| 1 |

Executive Summary |

| 1.1 |

Major Findings |

| 1.2 |

Major Conclusions |

| 1.3 |

Opportunities and Challenges |

| 1.4 |

People Screening Technology Outlook |

| 1.5 |

Corporate Liability |

| 1.6 |

Defining the Problem |

| 1.7 |

Identifying Vulnerabilities |

| 1.8 |

People Screening Systems Market Dynamics & Opportunities |

| 1.9 |

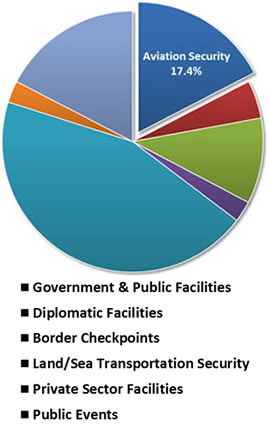

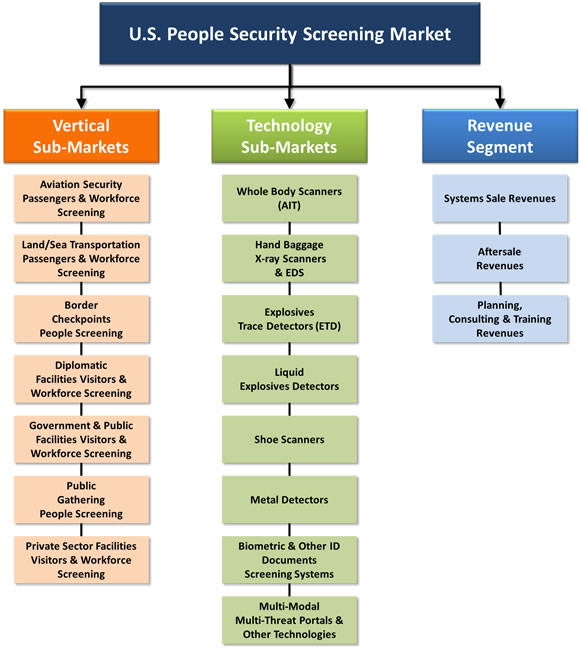

U.S. People Security Screening Market – 2014-2020 |

| 1.9.1 |

U.S. People Security Screening Market by Vertical Sub-Markets |

| 1.9.2 |

U.S. People Security Screening Market by Technology Sub-Markets |

| 1.9.3 |

U.S. People Security Screening Market by Revenue Sources |

| 2 |

People Security-Screening: Market Drivers |

| 3 |

People Security-Screening Market: Inhibitors |

| 4 |

People Screening: Business Opportunities & Challenges |

| 5 |

People Security-Screening Industry: SWOT Analysis |

| 5.1 |

Strengths |

| 5.2 |

Weaknesses |

| 5.3 |

Opportunities |

| 5.4 |

Threats |

| 6 |

People Security-Screening Industry: Competitive Analysis |

| 7 |

Present & Pipeline People Screening Technologies & Products |

| 7.1 |

Introduction |

| 7.2 |

Hand-held Baggage X-ray Screening Technology |

| 7.2.1 |

Hand-held Baggage X-ray Systems – Characteristics |

| 7.2.2 |

X-ray Systems – Principles of Operation |

| 7.2.3 |

Innocuous Materials Interference |

| 7.2.4 |

Threat Image Projection (TIP) |

| 7.2.5 |

Hand-held Baggage X-ray Technologies |

| 7.2.6 |

Conventional 2D X-ray |

| 7.2.7 |

Dual Energy X-ray |

| 7.2.8 |

Variable View X-ray |

| 7.2.9 |

Quasi 3-D Dual View Dual-Energy X-ray Imaging |

| 7.2.10 |

The Advanced Technology (AT) X-ray Systems |

| 7.2.10.1 |

Advanced Technology X-ray (AT) Systems Examples |

| 7.2.10.2 |

Smiths Detection HI-SCAN 6040aX |

| 7.2.11 |

Backscatter Screening X-ray |

| 7.2.12 |

Coherent Scatter X-ray |

| 7.2.13 |

Cast and Artificial Limbs Screening: X-ray Backscatter Technologies |

| 7.2.14 |

Transportable X-Ray People Screening Checkpoints |

| 7.2.15 |

Hand-held Baggage X-ray Technologies: Performance Comparison |

| 7.2.16 |

Hand-held Baggage X-ray Product Performance Standards |

| 7.2.17 |

Fused X-ray and ETD Screening |

| 7.2.18 |

Fused Hand-held Baggage X-ray and RFID Screening |

| 7.2.19 |

Multi-Threat Multi-Modal X-Ray Screening |

| 7.2.20 |

Advanced 2D Coherent X-ray Hand-held Baggage |

| 7.2.21 |

Stereoscopic “3D X-ray” Imaging |

| 7.3 |

Explosives Trace Detectors (ETD) |

| 7.3.1 |

ETD Principles of Operation |

| 7.3.2 |

ETD Core Technologies |

| 7.3.3 |

Explosives Trace Detection Configuration |

| 7.3.4 |

Ion Mobility Spectroscopy (IMS) |

| 7.3.5 |

ChemiLuminescence (CL) |

| 7.3.6 |

Electron Capture Detectors (ECD) |

| 7.3.7 |

Surface Acoustic Wave (SAW) |

| 7.3.8 |

Hand-held & Desktop ETD Devices |

| 7.3.8.1 |

Principles of Operation |

| 7.3.8.2 |

Sample Collection Methods |

| 7.3.8.3 |

Desktop and Portable ETD Devices – Technology Needs |

| 7.3.8.4 |

Hand-held, Desktop ETD – Cost Performance Analysis |

| 7.3.8.5 |

Explosive Detectors (Hand-held, Desktop and Portable) – Techno-Tactical & Economic Considerations |

| 7.3.8.6 |

Hand-held & Desktop ETD – Economic Considerations |

| 7.3.8.7 |

Sample System |

| 7.3.8.8 |

Vendors, Products & Prices |

| 7.3.9 |

ETD Technology Outlook – 2014-2020 |

| 7.3.9.1 |

Techno-Tactical Needs |

| 7.3.9.2 |

ETD of the Future: Techno-Tactical Drivers |

| 7.3.9.3 |

ETD of the Future: Performance & Operational Goals |

| 7.3.9.4 |

Advanced Sample Collection |

| 7.3.9.5 |

Dual Technology ETD |

| 7.3.10 |

Pipeline ETD Technologies |

| 7.3.10.1 |

Nano Technology Systems |

| 7.3.10.2 |

ETD MicroChemLab on a Chip |

| 7.3.10.3 |

Coated Micro-Cantilever ETD Detector |

| 7.3.10.4 |

Nanotechnology Platform Based ETD Detector |

| 7.3.11 |

Biometric (& Other) ID Documents Screening Systems Technologies |

| 7.3.12 |

The DHS S&T “Screen while Walk” Program |

| 7.3.13 |

TSA, Next Generation ETD Technologies R&D |

| 7.3.14 |

Integrated Explosives, Chemical Warfare and Narcotics Trace Detectors |

| 7.4 |

Whole Body Scanners (AIT) |

| 7.4.1 |

X-ray Backscatter AIT Portals |

| 7.4.1.1 |

Backscatter Imaging Technology – Principles of Operation |

| 7.4.1.2 |

Risks/Benefits of X-Ray AIT Systems |

| 7.4.1.3 |

Sample System |

| 7.4.1.4 |

Currently Available X-ray Backscatter Portals |

| 7.4.2 |

Active MMWave Whole Body AIT Scanners |

| 7.4.2.1 |

Principles of Operation |

| 7.4.2.2 |

Techno-Tactical & Economic Considerations |

| 7.4.2.3 |

Sample Systems |

| 7.4.3 |

AIT-2 Systems Deployment |

| 7.4.4 |

Next Generation AIT R&D Program |

| 7.4.5 |

Passive MMWave Whole Body Scanners |

| 7.4.5.1 |

Principle of Operation |

| 7.4.5.2 |

System Example: Millivision 350 Portal |

| 7.4.6 |

Terahertz Whole Body Scanners |

| 7.4.6.1 |

Terahertz Weapon Detection Portals Technology |

| 7.4.6.2 |

Terahertz Time Domain Spectroscopy (TTDS) |

| 7.4.7 |

Comparison of MMWave/Terahertz vs. Backscatter X-ray Portals |

| 7.4.8 |

Vendors and Products |

| 7.5 |

Metal Detection Portals & Devices |

| 7.5.1 |

Hand-held Metal Detectors |

| 7.5.1.1 |

Hand-held Metal Detectors: Principles of Operation |

| 7.5.1.2 |

Hand-held Metal Detectors: Technology & Operational Essentials |

| 7.5.1.3 |

Hand-held Metal Detectors: Sample System |

| 7.5.1.4 |

Hand-held Metal Detectors – Vendors |

| 7.5.2 |

Walk-through Metal Detection Portals |

| 7.5.2.1 |

Introduction |

| 7.5.2.2 |

Walk-through Electromagnetic Portals: Glossary |

| 7.5.2.3 |

Overview |

| 7.5.2.4 |

Walk-through Metal-Detection Portals: Principles of Operation |

| 7.5.2.5 |

Walk-through Metal Detection Portals Throughput |

| 7.5.2.6 |

Walk-through Metal Detection Portals: Techno-Tactical & Economic Considerations |

| 7.5.2.7 |

Walk-through Metal Detection Portals: Sample System |

| 7.5.2.8 |

Walk-through Metal Detection Portals – Vendors, Products & Prices |

| 7.6 |

Shoe Scanners |

| 7.6.1 |

Threats and Government Policy |

| 7.6.2 |

Shoe Scanners: Vendors, Products & Prices |

| 7.7 |

Bottled Liquids Scanners (BLS) |

| 7.7.1 |

Liquid Explosives Threats |

| 7.7.2 |

Liquid Explosives Screening |

| 7.7.3 |

DHS’s SENSIT Program |

| 7.7.4 |

Liquid Detection: Techno-Tactical Considerations |

| 7.7.5 |

Liquid Explosives Scanners – Vendors, Products and Prices |

| 7.7.6 |

Liquid Explosives Scanners – Sample System |

| 7.8 |

Body Cavities Screening Systems |

| 7.9 |

Computer Aided Detection (CAD) Software |

| 7.1 |

Biometric People Screening |

| 7.10.1 |

Biometric Identification, Drivers & Inhibitors and Government Influence |

| 7.10.2 |

Biometric Market Drivers & Inhibitors |

| 7.10.3 |

Market Drivers |

| 7.10.4 |

Market Inhibitors |

| 7.10.5 |

Biometric Portals |

| 7.10.6 |

Fused Biometric, Document Authentication and Interrogation Portals |

| 7.11 |

Multi-Modal & Multi-Threat People Screening Portals |

| 7.11.1 |

Overview |

| 7.11.2 |

Technology Status |

| 7.11.3 |

Core Technologies |

| 7.11.4 |

Example: Detection Systems Fusion Protocol (DSFP) |

| 7.12 |

Pat-down Body Search |

| 7.13 |

Hand-held Weapons and CBRNE Detectors |

| 7.13.1 |

Evolving Hand-held MMWave Wand – Sample |

| 7.14 |

Multi-Modal & Multi-Threat Portals |

| 7.14.1 |

Market Needs |

| 7.14.2 |

Proposed High Throughput Multi-Threat People Screening Portal |

| 7.14.3 |

Future People Screening Portals – Technology Essentials |

| 7.14.4 |

Future Multi-Threat Detection |

| 7.14.5 |

Molecularly Imprinted Polymer (MIP) Sensors |

| 7.14.6 |

MOS-Based Electro-Chemical Sensor Networks |

| 7.14.7 |

Future Shoe Scanners |

| 7.15 |

IATA & ICAO “Checkpoint of the Future” |

| 7.15.1 |

Present People Screening Checkpoint Performance |

| 7.15.2 |

The IATA & ICAO “Checkpoint of the Future” |

| 7.15.3 |

The Aborted IATA Checkpoint of the Future: Main Concepts |

| 7.16 |

TSA New Product Certification |

| 8 |

U.S. Federal Homeland Security Agencies |

| 9 |

U.S. People Security Screening Market by Vertical Sub-Markets |

| 9.1 |

Vertical Markets Size & CAGR – 2014-2020 |

| 9.1.1 |

Market Dynamics – 2012-2020 |

| 9.1.2 |

Market Breakdown – 2014-2020 |

| 10 |

Aviation Security Passengers & Workforce Screening Market |

| 10.1 |

U.S. Aviation Security Passengers & Workforce Screening: Market Background |

| 10.1.1 |

U.S. Transportation Security Administration (TSA) |

| 10.2 |

TSA Major Programs and Funding |

| 10.2.1 |

Screening Partnership Program |

| 10.2.2 |

Passenger and Baggage Screening Program |

| 10.2.3 |

Screening Training and Other Programs |

| 10.2.4 |

Airport Passengers & Baggage Screening Systems Installed Base [Units] & Procurement Plans by Modality |

| 10.2.5 |

Screening Technology Maintenance & Utilities Program |

| 10.2.6 |

Aviation Regulation and Other Enforcement Programs |

| 10.2.7 |

Airport Management, IT and Support Program |

| 10.2.8 |

Secure Flight Program |

| 10.2.9 |

Transportation Security Support Programs |

| 10.2.10 |

Federal Air Marshal Service Program |

| 10.3 |

U.S. Trusted Traveler Programs |

| 10.3.1 |

Trusted Traveler Programs Overview |

| 10.3.2 |

The Global Entry Program |

| 10.3.3 |

The NEXUS Program |

| 10.3.4 |

The SENTRI Program |

| 10.4 |

514 Airports Passenger Screening Statistics |

| 10.5 |

U.S. Aviation Passengers & Workforce Screening Market -2014-2020 |

| 10.5.1 |

U.S. Aviation Security People Screening Market – 2014-2020 |

| 11 |

Land/Sea Transportation Passengers & Workforce Screening Market |

| 11.1 |

U.S. Land/Sea Transportation Passengers & Workforce Screening Market Background |

| 11.1.1 |

Seaports and Marine Terminals |

| 11.1.2 |

Port Terminal Facilities |

| 11.1.3 |

Passenger Carriers |

| 11.1.4 |

Inland River, Coastal, and Great Lakes Systems |

| 11.2 |

Maritime Transportation: Terror Mitigation Strategy |

| 11.2.1 |

Transportation Worker Identification Credential Program |

| 11.2.2 |

Federal Port Security Grants |

| 11.3 |

Market Drivers |

| 11.4 |

Market Inhibitors |

| 11.4.1 |

U.S. Land/Sea Transportation Security People Screening Market – 2014-2020 |

| 12 |

Border Checkpoints People Screening Market |

| 12.1 |

U.S. Border Checkpoints People Screening Market Background |

| 12.1.1 |

Major Findings |

| 12.1.2 |

Major Conclusions |

| 12.1.3 |

Market Drivers |

| 12.1.4 |

Market Inhibitors |

| 12.1.5 |

U.S. Borders People Screening Market Business Opportunities & Challenges |

| 12.1.6 |

Automated Border Control |

| 12.1.7 |

U.S. Border Checkpoints People Security Screening Market – 2014-2020 |

| 13 |

Diplomatic Facilities Visitors and Workforce Screening Market |

| 13.1 |

U.S. Diplomatic Facilities Visitors and Workforce Screening Market Background |

| 13.1.1 |

Major Findings |

| 13.1.2 |

Diplomatic Corp Facilities People Screening Market: Business Opportunities |

| 13.1.3 |

Market Drivers |

| 13.1.4 |

Market Inhibitors |

| 13.1.5 |

U.S. Diplomatic Facilities People Security Screening Market – 2014-2020 |

| 14 |

Government & Public Facilities Visitors & Workforce Screening Market |

| 14.1 |

U.S. Government & Public Facilities Visitors & Workforce Screening Market Background |

| 14.1.1 |

The Federal National Protection and Programs Directorate |

| 14.1.2 |

The Federal Protective Service |

| 14.1.3 |

U.S. Government & Public Facilities People Security Screening Market – 2014-2020 |

| 15 |

Public Gathering People Screening Market |

| 15.1 |

U.S. Public Gathering People Screening Market Background |

| 15.1.1 |

Public Events People Screening Market: Business Opportunities |

| 15.1.2 |

Market Drivers |

| 15.1.3 |

Market Inhibitors |

| 15.1.4 |

U.S. Public Events People Security Screening Market – 2014-2020 |

| 16 |

Private Sector Facilities Visitors and Workforce Screening Market |

| 16.1 |

U.S. Private Sector Facilities Visitors and Workforce Screening Market Background |

| 16.1.1 |

Private Sector People Screening Security Infrastructure. |

| 16.1.2 |

Market Drivers |

| 16.1.3 |

Market Inhibitors |

| 16.1.4 |

U.S. Private Sector Facilities People Security Screening Market – 2014-2020 |

| 16.2 |

U.S. People Security Screening Market by Technology Sub-Markets |

| 16.2.1 |

Consolidated Market – 2014-2020 |

| 16.2.2 |

Market Dynamics – 2012-2020 |

| 16.2.3 |

Market Breakdown – 2014-2020 |

| 16.2.4 |

U.S. Whole Body Scanners (AIT) People Security Screening Market – 2014-2020 |

| 16.2.5 |

U.S. Hand Baggage X-Ray Scanners & EDS People Security Screening Market – 2014-2020 |

| 16.2.6 |

U.S. Explosives Trace Detectors (ETD) People Security Screening Market – 2014-2020 |

| 16.2.7 |

U.S. Liquid Explosives Detectors People Security Screening Market – 2014-2020 |

| 16.2.8 |

U.S. Shoe Scanners People Security Screening Market – 2014-2020 |

| 16.2.9 |

U.S. Metal Detectors People Security Screening Market – 2014-2020 |

| 16.2.10 |

U.S. Biometric (& Other) ID Documents Screening Systems People Security Screening Market – 2014-2020 |

| 16.2.11 |

U.S. Multi-Modal, Multi-Threat Portals and Other Technologies People Security Screening Market – 2014-2020 |

| 17 |

U.S. People Security Screening Market by Revenue Source |

| 17.1 |

U.S. People Security Screening Market Size [$M] and CAGR [%] by Revenue Segment – 2014-2020 |

| 17.1.1 |

Market Dynamics – 2012-2020 |

| 17.1.2 |

Market Breakdown – 2014-2020 |

| 17.1.3 |

U.S. People Security Screening Product Sales – 2014-2020 |

| 17.1.4 |

U.S. People Security Screening Aftersale Revenues – 2014-2020 |

| 17.1.5 |

U.S. People Security Screening Planning, Consulting & Training – 2014-2020 |

| 18 |

U.S. National and International Standards |

| 19 |

Business & Technological Opportunities & Challenges |

| 19.1 |

Introduction |

| 19.2 |

Upgraded Multi Threat Screening System |

| 19.3 |

Fused RFID, Risk Assessment and People Screening Meta-systems |

| 19.4 |

Third Party Service Business |

|

VENDORS |

| 20 |

Leading Vendors |

| 20.1 |

Vendors and Product Lines |

| 20.2 |

American Science and Engineering, Inc |

| 20.2.1 |

Company Profile |

| 20.2.2 |

People Screening Products |

| 20.3 |

Auto Clear |

| 20.3.1 |

Company Profile |

| 20.3.2 |

People Screening Products |

| 20.4 |

ADANI |

| 20.4.1 |

Company Profile |

| 20.5 |

Red X Defense |

| 20.5.1 |

Company Profile |

| 20.6 |

Syagen Technology |

| 20.6.1 |

Company Profile |

| 20.7 |

Thermo Electron Corporation |

| 20.7.1 |

Company Profile |

| 20.8 |

Biosensor Applications |

| 20.8.1 |

Company Profile |

| 20.9 |

Hitachi |

| 20.9.1 |

Company Profile |

| 20.1 |

Scent Detection Technologies |

| 20.10.1 |

Company Profile |

| 20.11 |

Ketech Defence |

| 20.11.1 |

Company Profile |

| 20.12 |

Mistral Security Inc |

| 20.12.1 |

Company Profile |

| 20.13 |

Appealing Products, Inc. (API) / ChemSee |

| 20.13.1 |

Company Profile |

| 20.14 |

DetectaChem LLC |

| 20.14.1 |

Company Profile |

| 20.15 |

Scintrex Trace |

| 20.15.1 |

Company Profile |

| 20.16 |

Flir Systems |

| 20.16.1 |

Company Profile |

| 20.17 |

Ion Applications Inc |

| 20.17.1 |

Company Profile |

| 20.18 |

BAHIA Corp (Sibel Ltd.) |

| 20.18.1 |

Company Profile |

| 20.19 |

CEIA |

| 20.19.1 |

Company Profile |

| 20.2 |

Garrett Electronics Inc. |

| 20.20.1 |

Company Profile |

| 20.21 |

Fisher Labs |

| 20.21.1 |

Company Profile |

| 20.22 |

Brijot Imaging Systems |

| 20.22.1 |

Company Profile |

| 20.23 |

TeraView |

| 20.23.1 |

Company Profile |

| 20.24 |

ThruVision Systems |

| 20.24.1 |

Company Profile |

| 20.25 |

Gilardoni SpA |

| 20.25.1 |

Company Profile |

| 20.25.2 |

People Screening Products |

| 20.26 |

L-3 Communications Security & Detection Systems |

| 20.26.1 |

Company Profile |

| 20.27 |

QinetiQ Ltd. |

| 20.27.1 |

Company Profile |

| 20.28 |

Westminster International Ltd. |

| 20.28.1 |

Company Profile |

| 20.29 |

LIXI, Inc |

| 20.29.1 |

Company Profile |

| 20.29.2 |

People Screening and People Security Screening Products |

| 20.3 |

MilliVision |

| 20.30.1 |

Company Profile |

| 20.31 |

MINXRAY, Inc. |

| 20.31.1 |

Company Profile |

| 20.32 |

Morpho Detection Inc. |

| 20.32.1 |

Company Profile |

| 20.33 |

Nuctech Co. Ltd. |

| 20.33.1 |

Company Profile |

| 20.33.2 |

People Screening Products |

| 20.33.2.1 |

Carry-on Baggage |

| 20.33.2.2 |

Whole Body Scan |

| 20.34 |

Rapiscan Security Products, Inc. |

| 20.34.1 |

Company Profile |

| 20.35 |

Scanna MSC Ltd. |

| 20.35.1 |

Company Profile |

| 20.36 |

Smiths Detection |

| 20.36.1 |

Company Profile |

| 20.36.2 |

People Screening Products |

| 20.36.2.1 |

Mail & Parcels Screening Systems |

| 20.37 |

Vidisco Ltd. |

| 20.37.1 |

Company Profile |

|

APPENDICES |

| 21 |

Appendix A: Covert Walk-by People Screening Technologies |

| 21.1 |

Walk-by Active Electromagnetic Weapons Detection Corridors |

| 21.2 |

Passive Electro Magnetic Signature Corridor |

| 21.3 |

Walk-by Passive MMWave Doorways |

| 21.4 |

Focal Plane Array Passive MMWave |

| 21.5 |

Walk-By Passive MMWave Imaging System |

| 21.6 |

Walk-by Fourier Transform Infrared (FTIR) Spectroscopy Systems |

| 21.7 |

Covert Walk-by Biometric Identification Corridors |

| 21.8 |

Fused Standoff Video Surveillance and Biometrics |

| 21.8.1 |

Example: IOM PassPort |

| 22 |

Appendix B: People Profiling and Behavior Tracking |

| 22.1 |

Scope |

| 22.2 |

Profiling Types |

| 22.2.1 |

Demographic Profiling |

| 22.2.2 |

Ethnic Profiling |

| 22.2.3 |

Behavioral Profiling |

| 22.2.4 |

Positive Profiling |

| 22.3 |

The Purpose of Profiling and Behavior Tracking |

| 22.3.1 |

How Is It Done? |

| 22.3.2 |

Behavior Profiling – Drivers |

| 22.3.3 |

Behavior Profiling – Inhibitors |

| 22.3.4 |

The Cost of Profiling |

| 23 |

Appendix C: CCTV Based People Screening |

| 23.1 |

Video Monitoring and Biometrics |

| 23.2 |

CCTV Biometric Face Recognition Identification vs. Verification |

| 23.3 |

Performance of CCTV Based Biometric Recognition Technologies |

| 23.4 |

Tag and Track – Intelligent Video Surveillance |

| 23.5 |

TSA Advanced Surveillance Program |

| 24 |

Appendix D: Abbreviations |

| 25 |

Appendix E: IATA Recommended Airport Passenger Screening Checkpoints |

| 26 |

Appendix F: People Screening Systems and Devices Industry |

| 26.1 |

Economic Turmoil Effects on the Aviation Security Market |

| 26.2 |

Globalization of the Industry |

| 26.3 |

Classification of the Industry Business and Industrial Activities |

| 26.4 |

Forces that Shape the People Screening Systems Industry & Markets |

| 26.5 |

Vendor – Government Relationship |

| 26.6 |

Barriers to Market Entry |

| 26.7 |

Industry Supply-Side & Demand-Side Analysis |

| 27 |

Appendix G: People Screening Industry: Business Models & Strategies |

| 27.1 |

Variable Economic Conditions |

| 27.2 |

Market Tiers |

| 27.3 |

Defense Primes & Mega Corporations’ Inroads into the Market |

| 27.4 |

Entry Strategies toward the People Screening Arena |

| 27.5 |

Price Elasticity |

| 27.6 |

Mergers and Acquisitions (M&A) |

| 28 |

The Report Research Methodology |

| 28.1 |

Report Structure |

| 28.2 |

Assumptions |

| 28.3 |

Research Methodology |

| 28.4 |

Who Is This Report For? |

| 28.5 |

Research Methods |

| 28.6 |

Terms of Reference |

| 29 |

Disclaimer & Copyright |