Description

See also the latest version of this report

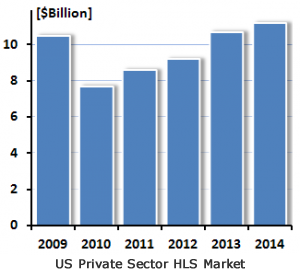

The US economic downturn has had an adverse effect on the 2010 US Private Sector Homeland Security (HLS) market. Despite bottom-line concerns, the private sector has a strong demand for HLS related products and services.

Whilst the economic factors may have changed growth expectations in 2010, the market is positioned to recover strongly in the 2011-2014 period.

Key changes and trends have also had a significant impact on the private sector market. There is a trend towards upgrading of the chemical industry security, smart grid security systems, cyber security, perimeter security, command, control & communication systems, IT systems and workforce & visitors screening systems.

This report is the first one addressing this multi-billion market overlooked by many. It is an essential tool for decision makers who are assessing or seeking an in-depth understanding of business opportunities in this market.

Contrary to what many in the industry believe, the report reveals that:

- The private sector procurement of homeland security related products and services represents 15-16% of the total US Homeland Security market.

- The US private sector HLS market is larger than the combined federal

aviation, maritime and land transportation HLS markets. - Over the next five years, the US private sector HLS market is

forecasted to grow at a CAGR of 9.1% from $7.7 billion in 2010 to $11.2 billion by 2014. - The US private sector controls 86% of the nation high-priority infrastructure sites.

- Industry sectors – such as smart grid security and chemical industry security – provide unique business opportunities to new market entrants.

The markets are presented from two vantage points:

- Products and services sectors (e.g., Explosives & Weapons Screening, Information Technology, Perimeter Security).

- Private sector industries (e.g., Chemical industry, Banking & Finance, Defense Industrial Base, Electric Utilities, Nuclear Power industry).