |

| 10.10.1. |

Application 3 Building and Infrastructure Decontamination Systems |

| 10.11. |

New Technologies Drivers |

| 10.12. |

New Technologies Inhibitors |

| 11 |

Decontamination Equipment Market Outlook 2011 2016 |

| 11.1. |

Scope, Assumptions and Overview |

| 11.2. |

U.S. Incidents Decontamination Equipment Sales & Service 2011 2016 |

| 11.3. |

Decontamination Equipment Market Forecast 2011 2016 |

| 11.4. |

Decontamination Equipment Service & Upgrade Market 2011 2016 |

| 12 |

Business Opportunities 2011-2016 |

| 12.1. |

Historical Perspective: A Market Waiting for Transition |

| 12.1.1. |

HLS Decontamination Strategy Outlook |

| 12.1.2. |

Factors Affecting Decontamination Systems Business Opportunities |

| 12.2. |

Business Opportunities for Decontamination Systems |

| 12.2.1. |

Business Opportunity 1 |

| 12.2.2. |

Business Opportunity 2 |

| 12.2.3. |

Business Opportunity 3 |

| 12.2.4. |

Business Opportunity 4 |

| 12.2.5. |

Business Opportunity 5 |

| 12.2.6. |

Business Opportunity 6 |

| 12.2.7. |

Business Opportunity 7 |

| 12.3. |

Radiological Decontamination Technologies |

| 12.3.1. |

Business Opportunity 8 |

| 12.3.2. |

Business Opportunity 9 |

| 12.3.3. |

Business Opportunity 10 |

| 12.3.4. |

Business Opportunity 11 |

| 12.3.5. |

Business Opportunity 12 |

| 12.4. |

Chemical-Biological Decontamination Technologies and Business Opportunities |

| 12.4.1. |

Business Opportunity 13 |

| 12.4.2. |

Business Opportunity 14 |

| 12.4.3. |

Business Opportunity 15 |

| 12.4.4. |

Business Opportunity 16 |

| 12.4.5. |

Business Opportunity 17 |

| 12.4.6. |

Business Opportunity 18 |

| 12.4.7. |

Business Opportunity 19 |

| 12.4.8. |

Business Opportunity 20 |

| 12.4.9. |

Business Opportunity 21 |

| 12.5. |

Contamination Simulation Algorithms |

| 12.5.1. |

Business Opportunity 22 |

| 13 |

Vendors and Products |

| 13.1. |

Decontamination Systems- Vendors and Products |

| 13.1.1. |

Allen-Vanguard Corporation |

| 13.1.2. |

Andax |

| 13.1.3. |

Base-X Inc. |

| 13.1.4. |

Bio Defense Corporation |

| 13.1.5. |

BIOQUELL, Inc. |

| 13.1.6. |

ClorDi Sys Solutions, Inc |

| 13.1.7. |

Container Products Corp. |

| 13.1.8. |

CRDS TVI Corporation |

| 13.1.9. |

Crest Ultrasonics Corp. |

| 13.1.10. |

Cryogenesis |

| 13.1.11. |

DQE, Inc. |

| 13.1.12. |

DuPont Personal Protection |

| 13.1.13. |

Environmental Fire Solutions, Inc. |

| 13.1.14. |

Equipment Management Company |

| 13.1.15. |

Fend- All |

| 13.1.16. |

First Line Technology, LLC |

| 13.1.17. |

Flangler Emergency Services, LLC |

| 13.1.18. |

Foster-Miller, Inc. |

| 13.1.19. |

FSI North America |

| 13.1.20. |

GenV- Clean Earth Technologies, LLC |

| 13.1.21. |

Global Ground Support |

| 13.1.22. |

Hughes Safety Showers Ltd. |

| 13.1.23. |

Intelgard, Inc. |

| 13.1.24. |

Karcher Futuretech GmbH |

| 13.1.25. |

Life Safety Systems, Inc. |

| 13.1.26. |

Matthews Specialty Vehicles, Inc |

| 13.1.27. |

Mobile Air Applied Science, Inc. |

| 13.1.28. |

Modec, Inc |

| 13.1.29. |

Nor E First Response, Inc. |

| 13.1.30. |

OWR AG |

| 13.1.31. |

Precision Lift, Inc. |

| 13.1.32. |

Reeves EMS, LLC |

| 13.1.33. |

RFD Beaufort |

| 13.1.34. |

RMC Medical |

| 13.1.35. |

Survival, Inc. |

| 13.1.36. |

SWEDE |

| 13.1.37. |

TSGI USA |

| 13.1.38. |

TVI Corporation |

| 13.1.39. |

Ultimate Survival Technologies |

| 13.1.40. |

US Foam Technologies, Inc |

| 13.1.41. |

Wel-Fab Inc. |

| 13.1.42. |

Western Shelter Systems |

| 13.1.43. |

Zimek Technologies, LLC |

| 13.1.44. |

Zumro, Inc. |

| 13.2. |

Other Decontamination Equipment, Kits etc |

| 13.2.1. |

Aero Tec Laboroatories Inc. |

| 13.2.2. |

Air Systems International |

| 13.2.3. |

Akron Brass Co. |

| 13.2.4. |

Allen-Vanguard, Inc |

| 13.2.5. |

Applied Surface Technologies |

| 13.2.6. |

BCDS, Inc. |

| 13.2.7. |

ClorDi Sys Solutions, Inc. |

| 13.2.8. |

Crestline Industries |

| 13.2.9. |

Cryogenesis |

| 13.2.10. |

Cryokinetics |

| 13.2.11. |

DQE, Inc. |

| 13.2.12. |

EFT |

| 13.2.13. |

Equipment Management Company |

| 13.2.14. |

E-Z-EM, Inc. |

| 13.2.15. |

Fend-All |

| 13.2.16. |

First Line Technology, LLC |

| 13.2.17. |

FSI North America |

| 13.2.18. |

Genecor International, Inc. |

| 13.2.19. |

Guild Associates, Inc. |

| 13.2.20. |

Haws Corporation |

| 13.2.21. |

Hydro-Therm |

| 13.2.22. |

IET, Inc. |

| 13.2.23. |

Intelgard |

| 13.2.24. |

Kappler, Inc |

| 13.2.25. |

Karcher Futuretech |

| 13.2.26. |

Minuteman International, Inc. |

| 13.2.27. |

Miti Manufacturing Co. Inc. |

| 13.2.28. |

Mobile Air Applied Science, Inc. |

| 13.2.29. |

Modec Inc. |

| 13.2.30. |

MorTan Inc. |

| 13.2.31. |

Nano Scale |

| 13.2.32. |

Nor E First Response, Inc. |

| 13.2.33. |

NPS Corporataion |

| 13.2.34. |

OWR AG |

| 13.2.35. |

Radiation Decontamination Solutions, LLC |

| 13.2.36. |

RAPID Deployment Products Inc. |

| 13.2.37. |

Red Head Brass, LLC |

| 13.2.38. |

Reeves EMS |

| 13.2.39. |

Reliapon |

| 13.2.40. |

RMC Medical |

| 13.2.41. |

Sabre Technical Services |

| 13.2.42. |

Slate Enterprises, Inc. |

| 13.2.43. |

SteriFx, Inc |

| 13.2.44. |

Steris Corporation |

| 13.2.45. |

Swede |

| 13.2.46. |

TECWAR® Tactical Water Purification Systems |

| 13.2.47. |

Tempest Technology, Inc. |

| 13.2.48. |

TVI Corporation |

| 14 |

Guidelines for Equipment Procurement |

| 14.1. |

Equipment Selection Factors |

| 14.2. |

Equipment Evaluation |

| 14.2.1. |

Commercial Decontaminants |

| 14.2.2. |

Decontamination Delivery Systems (Liquids) |

| 14.2.3. |

Decontamination Delivery Systems (Gaseous) |

| 14.2.4. |

Decontamination Shower Systems |

| 14.2.5. |

Decontamination Shower Hardware |

| 14.2.6. |

Decontamination Kits |

| 14.2.7. |

Decontamination Containment Items |

| 14.2.8. |

Decontamination Support Equipment |

| 15 |

Appendix A: CBRN Terror |

| 15.1. |

Biological Terror |

| 15.1.1. |

Bio-Weapons Historical Perspective |

| 15.1.2. |

Biological Terror Bacterial Agents |

| 15.1.3. |

Biological Terror Viral Agents |

| 15.1.4. |

Biological Terror Rickettsiae Agents |

| 15.1.5. |

Biological Terror Toxins |

| 15.2. |

Nuclear-Radiological Terror |

| 15.2.1. |

How Real is the Nuclear Threat? |

| 15.2.2. |

Nuclear Terror |

| 15.2.3. |

Radiological Dispersal Devices (RDD) |

| 15.3. |

Chemical Terror |

| 15.3.1. |

Nerve Agents |

| 15.3.2. |

Blister Agents |

| 16 |

Appendix B: Decontamination Legal Issues |

| 16.1. |

International Legislation/Agreements |

| 16.1.1. |

The Nuclear Weapons Non-Proliferation Treaty (NPT) 1970 |

| 16.1.2. |

The Biological and Toxin Weapons Convention (BTWC) 1972 |

| 16.1.3. |

Convention for the Physical Protection of Nuclear Material 1987 |

| 16.1.4. |

Chemicals Weapons Convention 1992 |

| 16.2. |

U.S. Legislation |

| 16.2.1. |

U.S. Code Title 50, Chapter 40 Defense Against Weapons of Mass Destruction |

| 16.2.2. |

Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) 1996 |

| 16.2.3. |

Emergency Supplemental Appropriations Act for Recovery from and Response to Terrorist Attacks on the United States 2001 |

| 16.2.4. |

Public Health Security and Bioterrorism Preparedness and Response Act 2002 |

| 16.2.5. |

Pandemic and All-Hazards Preparedness Act (PAHPA), 2006 |

| 16.2.6. |

Homeland Security Presidential Directive 21 |

| 17 |

Appendix C: List of References |