| 1. |

Introduction |

| 1.1. |

Scope |

| 1.2. |

Interplay Between: HLD, Federal, State & Local, Private Sector, Intelligence Community HLS Agencies |

| 1.3. |

Terms of Reference |

| 2. |

Executive Summary |

| 2.1. |

Key Findings and Conclusions |

| 2.1.1. |

Common Misconceptions |

| 2.1.2. |

Impact of Recent Economic Turmoil |

| 2.2. |

US HLS-HLD Organization |

| 2.3. |

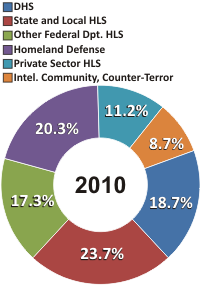

US HLS-HLD Funding and Markets Overview |

| 2.3.1. |

US HLS-HLD Outlay by Funding Source – 2009-2014 |

| 2.3.2. |

US HLS-HLD Market by Procurement Authority – 2009-2014 |

| 2.4. |

Federal HLS Funding and Markets |

| 2.4.1. |

Federal HLS Funding by Department – 2010-2014 |

| 2.4.2. |

Federal HLS Market by Department – 2010-2014 |

| 2.4.3. |

Federal HLS Funding by Mission Activity – 2010-2014 |

| 2.5. |

State and Local HLS Funding and Markets |

| 2.5.1. |

Key Findings |

| 2.5.2. |

State and Local HLS Funding – 2009-2014 |

| 2.5.3. |

State and Local HLS Market – 2000-2014 |

| 2.6. |

Private Sector HLS Funding and Market – 2009-2014 |

| 3. |

HLS-HLD Vendor – Client Relationship |

| 4. |

US HLS-HLD Market Drivers |

| 5. |

US HLS-HLD Market Inhibitors |

| 6. |

HLS- HLD Market: SWOT Analysis |

| 7. |

HLS-HLD Market: Competitive Analysis |

| 8. |

HLS-HLD Market Dynamics |

| 9. |

State & Local HLS Market – 2010-2014 |

| 9.1. |

State and Local HLS Funding Larger Than the DHS |

| 9.2. |

State and Local HLS Missions |

| 9.3. |

State and Local HLS Funding – 2009-2014 |

| 9.4. |

Federal HLS Grants – 2009-2014 |

| 9.5. |

Federally Funded State and Local HLS Programs: Funding & Market – 2009-2014 |

| 9.5.1. |

State Homeland Security Grant Program |

| 9.5.2. |

Urban Areas Security Initiative (UASI) Program |

| 9.5.3. |

Operation Stonegarden (OPSG) |

| 9.5.4. |

Metropolitan Medical Response System (MMRS) Program |

| 9.5.5. |

Citizen Corps Program (CCP) |

| 9.5.6. |

Nonprofit Security Grant Program (NSGP) |

| 9.5.7. |

Emergency Management Performance Grants (EMPG) |

| 9.5.8. |

Interoperable Emergency Communications Grant Program (IECGP) |

| 9.5.9. |

Regional Catastrophic Preparedness Grant Program (RCPGP) |

| 9.5.10. |

Emergency Operations Center (EOC) Grant Program |

| 9.5.11. |

Driver’s License Security Grant Program (DLSGP) |

| 9.5.12. |

Buffer Zone Protection Program (BZPP) |

| 9.5.13. |

Freight Rail Security Grant Program (FRSGP) |

| 9.5.14. |

Intercity Passenger Rail (Amtrak) |

| 9.5.15. |

Port Security Grant Program (PSGP) |

| 9.5.16. |

Intercity Bus Security Grant Program (IBSGP) |

| 9.5.17. |

Border Interoperability Demonstration Project (BIDP) Program |

| 9.5.18. |

Assistance to Firefighters Grants Program |

| 9.5.19. |

National Domestic Preparedness Consortium |

| 9.5.20. |

Interoperable Emergency Communication Grant Program (IECGP) |

| 9.6. |

Consolidated Federal, State and Local HLS Funding – 2009-2014 |

| 9.7. |

State and Local HLS Market Drivers |

| 9.8. |

State and Local Market Inhibitors |

| 9.9. |

State and Local Market SWOT Analysis |

| 9.1. |

State and Local Market Competitive Analysis |

| 9.11. |

State and Local Market Dynamics |

| 9.12. |

State and Local Consolidated HLS Market – 2010-2014 |

| 9.13. |

Primary Cities HLS Markets |

| 9.14. |

Arizona HLS Markets |

| 9.14.1. |

HLS Programs & Business Opportunities |

| 9.14.2. |

HLS Funding & Markets – 2009-2014 |

| 9.15. |

California HLS Markets – 2009-2014 |

| 9.15.1. |

HLS Programs & Business Opportunities |

| 9.15.2. |

HLS Funding & Markets – 2009-2014 |

| 9.16. |

Colorado HLS Markets – 2009-2014 |

| 9.16.1. |

HLS Programs & Business Opportunities |

| 9.16.2. |

HLS Funding & Markets – 2009-2014 |

| 9.17. |

District of Columbia HLS Markets – 2009-2014 |

| 9.17.1. |

HLS Programs & Business Opportunities |

| 9.17.2. |

HLS Funding & Markets – 2009-2014 |

| 9.18. |

Florida HLS Markets – 2009-2014 |

| 9.18.1. |

HLS Programs & Business Opportunities |

| 9.18.2. |

HLS Funding & Markets – 2009-2014 |

| 9.19. |

Georgia HLS Markets-2009-2014 |

| 9.19.1. |

HLS Programs & Business Opportunities |

| 9.19.2. |

HLS Funding & Markets – 2009-2014 |

| 9.2. |

Hawaii Markets – 2009-2014 |

| 9.20.1. |

HLS Programs & Business Opportunities |

| 9.20.2. |

HLS Funding & Markets-2009-2014 |

| 9.21. |

Illinois HLS Markets – 2009-2014 |

| 9.21.1. |

HLS Programs & Business Opportunities |

| 9.21.2. |

HLS Funding & Markets- 2009-2014 |

| 9.22. |

Indiana HLS Markets – 2009-2014 |

| 9.22.1. |

HLS Programs & Business Opportunities |

| 9.22.2. |

HLS Funding & Markets – 2009-2014 |

| 9.23. |

Kentucky HLS Markets – 2009-2014 |

| 9.23.1. |

HLS Programs & Business Opportunities |

| 9.23.2. |

HLS Funding & Markets – 2009-2014 |

| 9.24. |

Louisiana HLS Markets – 2009-2014 |

| 9.24.1. |

HLS Programs & Business Opportunities |

| 9.24.2. |

HLS Funding & Markets – 2009-2014 |

| 9.25. |

Maryland HLS Markets – 2009-2014 |

| 9.25.1. |

HLS Programs & Business Opportunities |

| 9.25.2. |

HLS Funding & Markets – 2009-2014 |

| 9.26. |

Massachusetts Markets – 2009-2014 |

| 9.26.1. |

HLS Programs & Business Opportunities |

| 9.26.2. |

HLS Funding & Markets – 2009-2014 |

| 9.27. |

Michigan HLS Markets – 2009-2014 |

| 9.27.1. |

HLS Programs & Business Opportunities |

| 9.27.2. |

HLS Funding & Markets – 2009-2014 |

| 9.28. |

Minnesota HLS Markets – 2009-2014 |

| 9.28.1. |

HLS Programs & Business Opportunities |

| 9.28.2. |

HLS Funding & Markets – 2009-2014 |

| 9.29. |

Missouri HLS Markets – 2009-2014 |

| 9.29.1. |

HLS Programs & Business Opportunities |

| 9.29.2. |

HLS Funding & Markets – 2009-2014 |

| 9.3. |

North Carolina HLS Markets – 2009-2014 |

| 9.30.1. |

HLS Programs & Business Opportunities |

| 9.30.2. |

HLS Funding & Markets – 2009-2014 |

| 9.31. |

Nevada HLS Markets – 2009-2014 |

| 9.31.1. |

HLS Programs & Business Opportunities |

| 9.31.2. |

HLS Funding & Markets – 2009-2014 |

| 9.32. |

New Jersey HLS Markets – 2009-2014 |

| 9.32.1. |

HLS Programs & Business Opportunities |

| 9.32.2. |

HLS Funding & Markets – 2009-2014 |

| 9.33. |

New York HLS Markets – 2009-2014 |

| 9.33.1. |

HLS Programs & Business Opportunities |

| 9.33.2. |

HLS Funding & Markets – 2009-2014 |

| 9.34. |

Ohio HLS Markets – 2009-2014 |

| 9.34.1. |

HLS Programs & Business Opportunities |

| 9.34.2. |

HLS Funding & Markets – 2009-2014 |

| 9.35. |

Oregon HLS Markets – 2009-2014 |

| 9.35.1. |

HLS Programs & Business Opportunities |

| 9.35.2. |

HLS Funding & Markets – 2009-2014 |

| 9.36. |

Pennsylvania HLS Markets – 2009-2014 |

| 9.36.1. |

HLS Programs & Business Opportunities |

| 9.36.2. |

HLS Funding & Markets – 2009-2014 |

| 9.37. |

Tennessee HLS Markets – 2009-2014 |

| 9.37.1. |

HLS Programs & Business Opportunities |

| 9.37.2. |

HLS Funding & Markets – 2009-2014 |

| 9.38. |

Texas HLS Markets – 2009-2014 |

| 9.38.1. |

HLS Programs & Business Opportunities |

| 9.38.2. |

HLS Funding & Markets – 2009-2014 |

| 9.39. |

Washington HLS Markets – 2009-2014 |

| 9.39.1. |

HLS Programs & Business Opportunities |

| 9.39.2. |

HLS Funding & Markets – 2009-2014 |

| 9.4. |

Wisconsin HLS Markets – 2009-2014 |

| 9.40.1. |

HLS Programs & Business Opportunities |

| 9.40.2. |

HLS Funding & Markets – 2009-2014 |

| 10. |

Private Sector HLS Market – 2010-2014 |

| 10.1. |

Scope and Background |

| 10.2. |

The Government and Private Sector Critical Infrastructure Database |

| 10.3. |

Private Sector HLS Market Segments |

| 10.4. |

Market Drivers |

| 10.5. |

Market Inhibitors |

| 10.6. |

SWOT Analysis |

| 10.7. |

Market: Competitiveness Analysis |

| 10.8. |

Market Dynamics |

| 10.9. |

Market by Industry – 2010-2014 |

| 10.9.1. |

Private Sector HLS Spending by Industry – 2009-2014 |

| 10.9.2. |

Private Sector HLS Market by Industry – 2009-2014 |

| 10.1. |

Banking & Finance – HLS Market – 2009-2014 |

| 10.10.1. |

Market Definition |

| 10.10.2. |

Market Analysis |

| 10.10.3. |

Operational/Security Risks |

| 10.10.4. |

Business Continuity |

| 10.10.5. |

Securities Industry |

| 10.10.6. |

Market Structure |

| 10.10.7. |

Market Drivers |

| 10.10.8. |

Market Inhibitors |

| 10.10.9. |

Market Characteristics |

| 10.10.10. |

Market Forecast – 2009-2014 |

| 10.11. |

Water Infrastructure – HLS Market – 2009-2014 |

| 10.11.1. |

Market Definition |

| 10.11.2. |

Market Analysis |

| 10.11.3. |

Responses to Terror-Related Security Concerns |

| 10.11.4. |

Market Structure |

| 10.11.5. |

Market Drivers |

| 10.11.6. |

Market Inhibitors |

| 10.11.7. |

Market Characteristics |

| 10.11.8. |

Market Forecast – 2009-2014 |

| 10.12. |

Electric Power Industry – HLS Market – 2010-2014 |

| 10.12.1. |

Market Definition |

| 10.12.2. |

Market Analysis |

| 10.12.3. |

Market Structure |

| 10.12.4. |

Market Drivers |

| 10.12.5. |

Market Inhibitors |

| 10.12.6. |

Market Characteristics |

| 10.12.7. |

Market Forecast – 2009-2014 |

| 10.13. |

Civil Nuclear Power Industry – HLS Market – 2009-2014 |

| 10.13.1. |

Market Definition |

| 10.13.2. |

Risk of Terror |

| 10.13.3. |

Market Structure |

| 10.13.4. |

Market Drivers |

| 10.13.5. |

Market Inhibitors |

| 10.13.6. |

Market Characteristics |

| 10.13.7. |

Market Forecast – 2009-2014 |

| 10.14. |

Petrochemical & HAZMAT Industry – HLS Market – 2009-2014 |

| 10.14.1. |

Market Definition: |

| 10.14.2. |

Market Analysis: |

| 10.14.3. |

Market Structure |

| 10.14.4. |

Market Drivers |

| 10.14.5. |

Market Inhibitors |

| 10.14.6. |

Market Characteristics |

| 10.14.7. |

Market Forecast – 2009-2010 |

| 10.15. |

Defense Industrial Base – HLS Market Forecast – 2009-2014 |

| 10.15.1. |

Market Structure |

| 10.15.2. |

Market Drivers |

| 10.15.3. |

Market Inhibitors |

| 10.15.4. |

Market Characteristics |

| 10.15.5. |

Market Forecast – 2009-2014 |

| 10.16. |

Information Technology Industry – HLS Market – 2009-2014 |

| 10.16.1. |

Market Structure |

| 10.16.2. |

Market Drivers |

| 10.16.3. |

Market Inhibitors |

| 10.16.4. |

Market Characteristics |

| 10.16.5. |

Market Forecast – 2009-2014 |

| 10.17. |

Transportation Industry – HLS Market – 2009-2014 |

| 10.17.1. |

Market Definition |

| 10.17.2. |

Market Structure |

| 10.17.3. |

Market Drivers |

| 10.17.4. |

Market Inhibitors |

| 10.17.5. |

Market Characteristics |

| 10.17.6. |

Market Forecast – 2009-2014 |

| 10.18. |

Postal & Shipping Industry – HLS Market – 2009-2014 |

| 10.18.1. |

Market Structure |

| 10.18.2. |

Market Drivers |

| 10.18.3. |

Market Inhibitors |

| 10.18.4. |

Market Characteristics |

| 10.18.5. |

Market Forecast – 2009-2014 |

| 10.19. |

Other Industry Sectors |

| 10.19.1. |

Market Characteristics |

| 10.19.2. |

Market Forecast – 2009-2010 |

| 10.2. |

Private Sector HLS Market by Security Activity – 2009-2014 |

| 10.20.1. |

Summary of Private Sector HLS Markets by Business Segments |

| 10.20.2. |

Employee & Visitors ID – Private Sector HLS Market – 2009-2014 |

| 10.20.3. |

Explosives & Weapons Screening – Private Sector HLS Market – 2009-2014 |

| 10.20.4. |

Perimeter Protection – Private Sector HLS Market – 2009-2014 |

| 10.20.5. |

Cyber-Terror & IT Security – Private Sector HLS Market – 2009-2014 |

| 10.20.6. |

Guard Services – Private Sector HLS Market – 2009-2014 |

| 10.20.7. |

Other Market Segments – 2009-2014 |

| 11. |

Homeland Defense (HLD) Market |

| 11.1. |

Scope |

| 11.2. |

HLS-HLD Interplay |

| 11.3. |

DOD HLD Missions and Organizations |

| 11.4. |

The Northern Command (NORTHCOM) |

| 11.4.1. |

Northern Command’s HLD Missions |

| 11.4.2. |

NORTHCOM’s Civil Support Missions |

| 11.4.3. |

DOD’s Structure for Interagency Coordination of HLD & Civil Support Missions |

| 11.4.4. |

DOD HLD Missions |

| 11.4.5. |

2010-2014 HLD Market Background |

| 11.4.6. |

Enabling DOD HLD Capabilities |

| 11.5. |

HLS-HLD National Response Plan |

| 11.6. |

HLS-HLD CBRNE Consequence Management |

| 11.6.1. |

HLD Airspace Alert Operations |

| 11.7. |

DOD & DOE HLD Nuclear Weapons Security Programs & Markets |

| 11.7.1. |

Air Force Nuclear Weapons Security: Military Personnel Program & Market – 2009-2014 |

| 11.7.2. |

Air Force Nuclear Weapons Security: Weapons Procurement Program & Market – 2009-2014 |

| 11.7.3. |

Air Force Nuclear Weapons Security: Operations & Equipment Maintenance Program & Market – 2009-2014 |

| 11.7.4. |

Air Force Nuclear Weapons Security: Construction Program & Market-2009-2014 |

| 11.7.5. |

Air Force Nuclear Weapons Security: Other Programs & Markets – 2009-2014 |

| 11.7.6. |

Navy Nuclear Weapons Security: Operations & Systems Maintenance Program & Market – 2009-2014 |

| 11.7.7. |

Navy Nuclear Weapons Security: Construction Program & Market – 2009-2014 |

| 11.7.8. |

Navy Nuclear Weapons Security: Navy & Marine Corps Manpower Program & Market – 2009-2014 |

| 11.7.9. |

Navy Nuclear Weapons Security: Other Programs & Markets – 2009-2014 |

| 11.7.10. |

Navy Nuclear Weapons Security: Weapons Procurement Program & Market – 2009-2014 |

| 11.7.11. |

OST Nuclear Weapons Security: Mission Capacity Program & Market -2009-2014 |

| 11.7.12. |

OST Nuclear Weapons Security: Program Management Program & Market – 2009-2014 |

| 11.7.13. |

OST Nuclear Weapons Security: Security Infrastructure Program & Market – 2009-2014 |

| 11.7.14. |

OST Nuclear Weapons Security: Security & Safety Capability Program & Market – 2009-2014 |

| 11.7.15. |

Pantex Nuclear Weapons Security: Security Personnel Program & Market – 2009-2014 |

| 11.7.16. |

Pantex Nuclear Weapons Security: Physical Security Program & Market – 2009-2014 |

| 11.7.17. |

Pantex Nuclear Weapons Security: Other Program & Market – 2009-2014 |

| 11.8. |

HLD Market Drivers |

| 11.9. |

HLD Market Inhibitors |

| 11.1. |

HLD Market SWOT Analysis |

| 11.11. |

HLD Market Competitive Analysis |

| 11.12. |

HLD Market Dynamics |

| 11.13. |

The US HLD Consolidated Spending and Market – 2009-2014 |

| 12. |

Counter-Terror (CT) Intelligence Community Market – 2010-2014 |

| 12.1. |

Scope |

| 12.2. |

Counter-Terror Intelligence |

| 12.3. |

Intelligence Community IT |

| 12.4. |

Managerial & Meta Systems Operation IT |

| 12.5. |

Business Opportunities and Challenges |

| 12.6. |

Market Overview |

| 12.7. |

Sub- Market Business Opportunities |

| 12.8. |

Counter-Terror Intelligence Community Market Drivers |

| 12.9. |

Counter-Terror Intelligence Community Market Inhibitors |

| 12.1. |

Counter-Terror Intelligence Community Market SWOT Analysis |

| 12.11. |

Counter-Terror Intelligence Community Market Competitive Analysis |

| 12.12. |

Counter-Terror Intelligence Community Market Dynamics |

| 12.13. |

Counter-Terror Intelligence Market – 2009-2014 |

| 13. |

Department of Homeland Security (DHS) |

| 13.1. |

DHS Background |

| 13.2. |

DHS Agencies and Units |

| 13.3. |

DHS Consolidated Markets – 2010-2014 |

| 13.3.1. |

Summary Outlook |

| 13.3.2. |

DHS Market by Agency – 2009-2014 |

| 14. |

DHS – Transportation Security Administration (TSA) |

| 14.1.1. |

TSA Background |

| 14.2. |

TSA – Agencies and Units |

| 14.3. |

TSA Sub-Markets by Programs |

| 14.3.1. |

Screening Partnership Program & Market – 2009-2014 |

| 14.3.2. |

Passenger and Baggage Screening Program & Market – 2009-2014 |

| 14.3.3. |

Screening Training Program & Market – 2009-2014 |

| 14.3.4. |

Passengers Checkpoint Support Program & Market – 2009-2014 |

| 14.3.5. |

EDS and ETD Procurement and Installation Program & Market – 2009-2014 |

| 14.3.6. |

Screening Technology Maintenance & Utilities Program & Market – 2009-2014 |

| 14.3.7. |

Aviation Regulation and Other Enforcement Program & Market – 2009-2014 |

| 14.3.8. |

Regulatory Inspection and Enforcement Program – 2009-2014 |

| 14.3.9. |

International Program – 2009-2014 |

| 14.3.10. |

Repair Station Inspection Program – 2009-2014 |

| 14.3.11. |

Airport Law Enforcement & Assessments Program – 2009-2014 |

| 14.3.12. |

National Explosives Detection Canine Training Program & Market – 2009-2014 (NEDCTP) |

| 14.3.13. |

Airport Management, IT, and Support Program & Market – 2009-2014 |

| 14.3.14. |

FFDO and Flight Crew Training Program & Market – 2009-2014 |

| 14.3.15. |

Air Cargo Program & Market – 2009-2014 |

| 14.3.16. |

Air Cargo Security Policy Program – 2009-2014 |

| 14.3.17. |

Air Cargo Inspectors Program – 2009-2014 |

| 14.3.18. |

National Explosives Detection Canine Training Program – 2009-2014 (NEDCTP) |

| 14.3.19. |

Surface Transportation Security Program & Markets – 2009-2014 |

| 14.3.20. |

Surface Transportation Security Staffing and Operations Market – 2009-2014 |

| 14.3.21. |

Surface Transportation Security Inspectors and Canines Program & Market – 2009-2014 |

| 14.3.22. |

Secure Flight Program & Market – 2009-2014 |

| 14.3.23. |

Transportation Worker Identification Credential (TWIC) Market – 2009-2014 |

| 14.3.24. |

Hazardous Materials Endorsement Threat Assessment Program & Market – 2009-2014 (HTAP) |

| 14.3.25. |

Alien Flight Student Program & Market – 2009-2014 (AFSP) |

| 14.3.26. |

Crew and Other Vetting Programs & Market – 2009-2014 |

| 14.3.27. |

Certified Cargo Screening Program & Market – 2009-2014 |

| 14.3.28. |

Large Aircraft Security Plan Program & Market – 2009-2014 |

| 14.3.29. |

Secure Identification Display Area Checks Program & Market – 2009-2014 |

| 14.3.30. |

Transportation Security Support Program & Market – 2009-2014 |

| 14.3.31. |

Federal Air Marshal Service Program & Market – 2009-2014 |

| 14.4. |

TSA – Emerging Technologies Systems and Prices |

| 14.5. |

TSA Consolidated Market – 2010-2014 |

| 14.5.1. |

Summary |

| 14.5.2. |

Market Drivers |

| 14.5.3. |

Market Inhibitors |

| 14.5.4. |

TSA Funding and Market – 2009-2014 |

| 15. |

DHS – US Customs & Border Protection (CBP) |

| 15.1. |

CBP Background |

| 15.2. |

CBP – Agencies & Units |

| 15.3. |

CBP Sub-Markets by Program |

| 15.3.1. |

Secure Border Initiative Program & Market – 2009-2014 |

| 15.3.2. |

Inspection and Detection Technology Program & Market – 2009-2014 |

| 15.3.3. |

Systems for Targeting Program & Market – 2009-2014 |

| 15.3.4. |

C-TPAT Program & Market – 2009-2014 |

| 15.3.5. |

International Cargo Screening – CSI and SFI Programs & Market – 2009-2014 |

| 15.3.6. |

CSI |

| 15.3.7. |

SFI |

| 15.3.8. |

Other International Programs |

| 15.3.9. |

Trusted Traveler Programs (TT) Program & Market – 2009-2014 |

| 15.3.10. |

NEXUS Highway and Air Program – 2009-2014 |

| 15.3.11. |

Secure Electronic Network for Traveler’s Rapid Inspection (SENTRI) Program – 2009-2014 |

| 15.3.12. |

Free and Secure Trade (FAST) Program – 2009-2014 |

| 15.3.13. |

Global Entry Program – 2009-2014 |

| 15.3.14. |

Automated Commercial Environment (ACE) Program & Market – 2009-2014 |

| 15.3.15. |

Critical Operations Protection & Processing Support (COPPS) /TECS Modernization Program & Market – 2009-2014 |

| 15.3.16. |

Facility Construction and Sustainment |

| 15.3.17. |

Air and Marine Interdiction Programs & Markets – 2009-2014 |

| 15.4. |

Inspection and Detection Technologies |

| 15.4.1. |

Existing Technologies |

| 15.4.2. |

Challenges |

| 15.5. |

Business Opportunities |

| 15.6. |

CBP Consolidated Markets – 2010-2014 |

| 15.6.1. |

Summary Outlook |

| 15.6.2. |

Market Drivers |

| 15.6.3. |

Market Inhibitors |

| 15.6.4. |

CBP Funding and Market – 2009-2014 |

| 16. |

DHS – Federal Emergency Management Agency (FEMA) |

| 16.1. |

FEMA Background |

| 16.2. |

FEMA – Agencies & Units |

| 16.3. |

FEMA Sub-Markets by Program |

| 16.3.1. |

Operating Activities Programs & Market – 2009-2014 |

| 16.3.2. |

Public Support Program |

| 16.3.3. |

Fire Management Support Grant Program (FMAGP) |

| 16.3.4. |

Community Disaster Loan Program |

| 16.3.5. |

Improvised Nuclear Device (IND) Response and Recovery Program |

| 16.3.6. |

Pre-Positioned Equipment Program (PEP) |

| 16.3.7. |

Nuclear/Radiological Incident Prevention Program (NRIPP) |

| 16.3.8. |

Individual Support Programs (IA) |

| 16.3.9. |

Contingency Programs |

| 16.3.10. |

National Capital Region Program & Market – 2009-2014 |

| 16.3.11. |

Urban Search and Rescue Program & Market – 2009-2014 |

| 16.3.12. |

State and Regional Preparedness Program & Market – 2009-2014 |

| 16.3.13. |

State HLS Program (SHSP) Market- 2009-2014 |

| 16.3.14. |

Firefighter Support Grants Program & Market – 2009-2014 |

| 16.3.15. |

Regional Catastrophic Preparedness Grant Program (RCPGP) Market – 2009-2014 |

| 16.3.16. |

Emergency Management Performance Grants (EMPG) Program & Market – 2009-2014 |

| 16.3.17. |

Metropolitan Statistical Area (MSA) Preparedness Program & Market – 2009-2014 |

| 16.3.18. |

Urban Area Security Initiative (UASI) Program & Market – 2009-2014 |

| 16.3.19. |

Rail & Transit Security Grant Program & Market – 2009-2014 |

| 16.3.20. |

Port Security Grant Program & Market – 2009-2014 |

| 16.3.21. |

Buffer Zone Protection Program & Market – 2009-2014 |

| 16.3.22. |

Training, Measurement, and Exercise Programs & Market – 2009-2014 |

| 16.3.23. |

National Exercise Program (NEP) Market – 2009-2014 |

| 16.3.24. |

Continuing Training Grants Program & Market – 2009-2014 |

| 16.3.25. |

Center for Domestic Preparedness Program & Market – 2009-2014 |

| 16.3.26. |

National Domestic Preparedness Consortium Program & Market – 2009-2014 |

| 16.3.27. |

Technical Support (TS) and Evaluation and Assessment Programs & Market – 2009-2014 |

| 16.3.28. |

Fire Administration Program & Market – 2009-2014 |

| 16.3.29. |

Radiological Emergency Preparedness Program & Market – 2009-2014 |

| 16.3.30. |

Pre-Disaster Mitigation Fund (PDM) Program – 2009-2014 |

| 16.3.31. |

Emergency Food and Shelter Program & Market – 2009-2014 |

| 16.3.32. |

Disaster Relief Fund Programs & Market – 2009-2014 |

| 16.3.33. |

Flood Hazard Mapping and Risk Analysis Program & Market – 2009-2014 |

| 16.3.34. |

National Flood Insurance Program (NFIP) Market – 2009-2014 |

| 16.3.35. |

Flood Mapping and Risk Analysis Program & Market – 2009-2014 |

| 16.4. |

FEMA Consolidated Markets – 2010-2014 |

| 16.4.1. |

Summary Outlook |

| 16.4.2. |

FEMA Funding and Market – 2009-2014 |

| 17. |

DHS – US Immigration & Customs Enforcement (ICE) |

| 17.1. |

ICE Background |

| 17.2. |

ICE – Agencies & Units |

| 17.3. |

ICE Sub-Markets by Program |

| 17.3.1. |

Visa Security Program & Market – 2009-2014 |

| 17.3.2. |

Criminal Alien Program & Market – 2009-2014 |

| 17.3.3. |

Transportation and Removal Program & Market – 2009-2014 |

| 17.3.4. |

Comprehensive Identification and Removal of Criminal Aliens Program & Market – 2009-2014 |

| 17.3.5. |

Automation Modernization Projects Program & Market – 2009-2014 |

| 17.3.6. |

Atlas Program & Market – 2009-2014 |

| 17.3.7. |

ICE Law Enforcement Systems Modernization Program & Market – 2009-2014 |

| 17.3.8. |

DRO Modernization (DROM) Program & Market – 2009-2014 |

| 17.3.9. |

Managed IT Investment Programs Market – 2009-2014 |

| 17.3.10. |

Investigations Programs Market – 2009-2014 |

| 17.3.11. |

Domestic Investigations Programs Market – 2009-2014 |

| 17.3.12. |

International Investigations Programs Market – 2009-2014 |

| 17.4. |

ICE Consolidated Funding and Markets – 2010-2014 |

| 17.4.1. |

Summary Outlook |

| 17.4.2. |

Market Drivers |

| 17.4.3. |

Market Inhibitors |

| 17.4.4. |

ICE Consolidated Funding and Market – 2009-2014 |

| 18. |

DHS – US Coast Guard (USCG) |

| 18.1. |

USCG Background |

| 18.2. |

USCG – Agencies & Units |

| 18.3. |

USCG Sub-Markets by Programs |

| 18.3.1. |

USCG Near-term Program Initiatives |

| 18.3.2. |

Major Programs Funding |

| 18.3.4. |

Migrant Interdiction Program & Market – 2009-2014 |

| 18.3.5. |

Other Law Enforcement Measures Program & Market – 2009-2014 |

| 18.3.6. |

Ports, Waterways and Coastal Security (PWCS) Program & Market – 2009-2014 |

| 18.3.7. |

USCG Key Strategic Issues |

| 18.4. |

USCG Consolidated Markets – 2010-2014 |

| 18.4.1. |

Summary Outlook |

| 18.4.2. |

Market Drivers |

| 18.4.3. |

Market Inhibitors |

| 18.4.4. |

USCG Funding and Market – 2009-2014 |

| 19. |

DHS – US Secret Service (USSS) |

| 19.1. |

USSS Background |

| 19.2. |

USSS Sub-Markets by Programs |

| 19.2.1. |

Major Operational Programs and Strategic Goals |

| 19.2.2. |

Electronic Crimes Special Agent Program (ECSAP) Market – 2009-2014 |

| 19.2.3. |

Cross Cutting Initiatives |

| 19.3. |

USSS Consolidated Markets – 2010-2014 |

| 19.3.1. |

Summary Outlook |

| 19.3.2. |

Market Drivers |

| 19.3.3. |

Market Inhibitors |

| 19.3.4. |

USSS Funding and Market – 2009-2014 |

| 20. |

DHS – Science & Technology Directorate (S&T) |

| 20.1. |

S&T Background |

| 20.2. |

S&T – Agencies & Units |

| 20.3. |

S&T Sub-Markets by Programs |

| 20.3.1. |

Border & Maritime Security Programs Market – 2009-2014 |

| 20.3.2. |

Border Officer Tools and Safety Program & Market – 2009-2014 |

| 20.3.3. |

Border Technologies Program & Market – 2009-2014 |

| 20.3.4. |

Maritime Technologies Program & Market – 2009-2014 |

| 20.3.5. |

Cargo and Conveyance Security Program & Market – 2009-2014 |

| 20.3.6. |

Chemical and Biological Programs Market – 2009-2014 |

| 20.3.7. |

Systems Studies and Decision Tools Program & Market – 2010-2014 |

| 20.3.8. |

Threat Awareness Program & Market – 2010-2014 |

| 20.3.9. |

Surveillance and Detection R&D Program & Market – 2009-2014 |

| 20.3.10. |

Forensics Program & Market – 2010-2014 |

| 20.3.11. |

Response and Restoration Program & Market – 2010-2014 |

| 20.3.12. |

Foreign Animal Diseases Program & Market – 2010-2014 |

| 20.3.13. |

Analysis Program & Market – 2009-2014 |

| 20.3.14. |

Detection Program & Market – 2010-2014 |

| 20.3.15. |

Response and Recovery Program & Market – 2010-2014 |

| 20.3.16. |

Command, Control and Interoperability Programs Market – 2009-2014 |

| 20.3.17. |

Basic/Futures Research (BFR) Program & Market – 2010-2014 |

| 20.3.18. |

Office for Interoperability and Compatibility (OIC) Program & Market – 2009-2014 |

| 20.3.19. |

Cyber-security Research Tools and Techniques (RTT) Program & Market – 2010-2014 |

| 20.3.20. |

Information Infrastructure Security (IIS) Program & Market – 2010-2014 |

| 20.3.21. |

Next Generation Technology (NGT) Program & Market – 2010-2014 |

| 20.3.22. |

Emerging Threats Program & Market – 2010-2014 |

| 20.3.23. |

Intelligence, Surveillance, and Reconnaissance (ISR) Program & Market – 2009-2014 |

| 20.3.24. |

Risk Sciences Program & Market – 2010-2014 |

| 20.3.25. |

Collaborative Information Sharing Program & Market – 2010-2014 |

| 20.3.26. |

Knowledge Frameworks Program & Market – 2009-2014 |

| 20.3.27. |

Advanced Forensic Technologies Program & Market – 2009-2014 |

| 20.3.28. |

Investigative Technologies Program & Market – 2010-2014 |

| 20.3.29. |

Explosives Related Programs Market – 2009-2014 |

| 20.3.30. |

Cargo Program & Market – 2010-2014 |

| 20.3.31. |

Canine Explosives Detection Program & Market – 2010-2014 |

| 20.3.32. |

Check Point Program & Market – 2010-2014 |

| 20.3.33. |

Homemade Explosives (HME) Program & Market – 2010-2014 |

| 20.3.34. |

Manhattan II Program & Market – 2010-2014 |

| 20.3.35. |

Conveyance Protection Program & Market – 2010-2014 |

| 20.3.36. |

Explosives Research Program & Market – 2010-2014 |

| 20.3.37. |

Prevent/Deter Program & Market – 2010-2014 |

| 20.3.38. |

Predict Program & Market – 2010-2014 |

| 20.3.39. |

Detect Program & Market – 2010-2014 |

| 20.3.40. |

Respond/Defeat Program & Market – 2010-2014 |

| 20.3.41. |

Mitigate Program & Market – 2010-2014 |

| 20.3.42. |

Crosscutting Program & Market – 2010-2014 |

| 20.3.43. |

Human Factors Programs Market – 2009-2014 |

| 20.3.44. |

Human Systems Research and Engineering Program & Market – 2010-2014 |

| 20.3.45. |

Technology Acceptance and Integration Program & Market – 2010-2014 |

| 20.3.46. |

Biometrics Program & Market – 2010-2014 |

| 20.3.47. |

Community Preparedness and Resilience Program & Market – 2010-2014 |

| 20.3.48. |

Motivation and Intent (M&I) Program & Market – 2010-2014 |

| 20.3.49. |

Suspicious Behavior Detection Program & Market – 2010-2014 |

| 20.3.50. |

Infrastructure and Geophysical Programs Market – 2009-2014 |

| 20.3.51. |

Advanced Surveillance and Detection Systems Program & Market – 2010-2014 |

| 20.3.52. |

Modeling, Simulation, and Analysis Program & Market – 2010-2014 |

| 20.3.53. |

Protective Technologies Program & Market – 2010-2014 |

| 20.3.54. |

Response and Recovery Technologies Program & Market – 2010-2014 |

| 20.3.55. |

Geophysical Program & Market – 2010-2014 |

| 20.3.56. |

First Responder Technologies Program & Market – 2010-2014 |

| 20.3.57. |

Geospatial Analysis Program & Market – 2011-2014 |

| 20.3.58. |

Incident Management Enterprise Program & Market – 2010-2014 |

| 20.3.59. |

Integrated Modeling, Mapping and Simulation Program & Market – 2010-2014 |

| 20.3.60. |

Innovation Program & Market – 2009-2014 |

| 20.3.61. |

Biometric Detector Project Program & Market – 2009-2014 |

| 20.3.62. |

Future Attribute Screening Technologies Mobile Module (FASTM2) Program & Market – 2010-2014 |

| 20.3.63. |

Tunnel Detect Program & Market – 2009-2014 |

| 20.3.64. |

Multi-modal Tunnel Detect Project Market – 2010-2014 |

| 20.3.65. |

Rapid Liquid Component Detector (MagViz) Project Market – 2010-2014 |

| 20.3.66. |

Resilient Electric Grid (REG) Project Market – 2010-2014 |

| 20.3.67. |

Resilient Tunnel Project Market – 2009-2014 |

| 20.3.68. |

Safe Container/Time Recorded Ubiquitous Sensor Technology (TRUST) Project Market – 2009-2014 |

| 20.3.69. |

Very Low Cost Bio Agent Detect Project Market – 2010-2014 |

| 20.3.70. |

Wide Area Surveillance Project Market – 2010-2014 |

| 20.3.71. |

Operationally Deployable Explosives Mitigation Project Market – 2011-2014 |

| 20.3.72. |

Passive Methods for Precision Behavioral Screening Project Market – 2011-2014 |

| 20.3.73. |

Laboratory Facilities Program & Market – 2009-2014 |

| 20.3.74. |

Radiological and Nuclear Program & Market – 2011-2014 |

| 20.3.75. |

Nuclear Detection Advanced Technology Demonstration (ATD) Program & Market – 2011-2014 |

| 20.3.76. |

Response and Recovery Program & Market – 2011-2014 |

| 20.3.77. |

Nuclear Detection Exploratory Research Program & Market – 2011-2014 |

| 20.3.78. |

Academic Research Initiative (ARI) Program & Market – 2011-2014 |

| 20.3.79. |

Test and Evaluation Standards Program & Market – 2009-2014 |

| 20.3.80. |

Transition Program & Market – 2009-2014 |

| 20.3.81. |

University Program & Market – 2009-2014 |

| 20.4. |

S&T Consolidated Markets – 2010-2014 |

| 20.4.1. |

Summary Outlook |

| 20.4.2. |

Market Drivers |

| 20.4.3. |

Market Inhibitors |

| 20.4.4. |

S&T Funding and Market – 2009-2014 |

| 21. |

DHS – Domestic Nuclear Detection Office (DNDO) |

| 21.1. |

DNDO Background |

| 21.2. |

DNDO – Agencies & Units |

| 21.3. |

DNDO Sub-Markets by Programs |

| 21.3.1. |

Systems Engineering and Architecture Programs & Markets – 2009-2014 |

| 21.3.2. |

Systems Engineering Program |

| 21.3.3. |

Standards Program |

| 21.3.4. |

Systems Architecture Program |

| 21.3.5. |

PRND Program |

| 21.3.6. |

Systems Development Programs & Markets – 2009-2014 |

| 21.3.7. |

Human Portable Systems Programs |

| 21.3.8. |

Cargo Advanced Automated Radiography System (CAARS) Follow-on Program |

| 21.3.9. |

Standoff Radiation Detection System (SORDS) Follow-on Program |

| 21.3.10. |

International Rail Program |

| 21.3.11. |

On-Dock Rail Program |

| 21.3.12. |

Boat-Mounted Sensor Program |

| 21.3.13. |

Transformational R&D Program & Market – 2009-2014 |

| 21.3.14. |

Assessment Programs & Markets – 2009-2014 |

| 21.3.15. |

Test and Evaluation (T&E) Infrastructure and Operations |

| 21.3.16. |

Special Nuclear Material (SNM) Sealed Source Development Program |

| 21.3.17. |

Graduated Rad/Nuc Detector Evaluation and Reporting (GRaDER) Program |

| 21.3.18. |

Test Data Management Programs |

| 21.3.19. |

Red Teaming and Net Assessments (RTNA) Program |

| 21.3.20. |

West Coast Maritime Pilot Program |

| 21.3.21. |

International Commercial Aviation Passengers and Baggage (Pax/Bag) Pilot Program |

| 21.3.22. |

Green Border Pilot |

| 21.3.23. |

Operations Support Program & Market – 2009-2014 |

| 21.3.24. |

Joint Analysis Center Program |

| 21.3.25. |

Nuclear Assessment Program |

| 21.3.26. |

Technical Reachback Program |

| 21.3.27. |

Training and Exercises Program |

| 21.3.28. |

National Technical Nuclear Forensics Programs & Markets – 2009-2014 |

| 21.3.29. |

National Nuclear Forensics Expertise Development Program (“Academic Pipeline”) |

| 21.3.30. |

Radiation Portal Monitor Program & Market – 2009-2014 |

| 21.3.31. |

Securing the Cities Initiative Program & Market – 2009-2014 |

| 21.3.32. |

Human Portable Radiation Detection Systems Program & Market – 2009-2014 |

| 21.3.33. |

Mobile Detection Deployment Program & Market – 2009-2014 |

| 21.4. |

DNDO Consolidated Markets – 2010-2014 |

| 21.4.1. |

Summary Outlook |

| 21.4.2. |

Market Drivers |

| 21.4.3. |

Market Inhibitors |

| 21.4.4. |

Main Business Opportunities |

| 21.4.5. |

DNDO Funding and Market – 2009-2014 |

| 22. |

DHS – Departmental Management & Operations (DMO) |

| 22.1. |

DMO Background |

| 22.2. |

DMO Agencies and Units |

| 22.3. |

DMO Sub-Markets by Programs |

| 22.3.1. |

IT Services Program & Market – 2009-2014 |

| 22.3.2. |

Infrastructure and Security Program & Market – 2009-2014 |

| 22.3.3. |

National Security Systems (NSS) Program & Market – 2009-2014 |

| 22.3.4. |

The HSDN Project Program & Market – 2009-2014 |

| 22.3.5. |

Human Resources Information Technology (HRIT) Program & Market – 2009-2014 |

| 22.3.6. |

Headquarters Consolidation Program & Market – 2009-2014 |

| 22.3.7. |

DHS HQ NAC Project Market – 2009-2014 |

| 22.4. |

DMO Consolidated Markets – 2010-2014 |

| 22.4.1. |

Summary Outlook |

| 22.4.2. |

DMO Funding and Market – 2009-2014 |

| 23. |

DHS Analysis and Operations (I&A and OPS) |

| 23.1. |

DHS I&A and OPS Background |

| 23.1.1. |

I&A |

| 23.1.2. |

OPS |

| 23.2. |

Initiatives |

| 23.3. |

DHS I&A and OPS Markets – 2010-2014 |

| 23.3.1. |

Summary Outlook |

| 23.3.2. |

DHS I&A and OPS Funding and Market – 2009-2014 |

| 24. |

DHS – Federal Law Enforcement Training Center (FLETC) |

| 24.1. |

FLETC Background |

| 24.2. |

FLETC Agencies and Units |

| 24.3. |

FLETC Sub-Markets by Programs |

| 24.3.1. |

Law Enforcement Training Programs & Markets – 2009-2014 |

| 24.3.2. |

Acquisition, Construction, Improvements & Related Programs & Markets – 2009-2014 |

| 24.3.3. |

Key Strategic Issues |

| 24.4. |

FLETC Consolidated Markets – 2010-2014 |

| 24.4.1. |

Summary Outlook |

| 24.4.2. |

FLETC Funding and Market – 2009-2014 |

| 25. |

DHS – US Citizenship & Immigration Services (USCIS) |

| 25.1. |

USCIS Background |

| 25.2. |

USCIS Agencies and Units |

| 25.3. |

USCIS Sub-Markets by Programs |

| 25.3.1. |

E-Verify Program & Market – 2009-2014 |

| 25.3.2. |

Real-ID Program & Market – 2010-2014 |

| 25.3.3. |

Systematic Alien Verification for Entitlements (SAVE) Program & Market – 2010-2014 |

| 25.3.4. |

Data Center Development Program & Market – 2010-2014 |

| 25.4. |

USCIS Consolidated Markets – 2010-2014 |

| 25.4.1. |

Summary Outlook |

| 25.4.2. |

USCIS Funding and Market – 2009-2014 |

| 26. |

DHS – National Protection and Programs Directorate (NPPD) |

| 26.1. |

NPPD Background |

| 26.2. |

NPPD Sub-Markets by Programs |

| 26.2.1. |

Infrastructure Protection (IP) Program & Market – 2009-2014 |

| 26.2.2. |

Identification and Analysis Program & Market – 2009-2014 |

| 26.2.3. |

Coordination and Information Sharing Program & Market – 2009-2014 |

| 26.2.4. |

Mitigation Program & Market – 2009-2014 |

| 26.2.5. |

Cyber-Security and Communications (CS&C) Program & Market – 2009-2014 |

| 26.2.6. |

US Computer Emergency Readiness Team Program & Market – 2010-2014 |

| 26.2.7. |

Strategic Initiatives Program & Market – 2010-2014 |

| 26.2.8. |

Outreach and Program & Market – 2010-2014 |

| 26.2.9. |

Priority Telecommunications Services Program & Market – 2009-2014 |

| 26.2.10. |

Next Generation Network Program & Market – 2009-2014 |

| 26.2.11. |

Programs to Study and Enhance Telecommunications Program & Market – 2009-2014 |

| 26.2.12. |

Critical Infrastructure Protection Program & Market – 2009-2014 |

| 26.2.13. |

Federal Protective Service Program & Market – 2009-2014 |

| 26.2.14. |

US-VISIT Program & Market – 2009-2014 |

| 26.2.15. |

Systems Operations and Maintenance (O&M) Program & Market – 2009-2014 |

| 26.2.16. |

Identity Screening Services |

| 26.2.17. |

Program Management Services |

| 26.2.18. |

Data Center Mirroring and Migration |

| 26.2.19. |

Unique Identity – Full Operational Capability Program & Market – 2009-2014 |

| 26.2.20. |

Current Services Growth |

| 26.3. |

NPPD Consolidated Markets – 2010-2014 |

| 26.3.1. |

Summary Outlook |

| 26.3.2. |

NPPD Funding and Market – 2009-2014 |

| 27. |

Office of Health Affairs (OHA) |

| 27.1. |

OHA Background |

| 27.2. |

OHA Sub-Markets by Programs |

| 27.2.1. |

Medical and Bio-defense Programs Funding |

| 27.2.2. |

BioWatch Program & Market – 2009-2014 |

| 27.2.3. |

Rapidly Deployable Chemical Detection System Program & Market – 2009-2014 |

| 27.2.4. |

National Bio-Surveillance Integration Center Program & Market – 2009-2014 |

| 27.3. |

OHA Consolidated Markets – 2010-2014 |

| 27.3.1. |

Summary Outlook |

| 27.3.2. |

OHA Funding and Market – 2009-2014 |

| 28. |

DHS – Office of Inspector General (OIG) |

| 28.1. |

OIG Background |

| 28.2. |

OIG Consolidated Markets – 2010-2014 |

| 28.2.1. |

Summary Outlook |

| 28.2.2. |

OIG Funding and Market – 2009-2014 |

| 29. |

Department of Defense (DOD) HLS |

| 29.1. |

DOD – Background |

| 29.2. |

DOD HLS Markets – 2010-2014 |

| 29.2.1. |

Summary Outlook |

| 29.2.2. |

DOD Funding and Market – 2009-2014 |

| 30. |

Department of Health & Human Services (DHHS) |

| 30.1. |

DHHS Background |

| 30.2. |

The Bio-Terror Mitigation Strategy |

| 30.3. |

DHHS Organization & Units |

| 30.3.1. |

DHHS HLS Funding & Markets by Programs – 2009-2014 |

| 30.4. |

Center for Disease Control (CDC) |

| 30.4.1. |

CDC HLS Funding & Market by Programs – 2009-2014 |

| 30.5. |

Food and Drug Administration (FDA) |

| 30.5.1. |

FDA Background |

| 30.5.2. |

FDA HLS Funding & Market by Programs – 2009-2014 |

| 30.6. |

DHHS HLS Funding & Markets – 2010-2014 |

| 30.6.1. |

Summary Outlook |

| 30.6.2. |

DHHS HLS Funding and Market – 2009-2014 |

| 31. |

Department of Justice (DOJ) |

| 31.1. |

DOJ HLS Background |

| 31.2. |

DOJ Organization & Units Agencies and Units |

| 31.3. |

Federal Bureau of Investigation (FBI) |

| 31.3.1. |

FBI HLS: Background |

| 31.3.2. |

FBI – Organization and Units |

| 31.3.3. |

FBI HLS Drivers |

| 31.4. |

DOJ HLS Funding & Market – 2009-2014 |

| 31.4.1. |

Summary Outlook |

| 31.4.2. |

DOJ HLS Funding and Market – 2009-2014 |

| 32. |

Department of Energy (DOE) |

| 32.1. |

DOE Background |

| 32.2. |

DOE HLS Funding & Market – 2009-2014 |

| 32.2.1. |

Summary Outlook |

| 32.2.2. |

DOE HLS Funding and Market – 2009-2014 |

| 33. |

Department of State (DOS) |

| 33.1. |

DOS: HLS Background |

| 33.2. |

DOS Organization |

| 33.3. |

DOS Sub-Markets by Programs |

| 33.3.1. |

DOS Border Security |

| 33.3.2. |

DOS Worldwide Security Protection |

| 33.3.3. |

Technical Support Working Group (TSWG) – D&CP |

| 33.4. |

Bureau of Diplomatic Security Program |

| 33.4.1. |

Diplomatic Security (DS) program |

| 33.5. |

DOS HLS Funding & Markets – 2009-2014 |

| 33.5.1. |

Summary Outlook |

| 33.5.2. |

DOS DHS Funding and Market – 2009-2014 |

| 34. |

US Department of Agriculture (USDA) |

| 34.1. |

USDA Background |

| 34.2. |

USDA Organization |

| 34.3. |

USDA HLS Programs |

| 34.3.1. |

Homeland Security Agricultural Program |

| 34.3.2. |

Strategic Partnership Program Agro-Terrorism (SPPA) Program |

| 34.4. |

USDA Consolidated HLS Markets – 2010-2014 |

| 34.4.1. |

Summary Outlook |

| 34.4.2. |

USDA HLS Funding and Market – 2009-2014 |

| 35. |

National Science Foundation (NSF) |

| 35.1. |

NSF Background |

| 35.2. |

NSF Organization |

| 35.3. |

NSF HLS Programs |

| 35.3.1. |

Critical infrastructures and Key Assets Protection Program |

| 35.4. |

NSF Consolidated Markets – 2009-2014 |

| 35.4.1. |

Summary Outlook |

| 35.4.2. |

NSF Funding and Market – 2009-2014 |

| 36. |

National Aeronautic & Space Administration (NASA) |

| 36.1. |

NASA Background |

| 36.2. |

NASA Consolidated Markets – 2009-2014 |

| 36.2.1. |

Summary Outlook |

| 36.2.2. |

NASA HLS Funding and Market – 2009-2014 |

| 37. |

Department of Transportation (DOT) |

| 37.1. |

DOT Background |

| 37.2. |

DOT Organization |

| 37.3. |

DOT HLS Sub Markets by Programs |

| 37.3.1. |

Federal Transit Administration (FTA) Security Program |

| 37.3.2. |

Hazardous Materials Emergency Preparedness Program |

| 37.3.3. |

Pipeline Safety Initiatives |

| 37.3.4. |

Transportation Security Grant Programs |

| 37.4. |

DOT Consolidated HLS Markets – 2010-2014 |

| 37.4.1. |

Summary Outlook |

| 37.4.2. |

DOT HLS Funding and Market – 2009-2014 |

| 38. |

Department of Commerce (DOC) |

| 38.1. |

DOC Background |

| 38.2. |

DOC Organization |

| 38.3. |

DOC Sub Markets by Programs |

| 38.3.1. |

NOAA Homeland Security Program |

| 38.3.2. |

Bureau of Industry and Security Programs |

| 38.3.3. |

NIST Programs |

| 38.4. |

DOC Consolidated HLS Markets – 2010-2014 |

| 38.4.1. |

Summary Outlook |

| 38.4.2. |

DOC HLS Funding and Market – 2009-2014 |

| 39. |

Aviation Security Market – 2010-2014 |

| 39.1. |

Scope |

| 39.2. |

US Aviation Security Counter-Terror Mitigation Tactics |

| 39.3. |

Passenger Screening |

| 39.3.1. |

Overview |

| 39.3.2. |

AIT People Screening Program |

| 39.3.3. |

People screening Market Analysis |

| 39.4. |

Checked Baggage Screening |

| 39.4.1. |

In-line Checked Luggage EDS Screening |

| 39.5. |

Air Cargo Screening |

| 39.6. |

Other Aviation Security Sectors |

| 39.6.1. |

Airport Perimeter Security |

| 39.6.2. |

Airport Employee and Service Personal Identification Program |

| 39.6.3. |

Project Newton |

| 39.6.4. |

Airports IT & Telecommunications Restructuring |

| 39.6.5. |

Electronic Surveillance |

| 39.6.6. |

Secure Air to Ground Communications |

| 39.7. |

Market Overview |

| 39.8. |

Market Drivers |

| 39.9. |

Market Inhibitors |

| 39.1. |

Market SWOT Analysis |

| 39.11. |

Market Competitive Analysis |

| 39.12. |

US Aviation Security Market – 2009-2014 |

| 40. |

Bio-Chem Detection Market – 2010-2014 |

| 40.1. |

Scope |

| 40.2. |

Overview and Policy |

| 40.3. |

Bio-Chem Detection Programs |

| 40.3.1. |

BioWatch program |

| 40.3.2. |

BioSense Program |

| 40.4. |

Bio-Surveillance, Detection & Forensics Business Challenges – 2010-2014 |

| 40.5. |

Market Overview |

| 40.6. |

Market Structure |

| 40.7. |

Market Drivers |

| 40.8. |

Market Inhibitors |

| 40.9. |

Market SWOT Analysis |

| 40.1. |

Competitive Analysis |

| 40.11. |

US Bio-Chem Detection Market – 2009-2014 |

| 41. |

Biometric-Based Systems Market – 2010-2014 |

| 41.1. |

Scope |

| 41.2. |

Markets & Programs |

| 41.2.1. |

The US “Registered Traveler” Program |

| 41.2.2. |

The “Global Envelope” Program |

| 41.2.3. |

“10 Point” Biometric US-VISIT Program |

| 41.2.4. |

Transportation Worker Identity Program |

| 41.2.5. |

DOD Biometric GWOT Related Programs |

| 41.3. |

Market Overview |

| 41.4. |

Business Opportunities |

| 41.5. |

Market Drivers |

| 41.6. |

Market Inhibitors |

| 41.7. |

US HLS-HLD Biometric Market – 2009-2014 |

| 42. |

Border & Perimeter Security Market – 2010-2014 |

| 42.1. |

Scope |

| 42.2. |

Strategic Context |

| 42.3. |

Border and Perimeter Security Components |

| 42.4. |

US Perimeter Security |

| 42.5. |

Border Security |

| 42.5.1. |

SBInet Program |

| 42.5.2. |

SBInet Market |

| 42.5.3. |

Automated Commercial Environment (ACE) Program |

| 42.5.4. |

Free and Secure Trade (FAST) Commercial Driver Program |

| 42.5.5. |

America’s Shield Initiative (ASI) Program |

| 42.6. |

Market Overview |

| 42.7. |

Business Opportunities Business Opportunities |

| 42.8. |

Market Drivers |

| 42.9. |

Market Inhibitors |

| 42.1. |

US Border & Perimeter Security Market – 2009-2014 |

| 43. |

Construction Market – 2010-2014 |

| 43.1. |

Scope |

| 43.2. |

Market Overview |

| 43.3. |

Market Drivers |

| 43.4. |

Market Inhibitors |

| 43.5. |

US HLS-HLD Construction Market – 2009-2014 |

| 44. |

Critical Infrastructure Security Market – 2010-2014 |

| 44.1. |

Scope |

| 44.2. |

Market Background |

| 44.2.1. |

Critical Infrastructure Vulnerabilities and Policy |

| 44.2.2. |

Planning of Infrastructure Security |

| 44.3. |

Strategy Outlook – 2009-2014 |

| 44.4. |

Information Sharing with the Private Sector |

| 44.4.1. |

Vulnerabilities |

| 44.4.2. |

2010-2014 Outlook |

| 44.5. |

Market Overview |

| 44.6. |

Business Opportunities |

| 44.7. |

Market Drivers |

| 44.8. |

Market Inhibitors |

| 44.9. |

US Critical Infrastructure Security Market – 2009-2014 |

| 45. |

Electronic Hardware Industry Market – 2010-2014 |

| 45.1. |

Market Definition & Programs |

| 45.2. |

Market Overview |

| 45.3. |

Market Drivers |

| 45.4. |

Market Inhibitors |

| 45.5. |

US Electronic Hardware Market – 2009-2014 |

| 46. |

First Responders Market – 2010-2014 |

| 46.1. |

Scope |

| 46.2. |

Market Background |

| 46.2.1. |

First Responders Planning and Training |

| 46.3. |

Business Opportunities – 2010-2014 |

| 46.4. |

Market Drivers |

| 46.5. |

Market Inhibitors |

| 46.6. |

First Responders Market – 2009-2014 |

| 47. |

Guard Services Market – 2010-2014 |

| 47.1. |

Scope |

| 47.2. |

Market Definition & Programs |

| 47.3. |

Market Overview |

| 47.4. |

Market Drivers |

| 47.5. |

Market Inhibitors |

| 47.6. |

HLS-HLD Guard Services Market – 2009-2014 |

| 48. |

Information & Communication Technology (ICT) Market – 2010-2014 |

| 48.1. |

Scope |

| 48.2. |

Market Background |

| 48.2.1. |

Threat and Vulnerability: A Five-Level Approach |

| 48.2.2. |

Products and Services |

| 48.2.3. |

HLS-HLD Software Industry |

| 48.3. |

ICT Programs |

| 48.3.1. |

DHS Cyber-Security Programs |

| 48.3.2. |

DHS – ICT Security Program |

| 48.3.3. |

Cyber-Security R&D Programs |

| 48.3.4. |

Secure Protocols for the Routing Infrastructure (SPRI) Program |

| 48.3.5. |

Large Datasets for Cyber-Security Programs |

| 48.3.6. |

HLS-HLD C3I Systems Technologies & Markets |

| 48.3.7. |

EAGLE II Program |

| 48.3.8. |

The DHS FirstSource Program |

| 48.3.9. |

Integrated Wireless Network Program |

| 48.3.10. |

HLS E-Geospatial Programs |

| 48.3.11. |

Combined Credentialing Program |

| 48.3.12. |

TSA Human Resources Information Technology Programs |

| 48.3.13. |

IAIP – Homeland Security Operations Center ICT Program |

| 48.3.14. |

FBI Sentinel Program |

| 48.3.15. |

FBI Trilogy Project |

| 48.3.16. |

Terrorist Watch Lists ICT |

| 48.4. |

Market Overview |

| 48.5. |

Business Opportunities – 2010-2014 |

| 48.6. |

Market Drivers |

| 48.7. |

Market Inhibitors |

| 48.8. |

ICT Market – 2009-2014 |

| 49. |

Maintenance, Upgrade & Refurbishment Market – 2010-2014 |

| 49.1. |

Market Definition & Programs |

| 49.2. |

Market Overview |

| 49.3. |

Market Drivers |

| 49.4. |

Market Inhibitors |

| 49.5. |

Maintenance, Upgrade & Refurbishment Market – 2009-2014 |

| 50. |

Maritime Security Market – 2010-2014 |

| 50.1. |

Scope |

| 50.2. |

Background |

| 50.3. |

US Maritime Security Legislation |

| 50.3.1. |

The Container Security Initiative (CSI) |

| 50.3.2. |

Customs-Trade Partnership Against Terrorism (C-TPAT) |

| 50.3.3. |

US 24-hour Advance Manifest Rule |

| 50.4. |

The US Coast Guard (USCG): Funding and Programs |

| 50.5. |

Container Screening Program |

| 50.6. |

Market Overview |

| 50.7. |

Business Opportunities – 2009-2014 |

| 50.8. |

Competitive Analysis |

| 50.9. |

Maritime Security Market – 2009-2014 |

| 51. |

Radio-Communication Market – 2010-2014 |

| 51.1. |

Scope |

| 51.2. |

Federal Radio Communication Programs |

| 51.2.1. |

Government Emergency Telecommunications Service Program |

| 51.2.2. |

Wireless Priority Service Program |

| 51.2.3. |

Alerting and Coordination Network (ACN) Program |

| 51.2.4. |

Shared Resources High Frequency Radio Program (SHARES) Program |

| 51.2.5. |

Telecom ISAC Program |

| 51.2.6. |

Emergency Response Training (ERT) Program |

| 51.2.7. |

Individual Mobilization Augmentee Program |

| 51.2.8. |

SAFECOM Communications Interoperability Programs |

| 51.2.9. |

“Emerge” Program |

| 51.2.10. |

Homeland Security Information Network (HSIN) Program |

| 51.2.11. |

Government Emergency Telecommunications Service Program |

| 51.2.12. |

Communications Interoperability Program |

| 51.3. |

Market Overview |

| 51.4. |

Market Drivers |

| 51.5. |

Market Inhibitors |

| 51.6. |

US HLS-HLD Radio-Communication Market – 2009-2014 |

| 52. |

RFID-based Systems Market – 2010-2014 |

| 52.1. |

Scope |

| 52.2. |

RFID Technologies Overview |

| 52.3. |

Market Overview |

| 52.4. |

Supply Chain Item Identification Market |

| 52.4.1. |

Supply Chain Counter-Terror RFID-based Systems |

| 52.5. |

Market Drivers |

| 52.6. |

Market Inhibitors |

| 52.7. |

People identification RFID-based Personal Documentation Market |

| 52.7.1. |

RFID-based “Registered Traveler” Program |

| 52.7.2. |

RFID in “Global Envelope” Program |

| 52.7.3. |

“Bio-Visa”, US-VISIT and International e-Passport Programs |

| 52.8. |

Market Drivers |

| 52.9. |

Market Inhibitors |

| 52.1. |

US RFID-based HLS-HLD Market – 2009-2014 |

| 53. |

CCTV Based Real-time Threats Identification Systems Market – 2010-2014 |

| 53.1. |

Scope |

| 53.2. |

Market Background |

| 53.2.1. |

CCTV Based Real-time Threats Identification Technologies |

| 53.2.2. |

TSA Advanced Surveillance Program |

| 53.2.3. |

Key Findings |

| 53.2.4. |

Major Conclusions |

| 53.3. |

Market Drivers |

| 53.4. |

Market Inhibitors |

| 53.5. |

CCTV Threat Identification Market – 2009-2014 |

| 54. |

Standoff Explosives Detection Market – 2010-2014 |

| 54.1. |

Scope |

| 54.2. |

Market Background |

| 54.2.1. |

Major Findings |

| 54.2.2. |

Standoff Explosives Detection Technologies |

| 54.2.3. |

Passive MMWave Doorways |

| 54.2.4. |

Standoff Explosives Trace Detection |

| 54.2.5. |

MMWave Detection |

| 54.2.6. |

Terahertz Explosives Detection |

| 54.2.7. |

Laser-Based Explosives Detection |

| 54.2.8. |

Raman Spectroscopy |

| 54.2.9. |

Light Detection and Ranging (LIDAR) |

| 54.2.10. |

Major Conclusions |

| 54.3. |

Market Drivers |

| 54.4. |

Market Inhibitors |

| 54.5. |

SWOT Analysis |

| 54.6. |

US Standoff Explosives Detection Market – 2009-2014 |