| 1 |

Executive Summary |

| 1.1 |

Key Findings and Conclusions |

| 1.2 |

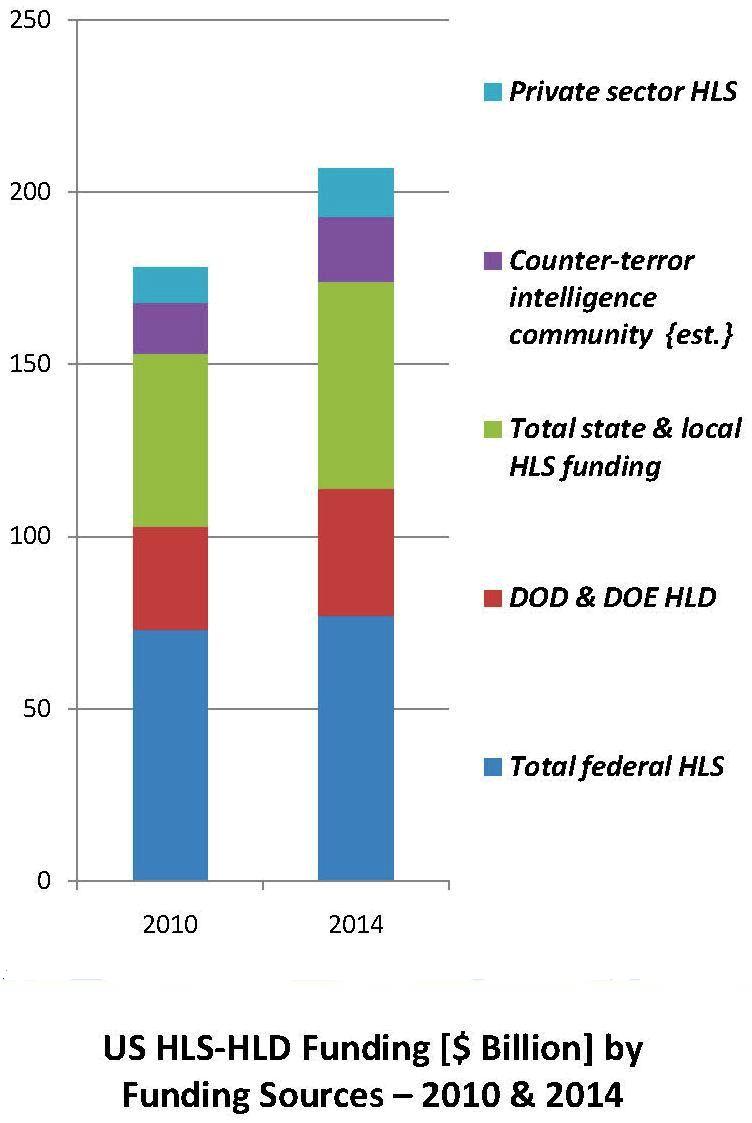

US HLD and Counter-Terror Intelligence Funding Overview |

| 1.3 |

US HLD and Counter-Terror Intelligence Market Overview |

| 2 |

Introduction |

| 2.1 |

Scope |

| 2.2 |

The Report Scenario |

| 2.3 |

Terms of Reference |

| 3 |

US HLS-HLD Organization |

| 3.1 |

US Federal HLS-HLD Structure |

| 3.2 |

Interplay Between HLD, Intelligence Community and HLS Agencies |

| 4 |

Homeland Defense (HLD) Market |

| 4.1 |

Introduction |

| 4.2 |

HLD Market Drivers |

| 4.3 |

HLD Market Inhibitors |

| 4.4 |

HLD Market SWOT Analysis |

| 4.5 |

HLD Market Competitive Analysis |

| 4.6 |

HLD Market Dynamics |

| 4.7 |

DOD HLD Missions and Organizations |

| 4.8 |

The Northern Command (NORTHCOM) |

| 4.8.1 |

Northern Command’s HLD Missions |

| 4.8.2 |

NORTHCOM’s Civil Support Missions |

| 4.8.3 |

DOD’s Structure for Interagency Coordination of HLD & Civil Support Missions |

| 4.8.4 |

HLD Strategic Concept |

| 4.8.5 |

2011-2014 HLD Market Background |

| 4.8.6 |

Enabling DOD HLD Capabilities |

| 4.9 |

HLS-HLD National Response Plan |

| 4.1 |

HLS-HLD CBRNE Consequence Management |

| 4.10.1 |

HLD Airspace Alert Operations |

| 4.11 |

DOD & DOE HLD Nuclear Weapons Security Programs & Markets |

| 4.11.1 |

Air Force Nuclear Weapons Security: Military Personnel Program & Market – 2011-2014 |

| 4.11.2 |

Air Force Nuclear Weapons Security: Weapons Procurement Program & Market – 2011-2014 |

| 4.11.3 |

Air Force Nuclear Weapons Security: Operations & Equipment Maintenance Program & Market – 2011-2014 |

| 4.11.4 |

Air Force Nuclear Weapons Security: Construction Program & Market – 2011-2014 |

| 4.11.5 |

Air Force Nuclear Weapons Security: Other Programs & Markets – 2011-2014 |

| 4.11.6 |

Navy Nuclear Weapons Security: Operations & Systems Maintenance Program & Market – 2011-2014 |

| 4.11.7 |

Navy Nuclear Weapons Security: Construction Program & Market – 2011-2014 |

| 4.11.8 |

Navy Nuclear Weapons Security: Navy & Marine Corps Manpower Program & Market – 2011-2014 |

| 4.11.9 |

Navy Nuclear Weapons Security: Other Programs & Markets – 2011-2014 |

| 4.11.10 |

Navy Nuclear Weapons Security: Weapons Procurement Program & Market – 2011-2014 |

| 4.11.11 |

OST Nuclear Weapons Security: Mission Capacity Program & Market – 2011-2014 |

| 4.11.12 |

OST Nuclear Weapons Security: Program Management Program & Market – 2011-2014 |

| 4.11.13 |

OST Nuclear Weapons Security: Security Infrastructure Program & Market – 2011-2014 |

| 4.11.14 |

OST Nuclear Weapons Security: Security & Safety Capability Program & Market – 2011-2014 |

| 4.11.15 |

Pantex Nuclear Weapons Security: Security Personnel Program & Market – 2011-2014 |

| 4.11.16 |

Pantex Nuclear Weapons Security: Physical Security Program & Market – 2011-2014 |

| 4.11.17 |

Pantex Nuclear Weapons Security: Other Program & Market – 2011-2014 |

| 4.12 |

The US HLD Consolidated Spending and Market – 2011-2014 |

| 5 |

HLS Related Intelligence Community (IC) Market 2011-2014 |

| 5.1 |

Counter-Terror IC Market Drivers |

| 5.2 |

Counter-Terror IC Market Inhibitors |

| 5.3 |

Counter-Terror IC Market SWOT Analysis |

| 5.4 |

Counter-Terror IC Market Competitive Analysis |

| 5.5 |

Counter-Terror IC Market Dynamics |

| 5.6 |

The US HLS Related Intelligence Community |

| 5.6.1 |

The Office of the Director of National Intelligence |

| 5.7 |

HLS Related IC Perimeter Security Market – 2011-2014 |

| 5.8 |

HLS related IC Information Technology Market – 2011-2014 |

| 5.8.1 |

HLS Related Intelligence Community IT |

| 5.8.2 |

HLS related Managerial & Meta Systems Operation IT |

| 5.8.3 |

IC Information Handling and Haring IT |

| 5.8.4 |

HLS Related Information Technology Market – 2011-2010 |

| 5.9 |

Contracted HLS Related IC Professional Personnel Market -2011-2014 |

| 5.1 |

Contracted Guarding/Security Personnel Market – 2011-2014 |

| 5.11 |

Communication Equipment and Services Market – 2011-2014 |

| 5.12 |

Security Clearance Services Market – 2011-2014 |

| 5.13 |

Employee and Visitors Screening Market – 2011-2014 |

| 5.14 |

Contracted Services Market – 2011-2014 |

| 5.15 |

Business Opportunities and Challenges |

| 5.16 |

Market Overview |

| 5.17 |

Sub- Market Business Opportunities |

| 5.18 |

Intelligence Contractors |

| 5.19 |

Counter-Terror Intelligence Market – 2011-2014 |