| Figure 1 |

Global People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) [$Million] by Modality – 2011-2016 |

| Figure 2 |

Global People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) [%] by Modality – 2011 & 2016 |

| Figure 3 |

Global People Screening Market Share (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [%] 2012 & 2016 |

| Figure 4 |

People Screening Technologies – Threats and Associated Detection Technologies |

| Figure 5 |

Airport People Screening Vectors |

| Figure 6 |

SWOT Analysis |

| Figure 7 |

People Screening Market Competitive Analysis |

| Figure 8 |

People Screening Technology & Products Performance Criteria |

| Figure 9 |

Trace Detection General Principle of Operation |

| Figure 10 |

Tabletop ETD: Operational Workflow |

| Figure 11 |

Explosives Trace Detection Technologies |

| Figure 12 |

The Airborne Concentration of Various Explosives |

| Figure 13 |

Typical Sensitivity of Various Explosive Trace Detection Technologies |

| Figure 14 |

Ion Mobility Spectroscopy (IMS) |

| Figure 15 |

Electron Capture Detectors (ECD) |

| Figure 16 |

Surface Acoustic Wave (SAW) Detectors |

| Figure 17 |

ETD People Screening Portals |

| Figure 18 |

ETD People Screening Portals – Principle of Operation |

| Figure 19 |

Trace Detection General Principle of Operation |

| Figure 20 |

Tabletop ETD Devices |

| Figure 21 |

Dose Comparison: Environmental Radiation vs. Backscatter Scan |

| Figure 22 |

Spectrum of MMWave Technologies |

| Figure 23 |

Active MMWave Imaging Technology Principles of Operation |

| Figure 24 |

A Passive MMWave Whole-Body Scanner Layout |

| Figure 25 |

Passive MMWave Scanner: Typical Threat Images |

| Figure 26 |

Electromagnetic Spectrum of the THz-Region. |

| Figure 27 |

Hand-Held Weapon Detector Proper Scanning Path |

| Figure 28 |

Single Zone Metal Detection Portal Technology |

| Figure 29 |

Walk-through metal-detection portals Technologies |

| Figure 30 |

Passive Magnetic Weapon-Detection Portal |

| Figure 31 |

Metal Detection Portals |

| Figure 32 |

Multiple-image Radiography (MIR) Technology |

| Figure 33 |

MIR Projection Images, vs. Conventional Radiography |

| Figure 34 |

a Conventional Radiograph vs. DEXI Technology |

| Figure 35 |

Biometric Identification, Drivers & Inhibitors and Government Influence |

| Figure 36 |

Global Biometric by Technology Share [%] 2009 |

| Figure 37 |

Model of GE Checkpoint of the Future |

| Figure 38 |

Cast and artificial limbs screening system |

| Figure 39 |

A prosthetic limbs backscatter image showing a gun hidden underneath a cast |

| Figure 40 |

SNL – ETD MicroChemLab on a Chip. |

| Figure 41 |

Components of SNL MicroHound Trace Explosives Detection System |

| Figure 42 |

Ames ‘Conductive CNT Explosives Detector’ |

| Figure 43 |

Future Screening Checkpoint (HSRC 2002 forecast) |

| Figure 44 |

Future Multi-Threat People Screening Checkpoint – (HSRC 2002 concept) |

| Figure 45 |

Airport Pre Screening Program Process |

| Figure 46 |

Airport CBP Pre-Screening Systems and Data Flow |

| Figure 47 |

IATA 2011 “Checkpoint of the Future” Concept |

| Figure 48 |

Fused Technologies- Concealed Weapons Detection |

| Figure 49 |

Molecular Imprinting Technique |

| Figure 50 |

The “checkpoint of the future” lanes |

| Figure 51 |

The “checkpoint of the future” |

| Figure 52 |

“checkpoint of the future” biometric card-passport reading station |

| Figure 53 |

“checkpoint of the future” Lane 1 |

| Figure 54 |

“checkpoint of the future” Lane 2 |

| Figure 55 |

“checkpoint of the future” Lane 3 |

| Figure 56 |

Global People Screening Systems Sales [$Million] by Modality – 2011-2016 |

| Figure 57 |

Global People Screening Systems Sales Market Share [%] by Modality – 2011 & 2016 |

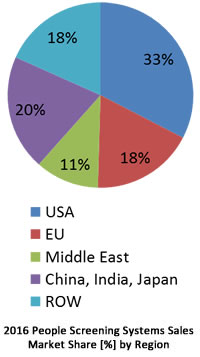

| Figure 58 |

Global People Screening Systems Sales [%] by Region – 2011 & 2016 |

| Figure 59 |

Global People Screening Portals Maintenance, Upgrade & Refurbishment Market [$Million] by Modality – 2011-2016 |

| Figure 60 |

Global People Screening Portals Maintenance, Upgrade & Refurbishment Market [%] by Modality – 2011 & 2016 |

| Figure 61 |

Global People Screening Portals Maintenance, Upgrade & Refurbishment Market vs. Systems Sales Market [$Million] – 2012 2016 |

| Figure 62 |

Global People Screening Portals Maintenance, Upgrade & Refurbishment vs. Systems Sales Market Share [%] – 2012 2016 |

| Figure 63 |

Global People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) [$Million] by Modality – 2011-2016 |

| Figure 64 |

Global People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) [%] by Modality – 2011 & 2016 |

| Figure 65 |

Global ETD Portals & Devices Sales [$Million] by Sector – 2011-2016 |

| Figure 66 |

Global ETD Portals & Devices Sales [%] by Sector – 2011 & 2016 |

| Figure 67 |

Global ETD Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Sector – 2011-2016 |

| Figure 68 |

Global ETD Portals & Devices – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [$Million] by Sector – 2011-2016 |

| Figure 69 |

Global ETD Portals & Devices – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [%] by Sector – 2011 & 2016 |

| Figure 70 |

US ETD Portals & Devices Market [$Million] by Sector – 2011-2016 |

| Figure 71 |

EU ETD Portals & Devices Market [$Million] by Sector – 2012 2016 |

| Figure 72 |

Middle East ETD Portals & Devices Market [$Million] by Sector – 2011-2016 |

| Figure 73 |

China, India, Japan ETD Portals & Devices Market [$Million] by Sector – 2011-2016 |

| Figure 74 |

ROW ETD Portals & Devices Market [$Million] by Sector – 2011-2016 |

| Figure 75 |

Global ETD Portals & Devices Sales [$Million] by Region – 2011-2016 |

| Figure 76 |

Global ETD Portals & Devices Sales [$Million] by Region – 2011 & 2016 |

| Figure 77 |

Global ETD Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 78 |

Global ETD Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011 & 2016 |

| Figure 79 |

Global ETD Portals & Devices – Systems and Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 80 |

Global ETD Portals & Devices – Systems and Maintenance, Upgrade & Refurbishment Market [%] by Region – 2011 & 2016 |

| Figure 81 |

ETD Portals & Devices Sales: Eight Key National Markets [$Million] – 2011-2016 |

| Figure 82 |

Global Whole Body Scanners Sales [$Million] by Sector – 2011-2016 |

| Figure 83 |

Global Whole Body Scanners Sales [%] by Sector – 2011 & 2016 |

| Figure 84 |

Global Whole Body Scanners Maintenance, Upgrade & Refurbishment Market [$Million] by Sector – 2011-2016 |

| Figure 85 |

Global Whole Body Scanners – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [$Million] by Sector – 2011-2016 |

| Figure 86 |

Global Whole Body Scanners – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [%] by Sector – 2011 & 2016 |

| Figure 87 |

US Whole Body (AIT) Scanning Systems Market [$Million] by Sector – 2011-2016 |

| Figure 88 |

EU Whole Body (AIT) Scanning Systems Market [$Million] by Sector – 2009 2016 |

| Figure 89 |

Middle East Whole Body (AIT) Scanning Systems Market [$Million] by Sector – 2011-2016 |

| Figure 90 |

China, India, Japan Whole Body (AIT) Scanning Systems Market [$Million] by Sector – 2011-2016 |

| Figure 91 |

ROW Whole Body (AIT) Scanning Systems Market [$Million] by Sector – 2011-2016 |

| Figure 92 |

Global Whole Body Scanners Systems Sales [$Million] by Region – 2011-2016 |

| Figure 93 |

Global Whole Body Scanners Systems Sales [$Million] by Region – 2011 & 2016 |

| Figure 94 |

Global Whole Body Scanners Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 95 |

Global Whole Body Scanners Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011 & 2016Total Market by Region – 2012 2016 |

| Figure 96 |

Global Whole Body Scanners – Systems and Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 97 |

Global Whole Body Scanners – Systems and Maintenance, Upgrade & Refurbishment Market [%] by Region – 2011 & 2016 |

| Figure 98 |

Whole Body Scanners Systems Sales: Eight Key National Markets [$Million] – 2011-2016 |

| Figure 99 |

Global Metal Detection Portals & Devices Sales [$Million] by Sector – 2011-2016 |

| Figure 100 |

Global Metal Detection Portals & Devices Sales [%] by Sector – 2011 & 2016 |

| Figure 101 |

Global Metal Detection Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Sector – 2011-2016 |

| Figure 102 |

Global Metal Detection Portals & Devices – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [$Million] by Sector – 2011-2016 |

| Figure 103 |

Global Metal Detection Portals & Devices – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [%] by Sector – 2011 & 2016 |

| Figure 104 |

US Metal Detection Portals & Devices Systems Market [$Million] by Sector – 2011-2016 |

| Figure 105 |

EU Metal Detection Portals & Devices Systems Market [$Million] by Sector – 2012 2016 |

| Figure 106 |

EU Metal Detection Portals & Devices Systems Market [$Million] by Sector – 2012 2016 |

| Figure 107 |

Middle East Metal Detection Portals & Devices Systems Market [$Million] by Sector – 2011-2016 |

| Figure 108 |

China, India, Japan Metal Detection Portals & Devices Systems Market [$Million] by Sector – 2011-2016 |

| Figure 109 |

ROW Metal Detection Portals & Devices Systems Market [$Million] by Sector – 2011-2016 |

| Figure 110 |

Global Metal Detection Portals & Devices Systems Sales [$Million] by Region – 2011-2016 |

| Figure 111 |

Global Metal Detection Portals & Devices Systems Sales [$Million] by Region – 2011 & 2016 |

| Figure 112 |

Global Metal Detection Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 113 |

Global Metal Detection Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 114 |

Global Metal Detection Portals & Devices Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011 & 2016 |

| Figure 115 |

Global Metal Detection Portals & Devices – Systems and Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 116 |

Global Metal Detection Portals & Devices – Systems and Maintenance, Upgrade & Refurbishment Market [%] by Region – 2011 & 2016 |

| Figure 117 |

Metal Detection Systems Sales: Eight Key National Markets [$Million] – 2011-2016 |

| Figure 118 |

Global Shoe Scanning – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [$Million] by Sector – 2011-2016 |

| Figure 119 |

Global Shoe Scanning – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [%] by Sector – 2011 & 2016 |

| Figure 120 |

Global Shoe Scanning Systems Sales [$Million] by Region – 2011-2016 |

| Figure 121 |

Global Shoe Scanning Systems Sales [$Million] by Region – 2011 & 2016 |

| Figure 122 |

Global Shoe Scanning Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 123 |

Global Shoe Scanning Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2010 & 2014 |

| Figure 124 |

Global Shoe Scanning – Systems and Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 125 |

Global Shoe Scanning – Systems and Maintenance, Upgrade & Refurbishment Market [%] by Region – 2011 & 2016 |

| Figure 126 |

Shoe Scanning Systems Sales: Eight Key National Markets [$Million] – 2011-2016 |

| Figure 127 |

Global Liquid Explosives Scanners – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [$Million] by Sector – 2011-2016 |

| Figure 128 |

Global Liquid Explosives Scanners – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [%] by Sector – 2011 & 2016 |

| Figure 129 |

Global Liquid Explosives Scanners Sales [$Million] by Region – 2011-2016 |

| Figure 130 |

Global Liquid Explosives Scanners Sales [$Million] by Region – 2011 & 2016 |

| Figure 131 |

Global Liquid Explosives Scanners Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 132 |

Global Liquid Explosives Scanners Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011 & 2016 |

| Figure 133 |

Global Liquid Explosives Scanners – Systems and Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 134 |

Global Liquid Explosives Scanners – Systems and Maintenance, Upgrade & Refurbishment Market [%] by Region – 2011 & 2016 |

| Figure 135 |

Liquid Explosives Scanners Sales: Eight Key National Markets [$Million] – 2011-2016 |

| Figure 136 |

Global Multi-Modal & Multi-Threat Portals Sales [$Million] by Sector – 2011-2016 |

| Figure 137 |

Global Multi-Modal & Multi-Threat Portals Sales [%] by Sector – 2011 & 2016 |

| Figure 138 |

Global Multi-Modal & Multi-Threat Portals Maintenance, Upgrade & Refurbishment Market [$Million] by Sector – 2011-2016 |

| Figure 139 |

Global Multi-Modal & Multi-Threat Portals – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [$Million] by Sector – 2011-2016 |

| Figure 140 |

Global Multi-Modal & Multi-Threat Portals – Consolidated (Systems Sales, Maintenance, Upgrade & Refurbishment) Market [%] by Sector – 2011 & 2016 |

| Figure 141 |

US Multi-Modal & Multi-Threat Portals – Systems Market [$Million] by Sector – 2011-2016 |

| Figure 142 |

EU Multi-Modal & Multi-Threat Portals – Systems Market [$Million] by Sector – 2012 2016 |

| Figure 143 |

Middle East Multi-Modal & Multi-Threat Portals – Systems Market [$Million] by Sector – 2011-2016 |

| Figure 144 |

China, India, Japan Multi-Modal & Multi-Threat Portals – Systems Market [$Million] by Sector – 2011-2016 |

| Figure 145 |

ROW Multi-Modal & Multi-Threat Portals – Systems Market [$Million] by Sector – 2011-2016 |

| Figure 146 |

Global Multi-Modal & Multi-Threat Portals Sales [$Million] by Region – 2011-2016 |

| Figure 147 |

Global Multi-Modal & Multi-Threat Portals Sales [$Million] by Region – 2011 & 2016 |

| Figure 148 |

Global Multi-Modal & Multi-Threat Portals Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 149 |

Global Multi-Modal & Multi-Threat Portals Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011 & 2016 |

| Figure 150 |

Global Multi-Modal & Multi-Threat Portals – Systems and Maintenance, Upgrade & Refurbishment Market [$Million] by Region – 2011-2016 |

| Figure 151 |

Global Multi-Modal & Multi-Threat Portals – Systems and Maintenance, Upgrade & Refurbishment Market [%] by Region – 2011 & 2016 |

| Figure 152 |

Multi-Modal & Multi-Threat Portals Systems Sales: Eight Key National Markets [$Million] – 2011-2016 |

| Figure 153 |

Global People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 154 |

Global People Screening Market Share (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [%] 2012 & 2016 |

| Figure 155 |

Airport Passengers Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 156 |

Land/Sea Transportation Passengers Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 157 |

Land Border Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 158 |

Land Border Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 159 |

Embassies and Consulates Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 160 |

Prison Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 161 |

Government Secured Facilities Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 162 |

Public Gathering Events People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 163 |

Private Sector People Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 164 |

Airport Passengers Screening Market (Systems Sales, Maintenance, Upgrade & Refurbishment) by End User [$Million] – 2012-2016 |

| Figure 165 |

TSA Organizational Chart |

| Figure 166 |

TSA Budget Structure [%] |

| Figure 167 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – US |

| Figure 168 |

People Screening Systems Sales [%] by Modality 2011 & 2016 US |

| Figure 169 |

UK Homeland Security, Homeland Defense and Counter Terror Intelligence Organizational Chart |

| Figure 170 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – UK |

| Figure 171 |

People Screening Systems Sales [%] by Modality 2011 & 2016 – UK |

| Figure 172 |

The German Homeland Security, Homeland Defence and Counter Terror Intelligence Organization Chart |

| Figure 173 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 Germany |

| Figure 174 |

People Screening Systems Sales [%] by Modality – 2011 & 2016 Germany |

| Figure 175 |

Spanish Homeland Security, Homeland Defense and Counter Terror Intelligence Organizational Chart |

| Figure 176 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – Spain |

| Figure 177 |

People Screening Systems Sales [%] by Modality – 2011 & 2016 – Spain |

| Figure 178 |

Indian Homeland Security, Homeland Defense and Counter Terror Intelligence Organizational Chart |

| Figure 179 |

Bureau of Civil Aviation Security Organizational Chart |

| Figure 180 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – India |

| Figure 181 |

People Screening Systems Sales [%] by Modality – 2011 & 2016 – India |

| Figure 182 |

China Internal Security and Intelligence community Organizational Chart |

| Figure 183 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – China |

| Figure 184 |

People Screening Systems Sales [%] by Modality – 2011 & 2016 – China |

| Figure 185 |

Japanese Homeland Security, Homeland Defense and Counter Terror Intelligence Organizational Chart |

| Figure 186 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – Japan |

| Figure 187 |

People Screening Systems Sales [%] by Modality – 2011 & 2016 – Japan |

| Figure 188 |

Brazilian Security organization |

| Figure 189 |

People Screening Systems Sales [$Million] by Modality – 2011-2016 – Brazil |

| Figure 190 |

People Screening Systems Sales [%] by Modality – 2011 & 2016 – Brazil |

| Figure 191 |

Standoff Electromagnetic Concealed Weapons Detection |

| Figure 192 |

Magnetic Signature Analysis System: Functional Block Diagram |

| Figure 193 |

Covert MMWave Sensor at a Door |

| Figure 194 |

Screening of Hand-held Baggage |

| Figure 195 |

Focal Plane Array Passive Standoff MMWave System |

| Figure 196 |

A Walk-By Passive MMWave Imaging System |

| Figure 197 |

Covert Walk-By Passive MMWave Images |

| Figure 198 |

Example of FTIR Application at Border Checkpoint Facilities |

| Figure 199 |

Biometric People Screening Corridor |

| Figure 200 |

Field of View of a Fused Video Surveillance and Biometrics |

| Figure 201 |

A Corridor CCTV & Biometric Portal Layout |

| Figure 202 |

Future People/Baggage Screening Turnstiles (Artist Rendition) |

| Figure 203 |

Profiling and Behavior Tracking Principles of Operation |