1. Executive Summary

1.1.

Key Findings and Conclusions

1.1.1.

Impact of Recent Economic Turmoil

1.2.

The Federal HLS Organization

1.3.

US HLS-HLD Funding and Market Overview

1.3.1.

US HLS-HLD Outlay by Funding Source – 2009-2014

1.3.2.

US HLS-HLD Market by “Demand Side” Sector – 2009-2014

1.4.

Federal HLS Funding and Markets

1.4.1.

Federal HLS Funding by Department 2011-2014

1.4.2.

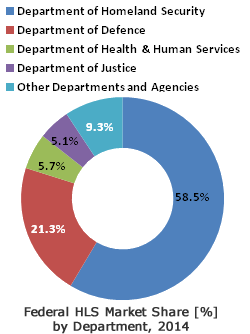

Federal HLS Market by Department 2011-2014

1.4.3.

Federal HLS Funding by Mission Activity 2011-2014

2. Methodology

2.1.

Introduction

2.2.

The Report Scenario

2.3.

Terms of Reference

2.4.

Interplay Between HLD, Federal, State & Local, Private Sector, Intelligence Community HLS Agencies

2.5.

Federal HLS Vendor Government Relationship

3. Federal HLS Market Drivers

4. Federal HLS Market Inhibitors

5. Federal HLS Market: SWOT Analysis

6. Federal HLS Market: Competitive Analysis

7. Federal HLS Market Dynamics

8. Federal HLS Funding and Market by Department Analysis – 2010-2014

8.1.

Federal HLS Funding Forecast

8.2.

Federal HLS Market Forecast

8.3.

Market vs. Funding

9. Federal HLS Funding by Mission Activity 2010 2014

9.1.

Overview.

9.2.

Terrorist Attacks Prevention and Mitigation Funding Forecast

9.2.1.

Intelligence and warning

9.2.2.

Border and Transportation Systems Protection

9.2.3.

Domestic Counterterrorism

9.2.4.

Funding – 2010-2014

9.3.

Critical Infrastructure Protection Funding Forecast

9.3.1.

Critical Infrastructures and Key Resources Protection

9.3.2.

Defending Against Catastrophic Threats

9.3.3.

Funding 2011-2014

9.4.

Incidents and CBRNE Attacks Recovery Funding Forecast

9.4.1.

Emergency Preparedness, Response and Recovery

9.4.2.

Funding 2011-2014

10. Department of Homeland Security (DHS)

10.1.

DHS Background

10.2.

DHS Agencies and Units

10.3.

DHS Consolidated Markets 2011-2014

10.3.1.

Summary Outlook

10.3.2.

DHS Market by Agency – 2009-2014

11. DHS – Transportation Security Administration (TSA)

11.1.

TSA Background

11.2.

TSA Agencies and Units

11.3.

TSA Sub-Markets by Programs

11.3.1.

Screening Partnership Program & Market – 2011-2014

11.3.2.

Passenger and Baggage Screening Program & Market – 2011-2014

11.3.3.

Screening Training Program & Market – 2011-2014

11.3.4.

Passengers Checkpoint Support Program & Market – 2011-2014

11.3.5.

EDS and ETD Procurement and Installation Program & Market – 2009-2014

11.3.6.

Screening Technology Maintenance & Utilities Program & Market – 2009-2014

11.3.7.

Aviation Regulation and Other Enforcement Program & Market – 2009-2014

11.3.8.

Regulatory Inspection and Enforcement Program – 2011-2014

11.3.9.

International Program – 2011-2014

11.3.10.

Repair Station Inspection Program – 2011-2014

11.3.11.

Airport Law Enforcement & Assessments Program – 2011-2014

11.3.12.

National Explosives Detection Canine Training Program & Market – 2009-2014 (NEDCTP)

11.3.13.

Airport Management, IT, and Support Program & Market – 2011-2014

11.3.14.

FFDO and Flight Crew Training Program & Market – 2011-2014

11.3.15.

Air Cargo Program & Market – 2011-2014

11.3.16.

Air Cargo Security Policy Program – 2011-2014

11.3.17.

Air Cargo Inspectors Program – 2011-2014

11.3.18.

National Explosives Detection Canine Training Program – 2009-2014 (NEDCTP)

11.3.19.

Surface Transportation Security Program & Markets – 2009-2014

11.3.20.

Surface Transportation Security Staffing and Operations Market – 2009-2014

11.3.21.

Surface Transportation Security Inspectors and Canines Program & Market – 2011-2014

11.3.22.

Secure Flight Program & Market – 2011-2014

11.3.23.

Transportation Worker Identification Credential (TWIC) Market – 2009-2014

11.3.24.

Alien Flight Student Program & Market – 2011-2014(AFSP)

11.3.25.

Crew and Other Vetting Programs & Market – 2011-2014

11.3.26.

Certified Cargo Screening Program & Market – 2011-2014

11.3.27.

Large Aircraft Security Plan, Program & Market – 2011

11.3.28.

Secure Identification Display Area Checks Program & Market – 2011-2014

11.3.29.

Transportation Security Support Program & Market – 2011-2014

11.3.30.

Federal Air Marshal Service Program & Market – 2011-2014

11.4.

TSA Emerging Technologies Systems and Prices

11.5.

TSA Consolidated Market 2011-2014

11.5.1.

Summary

11.5.2.

Market Drivers

11.5.3.

Market Inhibitors

11.5.4.

TSA Funding and Market – 2011-2014

12. DHS – US Customs & Border Protection (CBP)

12.1.

CBP Background

12.2.

CBP Agencies & Units

12.3.

CBP Sub-Markets by Program

12.3.1.

Secure Border Initiative Program & Market – 2011-2014

12.3.2.

Inspection and Detection Technology Program & Market – 2011-2014

12.3.3.

Systems for Targeting Program & Market – 2011-2014

12.3.4.

C-TPAT Program & Market – 2011-2014

12.3.5.

International Cargo Screening – CSI and SFI Programs & Market – 2009-2014

12.3.6.

CSI

12.3.7.

SFI

12.3.8.

Other International Programs

12.3.9.

Trusted Traveler Programs (TT) Program & Market – 2011-2014

12.3.10.

NEXUS Highway and Air Program – 2011-2014

12.3.11.

Secure Electronic Network for Traveler’s Rapid Inspection (SENTRI) Program – 2011-2014

12.3.12.

Free and Secure Trade (FAST) Program – 2011-2014

12.3.13.

Global Entry Program – 2011-2014

12.3.14.

Automated Commercial Environment (ACE) Program & Market – 2009-2014

12.3.15.

Critical Operations Protection & Processing Support (COPPS) /TECS Modernization Program & Market – 2011-2014

12.3.16.

Facility Construction and Sustainment

12.3.17.

Air and Marine Interdiction Programs & Markets – 2009-2014

12.4.

Inspection and Detection Technologies

12.4.1.

Existing Technologies

12.4.2.

Challenges

12.5.

Business Opportunities

12.6.

CBP Consolidated Markets 2011-2014

12.6.1.

Summary Outlook

12.6.2.

Market Drivers

12.6.3.

Market Inhibitors

12.6.4.

CBP Funding and Market – 2009-2014

13. DHS – Federal Emergency Management Agency (FEMA)

13.1.

FEMA Background

13.2.

FEMA Agencies & Units

13.3.

FEMA Sub-Markets by Program

13.3.1.

Operating Activities Programs & Market – 2009-2014

13.3.2.

Public Support Program

13.3.3.

Fire Management Support Grant Program (FMAGP)

13.3.4.

Community Disaster Loan Program

13.3.5.

Improvised Nuclear Device (IND) Response and Recovery Program

13.3.6.

Pre-Positioned Equipment Program (PEP)

13.3.7.

Nuclear/Radiological Incident Prevention Program (NRIPP)

13.3.8.

Individual Support Programs (IA)

13.3.9.

Contingency Programs

13.3.10.

National Capital Region Program & Market – 2011-2014

13.3.11.

Urban Search and Rescue Program & Market – 2011-2014

13.3.12.

State and Regional Preparedness Program & Market – 2011-2014

13.3.13.

State HLS Program (SHSP) Market- 2009-2014

13.3.14.

Firefighter Support Grants Program & Market – 2011-2014

13.3.15.

Regional Catastrophic Preparedness Grant Program (RCPGP) Market – 2009-2014

13.3.16.

Emergency Management Performance Grants (EMPG) Program & Market – 2011-2014

13.3.17.

Metropolitan Statistical Area (MSA) Preparedness Program & Market – 2011-2014

13.3.18.

Urban Area Security Initiative (UASI) Program & Market – 2011-2014

13.3.19.

Rail & Transit Security Grant Program & Market – 2011-2014

13.3.20.

Port Security Grant Program & Market – 2011-2014

13.3.21.

Buffer Zone Protection Program & Market – 2011-2014

13.3.22.

Training, Measurement, and Exercise Programs & Market – 2009-2014

13.3.23.

National Exercise Program (NEP) Market – 2011-2014

13.3.24.

Continuing Training Grants Program & Market – 2011-2014

13.3.25.

Center for Domestic Preparedness Program & Market – 2011-2014

13.3.26.

National Domestic Preparedness Consortium Program & Market – 2009-2014

13.3.27.

Technical Support (TS) and Evaluation and Assessment Programs & Market – 2009-2014

13.3.28.

Fire Administration Program & Market – 2011-2014

13.3.29.

Radiological Emergency Preparedness Program & Market – 2011-2014

13.3.30.

Pre-Disaster Mitigation Fund (PDM) Program – 2011-2014

13.3.31.

Emergency Food and Shelter Program & Market – 2011-2014

13.3.32.

Disaster Relief Fund Programs & Market – 2009-2014

13.3.33.

Flood Hazard Mapping and Risk Analysis Program & Market – 2011-2014

13.3.34.

National Flood Insurance Program (NFIP) Market – 2009-2014

13.3.35.

Flood Mapping and Risk Analysis Program & Market – 2011-2014

13.4.

FEMA Consolidated Markets 2011-2014

13.4.1.

Summary Outlook

13.4.2.

FEMA Funding and Market – 2009-2014

14. DHS – US Immigration & Customs Enforcement (ICE)

14.1.

ICE Background

14.2.

ICE Agencies & Units

14.3.

ICE Sub-Markets by Program

14.3.1.

Visa Security Program & Market – 2011-2014

14.3.2.

Criminal Alien Program & Market – 2011-2014

14.3.3.

Transportation and Removal Program & Market – 2011-2014

14.3.4.

Comprehensive Identification and Removal of Criminal Aliens Program & Market – 2011-2014

14.3.5.

Automation Modernization Projects Program & Market – 2011-2014

14.3.6.

Atlas Program & Market – 2011-2014

14.3.7.

ICE Law Enforcement Systems Modernization Program & Market – 2009-2014

14.3.8.

DRO Modernization (DROM) Program & Market – 2011-2014

14.3.9.

Managed IT Investment Programs Market – 2009-2014

14.3.10.

Investigations Programs Market – 2009-2014

14.3.11.

Domestic Investigations Programs Market – 2009-2014

14.3.12.

International Investigations Programs Market – 2009-2014

14.4.

ICE Consolidated Funding and Markets 2011-2014

14.4.1.

Summary Outlook

14.4.2.

Market Drivers

14.4.3.

Market Inhibitors

14.4.4.

ICE Consolidated Funding and Market – 2009-2014

15. DHS – US Coast Guard (USCG)

15.1.

USCG Background

15.2.

USCG Agencies & Units

15.3.

USCG Sub-Markets by Programs

15.3.1.

USCG Near-term Program Initiatives

15.3.2.

Defense Readiness Program & Market – 2011-2014

15.3.4.

Migrant Interdiction Program & Market – 2011-2014

15.3.5.

Other Law Enforcement Measures Program & Market – 2011-2014

15.3.6.

Ports, Waterways and Coastal Security (PWCS) Program & Market – 2009-2014

15.3.7.

USCG Key Strategic Issues

15.4.

USCG Consolidated Markets 2011-2014

15.4.1.

Summary Outlook

15.4.2.

Market Drivers

15.4.3.

Market Inhibitors

15.4.4.

USCG Funding and Market – 2009-2014

16. DHS – US Secret Service (USSS)

16.1.

USSS Background

16.2.

USSS Sub-Markets by Programs

16.2.1.

Major Operational Programs and Strategic Goals

16.2.2.

Electronic Crimes Special Agent Program (ECSAP) Market – 2009-2014

16.2.3.

Cross Cutting Initiatives

16.3.

USSS Consolidated Markets 2011-2014

16.3.1.

Summary Outlook

16.3.2.

Market Drivers

16.3.3.

Market Inhibitors

16.3.4.

USSS Funding and Market – 2009-2014

17. DHS – Science & Technology Directorate (S&T)

17.1.

S&T Background

17.2.

S&T – Agencies & Units

17.3.

S&T Sub-Markets by Programs

17.3.1.

Border & Maritime Security Programs Market – 2009-2014

17.3.2.

Border Officer Tools and Safety Program & Market – 2011-2014

17.3.3.

Border Technologies Program & Market – 2011-2014

17.3.4.

Maritime Technologies Program & Market – 2011-2014

17.3.5.

Cargo and Conveyance Security Program & Market – 2011-2014

17.3.6.

Chemical and Biological Programs Market – 2009-2014

17.3.7.

Systems Studies and Decision Tools Program & Market – 2011-2014

17.3.8.

Threat Awareness Program & Market – 2011-2014

17.3.9.

Surveillance and Detection R&D Program & Market – 2011-2014

17.3.10.

Forensics Program & Market – 2011-2014

17.3.11.

Response and Restoration Program & Market – 2010-2014

17.3.12.

Foreign Animal Diseases Program & Market – 2011-2014

17.3.13.

Analysis Program & Market – 2011-2014

17.3.14.

Detection Program & Market – 2011-2014

17.3.15.

Response and Recovery Program & Market – 2011-2014

17.3.16.

Command, Control and Interoperability Programs Market – 2009-2014

17.3.17.

Basic/Futures Research (BFR) Program & Market – 2011-2014

17.3.18.

Office for Interoperability and Compatibility (OIC) Program & Market – 2011-2014

17.3.19.

Cyber-security Research Tools and Techniques (RTT) Program & Market – 2011-2014

17.3.20.

Information Infrastructure Security (IIS) Program & Market – 2011-2014

17.3.21.

Next Generation Technology (NGT) Program & Market – 2011-2014

17.3.22.

Emerging Threats Program & Market – 2011-2014

17.3.23.

Intelligence, Surveillance, and Reconnaissance (ISR) Program & Market – 2011-2014

17.3.24.

Risk Sciences Program & Market – 2011-2014

17.3.25.

Collaborative Information Sharing Program & Market – 2011-2014

17.3.26.

Knowledge Frameworks Program & Market – 2011-2014

17.3.27.

Advanced Forensic Technologies Program & Market – 2011-2014

17.3.28.

Investigative Technologies Program & Market – 2011-2014

17.3.29.

Explosives Related Programs Market – 2009-2014

17.3.30.

Cargo Program & Market – 2011-2014

17.3.31.

Canine Explosives Detection Program & Market – 2011-2014

17.3.32.

Check Point Program & Market – 2011-2014

17.3.33.

Homemade Explosives (HME) Program & Market – 2011-2014

17.3.34.

Manhattan II Program & Market – 2011-2014

17.3.35.

Conveyance Protection Program & Market – 2011-2014

17.3.36.

Explosives Research Program & Market – 2011-2014

17.3.37.

Prevent/Deter Program & Market – 2011-2014

17.3.38.

Predict Program & Market – 2011-2014

17.3.39.

Detect Program & Market – 2011-2014

17.3.40.

Respond/Defeat Program & Market – 2011-2014

17.3.41.

Mitigate Program & Market – 2011-2014

17.3.42.

Crosscutting Program & Market – 2011-2014

17.3.43.

Human Factors Programs Market – 2009-2014

17.3.44.

Human Systems Research and Engineering Program & Market – 2010-2014

17.3.45.

Technology Acceptance and Integration Program & Market – 2011-2014

17.3.46.

Biometrics Program & Market – 2011-2014

17.3.47.

Community Preparedness and Resilience Program & Market – 2010-2014

17.3.48.

Motivation and Intent (M&I) Program & Market – 2011-2014

17.3.49.

Suspicious Behavior Detection Program & Market – 2011-2014

17.3.50.

Infrastructure and Geophysical Programs Market – 2009-2014

17.3.51.

Advanced Surveillance and Detection Systems Program & Market – 2010-2014

17.3.52.

Modeling, Simulation, and Analysis Program & Market – 2011-2014

17.3.53.

Protective Technologies Program & Market – 2011-2014

17.3.54.

Response and Recovery Technologies Program & Market – 2011-2014

17.3.55.

Geophysical Program & Market – 2011-2014

17.3.56.

First Responder Technologies Program & Market – 2011-2014

17.3.57.

Geospatial Analysis Program & Market – 2011-2014

17.3.58.

Incident Management Enterprise Program & Market – 2011-2014

17.3.59.

Integrated Modeling, Mapping and Simulation Program & Market – 2010-2014

17.3.60.

Innovation Program & Market – 2011-2014

17.3.61.

Biometric Detector Project Program & Market – 2011-2014

17.3.62.

Future Attribute Screening Technologies Mobile Module (FASTM2) Program & Market – 2010-2014

17.3.63.

Tunnel Detect Program & Market – 2011-2014

17.3.64.

Multi-modal Tunnel Detect Project Market – 2010-2014

17.3.65.

Rapid Liquid Component Detector (MagViz) Project Market – 2010-2014

17.3.66.

Resilient Electric Grid (REG) Project Market – 2010-2014

17.3.67.

Resilient Tunnel Project Market – 2009-2014

17.3.68.

Safe Container/Time Recorded Ubiquitous Sensor Technology (TRUST) Project Market – 2009-2014

17.3.69.

Very Low Cost Bio Agent Detect Project Market – 2010-2014

17.3.70.

Wide Area Surveillance Project Market – 2010-2014

17.3.71.

Operationally Deployable Explosives Mitigation Project Market – 2011-2014

17.3.72.

Passive Methods for Precision Behavioral Screening Project Market – 2011-2014

17.3.73.

Laboratory Facilities Program & Market – 2011-2014

17.3.74.

Radiological and Nuclear Program & Market – 2011-2014

17.3.75.

Nuclear Detection Advanced Technology Demonstration (ATD) Program & Market – 2011-2014

17.3.76.

Response and Recovery Program & Market – 2011-2014

17.3.77.

Nuclear Detection Exploratory Research Program & Market – 2011-2014

17.3.78.

Academic Research Initiative (ARI) Program & Market – 2011-2014

17.3.79.

Test and Evaluation Standards Program & Market – 2011-2014

17.3.80.

Transition Program & Market – 2011-2014

17.3.81.

University Program & Market – 2011-2014

17.4.

S&T Consolidated Markets 2011-2014

17.4.1.

Summary Outlook

17.4.2.

Market Drivers

17.4.3.

Market Inhibitors

17.4.4.

S&T Funding and Market – 2009-2014

18. DHS – Domestic Nuclear Detection Office (DNDO)

18.1.

DNDO Background

18.2.

DNDO Agencies & Units

18.3.

DNDO Sub-Markets by Programs

18.3.1.

Systems Engineering and Architecture Programs & Markets – 2009-2014

18.3.2.

Systems Engineering Program

18.3.3.

Standards Program

18.3.4.

Systems Architecture Program

18.3.5.

PRND Program

18.3.6.

Systems Development Programs & Markets – 2009-2014

18.3.7.

Human Portable Systems Programs

18.3.8.

Cargo Advanced Automated Radiography System (CAARS) Follow-on Program

18.3.9.

Standoff Radiation Detection System (SORDS) Follow-on Program

18.3.10.

International Rail Program

18.3.11.

On-Dock Rail Program

18.3.12.

Boat-Mounted Sensor Program

18.3.13.

Transformational R&D Program & Market – 2011-2014

18.3.14.

Assessment Programs & Markets – 2009-2014

18.3.15.

Test and Evaluation (T&E) Infrastructure and Operations

18.3.16.

Special Nuclear Material (SNM) Sealed Source Development Program

18.3.17.

Graduated Rad/Nuc Detector Evaluation and Reporting (GRaDER) Program

18.3.18.

Test Data Management Programs

18.3.19.

Red Teaming and Net Assessments (RTNA) Program

18.3.20.

West Coast Maritime Pilot Program

18.3.21.

International Commercial Aviation Passengers and Baggage (Pax/Bag) Pilot Program

18.3.22.

Green Border Pilot

18.3.23.

Operations Support Program & Market – 2011-2014

18.3.24.

Joint Analysis Center Program

18.3.25.

Nuclear Assessment Program

18.3.26.

Technical Reachback Program

18.3.27.

Training and Exercises Program

18.3.28.

National Technical Nuclear Forensics Programs & Markets – 2009-2014

18.3.29.

National Nuclear Forensics Expertise Development Program (“Academic Pipeline”)

18.3.30.

Radiation Portal Monitor Program & Market – 2011-2014

18.3.31.

Securing the Cities Initiative Program & Market – 2011-2014

18.3.32.

Human Portable Radiation Detection Systems Program & Market – 2009-2014

18.3.33.

Mobile Detection Deployment Program & Market – 2011-2014

18.4.

DNDO Consolidated Markets 2011-2014

18.4.1.

Summary Outlook

18.4.2.

Market Drivers

18.4.3.

Market Inhibitors

18.4.4.

Main Business Opportunities

18.4.5.

DNDO Funding and Market – 2009-2014

19. DHS – Departmental Management & Operations (DMO)

19.1.

DMO Background

19.2.

DMO Agencies and Units

19.3.

DMO Sub-Markets by Programs

19.3.1.

IT Services Program & Market – 2011-2014

19.3.2.

Infrastructure and Security Program & Market – 2011-2014

19.3.3.

National Security Systems (NSS) Program & Market – 2011-2014

19.3.4.

The HSDN Project Program & Market – 2011-2014

19.3.5.

Human Resources Information Technology (HRIT) Program & Market – 2011-2014

19.3.6.

Headquarters Consolidation Program & Market – 2011-2014

19.3.7.

DHS HQ NAC Project Market – 2009-2014

19.4.

DMO Consolidated Markets 2011-2014

19.4.1.

Summary Outlook

19.4.2.

DMO Funding and Market – 2009-2014

20. DHS Analysis and Operations (I&A and OPS)

20.1.

DHS I&A and OPS Background

20.1.1.

I&A

20.1.2.

OPS

20.2.

Initiatives

20.3.

DHS I&A and OPS Markets 2011-2014

20.3.1.

Summary Outlook

20.3.2.

DHS I&A and OPS Funding and Market – 2009-2014

21. DHS – Federal Law Enforcement Training Center (FLETC)

21.1.

FLETC Background

21.2.

FLETC Agencies and Units

21.3.

FLETC Sub-Markets by Programs

21.3.1.

Law Enforcement Training Programs & Markets – 2009-2014

21.3.2.

Acquisition, Construction, Improvements & Related Programs & Markets – 2009-2014

21.3.3.

Key Strat

Tables

Table 1

The American Recovery and Reinvestment Act DHS Market Funding [$M] by Agency

Table 2

US HLS-HLD Outlay [$ Billion] by Funding Source – 2009-2014

Table 3

US HLS-HLD Outlay [% of Total HLS-HLD] by Funding Source – 2009-2014

Table 4

US HLS-HLD Market [$ Billion] by “Demand Side” Sector – 2009-2014

Table 5

US HLS-HLD Market Share [%] by “Demand Side” Sector – 2009-2014

Table 6

Federal HLS Funding by Major Departments [$B] – 2009-2014

Table 7

Federal HLS Market [$B] by Departments – 2009-2014

Table 8

Federal HLS Market [$B] by Departments – 2009-2014

Table 9

Federal HLS Market Share [%] by Departments – 2009 & 2014

Table 10

Federal HLS Funding [$B] by Mission Activity – 2010-2014

Table 11

Federal HLS Funding Forecast by Mission Activity Share [%] – 2010-2014

Table 12

Evolution of HLS-HLD Market Dynamics – 2010-2014

Table 13

Federal HLS Funding by Department [$B]: 2009-2014

Table 14

Federal HLS Funding by Department [%]: 2009-2014

Table 15

U. S. Federal Consolidated HLS Market by Department [$B] 2009-2014

Table 16

U. S. Federal Consolidated HLS Market Share by Major Departments [%] 2009-2014

Table 17

Federal HLS Funding Forecast by Mission Activity [$B] 2011-2014

Table 18

Federal HLS Funding Forecast by Mission Activity Share [%] 2011-2014

Table 19

Terrorist Attacks Prevention and Mitigation Federal HLS Funding [$B] 2011-2014

Table 20

Major Homeland Security, IT and Communication Networks (Unclassified)

Table 21

Critical Infrastructure Protection Federal HLS Funding [$M] 2011-2014

Table 22

Incidents and CBRNE Attacks Recovery Federal HLS Funding Forecast by Agency [$B] 2011-2014

Table 23

DHS HLS Market [$B] by DHS Agency – 2009-2014

Table 24

Market Share [%] by DHS Agency – 2009-2014

Table 25

TSA Screening Partnership Program Funding & Market [$M] – 2009-2014

Table 26

TSA Passenger and Baggage Screening Funding & Program Market [$M] – 2009-2014

Table 27

TSA Screening Training Program Funding & Market [$M] – 2009-2014

Table 28

TSA Passengers and Baggage Installed Base [Units] and Procurement Plans Statistics by Technology

Table 29

TSA Checkpoint Support Program Funding & Market [$M] – 2009-2014

Table 30

TSA EDS and ETD Procurement and Installation Program Funding & Market [$M] – 2009-2014

Table 31

TSA Screening Technology Maintenance & Utilities Program Funding & Market [$M] – 2009-2014

Table 32

Screening Technology Maintenance & Utilities Program Market [M] – 2009-2014

Table 33

Checked Baggage Equipment Maintenance [$M] – FY2011

Table 34

TSA Aviation Regulation and Other Enforcement Program Funding & Market [$M] – 2009-2014

Table 35

Aviation Regulation and Other Enforcement Program Market [$M] Components – 2009-2014

Table 36

Projected FY 2011 Funded Canine Teams

Table 37

TSA Airport Management, IT, and Support Program Funding & Market [$M] – 2009-2014

Table 38

Airport Management, IT, and Support Programs – 2010-2011 Funding

Table 39

TSA FFDO and Flight Crew Training Program Funding & Market [$M] – 2009-2014

Table 40

Flight Deck Security Funding [$M] – 2010-2011

Table 41

TSA Air Cargo Program Funding & Market [$M] – 2009-2014

Table 42

Air Cargo Program Components Funding Market – 2009-2014

Table 43

Surface Transportation Initiatives

Table 44

Surface Transportation Security Inspection Program Components

Table 45

TSA Surface Transportation Security Program Funding & Market [$M] – 2009-2014

Table 46

TSA Secure Flight Program Funding & Market [$M] – 2009-2014

Table 47

TSA Transportation Worker Identification Credential (TWIC) Funding & Market [$M] – 2009-2014

Table 48

TSA Hazardous Materials Endorsement Threat Assessment Program Funding &Market [$M] – 2009-2014 (HTAP)

Table 49

TSA Alien Flight Student Program Funding & Market [$M] – 2009-2014 (AFSP)

Table 50

TSA Crew and Other Vetting Program Funding & Market [$M] – 2009-2014

Table 51

Certified Cargo Screening Program Funding & Market [$M] – 2009-2014

Table 52

TSA Large Aircraft Security Plan Program Funding & Market [$M] – 2009-2014

Table 53

TSA Secure Identification Display Area Checks Program Funding & Market [$M] – 2009-2014

Table 54

TSA Transportation Security Support Program Funding & Market [$M] – 2009-2014

Table 55

TSA Federal Air Marshal Service Program Funding & Market [$M] – 2009-2014

Table 56

Emerging TSA Technologies

Table 57

TSA Funding and Market – 2009-2014

Table 58

CBP Secure Border Initiative Program Funding & Market [$M] – 2009-2014

Table 59

CBP Inspection and Detection Technology Program Funding & Market [$M] – 2009-2014

Table 60

CBP Systems for Targeting Program Funding & Market [$M] – 2009-2014

Table 61

CBP C-TPAT Program Funding & Market [$M] – 2009-2014

Table 62

CBP International Cargo Screening – CSI and SFI Program Funding & Market [$M] – 2009-2014

Table 63

Data on Containers Scanned and Container Volume at SFI Ports

Table 64

Costs Incurred by DHS and DOE to Implement and Operate SFI Program, through June 2009 ($ in thousands)

Table 65

CBP Other International Program Funding & Market [$M] – 2009-2014

Table 66

CBP Trusted Traveler Programs (TT) Program Funding & Market [$M] – 2009-2014

Table 67

CBP Automated Commercial Environment (ACE) Program Funding & Market [$M] – 2009-2014

Table 68

CBP Critical Operations Protection & Processing Support (COPPS) /TECS Modernization Program Funding & Market [$M] – 2009-2014

Table 69

CBP Facility Construction and Sustainment Program Funding & Market [$M] – 2009-2014

Table 70

CBP Air and Marine Interdiction Program Funding & Market [$M] – 2009-2014

Table 71

Main Business Opportunities in Cooperation with CBP

Table 72

CBP Funding and Market – 2009-2014

Table 73

FEMA Operating Activities Program Funding & Market [$M] – 2009-2014

Table 74

FEMA National Capital Region Program Funding & Market [$M] – 2009-2014

Table 75

FEMA Urban Search and Rescue Program Funding & Market [$M] – 2009-2014

Table 76

FEMA State and Regional Preparedness Program Funding & Market [$M] – 2009-2014

Table 77

FEMA State HLS (SHSP) Program Funding & Market [$M] – 2010-2014

Table 78

FEMA Firefighter Support Grants Program Funding & Market [$M] – 2009-2014

Table 79

FEMA Regional Catastrophic Preparedness Grant Program Funding & Market [$M] – 2009-2014

Table 80

FEMA Emergency Management Performance Grants (EMPG) Program Funding & Market [$M] – 2009-2014

Table 81

FEMA Metropolitan Statistical Area (MSA) Preparedness Program Funding & Market [$M] – 2009-2014

Table 82

FEMA Urban Area Security Initiative (UASI) Program Funding & Market [$M] – 2009-2014

Table 83

FEMA Rail & Transit Security Grant Program Funding & Market [$M] – 2009-2014

Table 84

FEMA Port Security Grant Program Funding & Market [$M] – 2009-2014

Table 85

FEMA Buffer Zone Protection Program Funding & Market [$M] – 2009-2014

Table 86

FEMA Training, Measurement, and Exercise Program Funding & Market [$M] – 2009-2014

Table 87

FEMA National Exercise Program (NEP) Program Funding & Market [$M] – 2009-2014

Table 88

FEMA Continuing Training Grants Program Funding & Market [$M] – 2009-2014

Table 89

FEMA Center for Domestic Preparedness Program Funding & Market [$M] – 2009-2014

Table 90

FEMA National Domestic Preparedness Consortium Program Funding & Market [$M] – 2009-2014

Table 91

FEMA Technical Support (TA) and Evaluation and Assessment Program Funding & Market [$M] – 2009-2014

Table 92

FEMA Fire Administration Program Funding & Market [$M] – 2009-2014

Table 93

FEMA Radiological Emergency Preparedness Program Funding & Market [$M] – 2009-2014

Table 94

FEMA Emergency Food and Shelter Program Funding & Market [$M] – 2009-2014

Table 95

FEMA Disaster Relief Fund Program Funding & Market [$M] – 2009-2014

Table 96

FEMA Flood Hazard Mapping and Risk Analysis Program Funding & Market [$M] – 2009-2014

Table 97

FEMA National Flood Insurance Program (NFIP) Program Funding & Market [$M] – 2009-2014

Table 98

FEMA Mapping and Risk Analysis Program Funding & Market [$M] – 2009-2014

Table 99

FEMA Funding and Market – 2009-2014

Table 100

ICE Visa Security Program Funding & Market [$M] – 2009-2014

Table 101

ICE Criminal Alien Program Funding & Market [$M] – 2009-2014

Table 102

ICE Transportation and Removal Program Funding & Market [$M] – 2009-2014

Table 103

ICE Comprehensive Identification and Removal of Criminal Aliens Program Funding & Market [$M] – 2009-2014

Table 104

ICE Automation Modernization Program Funding & Market [$M] – 2009-2014

Table 105

ICE Managed IT Investment Program Funding & Market [$M] – 2009-2014

Table 106

ICE Investigations Program Funding & Market [$M] – 2009-2014

Table 107

ICE Domestic Investigations Program Funding & Market [$M] – 2009-2014

Table 108

ICE International Investigations Program Funding & Market [$M] – 2009-2014

Table 109

ICE Funding and Market – 2009-2014

Table 110

Coast Guard HLS and Non-HLS Missions

Table 111

USCG 2008-2014 Sub-Markets by Programs and Initiatives

Table 112

USCG Defense Readiness Program Funding & Market [$M] – 2009-2014

Table 113

USCG Migrant Interdiction Program Funding & Market [$M] – 2009-2014

Table 114

USCG Other Law Enforcement Measures Program Funding & Market [$M] – 2009-2014

Table 115

USCG Ports, Waterways and Coastal Security (PWCS) Program Funding & Market [$M] – 2009-2014

Table 116

USCG Funding and Market – 2009-2014

Table 117

Secret Service Major Operational Programs and Strategic Goals

Table 118

USSS Electronic Crimes Special Agent (ECSAP) Program Funding & Market [$M] – 2009-2014

Table 119

USSS Funding and Market – 2009-2014

Table 120

S&T Border & Maritime Security Program Funding & Market [$M] – 2009-2014

Table 121

S&T Border Officer Tools and Safety Program Funding & Market [$M] – 2009-2014

Table 122

S&T Border Technologies Program Funding & Market [$M] – 2010-2014

Table 123

S&T Maritime Technologies Program Funding & Market [$M] – 2010-2014

Table 124

S&T Cargo and Conveyance Security Program Funding & Market [$M] – 2010-2014

Table 125

S&T Chemical and Biological Program Funding & Market [$M] – 2009-2014

Table 126

S&T Systems Studies and Decision Tools Program Funding & Market [$M] – 2010-2014

Table 127

S&T Threat Awareness Program Funding & Market [$M] – 2010-2014

Table 128

S&T Surveillance and Detection R&D Program Funding & Market [$M] 2009-2014

Table 129

S&T Forensics Program Funding & Market [$M] – 2010-2014

Table 130

S&T Response and Restoration Program Funding & Market [$M] – 2010-2014

Table 131

S&T Foreign Animal Diseases Program Funding & Market [$M] – 2010-2014

Table 132

S&T Analysis Program Funding & Market [$M] – 2010-2014

Table 133

S&T Detection Program Funding & Market [$M] – 2010-2014

Table 134

S&T Response and Recovery Program Funding & Market [$M] – 2010-2014

Table 135

S&T Command, Control and Interoperability Program Funding & Market [$M] – 2009-2014

Table 136

S&T Basic/Futures Research (BFR) Program Funding & Market [$M] – 2010-2014

Table 137

S&T Office for Interoperability and Compatibility (OIC) Program Funding & Market [$M] – 2010-2014

Table 138

S&T Cyber-Security Research Tools and Techniques (RTT) Program Funding & Market [$M] – 2010-2014

Table 139

S&T Information Infrastructure Security (IIS) Program Funding & Market [$M] – 2010-2014

Table 140

S&T Next Generation Technology (NGT) Program Funding & Market [$M] -2010-2014

Table 141

S&T Emerging Threats Program Funding & Market [$M] – 2010-2014

Table 142

S&T Intelligence, Surveillance, and Reconnaissance (ISR) Program Funding & Market [$M] – 2010-2014

Table 143

S&T Risk Sciences Program Funding & Market [$M] – 2010-2014

Table 144

S&T Collaborative Information Sharing Program Funding & Market [$M] – 2010-2014

Table 145

S&T Knowledge Frameworks Program Funding & Market [$M] – 2010-2014

Table 146

S&T Advanced Forensic Technologies Program Funding & Market [$M] – 2010-2014

Table 147

S&T Investigative Technologies Program Funding & Market [$M] – 2010-2014

Table 148

S&T Explosives Related Program Funding & Market [$M] – 2009-2014

Table 149

S&T Cargo Program Funding & Market [$M] – 2010-2014

Table 150

S&T Canine Explosives Detection Program Funding & Market [$M] – 2010-2014

Table 151

S&T Check Point Program Funding & Market [$M] – 2010-2014

Table 152

S&T Homemade Explosives (HME) Program Funding & Market [$M] – 2010-2014

Table 153

S&T Manhattan II Program Funding & Market [$M] – 2010-2014

Table 154

S&T Conveyance Protection Program Funding & Market [$M] – 2010-2014

Table 155

S&T Explosives Research Program Funding & Market [$M] – 2010-2014

Table 156

S&T Prevent/Deter Program Funding & Market [$M] – 2010-2014

Table 157

S&T Predict Program Funding & Market [$M] – 2010-2014

Table 158

S&T Detect Program Funding & Market [$M] – 2010-2014

Table 159

S&T Respond/Defeat Program Funding & Market [$M] – 2010-2014

Table 160

S&T Mitigate Program Funding & Market [$M] – 2010-2014

Table 161

S&T Crosscutting Program Funding & Market [$M] – 2010-2014

Table 162

S&T Human Factors Program Funding & Market [$M] – 2009-2014

Table 163

S&T Human Systems Research and Engineering Program Funding & Market [$M] – 2010-2014

Table 164

S&T Technology Acceptance and Integration Program Funding & Market [$M] – 2010-2014

Table 165

S&T Biometrics Program Funding & Market [$M] – 2010-2014

Table 166

S&T Community Preparedness and Resilience Program Funding & Market [$M] – 2010-2014

Table 167

S&T Motivation and Intent (M&I) Program Funding & Market [$M] – 2010-2014

Table 168

S&T Suspicious Behavior Detection Program Funding & Market [$M] – 2010-2014

Table 169

S&T Infrastructure and Geophysical Program Funding & Market [$M] – 2009-2014

Table 170

S&T Advanced Surveillance and Detection Systems Program Funding & Market [$M] – 2010-2014

Table 171

S&T Modeling, Simulation, and Analysis Program Funding & Market [$M] – 2010-2014

Table 172

S&T Protective Technologies Program Funding & Market [$M] – 2010-2014

Table 173

S&T Response and Recovery Technologies Program Funding & Market [$M] – 2010-2014

Table 174

S&T Geophysical Program Funding & Market [$M] – 2010-2014

Table 175

S&T First Responder Technologies l Program Funding & Market [$M] – 2010-2014

Table 176

S&T Geospatial Analysis Program Funding & Market [$M] – 2011-2014

Table 177

S&T Incident Management Enterprise Program Funding & Market [$M] – 2010-2014

Table 178

S& Integrated Modeling, Mapping and Simulation Program Funding & Market [$M] – 2010-2014

Table 179

S&T Innovation Program Funding & Market [$M] – 2009-2014

Table 180

S&T Biometric Detector Program Funding & Market [$M] – 2010-2014

Table 181

S&T Future Attribute Screening Technologies Mobile Module (FASTM2) Program Funding & Market [$M] – 2010-2014

Table 182

S&T Multi-modal Tunnel Detect Program Funding & Market [$M] – 2010-2014

Table 183

S&T Rapid Liquid Component Detector (MagViz) Program Funding & Market [$M] – 2010-2014

Table 184

S&T Resilient Electric Grid (REG) Program Funding & Market [$M] – 2010-2014

Table 185

S&T Resilient Tunnel Program Funding & Market [$M] – 2010-2014

Table 186

S&T Safe Container /Time Recorded Ubiquitous Sensor Technology (TRUST) Program Funding & Market [$M] – 2010-2014

Table 187

S&T Very Low Cost Bio Agent Detect Program Funding & Market [$M] – 2010-2014

Table 188

S&T Wide Area Surveillance Program Funding & Market [$M] – 2010-2014

Table 189

S&T Operationally Deployable Explosives Mitigation Program Funding & Market [$M] – 2011-2014

Table 190

S&T Passive Methods for Precision Behavioral Screening Program Funding & Market [$M] – 2011-2014

Table 191

S&T Laboratory Facilities Program Funding & Market [$M] – 2009-2014

Table 192

S&T Radiological and Nuclear Program Funding & Market [$M] – 2011-2014

Table 193

S&T Nuclear Detection Advanced Technology Demonstration (ATD) Program Funding & Market [$M] – 2011-2014

Table 194

S&T Response and Recovery Program Funding & Market [$M] – 2011-2014

Table 195

S&T Nuclear Detection Exploratory Research Program Funding & Market [$M] – 2011-2014

Table 196

S&T Academic Research Initiative (ARI) Program Funding & Market [$M] – 2011-2014

Table 197

S&T Test and Evaluation Standards Program Funding & Market [$M] – 2009-2014

Table 198

S&T Transition Program Funding & Market [$M] – 2009-2014

Table 199

S&T Transition Program Funding & Market [$M] – 2009-2014

Table 200

S&T Funding and Market – 2009-2014

Table 201

DNDO Systems Engineering and Architecture Program Funding & Market [$M] – 2009-2014

Table 202

DNDO Systems Development Program Funding & Market [$M] – 2009-2014

Table 203

DNDO Transformational R&D Program Funding & Market [$M] – 2009-2014

Table 204

DNDO Assessment Program Funding & Market [$M] – 2009-2014

Table 205

DNDO Operations Support Program Funding [$M] – 2009-2014

Table 206

DNDO National Technical Nuclear Forensics Program Funding & Market [$M] – 2009-2014

Table 207

DNDO Radiation Portal Monitor Program Funding & Market [$M] – 2009-2014

Table 208

DNDO Securing the Cities Initiative Program Funding & Market [$M] – 2009-2014

Table 209

DNDO Human Portable Radiation Detection Systems Program Funding & Market [$M] – 2009-2014

Table 210

DNDO Funding and Market – 2009-2014

Table 211

DMO IT Services Program Funding & Market [$M] – 2009-2014

Table 212

DMO Infrastructure and Security Program Funding & Market [$M] – 2009-2014

Table 213

DMO National Security Systems (NSS) Program Funding & Market [$M] – 2009-2014

Table 214

DMO Human Resources Information Technology (HRIT) Program Funding & Market [$M] – 2009-2014

Table 215

DMO Headquarters Consolidation Program Funding & Market [$M] – 2009-2014

Table 216

DMO DHS HQ NAC Program Funding & Market [$M] – 2009-2014

Table 217

DMO Funding and Market – 2009-2014

Table 218

DHS I&A and OPS Funding and Market – 2009-2014

Table 219

FLETC Law Enforcement Training Program Funding & Market [$M] – 2009-2014

Table 220

FLETC Acquisition, Construction, Improvements & Related Program Funding & Market [$M] – 2009-2014

Table 221

FLETC Funding and Market – 2009-2014

Table 222

USCIS E-Verify Program Funding & Market [$M] – 2009-2014

Table 223

USCIS Real-ID Program Funding & Market [$M] – 2010-2014

Table 224

USCIS Systematic Alien Verification for Entitlements (SAVE) Program Funding & Market [$M] – 2010-2014

Table 225

USCIS Data Center Development Program Funding & Market [$M] – 2010-2014

Table 226

USCIS Funding and Market – 2009-2014

Table 227

NPPD Infrastructure Protection (IP) Program Funding & Market [$M] – 2009-2014

Table 228

NPPD Identification and Analysis Program Funding & Market [$M] – 2009-2014

Table 229

NPPD Coordination and Information Sharing Program Funding & Market [$M] – 2009-2014

Table 230

NPPD Mitigation Program Funding & Market [$M] – 2009-2014

Table 231

NPPD CS&C Program Funding & Market [$M] – 2009-2014

Table 232

NPPD US Computer Emergency Readiness Team Program Funding & Market [$M] – 2010-2014

Table 233

NPPD Strategic Initiatives Program Funding & Market [$M] – 2010-2014

Table 234

NPPD Outreach and Program Funding & Market [$M] – 2010-2014

Table 235

NPPD Priority Telecommunications Services Program Funding & Market [$M] – 2009-2014

Table 236

NPPD Next Generation Network Program Funding & Market [$M] – 2009-2014

Table 237

NPPD Programs to Study and Enhance Telecommunications Program Funding & Market [$M] – 2009-2014

Table 238

NPPD Critical Infrastructure Protection Program Funding & Market [$M] – 2009-2014

Table 239

NPPD Federal Protective Service Program Funding & Market [$M] – 2009-2014

Table 240

NPPD US-VISIT Program Funding & Market [$M] – 2009-2014

Table 241

US-VISIT Current Services O&M Projected Growth

Table 242

NPPD Funding and Market – 2009-2014

Table 243

OHA Medical and Bio-defense Program Funding & Market [$M] – 2009-2014

Table 244

OHA Bio-Watch Program Funding & Market [$M] – 2009-2014

Table 245

OHA Rapidly Deployable Chemical Detection System Program Funding & Market [$M] – 2009-2014

Table 246

OHA National Bio-Surveillance Integration Center Program Funding & Market [$M] – 2009-2014

Table 247

OHA Funding and Market – 2009-2014

Table 248

OIG Funding and Market – 2009-2014

Table 249

DOD HLS Funding and Market – 2011-2014

Table 250

DHHS HLS Market [$M] by Mission & Programs – 2009-2014

Table 251

DHHS HLS Funding and Market – 2009-2014

Table 252

DOJ HLS Funding and Market – 2009-2014

Table 253

DOE HLS Funding and Market – 2011-2014

Table 254

DOS HLS Funding and Market – 2011-2014

Table 255

USDA HLS Funding and Market – 2011-2014

Table 256

NSF HLS Funding and Market – 2011-2014

Table 257

NASA HLS Funding and Market – 2011-2014

Table 258

DOT HLS Funding and Market – 2011-2014

Table 259

DOC HLS Funding and Market – 2011-2014

Figures

Figure 1

US HLS-HLD Spending [$ Billion] by Funding Sources

Figure 2

US HLS-HLD Market [$ Billion] by Funding Sources

Figure 3

DHS HLS Funding [$M] vs. Other US HLS-HLD Funding Sources

Figure 4

US Federal HLS Structure

Figure 5

US HLS-HLD Outlay [$ Billion] by Key Funding Source – 2009-2014

Figure 6

US HLS-HLD Outlay [$ Billion] by Detailed Funding Source – 2009 & 2014

Figure 7

US HLS-HLD Outlay [%] by Detailed Funding Source – 2009 & 2014

Figure 8

US HLS-HLD Market [$ Billion] by Key “Demand Side” Sectors – 2009-2014

Figure 9

US HLS-HLD Market [$ Billion] by “Demand Side” Sector – 2009 & 2014

Figure 10

US HLS-HLD Market Share [%] by “Demand Side” Sector

Figure 11

Federal HLS Funding [$B] by Departments – 2009-2014

Figure 12

Federal HLS Funding Share [%] by Departments – 2009 & 2014

Figure 13

Federal HLS Market Share [%] by Departments – 2009 & 2014

Figure 14

Federal HLS Funding [$B] by Mission Activity – 2010-2014

Figure 15

Federal HLS Funding Share [%] by Mission Activity – 2010 &2014

Figure 16

HLS / HLD Responsibilities

Figure 17

Federal Government – Industry HLS Life Cycle

Figure 18

HLS Industry, Government Relationship

Figure 19

The HLS Vendor Client Inter-Relationship

Figure 20

HLD Market SWOT Analysis

Figure 21

HLD Market Competitiveness Analysis

Figure 22

Federal HLS Funding by Department [$B] 2009-2014

Figure 23

Federal HLS Funding by Department [%] 2014

Figure 24

U. S. Federal Consolidated HLS Market by Department [$B] 2009-2014

Figure 25

HLS Market Share by Major Departments [%] 2014

Figure 26

Total Federal HLS Budget vs. Market Forecasts [$B] 2009-2014

Figure 27

Federal HLS Funding Forecast by Mission Activity [$M] 2011-2014

Figure 28

Intelligence & Warning – Market Challenges, Drivers, Inhibitors and Technology Challenges

Figure 29

Border & Transportation Security Factors 2011-2014

Figure 30

Domestic Counterterrorism Market Challenges, Drivers, Inhibitors and Technology Challenges

Figure 31

Terrorist Attacks Prevention and Mitigation Federal HLS Funding [$B] 2011-2014

Figure 32

Protecting Critical Infrastructure & Key Assets Key Influence Elements

Figure 33

Defending Against Catastrophic Threats – Key Influence Elements

Figure 34

Critical Infrastructure Protection Federal HLS Funding [$B] 2011-2014

Figure 35

Emergency Preparedness and Response Key Influence Factors

Figure 36

Incidents and CBRNE Attacks Recovery Federal HLS Funding 2011-2014

Figure 37

DHS Organizational Structure

Figure 38

DHS HLS Budget Expenditure vs. HLS Market [$B] – 2009-2014

Figure 39

DHS’ Procurement Offices Interplay

Figure 40

DHS Market [$B] by DHS Agency – 2009-2014

Figure 41

DHS Market Forecast by DHS Agency Share [%]

Figure 42

TSA Organizational Structure

Figure 43

TSA Screening Partnership Program Funding & Market [$M] – 2009-2014

Figure 44

TSA Passenger and Baggage Screening Program Funding & Market [$M] – 2009-2014

Figure 45

TSA Screening Training Program Funding & Market [$M] – 2009-2014

Figure 46

TSA Checkpoint Support Program Funding & Market [$M] – 2009-2014

Figure 47

TSA EDS and ETD Procurement and Installation Program Funding & Market [$M] – 2009-2014

Figure 48

TSA Screening Technology Maintenance & Utilities Program Funding & Market [$M] – 2009-2014

Figure 49

TSA Aviation Regulation and Other Enforcement Program Funding & Market [$M] – 2009-2014

Figure 50

TSA Airport Management, IT, and Support Program Funding & Market [$M] – 2009-2014

Figure 51

TSA FFDO and Flight Crew Training Program Funding & Market [$M] – 2009-2014

Figure 52

TSA Air Cargo Program Funding & Market [$M] – 2009-2014

Figure 53

TSA Surface Transportation Security Program Funding & Market [$M] – 2009-2014

Figure 54

TSA Secure Flight Program Funding & Market [$M] – 2009-2014

Figure 55

TSA Transportation Worker Identification Credential (TWIC) Funding & Market [$M] – 2009-2014

Figure 56

TSA Hazardous Materials Endorsement Threat Assessment Program Funding & Market [$M] – 2009-2014 (HTAP)

Figure 57

TSA Alien Flight Student Program Funding & Market [$M] – 2009-2014 (AFSP)

Figure 58

TSA Crew and Other Vetting Program Funding & Market [$M] – 2009-2014

Figure 59

TSA Certified Cargo Screening Program Funding & Market [$M] – 2009-2014

Figure 60

TSA Large Aircraft Security Plan Program Funding & Market [$M] – 2009-2014

Figure 61

TSA Secure Identification Display Area Checks Program Funding & Market [$M] – 2009-2014

Figure 62

TSA Transportation Security Support Program Funding & Market [$M] – 2009-2014

Figure 63

TSA Federal Air Marshal Service Program Funding & Market [$M] – 2009-2014

Figure 64

TSA Consolidated Funding vs. Market [$M] – 2009-2014

Figure 65

Counter-MANPAD Project Chloe

Figure 66

TSA Market [$M] – 2009-2014

Figure 67

Borders Under Effective Control

Figure 68

CBP Organizational Structure

Figure 69

Conceptual View of SBInet Technologies to be Deployed

Figure 70

CBP Secure Border Initiative Program Funding & Market [$M] – 2009-2014

Figure 71

CBP Inspection and Detection Technology Program Funding & Market [$M] – 2009-2014

Figure 72

CBP Systems for Targeting Program Funding & Market [$M] – 2009-2014

Figure 73

CBP C-TPAT Program Funding & Market [$M] – 2009-2014

Figure 74

CBP International Cargo Screening – CSI and SFI Funding & Market [$M] – 2009-2014

Figure 75

CBP Other International Funding & Market [$M] – 2009-2014

Figure 76

CBP Trusted Traveler Programs (TT) Funding & Market [$M] – 2009-2014

Figure 77

CBP Automated Commercial Environment (ACE) Funding & Market [$M] – 2009-2014

Figure 78

CBP Critical Operations Protection & Processing Support (COPPS) /TECS Modernization Funding & Market [$M] – 2009-2014

Figure 79

CBP Facility Construction and Sustainment Program Funding & Market [$M] – 2009-2014

Figure 80

CBP Air and Marine Interdiction Funding & Market [$M] – 2009-2014

Figure 81

CBP Funding vs. HLS Market [$B] – 2009-2014

Figure 82

CBP Market [$M] – 2009-2014

Figure 83

FEMA Organizational Structure

Figure 84

FEMA Operating Activities Program Funding & Market [$M] – 2009-2014

Figure 85

FEMA National Capital Region Program Funding & Market [$M] – 2009-2014

Figure 86

FEMA Urban Search and Rescue Program Funding & Market [$M] – 2009-2014

Figure 87

FEMA State and Regional Preparedness Program Funding & Market [$M] – 2009-2014

Figure 88

FEMA State HLS (SHSP) Program Funding & Market [$M] – 2010-2014

Figure 89

FEMA Firefighter Support Grants Program Funding & Market [$M] – 2009-2014

Figure 90

FEMA Regional Catastrophic Preparedness Grant Program Funding & Market [$M] – 2009-2014

Figure 91

FEMA Emergency Management Performance Grants (EMPG) Program Funding & Market [$M] – 2009-2014

Figure 92

FEMA Metropolitan Statistical Area (MSA) Preparedness Program Funding & Market [$M] – 2009-2014

Figure 93

FEMA Urban Area Security Initiative (UASI) Program Funding & Market [$M] – 2009-2014

Figure 94

FEMA Rail & Transit Security Grant Program Funding & Market [$M] – 2009-2014

Figure 95

FEMA Port Security Grant Program Funding & Market [$M] – 2009-2014

Figure 96

FEMA Buffer Zone Protection Program Funding & Market [$M] – 2009-2014

Figure 97

FEMA Training, Measurement, and Exercise Program Funding & Market [$M] – 2009-2014

Figure 98

FEMA National Exercise Program (NEP) Program Funding & Market [$M] – 2009-2014

Figure 99

FEMA Continuing Training Grants Program Funding & Market [$M] – 2009-2014

Figure 100

FEMA Center for Domestic Preparedness Program Funding & Market [$M] – 2009-2014

Figure 101

FEMA National Domestic Preparedness Consortium Program Funding & Market [$M] – 2009-2014

Figure 102

FEMA Technical Support (TA) and Evaluation and Assessment Program Funding & Market [$M] – 2009-2014

Figure 103

FEMA Fire Administration Program Funding & Market [$M] – 2009-2014

Figure 104

FEMA Radiological Emergency Preparedness Program Funding & Market [$M] – 2009-2014

Figure 105

FEMA Emergency Food and Shelter Program Funding & Market [$M] – 2009-2014

Figure 106

FEMA Disaster Relief Fund Program Funding & Market [$M] – 2009-2014

Figure 107

FEMA Flood Hazard Mapping and Risk Analysis Program Funding & Market [$M] – 2009-2014

Figure 108

FEMA National Flood Insurance Program (NFIP) Program Funding & Market [$M] – 2009-2014

Figure 109

FEMA Mapping and Risk Analysis Program Funding & Market [$M] – 2009-2014

Figure 110

FEMA Consolidated Funding vs. Market [$M] – 2009-2014

Figure 111

FEMA Market [$M] – 2009-2014

Figure 112

ICE Organizational Structure

Figure 113

ICE Visa Security Program Funding & Market [$M] – 2009-2014

Figure 114

ICE Criminal Alien Program Funding & Market [$M] – 2009-2014

Figure 115

ICE Transportation and Removal Program Funding & Market [$M] – 2009-2014

Figure 116

ICE Comprehensive Identification and Removal of Criminal Aliens Program Funding & Market [$M] – 2009-2014

Figure 117

ICE Automation Modernization Program Funding & Market [$M] – 2009-2014

Figure 118

ICE Managed IT Investment Program Funding & Market [$M] – 2009-2014

Figure 119

ICE Investigations Program Funding & Market [$M] – 2009-2014

Figure 120

ICE Domestic Investigations Program Funding & Market [$M] – 2009-2014

Figure 121

ICE International Investigations Program Funding & Market [$M] – 2009-2014

Figure 122

ICE Consolidated Funding vs. Market [$B] – 2009-2014

Figure 123

ICE Consolidated Market [$M] – 2009-2014

Figure 124

US Coast Guard Funding by Missions

Figure 125

Variety of Technical Means Used by Coast Guards

Figure 126

Coast Guard Deep Water Maritime Security Platforms

Figure 127

US Coast Guard Organizational Structure

Figure 128

USCG Defense Readiness Program Funding & Market [$M] – 2009-2014

Figure 129

USCG Migrant Interdiction Program Funding & Market [$M] – 2009-2014

Figure 130

USCG Other Law Enforcement Measures Program Funding & Market [$M] – 2009-2014

Figure 131

USCG Ports, Waterways and Coastal Security (PWCS) Program Funding & Market [$M] – 2009-2014

Figure 132

USCG Funding vs. Market [$M] – 2009-2014

Figure 133

USCG Market [$M] – 2009-2014

Figure 134

USSS Electronic Crimes Special Agent (ECSAP) Program Funding & Market [$M] – 2009-2014

Figure 135

USSS Funding vs. Market [$M] – 2009-2014

Figure 136

USSS Market [$M] – 2009-2014

Figure 137

Directorate of S&T Partners and Affiliates

Figure 138

The S&T six B’s

Figure 139

S&T Organizational Structure

Figure 140

S&T Border & Maritime Security Program Funding & Market [$M] – 2009-2014

Figure 141

S&T Border Officer Tools and Safety Program Funding & Market [$M] 2009-2014

Figure 142

S&T Border Technologies Program Funding & Market [$M] – 2010-2014

Figure 143

S&T Maritime Technologies Program Funding & Market [$M] – 2010-2014

Figure 144

S&T Cargo and Conveyance Security Program Funding & Market [$M] 2010-2014

Figure 145

S&T Chemical and Biological Program Funding & Market [$M] – 2009-2014

Figure 146

S&T Systems Studies and Decision Tools Program Funding & Market [$M] – 2010-2014

Figure 147

S&T Threat Awareness Program Funding & Market [$M] – 2010-2014

Figure 148

S&T Surveillance and Detection R&D Program Funding & Market [$M] 2009-2014

Figure 149

S&T Forensics Program Funding & Market [$M] – 2010-2014

Figure 150

S&T Response and Restoration Program Funding & Market [$M] – 2010-2014

Figure 151

S&T Foreign Animal Diseases Program Funding & Market [$M] – 2010-2014

Figure 152

S&T Analysis Program Funding & Market [$M] – 2010-2014

Figure 153

S&T Detection Program Funding & Market [$M] – 2010-2014

Figure 154

S&T Response and Recovery Program Funding & Market [$M] – 2010-2014

Figure 155

S&T Command, Control and Interoperability Program Funding & Market [$M] – 2009-2014

Figure 156

S&T Basic/Futures Research (BFR) Program Funding & Market [$M] – 2010-2014

Figure 157

S&T Office for Interoperability and Compatibility (OIC) Program Funding & Market [$M] – 2010-2014

Figure 158

S&T Cyber-Security Research Tools and Techniques (RTT) Program Funding & Market [$M] – 2010-2014

Figure 159

S&T Information Infrastructure Security (IIS) Program Funding & Market [$M] – 2010-2014

Figure 160

S& Next Generation Technology (NGT) Program Funding & Market [$M] – 2010-2014

Figure 161

S&T Emerging Threats Program Funding & Market [$M] – 2010-2014

Figure 162

S&T Intelligence, Surveillance, and Reconnaissance (ISR) Program Funding & Market [$M] – 2010-2014

Figure 163

S&T Risk Sciences Program Funding & Market [$M] 2010-2014

Figure 164

S&T Collaborative Information Sharing Program Funding & Market [$M] – 2010-2014

Figure 165

S&T Knowledge Frameworks Program Funding & Market [$M] – 2010-2014

Figure 166

S&T Advanced Forensic Technologies Program Funding & Market [$M] – 2010-2014

Figure 167

S&T Investigative Technologies Program Funding & Market [$M] – 2010-2014

Figure 168

S&T Explosives Related Program Funding & Market [$M] – 2009-2014

Figure 169

S&T Cargo Program Funding & Market [$M] – 2010-2014

Figure 170

S&T Canine Explosives Detection Program Funding & Market [$M] – 2010-2014

Figure 171

S&T Check Point Program Funding & Market [$M] – 2010-2014

Figure 172

S&T Homemade Explosives (HME) Program Funding & Market [$M] – 2010-2014

Figure 173

S&T Manhattan II Program Funding & Market [$M] – 2010-2014

Figure 174

S&T Conveyance Protection Program Funding & Market [$M] – 2010-2014

Figure 175

S&T Explosives Research Program Funding & Market [$M] – 2010-2014

Figure 176

S&T Prevent/Deter Program Funding & Market [$M] – 2010-2014

Figure 177

S&T Predict Program Funding & Market [$M] – 2010-2014

Figure 178

S&T Detect Program Funding & Market [$M] – 2010-2014

Figure 179

S&T Respond/Defeat Program Funding & Market [$M] – 2010-2014

Figure 180

S&T Mitigate Program Funding & Market [$M] – 2010-2014

Figure 181

S&T Crosscutting Program Funding & Market [$M] – 2010-2014

Figure 182

S&T Human Factors Program Funding & Market [$M] – 2009-2014

Figure 183

Human Systems Research and Engineering Program Funding & Market [$M] -2010-2014

Figure 184

S&T Technology Acceptance and Integration Program Funding & Market [$M] – 2010-2014

Figure 185

S&T Biometrics Program Funding & Market [$M] – 2010-2014

Figure 186

S&T Community Preparedness and Resilience Program Funding & Market [$M] – 2010-2014

Figure 187

S&T Motivation and Intent (M&I) Program Funding & Market [$M] – 2010-2014

Figure 188

S&T Suspicious Behavior Detection Program Funding & Market [$M] – 2010-2014

Figure 189

S&T Infrastructure and Geophysical Program Funding & Market [$M] – 2009-2014

Figure 190

S&T Advanced Surveillance and Detection Systems Program Funding & Market [$M] – 2010-2014

Figure 191

S&T Modeling, Simulation, and Analysis Program Funding & Market [$M] – 2010-2014

Figure 192

S&T Protective Technologies Program Funding & Market [$M] – 2010-2014

Figure 193

S&T Response and Recovery Technologies Program Funding & Market [$M] – 2010-2014

Figure 194

S&T Geophysical Program Funding & Market [$M] – 2010-2014

Figure 195

S&T First Responder Technologies Program Funding & Market [$M] – 2010-2014

Figure 196

S&T First Geospatial Analysis Program Funding & Market [$M] – 2011-2014

Figure 197

S&T Incident Management Enterprise Program Funding & Market [$M] – 2010-2014

Figure 198

S& Integrated Modeling, Mapping and Simulation Program Funding & Market [$M] – 2010-2014

Figure 199

S&T Innovation Program Funding & Market [$M] – 2009-2014

Figure 200

S&T Biometric Detector Program Funding & Market [$M] – 2010-2014

Figure 201

S&T Future Attribute Screening Technologies Mobile Module (FASTM2) Project Program Funding & Market [$M] – 2010-2014

Figure 202

S&T Multi-modal Tunnel Detect Project Program Funding & Market [$M] – 2010-2014

Figure 203

S&T Rapid Liquid Component Detector (MagViz) Project Program Funding & Market [$M] – 2010-2014

Figure 204

S&T Resilient Electric Grid (REG) Project Program Funding & Market [$M] -2009-2014

Figure 205

S&T Resilient Tunnel Project Program Funding & Market [$M] – 2010-2014

Figure 206

S&T Safe Container /Time Recorded Ubiquitous Sensor Technology (TRUST) Program Funding & Market [$M] – 2010-2014

Figure 207

S&T Very Low Cost Bio Agent Detect Program Funding & Market [$M] 2010-2014

Figure 208

S&T Wide Area Surveillance Program Funding & Market [$M] – 2010-2014

Figure 209

S&T Operationally Deployable Explosives Mitigation Program Funding & Market [$M] – 2011-2014

Figure 210

S&T Passive Methods for Precision Behavioral Screening Program Funding & Market [$M] – 2011-2014

Figure 211

S&T Laboratory Facilities Program Funding & Market [$M] – 2009-2014

Figure 212

S&T Radiological and Nuclear Program Funding & Market [$M] – 2011-2014

Figure 213

S&T Nuclear Detection Advanced Technology Demonstration (ATD) Program Funding & Market [$M] – 2011-2014

Figure 214

S& Response and Recovery Program Funding & Market [$M] – 2011-2014

Figure 215

S&T Nuclear Detection Exploratory Research Program Funding & Market [$M] – 2011-2014

Figure 216

S& Academic Research Initiative (ARI) Program Funding & Market [$M] – 2011-2014

Figure 217

S&T Test and Evaluation Standards Program Funding & Market [$M] 2009-2014

Figure 218

S&T Transition Program Funding & Market [$M] – 2009-2014

Figure 219

S&T Transition Program Funding & Market [$M] – 2009-2014

Figure 220

S&T Funding vs. Market [$M] – 2009-2014

Figure 221

S&T Market [$M] – 2009-2014

Figure 222

Domestic Detection and Interdiction Architecture

Figure 223

DNDO FY 2011 Organizational Structure

Figure 224

DNDO Systems Engineering and Architecture Program Funding & Market [$M] – 2009-2014

Figure 225

DNDO Systems Development Program Funding & Market [$M] – 2009-2014

Figure 226

DNDO Transformational R&D Program Funding & Market [$M] – 2009-2014

Figure 227

DNDO Assessment Program Funding & Market [$M] – 2009-2014

Figure 228

DNDO Operations Support Program Funding [$M] – 2009-2014

Figure 229

DNDO National Technical Nuclear Forensics Program Funding & Market [$M] – 2009-2014

Figure 230

DNDO Radiation Portal Monitor Program Funding & Market [$M] – 2009-2014

Figure 231

DNDO Securing the Cities Initiative Program Funding & Market [$M] – 2009-2014

Figure 232

DNDO Human Portable Radiation Detection Systems Program Funding & Market [$M] – 2009-2014

Figure 233

DNDO Funding and Market [$M] – 2009-2014

Figure 234

DNDO Market [$M] – 2009-2014

Figure 235

Departmental Management & Operations Organizational Structure

Figure 236

DMO IT Services Program Funding & Market [$M] – 2009-2014

Figure 237

DMO Infrastructure and Security Program Funding & Market [$M] – 2009-2014

Figure 238

DMO National Security Systems (NSS) Program Funding & Market [$M] – 2009-2014

Figure 239

DMO Human Resources Information Technology (HRIT) Program Funding & Market [$M] – 2009-2014

Figure 240

DMO Headquarters Consolidation Program Funding & Market [$M] – 2009-2014

Figure 241

DMO DHS HQ NAC Program Funding & Market [$M] – 2009-2014

Figure 242

DMO Funding vs. Market [$M] – 2009-2014

Figure 243

DMO Market [$M] – 2009-2014

Figure 244

A&O Funding vs. Market [$M] – 2009-2014

Figure 245

DHS I&A and OPS Market [$M] – 2009-2014

Figure 246

FLETC Organizational Structure

Figure 247

FLETC Law Enforcement Training Program Funding & Market [$M] – 2009-2014

Figure 248

FLETC Acquisition, Construction, Improvements & Related Program Funding & Market [$M] – 2009-2014

Figure 249

FLETC Funding vs. Market [$M] – 2009-2014

Figure 250

FLETC Market [$M] – 2009-2014

Figure 251

USCIS Organizational Structure

Figure 252

USCIS E-Verify Program Funding & Market [$M] – 2009-2014

Figure 253

USCIS Real-ID Program Funding & Market [$M] – 2009-2014

Figure 254

USCIS Systematic Alien Verification for Entitlements (SAVE) Program Funding & Market [$M] – 2010-2014

Figure 255

USCIS Data Center Development Program Funding & Market [$M] – 2010-2014

Figure 256

USCIS Market [$M] – 2009-2014

Figure 257

NPPD Infrastructure Protection (IP) Program Funding & Market [$M] – 2009-2014

Figure 258

NPPD Infrastructure Protection (IP) Program Funding & Market [$M] – 2009-2014

Figure 259

NPPD Coordination and Information Sharing Program Funding & Market [$M] – 2009-2014

Figure 260

NPPD Mitigation Program Funding & Market [$M] – 2009-2014

Figure 261

NPPD CS&C Program Funding & Market [$M] – 2009-2014

Figure 262

NPPD US Computer Emergency Readiness Team Program Funding & Market [$M] – 2010-2014

Figure 263

NPPD Strategic Initiatives Program Funding & Market [$M] – 2010-2014

Figure 264

NPPD Outreach and Program Funding & Market [$M] – 2010-2014

Figure 265

NPPD Priority Telecommunications Services Program Funding & Market [$M] – 2009-2014

Figure 266

NPPD Next Generation Network Program Funding & Market [$M] – 2009-2014

Figure 267

NPPD Programs to Study and Enhance Telecommunications Program Funding & Market [$M] – 2009-2014

Figure 268

NPPD Critical Infrastructure Protection Program Funding & Market [$M] – 2009-2014

Figure 269

NPPD Federal Protective Service Program Funding & Market [$M] – 2009-2014

Figure 270

NPPD US-VISIT Program Funding & Market [$M] – 2009-2014

Figure 271

NPPD Funding vs. Market [$M] – 2009-2014

Figure 272

NPPD Market [$M] – 2009-2014

Figure 273

OHA Medical and Bio-defense Program Funding & Market [$M] – 2009-2014

Figure 274

OHA Bio-Watch Program Funding & Market [$M] – 2009-2014

Figure 275

OHA Rapidly Deployable Chemical Detection System Program Funding & Market [$M] – 2009-2014

Figure 276

OHA National Bio-Surveillance Integration Center Program Funding & Market [$M] – 2009-2014

Figure 277

OHA Funding vs. Market [$M] – 2009-2014

Figure 278

OHA Market [$M] – 2009-2014

Figure 279

OIG Funding vs. Market [$M] – 2009-2014

Figure 280

OIG Market [$M] – 2009-2014

Figure 281

DOD HLS Funding vs. HLS Market [$M] – 2009-2014

Figure 282

DOD Funding Structure by Mission [%], 2011

Figure 283

DOD HLS Market [$M] – 2009-2014

Figure 284

DHHS Organizational Structure

Figure 285

FDA Organization & Units

Figure 286

HHS HLS Funding vs. HLS Market [$M] – 2009-2014

Figure 287

DHHS HLS Market [$M] – 2009-2014

Figure 288

DHHS Funding Structure by Mission [%], 2011

Figure 289

DOJ Organizational Structure

Figure 290

FBI Organizational Structure

Figure 291

DOJ HLS Funding & Market [$M] – 2009-2014

Figure 292

DOJ HLS Market [$M] – 2009-2014

Figure 293

DOJ HLS Funding Structure by Mission [%], 2011

Figure 294

DOE Organizational Structure

Figure 295

DOE Funding vs. Market [$M] – 2009-2014

Figure 296

DOE Funding Structure by Mission [%], 2011

Figure 297

DOE HLS Market [$M] – 2009-2014

Figure 298

DOS Organizational Structure

<

Questions about this report? Contact Sales : 1-571-527-1010 or Analysts : 1-202-455-0966

1

Interested in this report? Need more information? Ask a Question!