| 1 |

Executive Summary |

| 1.1 |

Major Findings |

| 1.2 |

Major Conclusions |

| 1.3 |

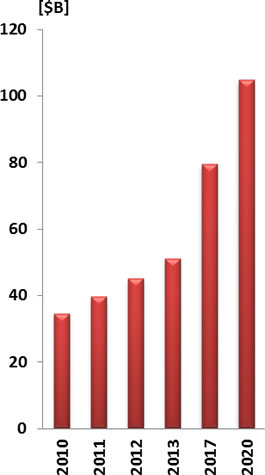

China HLS & Public Safety Market – 2013-2020 |

| 1.3.1 |

China vs. U.S.: GDP, Defense and HLS & Public Safety |

| 1.3.2 |

China HLS & Public Safety Market Dynamics |

| 1.3.3 |

China HLS & Public Safety Market by Vertical Submarket |

| 1.3.4 |

Market by Vertical Submarket: Market Share of Foreign Based Companies |

| 1.3.5 |

China HLS & Public Safety Markets by Technology |

| 1.3.6 |

Market by Technology – Market Share of Foreign Based Companies |

| |

MARKET ANALYSIS |

| 2 |

Defense Expenditure, HLS & Public Safety Expenditure and GDP: China vs. U.S. |

| 3 |

Market Drivers for Foreign Companies |

| 4 |

Market Inhibitors for Foreign Companies |

| 5 |

Market SWOT Analysis |

| 6 |

Competitive Analysis for Foreign Vendors |

| |

MARKET BACKGROUND |

| 7 |

China’s Economic, Political and Internal Security Challenges |

| 7.1 |

China Economic and Political Background |

| 7.2 |

China Urbanization Program |

| 7.2.1 |

China Urbanization Program: Background |

| 7.2.2 |

China’s Rural and Urban Households Income Gap |

| 7.3 |

Political-Economic Challenges |

| 7.4 |

Encompassing China’s Economic, Political and Security Risks |

| 7.5 |

Near Term Internal Security Challenges |

| 8 |

China 12th Five Year Plan |

| 8.1 |

The 12th Five Year Plan: Background |

| 8.2 |

The Twelfth Five Year Plan Reform: Highlights |

| 9 |

Homeland Security in China |

| 9.1 |

China Definition of Terrorism |

| 9.2 |

PRC Domestic Terrorism |

| 9.2.1 |

China’s Muslim Minority Outbreaks of Violence |

| 9.3 |

Security Legislation and Law Enforcement |

| 9.4 |

Terror Financing |

| 9.4.1 |

China Underground Banks |

| 9.4.2 |

Terrorist Financing Mitigation |

| 9.4.3 |

Terrorist Financing in Hong Kong |

| 9.4.4 |

Terrorist Financing in Macau |

| 9.4.5 |

China International Counterterror Cooperation |

| 9.5 |

Hong Kong Homeland Security Activities |

| 9.6 |

Macau Homeland Security Activities |

| 10 |

PRC National HLS and Public Safety Related Organizations |

| 10.1 |

China Ministry of Public Security |

| 10.2 |

Public Security Bureau |

| 10.3 |

China People’s Armed Police (PAP) |

| 10.4 |

China Ministry of State Security |

| 10.5 |

The PLA & People’s Armed Police Public Safety & Internal Security Missions |

| 11 |

China Domestic Homeland Security and Public Safety Industry |

| |

THE MARKET AND VERTICAL SUBMARKETS |

| 12 |

China Internal Security, Homeland Security & Public Safety Market by Vertical Submarket – 2013-2020 |

| 12.1 |

Total Market |

| 12.2 |

HLS and Public Safety Market for Foreign Based Companies |

| 13 |

China Critical Infrastructure Security Market |

| 13.1 |

Scope |

| 13.2 |

China Critical Infrastructure Security: Market Background |

| 13.3 |

China Critical Infrastructure Security: Business Opportunities |

| 13.4 |

China Critical Infrastructure Security: Market Drivers for Foreign Based Companies |

| 13.5 |

China Critical Infrastructure Security: Market Inhibitors for Foreign Companies |

| 13.6 |

China Critical Infrastructure Security Market – 2013-2020 |

| 13.6.1 |

2010-2020 Market Size & Analysis |

| 13.6.2 |

The Market: Local vs. Foreign Based Companies |

| 13.6.3 |

Market for Foreign Based Companies |

| 14 |

China Aviation Security Market |

| 14.1 |

China Aviation Security: Market Background |

| 14.2 |

China Aviation Security Business Opportunities for Foreign Companies |

| 14.3 |

China Aviation Security: Market Drivers for Foreign Based Companies |

| 14.4 |

China Aviation Security: Market Inhibitors for Foreign Companies |

| 14.5 |

China Aviation Security Market – 2013-2020 |

| 14.5.1 |

2010-2020 Market Size & Analysis |

| 14.5.2 |

The Market: Local vs. Foreign Based Companies |

| 14.5.3 |

Market for Foreign Based Companies |

| 15 |

China Maritime Security Market |

| 15.1 |

Scope |

| 15.2 |

China Maritime Security: Market Background |

| 15.2.1 |

China C-TPAT Membership |

| 15.3 |

Maritime Security: Business Opportunities |

| 15.4 |

The Global Maritime Industry |

| 15.5 |

China Maritime Security and Safety Agencies |

| 15.5.1 |

Maritime Safety Administration |

| 15.5.2 |

China Coast Guard |

| 15.6 |

China’s Maritime Security Market: Business Opportunities for Foreign Companies |

| 15.7 |

China Maritime Security: Market Drivers for Foreign Based Companies |

| 15.8 |

China Maritime Security: Market Inhibitors for Foreign Companies |

| 15.9 |

China Maritime Security Market – 2013-2020 |

| 15.9.1 |

2010-2020 Market Size & Analysis |

| 15.9.2 |

The Market: Local vs. Foreign Based Companies |

| 15.9.3 |

Market for Foreign Based Companies |

| 16 |

China Mass Transportation Security Market |

| 16.1 |

China Mass Transportation Security Market: Background |

| 16.1.1 |

Land Transport Infrastructure in China |

| 16.1.2 |

China Metro Industry |

| 16.1.3 |

Railway Security Business Opportunities |

| 16.1.4 |

Metro Security Industry Business Opportunities |

| 16.2 |

China Land Transportation Security: Market Drivers for Foreign Based Companies |

| 16.3 |

China Land Transportation Security: Market Inhibitors for Foreign Companies |

| 16.4 |

China Mass Transportation Security Market – 2013-2020 |

| 16.4.1 |

2010-2020 Market Size & Analysis |

| 16.4.2 |

The Market: Local vs. Foreign Based Companies |

| 16.4.3 |

Market for Foreign Based Companies |

| 17 |

China Land Border Security Market |

| 17.1 |

China Land Border Security Market: Background |

| 17.2 |

China Land Border Security Market – 2013-2020 |

| 17.2.1 |

2010-2020 Market Size & Analysis |

| 17.2.2 |

The Market: Local vs. Foreign Based Companies |

| 17.2.3 |

Market for Foreign Based Companies |

| 18 |

China First Responders & Disaster Mitigation Market |

| 18.1 |

China First Responders & Disaster Mitigation Market – 2013-2020 |

| 18.1.1 |

2010-2020 Market Size & Analysis |

| 18.1.2 |

The Market: Local vs. Foreign Based Companies |

| 18.1.3 |

Market for Foreign Based Companies |

| 19 |

China Safe Cities Market |

| 19.1 |

China Safe Cities Market: Background |

| 19.2 |

China Safe City Concept |

| 19.3 |

Public Safety Surveillance |

| 19.4 |

China Safe Cities: Technologies |

| 19.5 |

China 200 Most Populated Cities |

| 19.6 |

Market Drivers |

| 19.7 |

Market Inhibitors |

| 19.8 |

China Safe Cities Market – 2013-2020 |

| 19.8.1 |

2010-2020 Market Size & Analysis |

| 19.8.2 |

The Market: Local vs. Foreign Based Companies |

| 19.8.3 |

Market for Foreign Based Companies |

| 20 |

China Public Events Security Market |

| 20.1 |

China Public Events Security Market – 2013-2020 |

| 20.1.1 |

2010-2020 Market Size & Analysis |

| 20.1.2 |

The Market: Local vs. Foreign Based Companies |

| 20.1.3 |

Market for Foreign Based Companies |

| 21 |

China Homeland Security & Public Safety Market – Other Vertical Submarkets |

| 21.1 |

China Other Homeland Security & Public Safety Vertical Submarkets: Market Background |

| 21.2 |

Non-Lethal Weapons (NLW) Used By the People’s Armed Police (PAP) Market |

| 21.2.1 |

Scope |

| 21.2.2 |

China NLW: Market Background |

| 21.2.3 |

Public Safety Technologies RDT&E |

| 21.3 |

The Private Sector Public Safety Systems Market Background |

| 21.4 |

China Other Homeland Security & Public Safety Vertical Submarkets – 2013-2020 |

| 21.4.1 |

2010-2020 Market Size & Analysis |

| 21.4.2 |

The Market: Local vs. Foreign Based Companies |

| 21.4.3 |

Market for Foreign Based Companies |

| |

MARKET BY TECHNOLOGY |

| 22 |

China Internal Security, Homeland Security & Public Safety Market by Technology – 2013-2020 |

| 22.1 |

Total Market |

| 22.2 |

Market for Foreign Based Companies |

| 23 |

China Explosives & Contraband Detection Market |

| 23.1 |

Scope |

| 23.2 |

China Explosives & Contraband Detection: Market Background |

| 23.3 |

Business Opportunities |

| 23.4 |

China Explosives & Contraband Detection Market– 2013-2020 |

| 23.4.1 |

2010-2020 Market Size & Analysis |

| 23.4.2 |

The Market: Local vs. Foreign Based Companies |

| 23.4.3 |

Market for Foreign Based Companies |

| 24 |

China Bio-Terror & Infectious Disease Outbreak Detection Technologies Market |

| 24.1 |

Scope |

| 24.2 |

China Bio-Terror & Infectious Disease Outbreak Detection Technologies: Market Background |

| 24.3 |

China Bio-Terror & Infectious Disease Outbreak Detection Technologies Market: Business Opportunities |

| 24.3.1 |

Business Opportunity 1 – Emerging Threats |

| 24.3.2 |

Business Opportunity 2 – Human Sentinel Surveillance System |

| 24.3.3 |

Business Opportunity 3 – China Animal Sentinel Surveillance System |

| 24.3.4 |

Business Opportunity 4 – Biological IC3 Infrastructure. |

| 24.3.5 |

Business Opportunity 5 – Reducing False Alarms |

| 24.3.6 |

Business Opportunity 6 – Reducing Cost |

| 24.4 |

China Bio-Terror & Disease Outbreak Detection Market – 2013-2020 |

| 24.4.1 |

2010-2020 Market Size & Analysis |

| 24.4.2 |

The Market: Local vs. Foreign Based Companies |

| 24.4.3 |

Market for Foreign Based Companies |

| 25 |

China People Security Screening Market |

| 25.1 |

Scope |

| 25.2 |

People Screening Security: Market Background |

| 25.2.1 |

China Secured Facilities People Screening |

| 25.2.2 |

People Screening Technologies |

| 25.3 |

China Air, Sea and Mass Transportation Passenger Screening Market |

| 25.4 |

China People Security Screening Market: Business Opportunities |

| 25.5 |

China People Security Screening Market – 2013-2020 |

| 25.5.1 |

2010-2020 Market Size & Analysis |

| 25.5.2 |

The Market: Local vs. Foreign Based Companies |

| 25.5.3 |

Market for Foreign Based Companies |

| 26 |

China Perimeter Security Market |

| 26.1 |

Scope |

| 26.2 |

China Perimeter Security: Market Background |

| 26.2.1 |

China Perimeter Security Market: Introduction |

| 26.2.2 |

Multi-layered Perimeter Security |

| 26.2.3 |

Multi-Sensor Fusion |

| 26.2.4 |

Perimeter Security CCTV Surveillance |

| 26.2.5 |

Automatic Perimeter Intrusion Assessment |

| 26.2.6 |

External Perimeter Security Systems |

| 26.2.7 |

Video Surveillance Management |

| 26.2.8 |

Perimeter Security Command and Control |

| 26.2.9 |

Perimeter Security Technologies |

| 26.2.10 |

Perimeter Security Communications |

| 26.2.11 |

Perimeter Security Command and Control Systems |

| 26.2.12 |

Perimeter Access Control |

| 26.2.13 |

Perimeter Security Biometric Systems |

| 26.3 |

China Perimeter Security Market: Business Opportunities |

| 26.4 |

China Perimeter Security Market – 2013-2020 |

| 26.4.1 |

2010-2020 Market Size & Analysis |

| 26.4.2 |

The Market: Local vs. Foreign Based Companies – 2010-2020 |

| 26.4.3 |

Market for Foreign Based Companies |

| 27 |

China Biometric ID Market |

| 27.1 |

Scope |

| 27.2 |

China National Biometric ID card: Market Background |

| 27.3 |

Foreign Delegates in China Biometric Passports |

| 27.4 |

China’s Biometric Passports Market |

| 27.5 |

Homeland Security & Public Safety Related Biometric ID Market: Business Opportunities |

| 27.6 |

China Homeland Security & Public Safety Biometric ID Market – 2013-2020 |

| 27.6.1 |

2010-2020 Market Size & Analysis |

| 27.6.2 |

The Market: Local vs. Foreign Based Companies |

| 27.6.3 |

Market for Foreign Based Companies |

| 28 |

China CCTV Security Surveillance Market |

| 28.1 |

Scope |

| 28.2 |

China CCTV Security Surveillance: Market Background |

| 28.2.1 |

CCTV Security Surveillance in China |

| 28.2.2 |

Wireless Video Surveillance Systems |

| 28.2.3 |

Cloud Computing & Storage Digital Video Surveillance |

| 28.2.4 |

High Definition IP Networked Video Surveillance Cameras |

| 28.3 |

China HLS and Public Safety CCTV Surveillance Systems Market: Business Opportunities |

| 28.4 |

China CCTV Security Surveillance Market – 2013-2020 |

| 28.4.1 |

2010-2020 Market Size & Analysis |

| 28.4.2 |

The Market: Local vs. Foreign Based Companies |

| 28.4.3 |

Market for Foreign Based Companies |

| 29 |

China Public Safety Smart Video Surveillance Systems Market |

| 29.1 |

Scope |

| 29.2 |

China HLS & Public Safety Smart Video Surveillance Systems: Market Background |

| 29.2.1 |

Major Findings |

| 29.2.2 |

Major Conclusions |

| 29.2.3 |

Intelligent Video Surveillance Technologies |

| 29.3 |

China HLS & Public Safety Smart Video Surveillance Systems Market: Business Opportunities |

| 29.4 |

China Public Safety Smart Video Surveillance Market –2013-2020 |

| 29.4.1 |

2010-2020 Market Size & Analysis |

| 29.4.2 |

The Market: Local vs. Foreign Based Companies |

| 29.4.3 |

Market for Foreign Based Companies |

| 30 |

China HLS and Public Safety Information Technology (IT) Market |

| 30.1 |

Scope |

| 30.2 |

China General Information Technology (IT): Market Background |

| 30.2.1 |

China general Information & communication Technology (ICT) Market |

| 30.2.2 |

China’s Software Industry |

| 30.2.3 |

Vertical Submarket Software And Specialty Software in China |

| 30.2.4 |

High-End Enterprise Management Systems Software in China |

| 30.3 |

China HLS & PS Information Technology Market Background |

| 30.4 |

China Homeland Security and Public Safety Software Market |

| 30.5 |

Products and Services Associated With Homeland Security & PS, IT in China |

| 30.6 |

China Homeland Security & PS IT Market: Business Opportunities |

| 30.7 |

China Homeland Security and Public Safety Information Technology (IT) Market – 2013-2020 |

| 30.7.1 |

2010-2020 Market Size & Analysis |

| 30.7.2 |

The Market: Local vs. Foreign Based Companies |

| 30.7.3 |

Market for Foreign Based Companies |

| 31 |

China Public Safety Cyber Security Market |

| 31.1 |

Scope |

| 31.2 |

Internet in China |

| 31.3 |

China Cyber Control & Security: Background |

| 31.3.1 |

The Golden Shield Project |

| 31.3.2 |

China, Cyber Warfare Capabilities |

| 31.3.3 |

China Public Self-Regulated Cyber Control Programs |

| 31.3.4 |

China Internet Service Providers’ Control |

| 31.3.5 |

Cyber Control Circumvention Technologies Used in China |

| 31.3.6 |

China Pipeline Cyber Control Projects |

| 31.3.7 |

China Targeted Cyber Platforms |

| 31.3.8 |

China Targeted Discussion Forums |

| 31.3.9 |

China Targeted Social Media Websites |

| 31.4 |

China Public Safety Cyber Security Market – 2013-2020 |

| 31.4.1 |

2010-2020 Market Size & Analysis |

| 31.4.2 |

The Market: Local vs. Foreign Based Companies |

| 31.4.3 |

Market for Foreign Based Companies |

| 32 |

China Homeland Security & Public Safety Command and Control Systems Market |

| 32.1 |

Scope |

| 32.2 |

Homeland Security & Public Safety Command and Control Systems: Market Background. |

| 32.3 |

China Homeland Security and Public Safety Command and Control Systems Market: Business Opportunities |

| 32.4 |

China Homeland Security & Public Safety Command and Control Systems Market – 2013-2020 |

| 32.4.1 |

2010-2020 Market Size & Analysis |

| 32.4.2 |

The Market: Local vs. Foreign Based Companies |

| 32.4.3 |

Market for Foreign Based Companies |

| 33 |

China Natural & Manmade Disaster Rescue & Recovery Equipment Market |

| 33.1 |

Scope |

| 33.2 |

China Natural & Manmade Disaster Rescue & Recovery Equipment: Market Background |

| 33.3 |

Natural Disasters in China |

| 33.4 |

Disaster Recovery: Information Technology Sub-Market Background |

| 33.5 |

Search, Rescue and Recovery Systems Market: Business Opportunities |

| 33.6 |

China Natural & Manmade Disaster Rescue & Recovery Equipment Market – 2013-2020 |

| 33.6.1 |

2010-2020 Market Size & Analysis |

| 33.6.2 |

The Market: Local vs. Foreign Based Companies |

| 33.6.3 |

Market for Foreign Based Companies |

| 34 |

China Homeland Security & Public Safety Communication Equipment Market |

| 34.1 |

Scope |

| 34.2 |

China Homeland Security & Public Safety Communication Equipment: Market Background |

| 34.2.1 |

China’s Communication Interoperability Challenge |

| 34.2.2 |

Advantages of Interoperable Communications |

| 34.3 |

Main Conclusions |

| 34.3.1 |

China’s National Communication Policy |

| 34.4 |

China HLS & Public Safety Communication Equipment Market: Business Opportunities |

| 34.4.1 |

Managed Services for Shared/Core Services |

| 34.4.2 |

Migration from “Simple” to “Integrated” Networks |

| 34.5 |

China Homeland Security & Public Safety Communication Equipment Market – 2013-2020 |

| 34.5.1 |

2010-2020 Market Size & Analysis |

| 34.5.2 |

The Market: Local vs. Foreign Based Companies |

| 34.5.3 |

Market for Foreign Based Companies |

| |

VENDORS |

| 35 |

Local & International Vendors |

| 35.1 |

AB Group Mension |

| 35.1.1 |

AB Group: Company Profile |

| 35.1.2 |

AB Group: Main HLS & Public Safety Product Lines |

| 35.1.3 |

Contact Information |

| 35.2 |

ACESEE Security Ltd. |

| 35.2.1 |

ACESEE Security: Company Profile |

| 35.2.2 |

ACESEE Security: Main HLS & Public Safety Product Lines |

| 35.2.3 |

Contact Information |

| 35.3 |

Beijing Aurine Yingke Intelligent Systems Integration Co. Ltd. |

| 35.3.1 |

Beijing Aurine Yingke Intelligent Systems Integration: Company Profile |

| 35.3.2 |

Beijing Aurine Yingke Intelligent Systems Integration: Main HLS & Public Safety Product Lines |

| 35.3.3 |

Contact Information |

| 35.4 |

Beijing Jingjinwu High-Tech Co. Ltd. |

| 35.4.1 |

Beijing Jingjinwu High-Tech: Company Profile |

| 35.4.2 |

Beijing Jingjinwu High-Tech: Main Homeland Security & Public Safety Product Lines |

| 35.4.3 |

Contact Information |

| 35.5 |

Beijing Opto-Electronics Technology Co. Ltd. |

| 35.5.1 |

Beijing Opto-Electronics Technology: Company Profile |

| 35.5.2 |

Beijing Opto-Electronics Technology: Main Homeland Security & Public Safety Product Lines |

| 35.5.3 |

Contact Information |

| 35.6 |

Beijing TongMeiDa Science & Technology Development Co. Ltd. |

| 35.6.1 |

Beijing TongMeiDa Science &Technology Development: Company Profile |

| 35.6.2 |

Beijing TongMeiDa Science & Technology Development: Main Homeland Security & Public Safety Product Lines |

| 35.6.3 |

Contact Information |

| 35.7 |

Beijing YinXing TianYuan Science & Technology Co. Ltd. |

| 35.7.1 |

Beijing YinXing TianYuan Science & Technology: Company Profile |

| 35.7.2 |

Beijing YinXing TianYuan Science and Technology: Main HLS & Public Safety Product Lines |

| 35.7.3 |

Contact Information |

| 35.8 |

Beijing Zhong Tianfeng Security Protection Technologies Co.Ltd. |

| 35.8.1 |

Beijing Zhong Tianfeng Security Protection Technologies: Company Profile |

| 35.8.2 |

Beijing Zhong Tianfeng Security Protection Technologies: Main Homeland Security & Public Safety Product Lines |

| 35.8.3 |

Contact Information |

| 35.9 |

Beijing Zhongdun Anmin Analysis Technology Co. Ltd. |

| 35.9.1 |

Beijing Zhongdun Anmin Analysis Technology: Company Profile |

| 35.9.2 |

Beijing Zhongdun Anmin Analysis Technology: Main Homeland Security & Public Safety Product Lines |

| 35.9.3 |

Contact Information |

| 35.1 |

BlueStar SecuTech Inc. |

| 35.10.1 |

BlueStar SecuTech: Company Profile |

| 35.10.2 |

BlueStar SecuTech: Main HLS & Public Safety Product Lines |

| 35.10.3 |

Contact Information |

| 35.11 |

Bosch Security Co. Ltd. |

| 35.11.1 |

Bosch Security: Company Profile |

| 35.11.2 |

Bosch Security: Main Homeland Security & Public Safety Product Lines |

| 35.11.3 |

Contact Information |

| 35.12 |

Changzhou Hengsion Electronic S&T Co. Ltd. |

| 35.12.1 |

Changzhou Hengsion Electronic S&T: Company Profile |

| 35.12.2 |

Changzhou Hengsion Electronic S&T: Main Homeland Security & Public Safety Product Lines |

| 35.12.3 |

Contact Information |

| 35.13 |

China Aerospace Science & Industry Corporation (CASIC) |

| 35.13.1 |

China Aerospace Science & Industry Corp.: Company Profile |

| 35.13.2 |

China Aeropsace Science & Industry Corp: Main HLS & Public Safety Product Lines |

| 35.13.3 |

Contact Information |

| 35.14 |

China Aerospace Science & Technology Corporation |

| 35.14.1 |

China Aerospace Science & Technology Corp.: Company Profile |

| 35.14.2 |

China Aerospace Science & Technology Corp.: Main HLS & Public Safety Product Lines |

| 35.14.3 |

Contact Information |

| 35.15 |

China Electronics Technology Group Corporation (CETC) |

| 35.15.1 |

China Electronics Technology Group Corp.: Company Profile |

| 35.15.2 |

China Electronics Technology Group Corp.: Main HLS & Public Safety Product Lines |

| 35.15.3 |

Contact Information |

| 35.16 |

China National Aero-Technology Import & Export Corporation (CATIC) |

| 35.16.1 |

China National Aero-Technology Import & Export Corp.: Company Profile |

| 35.16.2 |

China National Aero-Technology Import & Export Corp.: Main HLS & Public Safety Product Lines |

| 35.16.3 |

Contact Information |

| 35.17 |

China National Electronics Import & Export Corporation (CEIEC) |

| 35.17.1 |

China National Electronics Import & Export Corp.: Company Profile |

| 35.17.2 |

China National Electronics Import & Export Corp.: Main HLS & Public Safety Product Lines |

| 35.17.3 |

Contact Information |

| 35.18 |

China North Industries Corporation (NORINCO) |

| 35.18.1 |

China North Industries Corp.: Company Profile |

| 35.18.2 |

China North Industries Corp.: Main HLS & Public Safety Product Lines |

| 35.18.3 |

Contact Information |

| 35.19 |

China Xinshidai Company |

| 35.19.1 |

China Xinshidai: Company Profile |

| 35.19.2 |

China Xinshidai Company: Main HLS & Public Safety Product Lines |

| 35.19.3 |

Contact Information |

| 35.2 |

EADS Defense & Security China |

| 35.20.1 |

EADS Defense & Security China: Company Profile |

| 35.20.2 |

EADS Defense & Security China: Main Homeland Security & Public Safety Product Lines |

| 35.21 |

FACE-TEK Technology Co. Ltd. |

| 35.21.1 |

FACE-TEK Technology: Company Profile |

| 35.21.2 |

FACE-TEK Technology: Main Homeland Security & Public Safety Product Lines |

| 35.21.3 |

Contact Information |

| 35.22 |

FLIR Systems (Shanghai) Co. Ltd. |

| 35.22.1 |

FLIR Systems (Shanghai): Company Profile |

| 35.22.2 |

FLIR systems (Shanghai): Main Homeland Security & Public Safety Product Lines |

| 35.22.3 |

Contact Information |

| 35.23 |

Gantch Technology Co. Ltd. |

| 35.23.1 |

Gantch Technology: Company Profile |

| 35.23.2 |

Gantch Technology: Main Homeland Security & Public Safety Product Lines |

| 35.23.3 |

Contact Information |

| 35.24 |

GE Security Asia (China) |

| 35.24.1 |

GE Security Asia (China): Company Profile |

| 35.24.2 |

GE Security Asia (China): Main Homeland Security & Public Safety Product Lines |

| 35.24.3 |

Contact Information |

| 35.25 |

Hangzhou Hikvision Digital Technology Co. Ltd. |

| 35.25.1 |

Hangzhou Hikvision Digital Technology: Company Profile |

| 35.25.2 |

Hangzhou Hikvision Digital Technology: Main HLS & Public Safety Product Lines |

| 35.25.3 |

Contact Information |

| 35.26 |

Hangzhou Lihong Electronics Co. Ltd. |

| 35.26.1 |

Hangzhou Lihong Electronics: Company Profile |

| 35.26.2 |

Hangzhou Lihong Electronics: Main Homeland Security & Public Safety Product Lines |

| 35.26.3 |

Contact Information |

| 35.27 |

Hanvon Technology Co. Ltd. |

| 35.27.1 |

Hanvon Technology: Company Profile |

| 35.27.2 |

Hanvon Technology: Main HLS & Public Safety |

| 35.27.3 |

Contact Information |

| 35.28 |

HK HDDCCTV Technology Co. Ltd. |

| 35.28.1 |

HK HDDCCTV Technology: Company Profile |

| 35.28.2 |

HK HDDCCTV Technology: Main Homeland Security & Public Safety Product Lines |

| 35.28.3 |

Contact Information |

| 35.29 |

Honeywell Security Group |

| 35.29.1 |

Honeywell Security Group: Company Profile |

| 35.29.2 |

Honeywell Security Group: Main Homeland Security & Public Safety Product Lines |

| 35.29.3 |

Contact Information |

| 35.3 |

IBM China |

| 35.30.1 |

IBM China: Company Profile |

| 35.30.2 |

IBM China: Main Homeland Security & Public Safety Product Lines |

| 35.30.3 |

Contact Information |

| 35.31 |

Infinova |

| 35.31.1 |

Infinova: Company Profile |

| 35.31.2 |

Infinova: Main HLS & Public Safety Product Lines |

| 35.31.3 |

Contact Information |

| 35.32 |

JoiningTek Shanghai Co. Ltd. |

| 35.32.1 |

JoiningTek Shanghai: Company Profile |

| 35.32.2 |

JoiningTek Shanghai: Main Homeland Security & Public Safety Product Lines |

| 35.32.3 |

Contact Information |

| 35.33 |

L-3 Security & Detections Systems |

| 35.33.1 |

L-3 Security & Detections Systems: Company Profile |

| 35.33.2 |

L-3 Security & Detections Systems: Main Homeland Security & Public Safety Product Lines |

| 35.33.3 |

Contact Information |

| 35.34 |

LB Technology Co. Ltd. |

| 35.34.1 |

LB Technology: Company Profile |

| 35.34.2 |

LB Technology: Homeland Security & Public Safety Product Lines |

| 35.34.3 |

Contact Information |

| 35.35 |

Mily Link International Co. Ltd. |

| 35.35.1 |

Mily Link International: Company Profile |

| 35.35.2 |

Mily Link International: Main Homeland Security & Public Safety Product Lines |

| 35.35.3 |

Contact Information |

| 35.36 |

OB Telecom Electronics Co. Ltd. |

| 35.36.1 |

OB Telecom Electronics: Company Profile |

| 35.36.2 |

OB Telecom Electronics: Main Homeland Security & Public Safety Product Lines |

| 35.36.3 |

Contact Information |

| 35.37 |

Panasonic |

| 35.37.1 |

Panasonic: Company Profile |

| 35.37.2 |

Panasonic: Main Homeland Security & Public Safety Product Lines |

| 35.37.3 |

Contact Information |

| 35.38 |

Quanzhou Anda Electronic Co. Ltd. |

| 35.38.1 |

Quanzhou Anda Electronic: Company Profile |

| 35.38.2 |

Quanzhou Anda Electronic: Main Homeland Security & Public Safety Product Lines |

| 35.38.3 |

Contact Information |

| 35.39 |

Santachi Video Technology (Shenzhen) Co. Ltd. |

| 35.39.1 |

Santachi Video Technology (Shenzhen): Company Profile |

| 35.39.2 |

Santachi Video Technology: Main Homeland Security & Public Safety Product Lines |

| 35.39.3 |

Contact Information |

| 35.4 |

Shandong Sheenrun Electronics |

| 35.40.1 |

Shandong Sheenrun Electronics: Company Profile |

| 35.40.2 |

Shandong Sheenrun Electronics: Main Homeland Security & Public Safety Product Lines |

| 35.40.3 |

Contact Information |

| 35.41 |

Shanghai Changchen Intelligent Systems Co. Ltd. |

| 35.41.1 |

Shanghai Changchen Intelligent Systems: Company Profile |

| 35.41.2 |

Shanghai Changchen Intelligent Systems: Main Homeland Security and Public Safety Product Lines |

| 35.41.3 |

Contact Information |

| 35.42 |

Shanghai Foready Electronic Co. Ltd. |

| 35.42.1 |

Shanghai Foready Electronic: Company Profile |

| 35.42.2 |

Shanghai Foready Electronic: Main Homeland Security & Public Safety Product Lines |

| 35.42.3 |

Contact Information |

| 35.43 |

Shanghai Gaojing Radiography Technology Co. Ltd. |

| 35.43.1 |

Shanghai Gaojing Radiography Technology: Company Profile |

| 35.43.2 |

Shanghai Gaojing Radiography Technology: Main Homeland Security & Public Safety Product Lines |

| 35.43.3 |

Contact Information |

| 35.44 |

Shanghai INHOT Electronic Technology Co. Ltd. |

| 35.44.1 |

Shanghai INHOT Electronic Technology: Company Profile |

| 35.44.2 |

Shanghai INHOT Electronic Technology: Main Homeland Security & Public Safety Product Lines |

| 35.44.3 |

Contact Information |

| 35.45 |

Shanghai Sikorsky Aircraft Company Ltd |

| 35.45.1 |

Shanghai Sikorsky Aircraft Company Ltd: Company Profile |

| 35.45.2 |

Sikorsky: Main Homeland Security & Public Safety Product Lines |

| 35.45.3 |

Contact Information |

| 35.46 |

Shenzhen Fengtaida Electronic Co. Ltd. |

| 35.46.1 |

Shenzhen Fenftaida Electronic: Company Profile |

| 35.46.2 |

Shenzhen Fenftaida Electronic: Main Homeland Security & Public Safety Product Lines |

| 35.46.3 |

Contact Information |

| 35.47 |

Shenzhen HuangHe Digital Technology Co. Ltd. |

| 35.47.1 |

Shenzhen HuangHe Digital Technology: Company Profile |

| 35.47.2 |

Shenzhen HuangHe Digital Technology: Main Homeland Security & Public Safety Product Lines |

| 35.47.3 |

Contact Information |

| 35.48 |

Shenzhen Jinghualong Security Equipments Co. Ltd. |

| 35.48.1 |

Shenzhen Jinghualong Security Equipments: Company Profile |

| 35.48.2 |

Shenzhen Jinghualong Security Equipments: Main Homeland Security & Public Safety Product Lines |

| 35.48.3 |

Contact Information |

| 35.49 |

Shenzhen Shi Diheng Technology Co. Ltd. |

| 35.49.1 |

Shenzhen Shi Diheng Technology: Company Profile |

| 35.49.2 |

Shenzhen Shi Diheng Technology: Main Homeland Security & Public Safety Product Lines |

| 35.49.3 |

Contact Information |

| 35.5 |

Shenzhen Zhongsuo Electronics Co. Ltd. |

| 35.50.1 |

Shenzhen Zhongsuo Electronics: Company Profile |

| 35.50.2 |

Shenzhen Zhongsuo Electronics: Main Homeland Security & Public Safety Product Lines |

| 35.50.3 |

Contact Information |

| 35.51 |

Shenzhen ZTE NetView Technology |

| 35.51.1 |

Shenzhen ZTE NetView Technology: Company Profile |

| 35.51.2 |

Shenzhen ZTE NetView Technology: Main Homeland Security & Public Safety Product Lines |

| 35.51.3 |

Contact Information |

| 35.52 |

Siemens Building Technology (China) Co. Ltd. |

| 35.52.1 |

Siemens Building Technology (China): Company Profile |

| 35.52.2 |

Siemens Building Technology (China): Main Homeland Security & Public Safety Product Lines |

| 35.52.3 |

Contact Information |

| 35.53 |

Tianjin Jan Mekia Electronic Co. Ltd. |

| 35.53.1 |

Tianjin Jan Mekia Electronic: Company Profile |

| 35.53.2 |

Tianjin Jan Mekia Electronic: Main Homeland Security & Public Safety Product Lines |

| 35.53.3 |

Contact Information |

| 35.54 |

Tianjin Tiandy Digital Technology Co. Ltd. |

| 35.54.1 |

Tianjin Tiandy Digital Technology: Company Profile |

| 35.54.2 |

Tianjin Tiandy Digital Technology: Main Homeland Security & Public Safety Product Lines |

| 35.54.3 |

Contact Information |

| 35.55 |

UniVision Engineering Ltd. |

| 35.55.1 |

UniVision Engineering: Company Profile |

| 35.55.2 |

UniVision Engineering: Main Homeland Security & Public Safety Product Lines |

| 35.55.3 |

Contact Information |

| 35.56 |

Zhangjiagang Goldnet Fencing Systems |

| 35.56.1 |

Zhangjiagang Goldnet Fencing Systems: Company Profile |

| 35.56.2 |

Zhangjiagang Goldnet Fencing Systems: Main HLS & Public Safety Product Lines |

| 35.56.3 |

Contact Information |

| 35.57 |

Zhejiang Dahua Technology |

| 35.57.1 |

Zhejiang Dahua Technology: Company Profile |

| 35.57.2 |

Zhejiang Dahua Technology: Main HLS & Public Safety Product Lines |

| 35.57.3 |

Contact Information |

| 35.58 |

Zhuhai Freeview Infomation Technology |

| 35.58.1 |

Zhuhai Freeview Infomation Technology: Company Profile |

| 35.58.2 |

Zhuhai Freeview Infomation Technology: Main HLS & Public Safety Product Lines |

| 35.58.3 |

Contact Information |

| |

APPENDICES |

| 36 |

Appendix A: The Tsinghua “Comprehensive Security” Report |

| 36.1 |

New Thinking on Stability Maintenance: Long-Term Social Stability via Institutionalized Expression of Interests |

| 36.1.1 |

Cost of Maintaining Stability |

| 37 |

Appendix B: China Provinces HLS and Public Safety Funding |

| 38 |

Appendix C: China Homeland Defense (HLD) Bodies |

| 38.1 |

PRC Ministry of National Defense |

| 38.2 |

China PLA |

| 38.3 |

China Defense Budget |

| 39 |

Appendix D: Protecting Intellectual Property in China |

| 39.1 |

Intellectual Property in China |

| 39.2 |

Enforcement of Intellectual Property Rights |

| 39.3 |

Patents in China |

| 39.4 |

Copyright Law in China |

| 39.5 |

Trademarks in China |

| 39.6 |

Technology Licensing in China |

| 39.7 |

Protecting Intellectual Property in China |

| 40 |

Appendix E: Doing HLS & Public Safety Business in China by Foreign Based Companies |

| 40.1 |

Doing HLS & Public Safety Business in China by Importing Companies: Introduction |

| 40.2 |

Business in China: Small and Medium Sized Foreign Vendors. |

| 40.2.1 |

Market Opportunities in China |

| 40.3 |

Entry into China HLS & Public Safety Market: Process and Strategy |

| 40.4 |

Selling HLS and Public Safety Products to the Chinese Government |

| 40.5 |

Buy-China Legislation |

| 40.6 |

Sales Channels |

| 40.7 |

Marketing and Sales in the PRC |

| 40.8 |

Logistics in China |

| 40.9 |

Mainland China Agents and Distributors |

| 40.1 |

Mainland China Trading Companies |

| 40.10.1 |

Agents in the PRC |

| 40.11 |

Establishing an Office in Mainland China |

| 40.12 |

Direct Marketing in China |

| 40.13 |

Joint Ventures in China |

| 40.14 |

Electronic Commerce in China |

| 40.15 |

Marketing in China |

| 40.16 |

Pricing Strategy |

| 40.17 |

Professional Services in China |

| 40.18 |

Local Management Services |

| 40.19 |

Import to China: Tariffs |

| 40.2 |

China Taxes Legislation |

| 40.21 |

U.S. Export Controls |

| 40.22 |

The Standardization Administration of China |

| 40.23 |

Product Certification |

| 40.24 |

Foreign Investment in China |

| 40.25 |

PRC International Business: 2012 Rankings |

| 40.26 |

Conversion and Transfer Policies |

| 40.27 |

Intellectual Property Rights |

| 40.28 |

Transparency of Regulatory System |

| 40.29 |

Competition by State-Owned Enterprises |

| 40.3 |

Corruption |

| 40.31 |

PRC Bilateral Investment Agreements with Foreign Countries |

| 40.32 |

Foreign Direct Investment Statistics |

| 40.33 |

Procedures of Payment in the PRC |

| 40.34 |

Banking in China |

| 40.35 |

PRC Monetary Regulations |

| 40.36 |

U.S. Government Export Credits |

| 40.37 |

The World Bank and other Multilateral Agencies |

| 41 |

Appendix F: Contacts Information for Foreign Importers to China of HLS & Public Safety Products |

| 41.1 |

Ministry of Industry and Information Technology (MIIT) |

| 41.2 |

Ministry of Justice |

| 41.3 |

Ministry of Human Resources and Social Security (MOHRSS) |

| 41.4 |

Ministry of Public Security |

| 41.5 |

Ministry of Health (MOH) |

| 41.6 |

National Development and Reform Commission (NDRC) |

| 41.7 |

Ministry of Transport |

| 41.8 |

Ministry of Finance |

| 41.9 |

Ministry of Foreign Affairs |

| 41.1 |

Ministry of Commerce |

| 41.11 |

Hong Kong and Macau Affairs Office of the State Council |

| 41.12 |

State Council Information Office of the PRC |

| 41.13 |

Legislative Affairs Office |

| 41.14 |

Office of Overseas Chinese Affairs office of the State Council |

| 41.15 |

Research Office of the State Council |

| 41.16 |

Taiwan Affairs Office |

| 41.17 |

Ministry of Railways |

| 41.18 |

Ministry of Science and Technology |

| 41.19 |

Ministry of Water Resources |

| 41.2 |

Government Offices Administration of the State Council |

| 41.21 |

Civil Aviation Administration of China |

| 41.22 |

General Administration of Customs |

| 41.23 |

State Administration for Industry and Commerce |

| 41.24 |

The State Administration for Religious Affairs |

| 41.25 |

The State Administration of Radio, Film, and Television |

| 41.26 |

General Administration for Quality Supervision, Inspection and Quarantine |

| 41.27 |

State Administration of Taxation |

| 41.28 |

The State Food and Drug Administration (SFDA), under the Ministry of Health – MOH |

| 41.29 |

State Intellectual Property Office |

| 41.3 |

National Copyright Administration |

| 41.31 |

National Bureau of Statistics |

| 41.32 |

China Securities Regulatory Commission |

| 41.33 |

Chinese Academy of Engineering |

| 41.34 |

Chinese Academy of Sciences |

| 41.35 |

Development Research Center of the State Council |

| 41.36 |

China Earthquake Administration |

| 41.37 |

State Administration of Foreign Exchange |

| 41.38 |

State Administration of Foreign Experts Affairs |

| 41.39 |

China National Light Industry Council |

| 41.4 |

All-China Federation of Industry and Commerce |

| 41.41 |

China Council for the Promotion of International Trade (CCPIT) |

| 41.42 |

People’s Insurance Company of China |

| 41.43 |

China International Trust and Investment Corporation |

| 41.44 |

Association for Manufacturing Technology |

| 41.45 |

American Chamber of Commerce China |

| 41.46 |

American Equipment Manufacturers (AEM) |

| 41.47 |

Council of American States in China (CASIC) |

| 41.48 |

U.S.-China Business Council |

| 41.49 |

United States Information Technology Office (USITO) |

| 41.5 |

U.S. Embassy Beijing |

| 41.51 |

U.S. Commercial Service |

| 41.52 |

U.S. Department of Commerce |

| 41.53 |

The China Business Information Center (CBIC) |

| 41.54 |

Multilateral Development Bank Office |

| 41.55 |

Office of U.S. Trade Representative China Desk |

| 41.56 |

U.S.-China Business Council |

| 42 |

HSRC Methodology |

| 42.1 |

Scope |

| 42.2 |

Research Methodology |

| 43 |

Disclaimer |

| |

|

| |

|