| |

PUBLIC SAFETY & HOMELAND SECURITY TECHNOLOGY MARKETS |

| 1 |

U.S. Cybersecurity Market – 2016-2022 |

| 1.1 |

Market & Technology Background |

| 1.1.1 |

Safeguard and Secure U.S. Cyberspace |

| 1.1.2 |

Cyber Terror & Crime |

| 1.1.3 |

Cyber Warfare |

| 1.1.4 |

Denial of Service |

| 1.1.5 |

Deliberate Manipulation of Information |

| 1.1.6 |

Detection of Unauthorized Activity |

| 1.1.7 |

Anti-Malware Cybersecurity |

| 1.1.8 |

Privacy Enhanced Technologies (PETs) |

| 1.2 |

Key Cybersecurity Vendors |

| 1.3 |

U.S. Cybersecurity Market: Business Opportunities |

| 1.4 |

SWOT Analysis |

| 1.4.1 |

Cybersecurity Market: Strengths |

| 1.4.2 |

Cybersecurity Market: Weaknesses |

| 1.4.3 |

Cybersecurity Market: Opportunities |

| 1.4.4 |

Cybersecurity Market: Threats |

| 1.5 |

U.S. Cybersecurity Market |

| 1.5.1 |

Cybersecurity Market: Drivers |

| 1.5.2 |

Cybersecurity Market: Inhibitors |

| 1.5.3 |

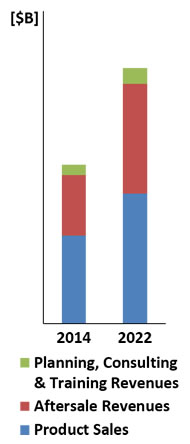

U.S. Cybersecurity Market Sales and Aftersales Revenues – 2014-2022 |

| 1.5.4 |

U.S. Cybersecurity Market Dynamics – 2014-2022 |

| 1.5.5 |

U.S. Cybersecurity Market Breakdown – 2014-2022 |

| 2 |

U.S. Public Safety & Homeland Security: Emergency Communication Market – 2016-2022 |

| 2.1 |

Market & Technology Background |

| 2.1.1 |

Scope |

| 2.2 |

Office of Emergency Communications |

| 2.3 |

SAFECOM |

| 2.3.1 |

Market Background |

| 2.3.2 |

Emergency Communication: Technology Market Background |

| 2.4 |

U.S. Public Safety & Homeland Security Communication Market: Business Opportunities |

| 2.4.1 |

Market Prospects by Vertical Market |

| 2.4.2 |

Managed Services for Shared/Core Services |

| 2.4.3 |

Migration from “Simple” to “Integrated” Networks |

| 2.5 |

U.S. Public Safety & Homeland Security Emergency Communication: Market Drivers |

| 2.6 |

U.S. Public Safety & Homeland Security Emergency Communication: Market Inhibitors |

| 2.7 |

U.S. Emergency Communication Market |

| 2.7.1 |

U.S. Sales and Aftersales Revenues – 2014-2022 |

| 2.7.2 |

U.S. Communication Market Dynamics – 2014-2022 |

| 2.7.3 |

U.S. Communication Market Breakdown – 2014-2022 |

| 3 |

U.S. Perimeter Intrusion Detection Market – 2016-2022 |

| 3.1 |

U.S. Perimeter Intrusion Detection: Market & Technology Background |

| 3.1.1 |

Passive Infrared (PIR) Motion Detection |

| 3.1.2 |

Access Control Systems |

| 3.2 |

Intrusion Detection Systems: Business Opportunities & Challenges |

| 3.2.1 |

Intrusion Detection Challenges |

| 3.2.2 |

U.S. Intrusion Detection Market: Business Opportunities |

| 3.3 |

Perimeter Intrusion Detection Market: SWOT Analysis |

| 3.3.1 |

Perimeter Intrusion Detection Market: Strengths |

| 3.3.2 |

Perimeter Intrusion Detection Market: Weaknesses |

| 3.3.3 |

Perimeter Intrusion Detection Market: Opportunities |

| 3.3.4 |

Perimeter Intrusion Detection Market: Threats |

| 3.4 |

U.S. Perimeter Intrusion Detection Market………. 71 |

| 3.4.1 |

U.S. Perimeter Intrusion Detection: Market Drivers |

| 3.4.2 |

U.S. Perimeter Intrusion Detection: Market Inhibitors |

| 3.4.3 |

U.S. Perimeter Intrusion Detection Market: Systems Sales and Aftersales Revenues – 2014-2022 |

| 3.4.4 |

Perimeter Intrusion Detection: Market Dynamics – 2014-2022 |

| 3.4.5 |

Perimeter Intrusion Detection: Market Breakdown – 2014-2022 |

| 4 |

U.S. Natural & Manmade Disaster Early Warning, Rescue & Recovery Equipment Markets – 2016-2022 |

| 4.1 |

Market Background |

| 4.2 |

Training and Education Markets |

| 4.3 |

Emergency Medical Services (EMS) |

| 4.4 |

Emergency Management Software |

| 4.5 |

SWOT Analysis |

| 4.5.1 |

Disaster Early Warning, Rescue & Recovery Market: Strengths |

| 4.5.2 |

Disaster Early Warning, Rescue & Recovery Market: Weaknesses |

| 4.5.3 |

Disaster Early Warning, Rescue & Recovery Market: Opportunities |

| 4.5.4 |

Disaster Early Warning, Rescue & Recovery Market: Threats |

| 4.6 |

U.S. Natural & Manmade Disaster Early Warning, Rescue & Recovery Equipment Markets -2016-2022 |

| 4.6.1 |

Market Drivers |

| 4.6.2 |

Market Inhibitors |

| 4.6.3 |

Sales and Aftersales Revenues – 2014-2022 |

| 4.6.4 |

Disaster Early Warning, Rescue & Recovery: Market Dynamics – 2014-2022 |

| 4.6.5 |

Disaster Early Warning, Rescue & Recovery: Market Breakdown – 2014-2022 |

| 5 |

U.S. Mobile Devices Security Market – 2016-2022 |

| 5.1 |

Mobile Devices Security Market Background |

| 5.2 |

Sales and Aftersales Revenues – 2014-2022 |

| 5.3 |

Mobile Devices Security Market Dynamics – 2014-2022 |

| 5.4 |

Mobile Devices Security Market Breakdown – 2014-2022 |

| 6 |

U.S. Biometrics– Public Safety & Homeland Security Market – 2016-2022 |

| 6.1 |

Biometric Market & Technology Background |

| 6.2 |

Multimodal Biometric Systems |

| 6.3 |

Public Safety & Homeland Security Applications |

| 6.4 |

U.S. Biometrics Market: Business Opportunities & Challenges |

| 6.5 |

SWOT Analysis |

| 6.5.1 |

Biometrics Market: Strengths |

| 6.5.2 |

Biometrics Market: Weaknesses |

| 6.5.3 |

Biometrics Market: Opportunities |

| 6.5.4 |

Biometrics Market: Threats |

| 6.6 |

U.S. Biometrics – Public Safety & Homeland Security Market |

| 6.6.1 |

Biometrics Market: Drivers |

| 6.6.2 |

Biometrics Market: Inhibitors |

| 6.6.3 |

Sales and Aftersales Revenues – 2014-2022 |

| 6.6.4 |

Biometrics Market Dynamics – 2014-2022 |

| 6.6.5 |

Biometrics Market Breakdown – 2014-2022 |

| 7 |

U.S. Video Analytics – Public Safety & Homeland Security Market – 2016-2022 |

| 7.1 |

Video Analytics Market & Technology Background |

| 7.2 |

Video Analytics: Public Safety & Homeland Security Applications |

| 7.3 |

U.S. Video Analytics Market: Business Opportunities |

| 7.4 |

Video Analytics Market: SWOT Analysis |

| 7.4.1 |

Video Analytics Market: Strengths |

| 7.4.2 |

Video Analytics Market: Weaknesses |

| 7.4.3 |

Video Analytics Market: Opportunities |

| 7.4.4 |

Video Analytics Market: Threats |

| 7.5 |

U.S. Video Analytics – Public Safety & Homeland Security Market |

| 7.5.1 |

Market Drivers |

| 7.5.2 |

Market Inhibitors |

| 7.5.3 |

Sales and Aftersales Revenues – 2014-2022 |

| 7.5.4 |

Video Analytics Market Dynamics – 2014-2022 |

| 7.5.5 |

Video Analytics Market Breakdown – 2014-2022 |

| 8 |

U.S. RFID – Public Safety & Homeland Security Market – 2016-2022 |

| 8.1 |

Market Background |

| 8.1.1 |

RFID-based e-ID Personal Documents Markets |

| 8.1.2 |

RFID-Based Systems “Registered Traveler” Programs |

| 8.1.3 |

Smart Border E-Passport Programs |

| 8.1.4 |

Public Safety & Homeland Security RFID-Based Systems Supply Chain Markets |

| 8.2 |

U.S. Public Safety & Homeland Security RFID-Based Technology: Market Background |

| 8.3 |

RFID Systems Security |

| 8.3.1 |

Tag Data Security |

| 8.3.2 |

Reader Security |

| 8.4 |

U.S. RFID – Public Safety & Homeland Security Market |

| 8.4.1 |

U.S. Public Safety & Homeland Security RFID: Market Drivers |

| 8.4.2 |

U.S. Public Safety & Homeland Security RFID: Market Inhibitors |

| 8.4.3 |

U.S. Public Safety & Homeland Security RFID: Market Sales and Aftersales Revenues – 2014-2022 |

| 8.4.4 |

U.S. Public Safety & Homeland Security RFID: Market Dynamics – 2014-2022 |

| 8.4.5 |

U.S. Public Safety & Homeland Security RFID: Market Breakdown – 2014-2022 |

| 9 |

U.S. Cloud Security Market – 2016-2022 |

| 9.1 |

Cloud Security – Market Background |

| 9.2 |

U.S. Public Safety & Homeland Security Cloud Computing and Security |

| 9.3 |

Cloud Security Threats |

| 9.4 |

U.S. Public Safety & Homeland Security Cloud Computing Market: SWOT Analysis |

| 9.4.1 |

Cloud Security Market: Strengths |

| 9.4.2 |

Cloud Security Market: Weaknesses |

| 9.4.3 |

Cloud Security Market: Opportunities |

| 9.4.4 |

Cloud Security Market: Threats |

| 9.5 |

U.S. Cloud Security Market |

| 9.5.1 |

U.S. Cloud Security Market: Drivers |

| 9.5.2 |

U.S. Cloud Security Market: Inhibitors |

| 9.5.3 |

U.S. Cloud Security Market: Sales and Aftersales Revenues – 2014-2022 |

| 9.5.4 |

U.S. Cloud Security Market Dynamics – 2014-2022 |

| 9.5.5 |

U.S. Cloud Security Market Breakdown – 2014-2022 |

| 10 |

U.S. Video Surveillance – Public Safety & Homeland Security Market – 2016-2022 |

| 10.1 |

Market & Technology Background |

| 10.2 |

Video Surveillance: Public Safety & Homeland Security Applications |

| 10.3 |

U.S. Video Surveillance Market: Business Opportunities & Challenges |

| 10.4 |

SWOT Analysis |

| 10.4.1 |

Video Surveillance Market: Strengths |

| 10.4.2 |

Video Surveillance Market: Weaknesses |

| 10.4.3 |

Video Surveillance Market: Opportunities |

| 10.4.4 |

Video Surveillance Market: Threats |

| 10.5 |

U.S. Public Safety & Homeland Security Video Surveillance Market |

| 10.5.1 |

Video Surveillance Market: Drivers |

| 10.5.2 |

Video Surveillance Market: Inhibitors |

| 10.5.3 |

Video Surveillance Market: Sales and Aftersales Revenues – 2014-2022 |

| 10.5.4 |

Video Surveillance Market Dynamics – 2014-2022 |

| 10.5.5 |

Video Surveillance Market Breakdown – 2014-2022 |

| 11 |

U.S. Public Safety & Homeland Security: Big Data & Analytics Market – 2016-2022 |

| 11.1 |

Public Safety & Homeland Security Big Data & Analytics Market & Technology Background |

| 11.2 |

Public Safety & Homeland Security Big Data |

| 11.2.1 |

Access and Delivery Infrastructure |

| 11.2.2 |

Data Centric Access Control |

| 11.2.3 |

Access Control |

| 11.2.4 |

Access Control in Databases |

| 11.2.5 |

Encryption Prescribed Access Control |

| 11.2.6 |

Trusted Bootstrapping |

| 11.2.7 |

Public Safety & Homeland Security Big Data & Analytics |

| 11.3 |

Big Data: Homeland Security and Internal Security Applications |

| 11.4 |

SWOT Analysis |

| 11.4.1 |

Public Safety & Homeland Security Big Data & Analytics Market: Strengths |

| 11.4.2 |

Public Safety & Homeland Security Big Data & Analytics Security Market: Weaknesses |

| 11.4.3 |

Public Safety & Homeland Security Big Data & Analytics Security Market: Opportunities |

| 11.4.4 |

Public Safety & Homeland Security Big Data & Analytics Threats |

| 11.5 |

U.S. Big Data – Public Safety & Homeland Security Market |

| 11.5.1 |

Public Safety & Homeland Security Big Data & Analytics Market: Drivers |

| 11.5.2 |

Public Safety & Homeland Security Big Data & Analytics Market: Inhibitors |

| 11.5.3 |

Public Safety & Homeland Security Big Data & Analytics Market: Sales and Aftersales Revenues – 2014-2022 |

| 11.5.4 |

Public Safety & Homeland Security Big Data & Analytics: Market Dynamics – 2014-2022 |

| 11.5.5 |

Public Safety & Homeland Security Big Data & Analytics: Market Breakdown – 2014-2022 |

| 12 |

U.S. Public Safety & Homeland Security: Metal Detectors Market – 2016-2022 |

| 12.1 |

U.S. Public Safety & Homeland Security Metal Detectors Market & Technology Background |

| 12.1.1 |

Hand-Held Metal Detectors |

| 12.1.1.1 |

The Market |

| 12.1.1.2 |

Principles of Operation |

| 12.1.1.3 |

Technology & Operational Essentials |

| 12.1.1.4 |

Hand-Held Metal Detectors – Technology Trends |

| 12.1.2 |

Metal Detection Portals |

| 12.1.2.1 |

The Market |

| 12.1.2.2 |

Metal Detection Portals Technology |

| 12.2 |

U.S. Public Safety & Homeland Security Metal Detectors Market: Business Opportunities & Challenges |

| 12.3 |

U.S. Public Safety & Homeland Security Metal Detectors Market: SWOT Analysis |

| 12.3.1 |

Metal Detectors Market: Strengths |

| 12.3.2 |

Metal Detectors Market: Weaknesses |

| 12.3.3 |

Metal Detectors Market: Opportunities |

| 12.3.4 |

Metal Detectors Market: Threats |

| 12.4 |

U.S. Public Safety & Homeland Security Metal Detectors Market |

| 12.4.1 |

Metal Detectors Market: Drivers |

| 12.4.2 |

Metal Detectors Market: Inhibitors |

| 12.4.3 |

Metal Detectors Market: Sales and Aftersales Revenues – 2014-2022 |

| 12.4.4 |

Metal Detectors Market Dynamics – 2014-2022 |

| 12.4.5 |

Metal Detectors Market Breakdown – 2014-2022 |

| 13 |

U.S. Public Safety & Homeland Security: C2/C4ISR Systems Market – 2016-2022 |

| 13.1 |

Scope |

| 13.2 |

Market & Technology Background |

| 13.3 |

U.S. C2/C4ISR Systems: Business Opportunities |

| 13.4 |

SWOT Analysis |

| 13.4.1 |

C2/C4ISR Market: Strengths |

| 13.4.2 |

C2/C4ISR Market: Weaknesses |

| 13.4.3 |

C2/C4ISR Market: Opportunities |

| 13.4.4 |

C2/C4ISR Market: Threats |

| 13.5 |

U.S. Public Safety & Homeland Security C2/C4ISR Market |

| 13.5.1 |

U.S. Public Safety & Homeland Security C2/C4ISR Market: Sales and Aftersales Revenues – 2014-2022 |

| 13.5.2 |

U.S. Public Safety & Homeland Security: C2/C4ISR Market Dynamics – 2014-2022 |

| 13.5.3 |

U.S. Public Safety & Homeland Security: C2/C4ISR Market Breakdown – 2014-2022 |

| 14 |

U.S. Personal (Ballistic & CBRNE) Protective Gear – Public Safety & Homeland Security Market – 2016-2022 |

| 14.1 |

Market & Technology Background |

| 14.1.1 |

Personal Body Armor |

| 14.1.2 |

Respiratory Protective Equipment |

| 14.1.3 |

CBRN and Hazmat Personal Protective Gear |

| 14.2 |

SWOT Analysis |

| 14.2.1 |

Protective Gear Market: Strengths |

| 14.2.2 |

Protective Gear Market: Weaknesses |

| 14.2.3 |

Protective Gear Market: Opportunities |

| 14.2.4 |

Protective Gear Market: Threats |

| 14.3 |

U.S. Personal (Ballistic & CBRNE) Protective Gear – Public Safety & Homeland Security Market |

| 14.3.1 |

Sales and Aftersales Revenues – 2014-2022 |

| 14.3.2 |

Protective Gear Market Dynamics – 2014-2022 |

| 14.3.3 |

Protective Gear Market Breakdown – 2014-2022 |

| 15 |

U.S. Electronic Fencing – Public Safety & Homeland Security Market – 2016-2022 |

| 15.1 |

Electronic Fences Technologies |

| 15.1.1 |

Vibration Sensors Mounted on Fence |

| 15.1.2 |

Capacitance Sensors Fence |

| 15.1.3 |

Strain Sensitive Cables Fence |

| 15.1.4 |

Fiber Optic Fence |

| 15.1.5 |

Taut Wire Fence |

| 15.1.6 |

Ported Coax Buried Line Fence |

| 15.1.7 |

Buried Geophone Fence |

| 15.2 |

Electronic Fencing: Business Opportunities & Challenges |

| 15.3 |

SWOT Analysis |

| 15.3.1 |

Electronic Fencing Market: Strengths |

| 15.3.2 |

Electronic Fencing Market: Weaknesses |

| 15.3.3 |

Electronic Fencing Market: Opportunities |

| 15.3.4 |

Electronic Fencing Market: Threats |

| 15.4 |

U.S. Electronic Fencing – Public Safety & Homeland Security Market |

| 15.4.1 |

Sales and Aftersales Revenues – 2014-2022 |

| 15.4.2 |

Electronic Fencing Market Dynamics – 2014-2022 |

| 15.4.3 |

Electronic Fencing Market Breakdown – 2014-2022 |

| 16 |

U.S. Homeland Security & Public Safety: Bio-Agents & Infectious Disease Detection Market – 2016-2022 |

| 16.1 |

Market Background |

| 16.2 |

Bio-Detection Technologies |

| 16.2.1 |

Sampling the Environment |

| 16.2.2 |

Bio-Detectors in a Multitude of Ambient Settings |

| 16.2.3 |

Bio-Detection Triggering |

| 16.2.4 |

Sample Collection |

| 16.2.5 |

Bio-Particle Detectors |

| 16.2.6 |

Bio-Agent Identification |

| 16.2.7 |

National Biosurveillance Systems |

| 16.3 |

Bio-Agents & Infectious Disease Detection: Public Safety & Homeland Security Applications |

| 16.4 |

U.S. Bio-Agents & Infectious Disease Detection Market: Business Opportunities & Challenges |

| 16.5 |

SWOT Analysis |

| 16.5.1 |

Bio-Agents & Infectious Disease Detection Market: Strengths |

| 16.5.2 |

Bio-Agents & Infectious Disease Detection Market: Weaknesses |

| 16.5.3 |

Bio-Agents & Infectious Disease Detection Market: Opportunities |

| 16.5.4 |

Bio-Agents & Infectious Disease Detection Market: Threats |

| 16.6 |

U.S. Bio-Agents & Infectious Disease Detection – Public Safety & Homeland Security Market |

| 16.6.1 |

Sales and Aftersales Revenues – 2014-2022 |

| 16.6.2 |

Bio-Agents & Infectious Disease Detection: Market Dynamics – 2014-2022 |

| 16.6.3 |

Bio-Agents & Infectious Disease Detection: Market Breakdown – 2014-2022 |

| 17 |

U.S. CBRN & Hazmat Incidents Decontamination Gear Market – 2016-2022 |

| 17.1 |

CBRN & Hazmat Decontamination Technology: Market Background |

| 17.1.1 |

Decontamination of CBRN & Hazmat Incidents |

| 17.1.2 |

Decontamination Core Technologies |

| 17.1.3 |

The Decontamination Cycle |

| 17.2 |

Decontamination Strategy |

| 17.3 |

The Decontamination Industry |

| 17.4 |

U.S. Decontamination Gear of CBRN & Hazmat Incidents – Public Safety & Homeland Security Market |

| 17.4.1 |

Sales and Aftersales Revenues – 2014-2022 |

| 17.4.2 |

CBRN & Hazmat Incidents Decontamination: Market Dynamics – 2014-2022 |

| 17.4.3 |

CBRN & Hazmat Incidents Decontamination: Market Breakdown – 2014-2022 |

| 18 |

U.S. Hazmat & CBRN Incident Detection Market – 2016-2022 |

| 18.1 |

Technology Market Background |

| 18.1.1 |

Scope |

| 18.1.2 |

Chemical Agent Detection Technologies |

| 18.1.3 |

Nuclear/Radiological Detection Technologies |

| 18.1.3.1 |

The Advanced Spectroscopic Portal (ASP) |

| 18.1.3.2 |

Human Portable Radiation Detection Systems (HPRDS) Program |

| 18.1.3.3 |

Nuclear- Radiological People Screening Portals |

| 18.2 |

Market Background |

| 18.2.1 |

Chemical Plant Security |

| 18.2.2 |

Nuclear/Radiological Detection Markets |

| 18.3 |

Chemical, Hazmat & Nuclear Detection: Business Opportunities & Challenges |

| 18.4 |

SWOT Analysis |

| 18.4.1 |

Hazmat & CBRN Incident Detection Market: Strengths |

| 18.4.2 |

Hazmat & CBRN Incident Detection Market: Weaknesses |

| 18.4.3 |

Hazmat & CBRN Incident Detection: Market: Opportunities |

| 18.4.4 |

Hazmat & CBRN Incident Detection Market: Threats |

| 18.5 |

U.S. Hazmat & CBRN Incident Detection – Public Safety & Homeland Security Market |

| 18.5.1 |

Sales and Aftersales Revenues – 2014-2022 |

| 18.5.2 |

Hazmat & CBRN Incident Detection: Market Dynamics – 2014-2022 |

| 18.5.3 |

Hazmat & CBRN Incident Detection: Market Breakdown – 2014-2022 |

| 19 |

U.S. Checked Luggage EDS & BHS – Public Safety & Homeland Security Market – 2016-2022 |

| 19.1 |

Explosive Detection Systems: Technology Market Background |

| 19.1.1 |

Explosive Detection Systems: Throughput |

| 19.2 |

Checked Luggage EDS & BHS – Public Safety & Homeland Security Market |

| 19.2.1 |

Sales and Aftersales Revenues – 2014-2022 |

| 19.2.2 |

Checked Luggage EDS & BHS: Market Dynamics – 2014-2022 |

| 19.2.3 |

Checked Luggage EDS & BHS: Market Breakdown – 2014-2022 |

| 20 |

U.S. Public Safety & Homeland Security Non-Lethal Weapons Market – 2016-2022 |

| 20.1 |

Non-Lethal Weapons: Technology Market Background |

| 20.2 |

Less-Lethal Weapons: Market Background |

| 20.3 |

U.S. Non-Lethal Weapons Market: Business Opportunities & Challenges |

| 20.4 |

Non-Lethal Weapons Market: SWOT Analysis |

| 20.4.1 |

Non-Lethal Weapons Market: Strengths |

| 20.4.2 |

Non-Lethal Weapons Market: Weaknesses |

| 20.4.3 |

Non-Lethal Weapons Market: Opportunities |

| 20.4.4 |

Non-Lethal Weapons Market: Threats |

| 20.5 |

U.S. Non-Lethal Weapons – Public Safety & Homeland Security Market |

| 20.5.1 |

Non-Lethal Weapons Market: Sales and Aftersales Revenues – 2014-2022 |

| 20.5.2 |

Non-Lethal Weapons Market Dynamics – 2014-2022 |

| 20.5.3 |

Non-Lethal Weapons Market Breakdown – 2014-2022 |

| 21 |

U.S. Public Safety & Homeland Security Counter-IED Technologies Markets – 2016-2022 |

| 21.1 |

Market & Technology Background |

| 21.2 |

U.S. Counter-IED Market: Business Opportunities & Challenges |

| 21.2.1 |

Maintenance and Upgrades (Particularly of Jammers, and Armored Trucks) |

| 21.2.2 |

Sensors and Other Electronic Systems Upgrade/s |

| 21.2.3 |

Standoff Suicide Bombers Detection |

| 21.2.4 |

Suicide Bombers Detonation Neutralization |

| 21.2.5 |

Standoff Detection of VBIED |

| 21.2.6 |

VBIED Detonation Neutralization |

| 21.2.7 |

Standoff Explosive Detection in Urban Environment |

| 21.2.8 |

Large Area IED Detection Coverage |

| 21.2.9 |

IED Placement Detection |

| 21.2.10 |

Active Armors for Vehicles |

| 21.3 |

U.S. Counter-IED Market: SWOT Analysis |

| 21.3.1 |

Counter-IED Market: Strengths |

| 21.3.2 |

Counter-IED Market: Weaknesses |

| 21.3.3 |

Counter-IED Market: Opportunities |

| 21.3.4 |

Counter-IED Market: Threats |

| 21.4 |

U.S. Counter-IED Technologies – Public Safety & Homeland Security Market |

| 21.4.1 |

U.S. Counter-IED Market: Sales and Aftersales Revenues – 2014-2022 |

| 21.4.2 |

Counter-IED Market Dynamics – 2014-2022 |

| 21.4.3 |

Counter-IED Market Breakdown – 2014-2022 |

| 22 |

U.S. X-Ray Screening Market – 2016-2022 |

| 22.1 |

X-Ray Screening Technology and Market Background |

| 22.1.1 |

2D X-Ray, EDS and ETD Explosives Detection Technologies – Pros and Cons |

| 22.1.2 |

X-Ray Systems – Characteristics |

| 22.1.3 |

X-Ray Systems – Principles of Operation |

| 22.1.4 |

People Screening Backscatter AIT |

| 22.2 |

X-Ray Screening Background |

| 22.3 |

X-Ray Screening: Business Opportunities & Challenges |

| 22.4 |

X-Ray Security Scanners: SWOT Analysis |

| 22.4.1 |

X-Ray Security Scanners Market: Strengths |

| 22.4.2 |

X-Ray Security Scanners Market: Weaknesses |

| 22.4.3 |

X-Ray Security Scanners Market: Opportunities |

| 22.4.4 |

X-Ray Security Scanners Market: Threats |

| 22.5 |

U.S. X-Ray Scanners – Public Safety & Homeland Security Market |

| 22.5.1 |

X-Ray Screening Market: Sales and Aftersales Revenues – 2014-2022 |

| 22.5.2 |

X-Ray Screening Market Dynamics – 2014-2022 |

| 22.5.3 |

X-Ray Screening Market Breakdown – 2014-2022 |

| 23 |

U.S. Explosives Trace Detection Market – 2016-2022 |

| 23.1 |

Market & Technology Background |

| 23.1.1 |

ETD Technologies |

| 23.1.2 |

ETD Market Background |

| 23.2 |

Explosives Trace Detection: Public Safety & Homeland Security Applications |

| 23.2.1 |

Explosives Detected by Explosives Trace Detection |

| 23.2.2 |

Explosives Trace Detection Configuration |

| 23.2.3 |

ETD Applications |

| 23.3 |

U.S. Explosives Trace Detection: Business Opportunities & Challenges |

| 23.4 |

U.S. Explosives Trace Detector Market: SWOT Analysis |

| 23.4.1 |

U.S. Explosives Trace Detector Market: Strengths |

| 23.4.2 |

U.S. Explosives Trace Detector Market: Weaknesses |

| 23.4.3 |

U.S. Explosives Trace Detector Market: Opportunities |

| 23.4.4 |

U.S. Explosives Trace Detector Market: Threats |

| 23.5 |

U.S. Explosives Trace Detector Market – 2014-2022 |

| 23.5.1 |

Explosives Trace Detector Market: Sales and Aftersales Revenues – 2014-2022 |

| 23.5.2 |

Explosives Trace Detection Market Dynamics – 2014-2022 |

| 23.5.3 |

Explosives Trace Detection Market Breakdown – 2014-2022 |

| 24 |

U.S. Standoff Explosives & Weapons Detection Market – 2016-2022 |

| 24.1 |

Market & Technology Background |

| 24.1.1 |

Suicide Bombers & Vehicle Borne IEDs |

| 24.2 |

Standoff Explosives & Weapons Detection Market: Business Opportunities & Challenges |

| 24.2.1 |

Business Opportunities |

| 24.2.2 |

PBIED & VBIED Detection: Technological Challenges |

| 24.3 |

U.S. Public Safety & Homeland Security Standoff Explosives & Weapon Detection Market |

| 24.3.1 |

Market Drivers |

| 24.3.2 |

Market Inhibitors |

| 24.3.3 |

Sales and Aftersales Revenues – 2014-2022 |

| 24.3.4 |

Standoff Explosives & Weapons Detection: Market Dynamics – 2014-2022 |

| 24.3.5 |

Standoff Explosives & Weapons Detection: Market Breakdown – 2014-2022 |

| 25 |

U.S. Public Safety & Homeland Security Vehicle & Container Screening – 2016-2022 |

| 25.1 |

Vehicle & Container Screening Portals Technologies |

| 25.1.1 |

Comparison of Container-Vehicle Screening Technologies |

| 25.1.2 |

X-Ray Container-Vehicle Screening Systems |

| 25.1.3 |

Dual Energy X-Ray Container-Vehicle Screening |

| 25.1.4 |

Dual-View X-Ray Container-Vehicle Screening |

| 25.1.5 |

Backscatter X-Ray Container-Vehicle Screening |

| 25.1.6 |

Gamma Ray Systems Container-Vehicle Screening |

| 25.1.7 |

Linac Based X-Ray Container-Vehicle Screening Systems |

| 25.2 |

Vehicle & Container Screening Portals: Market Background |

| 25.3 |

SWOT Analysis |

| 25.3.1 |

Vehicle & Container Screening Market: Strengths |

| 25.3.2 |

Vehicle & Container Screening Market: Weaknesses |

| 25.3.3 |

Vehicle & Container Screening Market: Opportunities |

| 25.3.4 |

Vehicle & Container Screening Market: Threats |

| 25.4 |

U.S. Vehicle & Container Screening Systems – Public Safety & Homeland Security Market |

| 25.4.1 |

Vehicle & Container Screening Market: Sales and Aftersales Revenues – 2014-2022 |

| 25.4.2 |

Vehicle & Container Screening Market Dynamics – 2014-2022 |

| 25.4.3 |

Vehicle & Container Screening Market Breakdown – 2014-2022 |

| 26 |

Methodology |

| 26.1 |

Report Structure |

| 26.2 |

For Whom is this Report Intended? |

| 26.3 |

Research Methods |

| 26.4 |

Assumptions |

| 26.5 |

Possible Scenario Analysis |

| 27 |

Disclaimer and Copyright |