Description

According to the report, the aviation security market is forecasted to make a robust comeback, generating a 2014-2020 CAGR of 13.1%.

The radical Islamic terror attacks in Europe in early 2015 coupled with the ever-growing threats are forcing European authorities to take drastic steps to enhance airport security. The market will thus undergo a wave of expansion generated from new and maturing sectors and technologies such as Aviation Traffic Control cybersecurity, automated border control kiosks, cargo screening, perimeter security systems and advanced ICT technologies. These will create new market niches and fresh business opportunities.

See also the latest version of this report

|

| European Aviation Security Layers |

According to the report the market growth is boosted by the following 9 drivers:

- The early 2015 radical Islamic terror attacks in Europe are forcing the European airport security measures and market to undergo a wave of expansion.

- The number of European flight routes and airline passengers has increased significantly. In 2014, over 850 million passengers arrived at or departed from more than 450 airports in the EU. It is forecasted to double by 2025.

- The EU aviation security sector is highly regulated.

- Advancements in security infrastructure and screening technologies.

- The moderate growth of the aviation sector in other regions.

- The need to streamline airport security processes and reduce passengers’ waiting time.

- Replacement and upgrades of outdated security-related systems.

- Growing aftersales revenues.

- The risks of aviation security-related cyber terror (e.g., air traffic control).

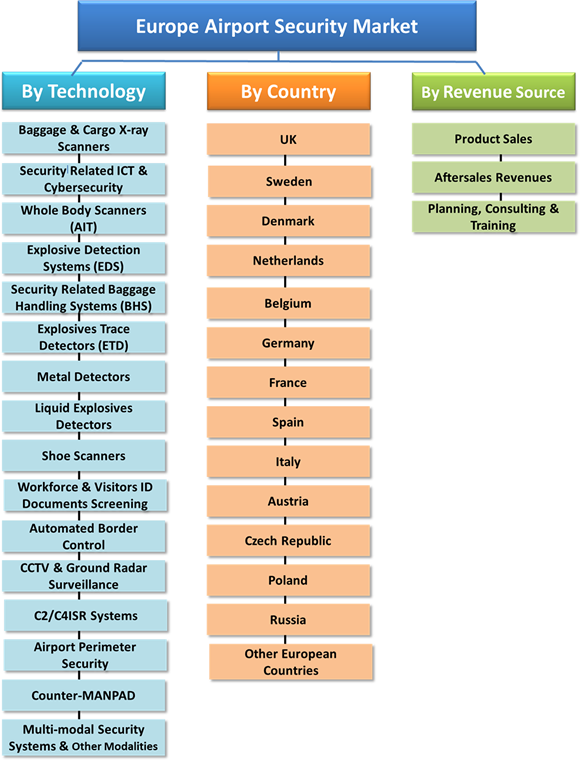

The report examines each dollar spent in the market via 3 orthogonal money trails:

- By 4 revenue sources including Product Sale, Aftersale Revenues, Planning, Consulting & Training.

- By 16 technology markets: Baggage & Cargo X-ray Scanners, Security-Related ICT & Cybersecurity, Whole Body Scanners (AIT), Explosive Detection Systems (EDS), Security-Related Baggage Handling Systems (BHS), Explosives Trace Detectors (ETD), Metal Detectors, Liquid Explosives Detectors, Shoe Scanners, Workforce & Visitors ID Documents Screening, Automated Border Control, CCTV & Ground Radar Surveillance, C2/C4ISR Systems, Airport Perimeter Security, Counter-MANPAD, Multi-modal Security Systems and other Modalities.

- By 14 national markets: U.K., Sweden, Denmark, Netherlands, Belgium, Germany, France, Spain, Italy, Austria, Czech Republic, Poland, Russia, Other European countries.

These can be seen below:

The “European Airport Security: Technologies, Industry & Markets – 2015-2020” report is a valuable resource for decision-makers in the aviation security community. It has been explicitly customized for industry executives to identify business opportunities, developing technologies, market trends and risks; as well as to benchmark business plans.

Questions answered in this 2-volume 405 page report include:

- What are the challenges to the European market penetration?

- What will the Europe market size be in 2015-2020?

- What are the key and pipeline technologies?

- How does the balance of passenger satisfaction & operational efficiency versus stringent security measures affect the security industry?

- What are the key market trends?

- What are the business opportunities to increase your market share?

- Where are the most attractive business opportunities?

- What is driving the European market?

- What are the inhibitors to your growth?

- What are the risks to your market share?

- Who are the key vendors in this market?

- What are the key procurement models of Europe airport authorities, and how do they affect the business models of the industry?

- What are the threats faced by the key vendors?

- What are the European procurement models, and how do they affect the business models of the industry?

- What are the European main end user trends?

- How can the supplier industry adopt new technologies to meet the security needs of future airport operating models?

With 405 pages and 105 tables and 212 figures, this 2-volume “European Airport Security: Technologies, Industry & Markets – 2015-2020” report is the most extensive Aviation Security market & technology research project ever conducted. This landmark report offers for each of its 58 sub-markets 2011-2014 market data and analyses, as well as 2015-2020 forecasts and analyses. This 2-volume report is the most comprehensive review of the global airport security technologies, industry & markets available today.

Detailed market analysis frameworks include:

- Market drivers & inhibitors

- Business opportunities & challenges

- SWOT analysis

- Aviation security eco-system

- Competitive analysis

- Business environment

Companies operating in the market (profiles, products and contact info): American Science and Engineering Inc., Auto Clear, IBM, Lockheed Martin, ADANI, Red X Defense, Syagen Technology. Thermo Electron Corporation, Biosensor Applications, Hitachi, Scent Detection Technologies, Ketech Defence, Mistral Security Inc, Appealing Products Inc. (API), ChemSee, DetectaChem LLC, Scintrex Trace, Flir Systems, Implant Sciences Corp., Ion Applications Inc, BAHIA Corp (Sibel Ltd.), CEIA, Fisher Labs, Brijot Imaging Systems, TeraView, ThruVision Systems, Gilardoni SpA, L-3 Communications Security & Detection Systems, QinetiQ Ltd., Westminster International Ltd., LIXI Inc, MilliVision, MINXRAY Inc., Morpho Detection Inc., Nuctech Co. Ltd., Rapiscan Security Products Inc., Scanna MSC Ltd., Smiths Detection, Vidisco Ltd.

Airports Security Screening Data at over 333 airports in 13 countries: The report provides screening data at each and every airport with a combined screening total of 647M million passengers. For each country, all airports with over 100,000 annual screened passengers are presented, including details on the number of screened passengers, and the annual growth rate.